Unemployment Ohio W2 Online

Updated W-21099 Upload Feature NOW LIVE on the Ohio Business Gateway. If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns.

United Opt What Is W2 Form Meaning Components Uses And Facts Of W2

United Opt What Is W2 Form Meaning Components Uses And Facts Of W2

OnlineElectronic Filing NEW Quarterly Wage Reporting Tool Latest Version.

Unemployment ohio w2 online. Never sent me a W2 If you are on unemployment you do not get a W2 you would get a 1099-G form from your State. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Select the Apply For Benefits link in the top left if you have NEVER filed for unemployment benefits from Ohio before.

You dont enter information for unemployment in the W-2 section. To restart your claim log into your account at unemploymentohiogov or call 877 644-6562 during the first week you are unemployed. Apply for Unemployment Now Employee 1099 Employee Employer.

To submit your quarterly tax report online please visit httpsericohiogov. Ive never filed for unemployment before but it says I already have an account. If you restart your claim online you will need your PIN.

UpdatedAugust 14 2013 Efficient Convenient Saves Time Improves Accuracy Offline The Quarterly Wage Reporting Tool QWRT is an offline tool designed to help employers a. Enter the amount from Box 1 on Line 19 Unemployment Compensation of your 1040 form. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

W-2 Upload Frequently Asked Questions. JFS-20106 Employers Representative Authorization for Taxes. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment.

You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers. Welcome to Ohio Pandemic Unemployment Assistance Online Application. Administration with certain modifications outlined below for the federal W-2.

NOTE that pursuant to the IRS webpage the following now applies to your federal taxes. IncomeStatementsEWTtaxstateohus or by calling. Those who issue 250 or more W-2 forms must submit this.

The 1099-G form is available as of January 2021. Most States have an option to download your 1099-G on their unemployment site. Although some states will enable you to download your unemployment W2 form and the 1099-G form that is also required you should be aware that downloading the necessary documentation online isnt always possibleDepending on how advanced your states online infrastructure is youll either receive a private message with the forms you need to fill in or there will be a section on the website devoted to.

If you have an online account in the Ohio PUA system enter. Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at. The online initial application takes about 25 minutes.

Employers with questions can call 614 466-2319. If you restart your claim online you will need your PIN. Also used by employers to authorize the Ohio Department of Job and Family.

Online filing is now available for Ohio W-2s and 1099-Rs Please review the 1099-R Upload Specifications on ODTs website. The guidance provides several tax filing scenarios but many OSCPA members have asked about taxpayers who previously filed federal and Ohio tax returns and are waiting for IRS to issue a refund based on the unemployment benefits deduction. As such ODT issued guidance on April 6 related to the unemployment benefits deduction for tax year 2020.

Filing taxes is much easier when you have all the forms you need in front of you. If you are disconnected use your username and PIN to log back on and resume the application process. Unemployment benefits provide short-term income to unemployed workers who lose their jobs through no fault of their own and who are actively seeking work.

You will need to file a new claim if you have not applied for unemployment benefits at any time in the past 12 months. 1099 Upload Frequently Asked Questions. Payments for the first quarter of 2020 will be due April 30.

Your application is not filed until you receive a confirmation number. To see if you are eligible apply at unemploymentohiogov or call 877 644-6562. All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form.

Many states now offer online access to 1099-G forms which is a big help when its time to file but you never received the form. Please use our Quick Links or access one of the images below for additional information. Your local unemployment office may be able to supply these numbers by phone if you cant access the form online.

If this amount if greater than 10 you must report this income to the IRS. Please note that Unemployment Insurance is available to Hoosiers whose employment has been interrupted or ended due to COVID-19 you should file for UI and your claim will. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes.

On your 1099-G form Box 1 Unemployment Compensation shows the amount you received in unemployment wages.

What Is A W 3 Form And How Do I File It Gusto

What Is A W 3 Form And How Do I File It Gusto

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Dd Form 1750 Example Figure 2 2 Da Form 5748 R Shipment Unit Packing List And Doctors Note Template Word Template Word Free

Dd Form 1750 Example Figure 2 2 Da Form 5748 R Shipment Unit Packing List And Doctors Note Template Word Template Word Free

What Is A W 3 Form And How Do I File It Gusto

What Is A W 3 Form And How Do I File It Gusto

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

How To Fill Out Irs Form 940 Futa Tax Return Youtube

How To Fill Out Irs Form 940 Futa Tax Return Youtube

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

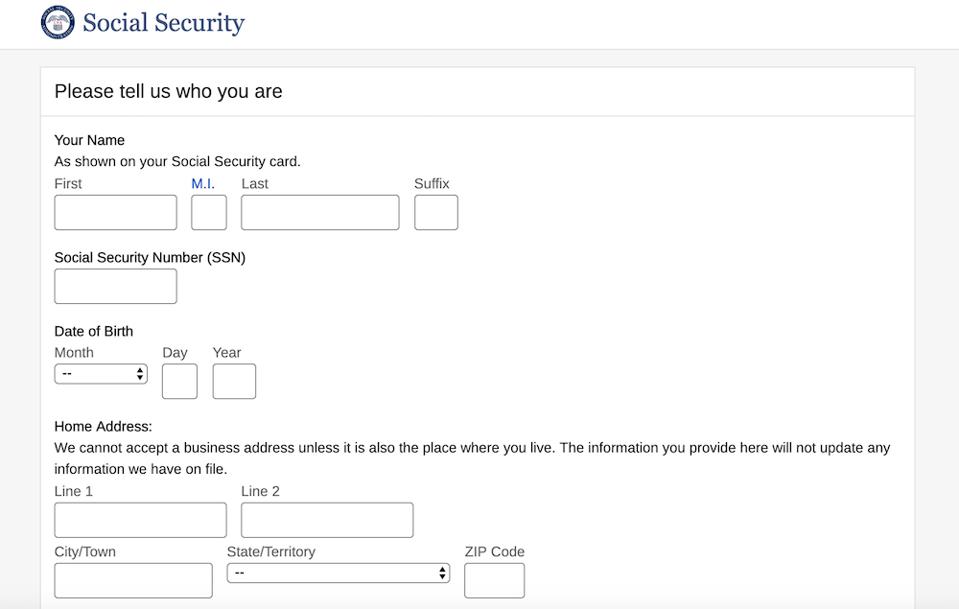

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Need A Copy Of Your Social Security Form For Tax Season Here S How To Get One

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Where Can I Physically Pick Up 1099 And W 2 Forms Quora

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Fillable Da Form 2823 Sworn Statement Free Download Statement Template Statement Balance Sheet Template

Fillable Da Form 2823 Sworn Statement Free Download Statement Template Statement Balance Sheet Template

Pin On 1000 Examples Online Form Templates

Pin On 1000 Examples Online Form Templates

Post a Comment for "Unemployment Ohio W2 Online"