Unemployment Due To Covid Ct

Guidance FAQs for individuals and businesses. PSL provides up to 40 hours of leave for certain workers per year for the.

State Recovers 10 Of Covid 19 Job Losses In May Cbia

State Recovers 10 Of Covid 19 Job Losses In May Cbia

As of April 7 2021 there were 294522 confirmed cases 25257 suspected cases and 7940 COVID-associated deaths in the state.

Unemployment due to covid ct. The COVID-19 outbreak has had a significant impact on the lives of many Connecticut citizens including Connecticut workers and employers. Closed due to COVID-19 precautions. Unemployment Compensation March 18 2020 If your hours have been reduced or eliminated at work due to this health emergency file immediately for unemployment compensation.

Welcome to the CT Unemployment Benefits Center File a new claim for state or federal unemployment benefits. I have no paid time off through my employer. The first case relating to the COVID-19 pandemic in the US.

Apply even if youre told youre not eligible as the rules and requirements may be changed under these extreme circumstances. As of April 1 2021 1211071 people 3335 of Connecticut. Get the facts at ctgovcoronavirus.

The Emergency Unemployment Insurance Stabilization and Access Act of 2020 provides 500 million in federal funding for state unemployment systems and an additional 500 million in funding for those systems in states with drastic spikes in unemployment that meet certain. If you answer no your benefits will be stopped. If your employment has been impacted by the COVID-19 crisis please visit the websites below for employment and training opportunities as well as to file for unemployment benefits.

Many Connecticut residents who never dreamed they would be filing for unemployment benefits now find themselves navigating a very choppy and. Reopen a previous claim for unemployment benefits. The Connecticut Department of Labor is develop additional programming within Connecticuts unemployment insurance system to accommodate the.

If I become sick from COVID-19 and I need to leave work or I get terminated can I collect unemployment benefits. COVID-19 and the business shutdowns it caused led employers to slash 299300 jobs from a peak in December 2018 to April 2020 when the full impact of Connecticuts lockdown was felt. 31-226a provides individuals who believe that they have been retaliated against with an opportunity for a hearing.

