Unemployment Money Being Taken Back

Individuals who turn down their previous jobs and continue to collect benefits could be forced to pay back all of the money as well as incur a 30 penalty and face limitations on filing for. PUA wasnt set up.

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Or the money can be withheld from your paycheck lottery winnings and tax refunds due to you or your spouse.

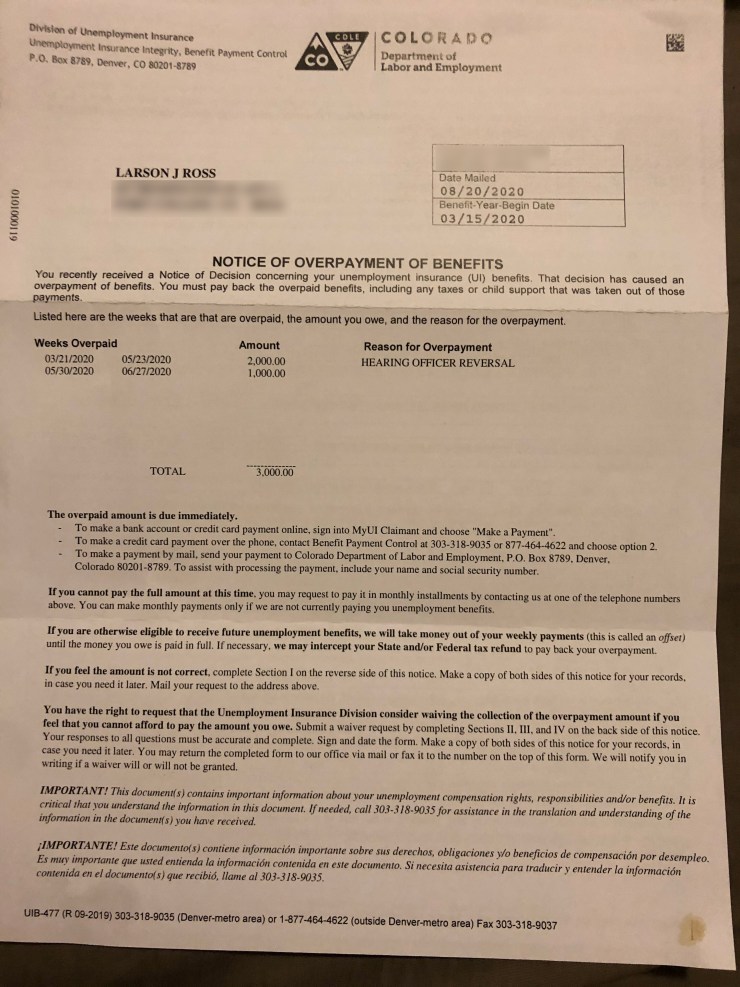

Unemployment money being taken back. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. You must pay back any overpayment of benefits you received regardless of how the overpayment was received. Retroactive Unemployment Benefits Back Pay for 300 Weekly FPUC PUA and PEUC Under 2021 Extension by Andy 584 This article was last updated on February 4 Congressional leaders and the President have now passed the 900 billion COVID relief stimulus package into law under the Continued Assistance for Unemployed Workers Act of 2020 CAA.

And 100 of any unemployment benefits you get after the 1 year ineligibility ends can be withheld until the amount you owe is paid in full. Unemployment benefits are designed to help out-of-work adults pay their bills while they look for a new job. Most states offer payment plan options if you cant pay back the money you received right away.

Many people receiving unemployment money from Arizona woke up Saturday to empty accounts. You may have to pay in one lump sum. When your state reverses your unemployment insurance claim the situation is different from a denial or discontinuation of your claim.

You can mail a payment for all or a portion of the amounts that was overpaid. But that aid has become a headache for. Meg Patrick an unemployed 61-year-old grandmother of three is caught between two unemployment agencies.

Friday night the unemployment accounts of people who received their money via a Bank of America debit card. Also millions of people received unemployment benefits in 2020 up to 10200 of which will now be tax-free for those with an adjusted gross income. CHICAGO CBS Tax time is now a troubling time for those who have been ensnared in the states unemployment system this year.

Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. The victims of fraudsters using the identity of strangers to get their hands on IDES money are now being told their state tax refunds will be withheld if they dont return money they never even received. While paying back unemployment benefits usually is not required you may have to pay back unemployment benefits if your states unemployment commission.

The overpayment included funds from Pandemic Unemployment Assistance and from a 600 federal supplement to unemployment insurance. The Montclair woman was told she has to pay back. In some cases if a state mistakenly overpays an unemployment recipient they can waive the requirement that excess funds be returned.

For those in other states dont spend the money and hold onto the.

8 Prayers For The Unemployed Prayer For Work Prayer For Guidance Job Bible Verse

8 Prayers For The Unemployed Prayer For Work Prayer For Guidance Job Bible Verse

New Maryland Unemployment Website Application Back Up After Temporarily Taken Down To Resolve Mortgage Interest Rates Mortgage Interest Current Mortgage Rates

New Maryland Unemployment Website Application Back Up After Temporarily Taken Down To Resolve Mortgage Interest Rates Mortgage Interest Current Mortgage Rates

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Pandemic Unemployment Assistance 20 Questions And Answers For Employers Ogletree Deakins

Pandemic Unemployment Assistance 20 Questions And Answers For Employers Ogletree Deakins

New York State Department Of Labor Unemployment Insurance Benefits New York State York New York

New York State Department Of Labor Unemployment Insurance Benefits New York State York New York

Loans For Unemployed Are Finest And Reliable Financial Assistance For Jobless Applicants To Meet All Urge Loans For Bad Credit Payday Loans Payday Loans Online

Loans For Unemployed Are Finest And Reliable Financial Assistance For Jobless Applicants To Meet All Urge Loans For Bad Credit Payday Loans Payday Loans Online

Get Assured Of Your Future Investments Need Money Cold Hard Cash How To Get Rich

Get Assured Of Your Future Investments Need Money Cold Hard Cash How To Get Rich

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

What To Do If You Don T Want To Go Back To Work Back To Work Best Online Jobs Starting A Business

What To Do If You Don T Want To Go Back To Work Back To Work Best Online Jobs Starting A Business

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

The Saga Of Efraim Diveroli And Aey Serves As A Teachable Moment For Contracting Officials Military Veterans War Dogs United States Military

The Saga Of Efraim Diveroli And Aey Serves As A Teachable Moment For Contracting Officials Military Veterans War Dogs United States Military

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Unemployment 1 400 Stimulus Checks Extended Benefits Slated In House Covid Relief Deadline

Unemployment 1 400 Stimulus Checks Extended Benefits Slated In House Covid Relief Deadline

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Extra 600 Unemployment Benefits To End 1 Week Early For Many Labor Department Says In 2020 Unemployment Labour Department Second Grade Books

Extra 600 Unemployment Benefits To End 1 Week Early For Many Labor Department Says In 2020 Unemployment Labour Department Second Grade Books

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Post a Comment for "Unemployment Money Being Taken Back"