Sc Unemployment Tax Rate 2020

Without this rate freeze at the 2020 level businesses would have had to pay double. The tax class assignment in the notice should be used for the full calendar year.

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

SC unemployment tax rate to drop 34 for businesses in 2020 McMaster announces.

Sc unemployment tax rate 2020. The 2020 SUI tax rates will range from 006 to 546 including the additional 006 contingency surchargeWithin the rate schedule employer tax rates decreased between 0062 and 1191 due to the elimination of the solvency surcharge. The 19 trillion Covid relief measure limits that break to individuals and couples whose. The state also assess a 006 Contingency Assessment Rate for new employers but that rate is automatically calculated by Patriot and does not need to be included when entering your SUTA rate in the software.

It provided an additional 600 per week in unemployment compensation per recipient through July 2020. 56 rows 2013 legislation HB 168 increased the SUI taxable wage base to a minimum. Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well.

Unemployment tax credit. For 2020 the FUTA tax rate is projected to be 6 per the IRS. A year into the pandemic many are still coping with the fallout emotionally and financially.

The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020. Guide for how to file taxes if you received unemployment in SC in 2020 according to South Carolina Department of Employment and Workforce Department of Revenue and IRS. Here is a list of the non-construction new employer tax.

9 That extra 600 is also taxable after the first 10200. Residents with 150000 in taxable income pay a marginal state tax rate of 825 percent. Unemployment compensation is usually taxed in Delaware.

If youre one of the many people still recovering from losing your job last year you may have been relieved to hear that President Joe Bidens 19. Late last year Gov. That would translate into incremental state taxes of 841 on 10200 in unemployment compensation.

State Income Tax Range. 52 rows SUI tax rate by state. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10.

However unemployment benefits received in 2020 are exempt from tax. Please note that tax rates are applicable to the first 14000 each employee earns. State Taxes on Unemployment Benefits.

The unemployment tax rate will not increase next year. This 7000 is known as the taxable wage base. The rate includes a base rate of 049 and an administrative assessment of 006.

Between March and April 2020 unemployment soared to 148 a number not seen in America since before WW2 according to the Pew Research Center. The unemployment tax rate for new employers is the rate for experienced employers assigned to Rate Class 12 which is to be 055. Thats why different states have different income tax rates and some like.

Crediting a cruising economy and lower than usual unemployment claims next years unemployment insurance tax rate for South Carolina businesses will dip another 34 Gov. A number of states wont let tax-filers exclude that 10200 from their 2020 income. Columbia SC 29211-0100 Taxable Processing Center PO Box 101105 Columbia SC 29211-0105 South Carolina Department of Revenue IIT Voucher PO Box 100123 Columbia SC 29202 South Carolina Department of Revenue Income Tax PO Box 125 Columbia SC 29214-0400.

South Carolinas unemployment-taxable wage base is to remain at 14000 in 2021 unchanged from 2020. Individual rates are based on an employers computed benefit ratio. Get Your SUTA Rate View Details The South Carolina new employer SUTA UI for 2020 is 049 for 2021 which consists of the base rate solvency surcharge.

Although tax rates for each tax class are frozen at their 2020 levels individual businesses may still move between classes based on their unemployment claim activity. The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year. Henry McMaster announced that businesses in South Carolina would receive a 34 percent cut to.

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

![]() Covid Federal Programs Sc Department Of Employment And Workforce

Covid Federal Programs Sc Department Of Employment And Workforce

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

Sc Unemployment Agency S New Security Check Hinders Some From Receiving Payments Business Postandcourier Com

Sc Unemployment Agency S New Security Check Hinders Some From Receiving Payments Business Postandcourier Com

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

Sc Dew Announces 3 Programs To Expand Unemployment Benefits Wpde

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

1040ez Tax Calculator The Bank Of South Carolina

1040ez Tax Calculator The Bank Of South Carolina

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

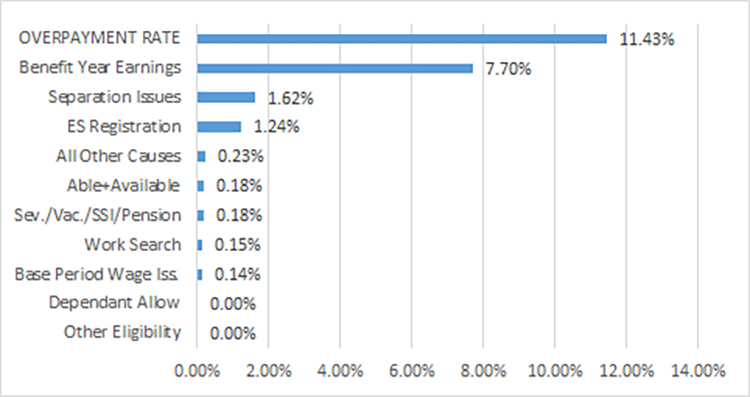

South Carolina U S Department Of Labor

South Carolina U S Department Of Labor

South Carolina U S Department Of Labor

South Carolina U S Department Of Labor

Where S My Refund South Carolina H R Block

Where S My Refund South Carolina H R Block

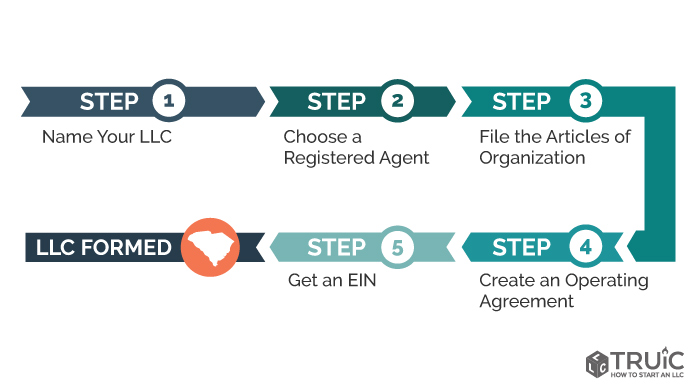

Llc In Sc How To Form An Llc In South Carolina Truic Guides

Llc In Sc How To Form An Llc In South Carolina Truic Guides

How Severely Will Covid 19 Impact Sui Tax Rates Managedpay

How Severely Will Covid 19 Impact Sui Tax Rates Managedpay

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

How Severely Will Covid 19 Impact Sui Tax Rates Managedpay

How Severely Will Covid 19 Impact Sui Tax Rates Managedpay

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Gov Mcmaster Says South Carolina S Unemployment Tax Rate Will Remain Unchanged Wpde

Gov Mcmaster Says South Carolina S Unemployment Tax Rate Will Remain Unchanged Wpde

![]() Tax Rate Information Sc Department Of Employment And Workforce

Tax Rate Information Sc Department Of Employment And Workforce

Post a Comment for "Sc Unemployment Tax Rate 2020"