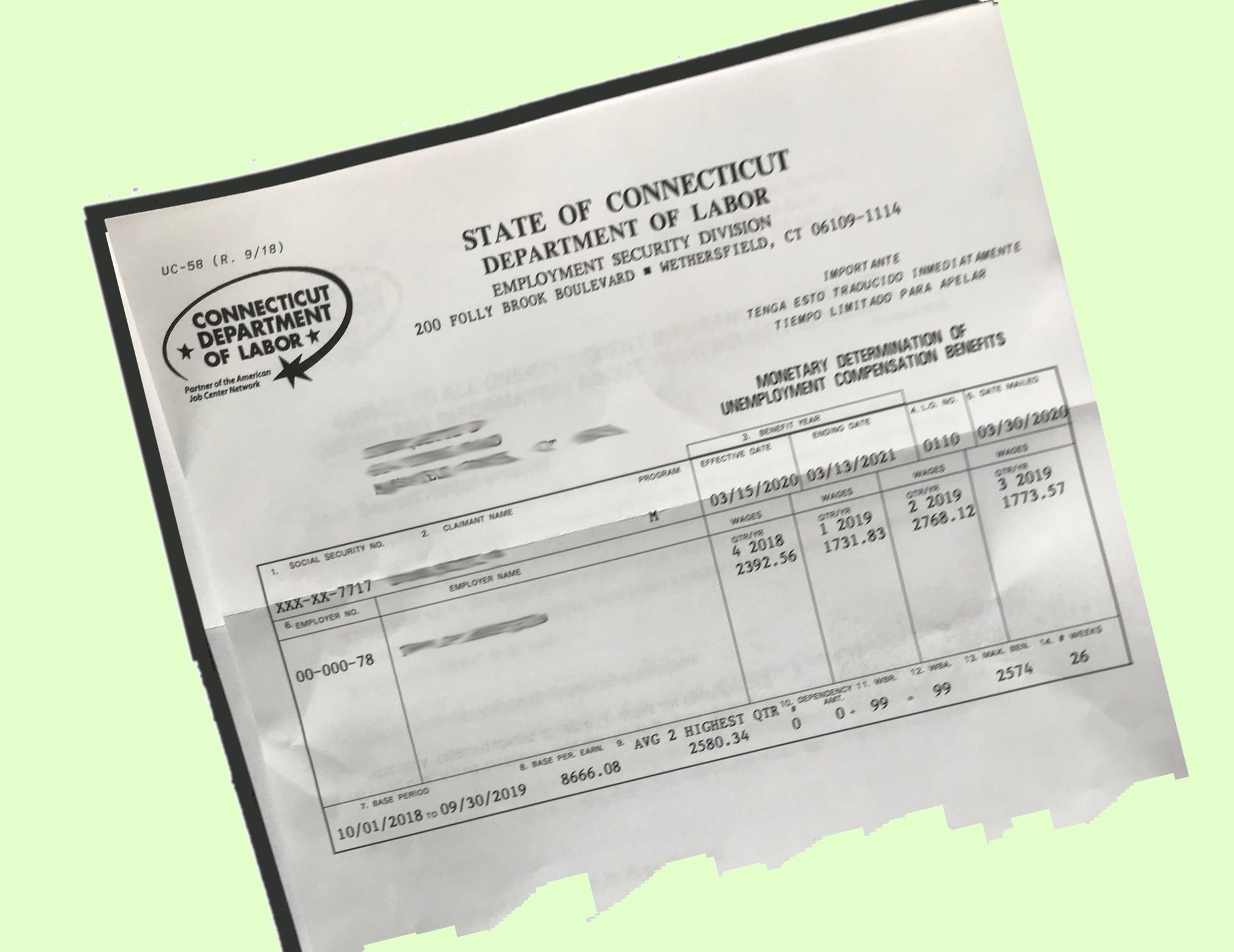

200 Folly Brook Boulevard Wethersfield CT 06109 Phone. The CT Department of Labor has all the latest updates on the CARES Act and unemployment insurance Unemployment Employee. Unemployed Due to COVID-19.

Connecticut COVID-19 UI benefits will not be charged to employer accounts According to the Connecticut Department of Labor contributory employer unemployment insurance UI accounts will not be charged with COVID-19 UI benefits. State of Connecticut was confirmed on March 8 although there had been multiple suspected cases before that point which tested negative. The CT Labor Department is working diligently to analyze the federal pandemic relief details found within the Coronavirus Aid Relief and Economic Security CARES Act signed into law on 3272020.

Assistance and Relief Unemployment Employee. Connecticut Pandemic Unemployment Assistance PUA On March 27 2020 the President signed into law the CARES Act which includes the Relief for Workers Affected by Coronavirus Act set out in Title II Subtitle A. The state Department of.

It is illegal for an employer to retaliate against individuals who have exercised their rights under the Connecticut Unemployment Compensation Act. This is the result of Governor Lamonts. CONNECTICUT The number of Connecticut residents who have filed for unemployment since the coronavirus pandemic broke out is up to 250000 claims Gov.

The Coronavirus Aid Relief and Economic Security Act that was signed into law March 27 contains three unemployment insurance stimulus programs directed towards individuals who find themselves partially or totally unemployed due to COVID-19. Connecticuts Official State Website. Or unable or unavailable to work due to COVID-19 related reasons.

Please be advised that Congress has extended the Pandemic Emergency Unemployment Compensation PEUC program through week-ending April 10 2021. A new Federal Pandemic Unemployment Compensation FPUC payout of 300 per week is now in effect for up to 11 weeks. Due to the COVID-19 pandemic the Commissioner has waived the requirement to look for work.

For covered service workers and employers with 50 or more employees PSL will cover certain absences caused by COVID-19. Answer YES to question 1 on your weekly claim.

Http Www Ctdol State Ct Us Ui Online Guide 20for 20filing 20ct 20unemployment 20claims Pdf

Ct Dol Received 402 000 Unemployment Applications Since Start Of Pandemic News Wfsb Com

Ct Dol Received 402 000 Unemployment Applications Since Start Of Pandemic News Wfsb Com

