Should You Claim Dependents On Unemployment Ohio

At this time no. Box 182212 Columbus OH 43218-2212.

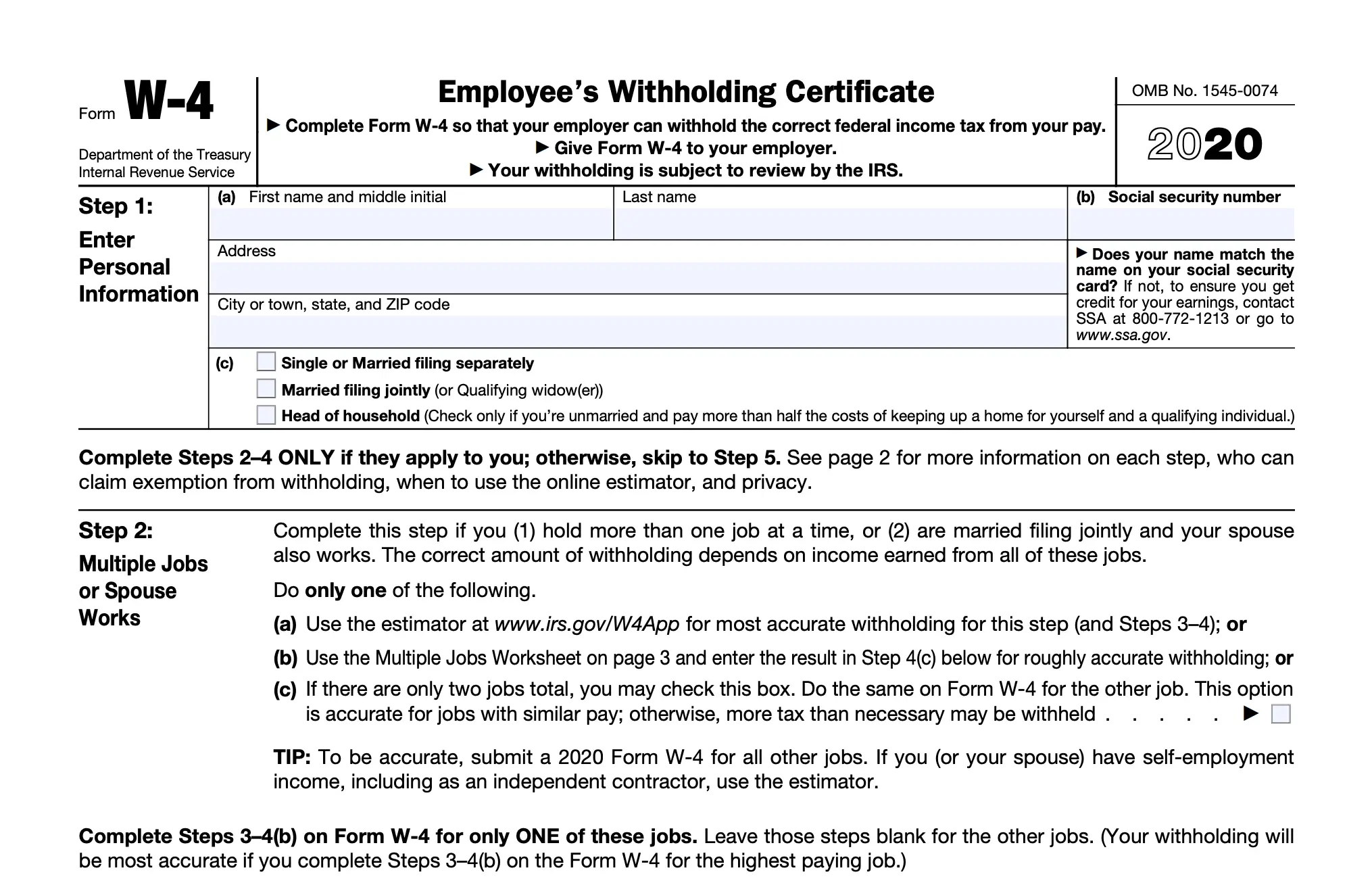

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

To qualify the dependent must be considered a natural child stepchild or adopted child or a dependent spouse who lives with you and you provide at least half their support in the last 90 days.

Should you claim dependents on unemployment ohio. A dependent is usually a spouse or child you support financially. While penalties for this vary by state and the amount of money defrauded by the claim every state requires beneficiaries to return unemployment benefits they received to which they werent entitled. You cannot claim any child that has been previously claimed by a spouse or co-parent on an established Unemployment Insurance claim in the past year.

You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing. But if you didnt claim them for the purpose of withholding then you can claim the dependents on your tax return when you file for that year which may make you. Office of Unemployment Insurance Operations PO.

This chart will help you determine the dependency class you belong to. You can file online 24 hours a day 7 days a week at unemploymentohiogov. A spouse may be claimed as a dependent if.

Have you filed a claim for Unemployment Benefits in the last 12 months. Being unemployed is stressful enough but its even more stressful when you have dependents to care for. Can you receive unemployment benefits if you are taking care of a sick relative or loved one.

If you live in Ohio and have lost your job you may be able to get cash assistance through Ohios unemployment program. You can find one of several Ohio Unemployment Office locations using our free guide or you can write to the Ohio Unemployment Office. Arizona taxes unemployment compensation to the same extent as it is taxed under federal law.

If you and your spouse file joint tax returns and one of you can be claimed as a dependent neither of you can claim any dependents. The State of Ohio has a special law which grants different unemployment eligibility benefits to unemployed personnel based on the number of dependents. In some states you can collect a small dependent benefit in addition to your unemployment payments.