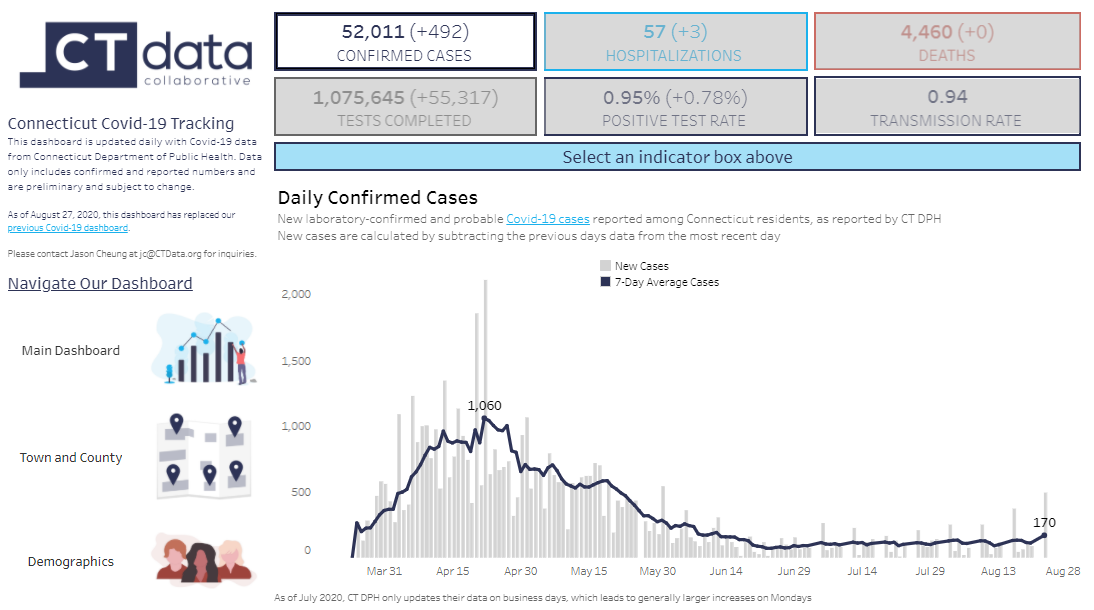

Covid 19 In Connecticut Ctdata

Covid 19 In Connecticut Ctdata

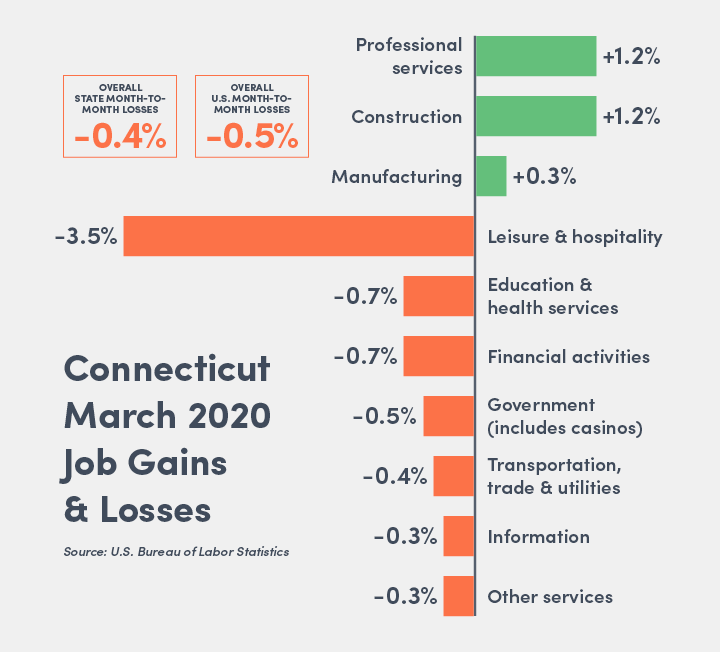

Hospitality Healthcare Retail Sectors Take Early Covid 19 Jobs Hit Cbia

Hospitality Healthcare Retail Sectors Take Early Covid 19 Jobs Hit Cbia

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Https Www Ctdol State Ct Us Uiemployers Pdf

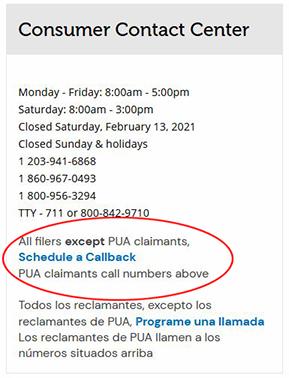

Unemployment Services Connecticut Public

Unemployment Services Connecticut Public

Http Www Ctdol State Ct Us Ui Online Guide 20for 20filing 20ct 20unemployment 20claims Pdf

Unemployment Claims Now Accepted Online Ctnewsjunkie

Unemployment Claims Now Accepted Online Ctnewsjunkie

Unemployed Urged To File For Extended Benefits Business Journalinquirer Com

Unemployed Urged To File For Extended Benefits Business Journalinquirer Com

Report Offers Glimpse Of Covid 19 Economic Damage Cbia

Report Offers Glimpse Of Covid 19 Economic Damage Cbia

Updated Coronavirus In Connecticut Connecticut Health Investigative Team

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

Governor Lamont Provides Update On Connecticut S Coronavirus Response Efforts

Governor Lamont Provides Update On Connecticut S Coronavirus Response Efforts

Ct Dept Of Labor Unemployment Rate Private Sector Employment Up

Ct Dept Of Labor Unemployment Rate Private Sector Employment Up

Questions And Answers About Unemployment During Covid 19 Ctlawhelp

Questions And Answers About Unemployment During Covid 19 Ctlawhelp

Here S How Coronavirus Rescue Bill Boosts Unemployment Benefits

Here S How Coronavirus Rescue Bill Boosts Unemployment Benefits

Some But Not All Ct Jobless To Receive 600 Federal Unemployment Pay Soon

Some But Not All Ct Jobless To Receive 600 Federal Unemployment Pay Soon

Post a Comment for "Unemployment Due To Covid Ct"