Have you worked in regular employment not military or federal. Waiting more than a week to apply will delay the start of your claim and no benefits will be paid for weeks of unemployment that pass before the week you file. Answer this question Yes if you have filed a claim for benefits in any state in the past 12 months.

How long you can receive unemployment benefits will depend on your work history. See the Ohio Department of Job and Family Services ODJFS unemployment tool to estimate the amount of money you could get based on your old wages. Your case will be scheduled for either an in-person or a.

In some states the amount is set and in others its a percentage. Dependent with unemployment. If you provided more than 50 of her support you can claim her but if you do she will more than likely have a tax liability for the unemployment.

If asymptomatic individuals remove themselves from employment as opposed to an employer or medical professional removing them from employment they are not be eligible for benefits. Learn more about unemployment. Only one spouse can claim the dependent s for unemployment benefits.

If your weekly benefit rate is less than the maxium weekly benefit rate and you have dependents you may qualify for Dependency Benefits. When you apply for the dependency benefit you. Claiming dependent benefits to which you are not entitled you commit unemployment fraud.

Your claim will begin the Sunday of the calendar week your application is filed. The unemployment benefit amount is based on the number of dependents helping workers with children spouse. You should apply for unemployment benefits as soon as you become unemployed.

State Taxes on Unemployment Benefits. Under the Pandemic Unemployment Assistance and Pandemic Emergency Unemployment Compensation program unemployment benefits have been extended for 13 to 26 weeks depending on state and also expanded to cover a lot more unemployed workers and their dependents. Dependency Benefits are equal to 7 percent of your weekly benefit rate for the first dependent and 4 percent for each of the next two dependents.

If you do not have access to the internet you may visit your local library or OhioMeansJobs center where. To file weekly claims you will need your Social Security number and PIN. Youll use your Social Security number to find what location is processing your claim according to this list.

But dependents cant claim someone else as a dependent. You can claim dependents on Form W-4 when you authorize your employer to withhold taxes from your paycheck. Please visit unemploymentohiogov click on the Report Identity Theft button and complete the form so that we can investigate the claim that was filed and take appropriate actionsThis can include correcting the 1099-G form that you were sent.

Ohio Unemployment Insurance BENEFITS CHART - 2021 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application. Provide the state you filed in and answer the question regarding work since you last filed. You are legally married You must be married at least 90 days during the time you earned your Base Period wages or the term of the marriage was within the Base Period wages earned.

What To Know About The First Stimulus Check Get It Back Tax Credits For People Who Work

What To Know About The First Stimulus Check Get It Back Tax Credits For People Who Work

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

When To Claim Children As Dependents On Your Taxes Fox Business

When To Claim Children As Dependents On Your Taxes Fox Business

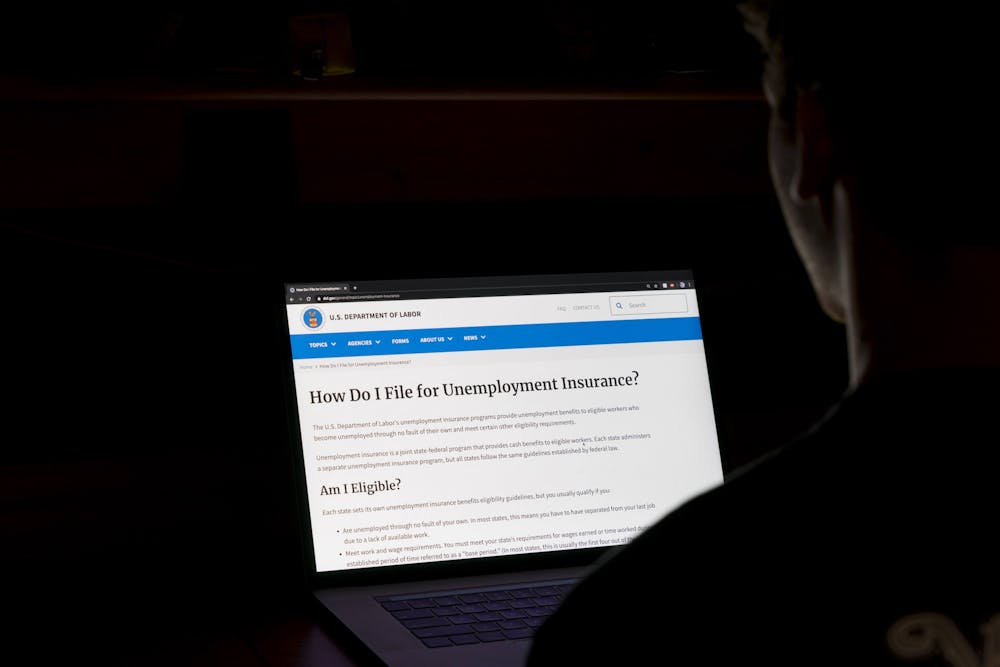

Students File For Unemployment As Covid 19 Forces Layoffs The Beacon

Students File For Unemployment As Covid 19 Forces Layoffs The Beacon

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

What To Watch For When Filing 2020 Tax Returns The Blade

What To Watch For When Filing 2020 Tax Returns The Blade

What You Should Know About Unemployment Compensation

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Q A Your Most Common Unemployment Questions The Lima News

Q A Your Most Common Unemployment Questions The Lima News

How To Claim Your Girlfriend On Your Taxes If She Lives With You Toughnickel

How To Claim Your Girlfriend On Your Taxes If She Lives With You Toughnickel

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Post a Comment for "Should You Claim Dependents On Unemployment Ohio"