State Of Ohio Unemployment Qualifications

Earnings equal to or less than 20 of a claimants weekly benefit amount will not reduce the amount of benefits paid. Ohioans who have exhausted all regular unemployment and weekly extensions also may be eligible for the program.

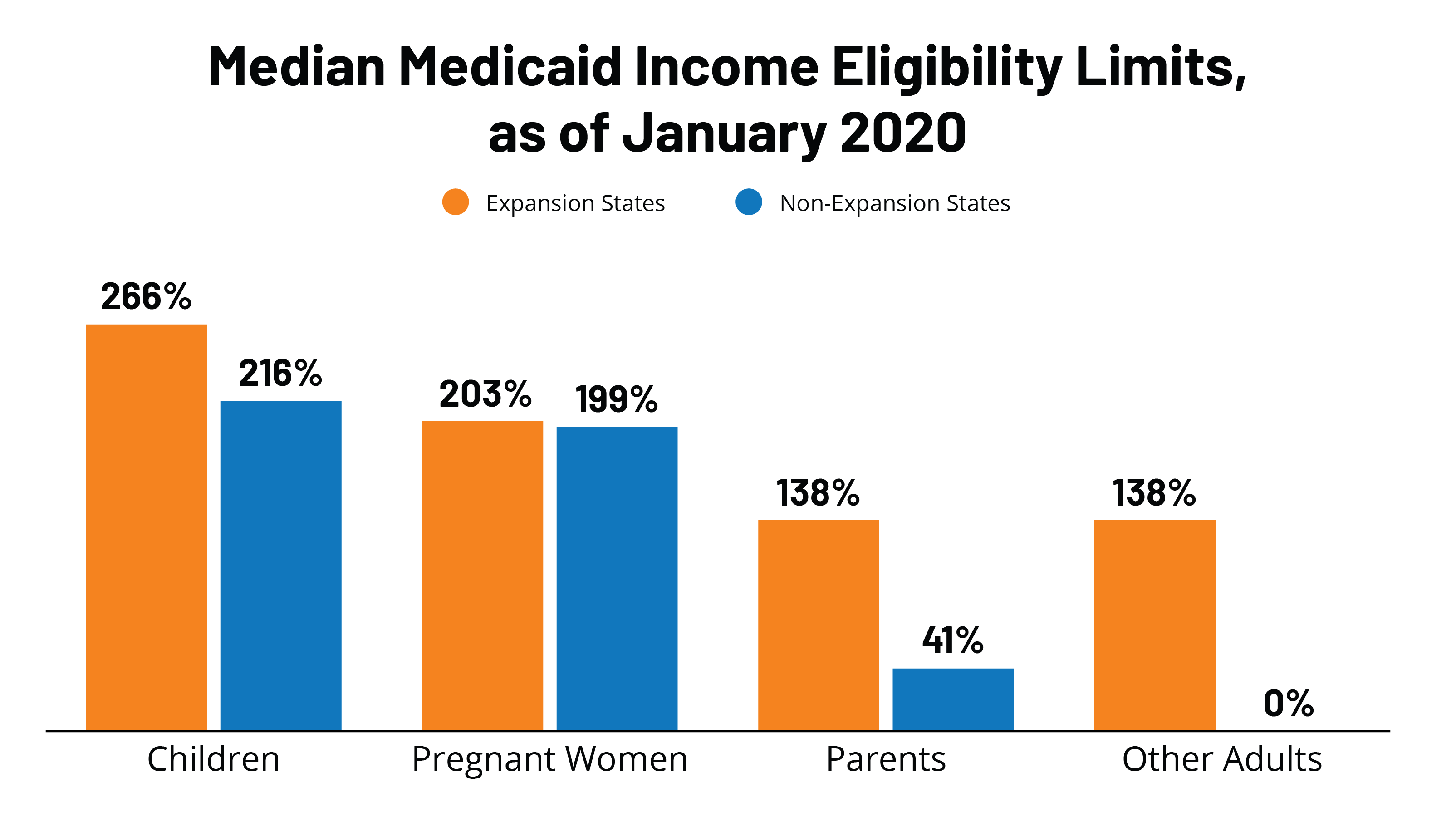

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Have worked and earned income in Ohio.

State of ohio unemployment qualifications. To have Ohio unemployment eligibility you must meet the following criteria. Individuals who are partially unemployed due to lack of work may be eligible for benefits. Expanded Eligibility Resource Hub The new federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax.

Must be physically able to work and available for work. Earnings over 20 of the weekly benefit amount will reduce the benefit payment dollar for dollar. You are either totally or partially unemployed when you file your claim.

Since your weekly benefit amount is a result of your wages during the 18 months before your claim partial unemployment benefits tend to apply to those who lost a full-time job and could only find a replacement with less pay or hours. Earnings equal to or over the benefit amount will result in no benefits for that week. If you are totally unemployed it means you have no income or earnings due to you during the week you apply for unemployment.

COLUMBUS Ohio The State of Ohio has broadened the requirements for unemployment to include those in quarantine or unable to work due to coronavirus preventive measures beginning Monday. A week may be established with any. If you are not a resident of Ohio but worked in Ohio at your last job you still have Ohio unemployment eligibility.

Any earnings from employment during the week claimed may reduce the amount of benefits paid. Apply for Unemployment Now Employee 1099 Employee Employer. Congratulations on starting a business in the great state of Ohio.

In order to establish unemployment eligibility in Ohio you have to. Coronavirus and Unemployment Benefits Frequently Asked Questions and answers for claimants and employers can be found here. Due to the pandemic Ohioans who earned less than 150000 do no have to pay state or federal income tax on the first 10200 in unemployment income they received in 2020.

Check if you are meeting all the requirements mentioned below. The State of Ohio is an Equal Employment Opportunity Employer and does not discriminate on the basis of race color religion gender gender identity or expression national origin ancestry military status disability age 40 years or older genetic information sexual orientation or caregiver status in making employment-related decisions about an individual. The federal Pandemic Unemployment Assistance Program PUA designed to provide benefits for individuals who are ineligible for state unemployment benefits including self.

Be a resident of Ohio. There is no minimum income requirement. If you are not a resident of Ohio but worked in Ohio at your last job you should still have Ohio unemployment eligibility.

To be eligible workers must fit one of these categories. Earnings equal to or less than 20 of a claimants weekly benefit amount will not reduce the amount of benefits paid. The Ohio Department of.

True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. You must have worked full-time or part-time at least 20 weeks during the base period see the first chart below for any number of employers who pay unemployment contributions. Be a resident of Ohio.

Highlighted below are two important pieces of information to help you register your business and begin reporting. How Ohios Unemployment Insurance Benefit Amounts Are Calculated Minimum number of weeks worked. Those laid off as a direct result of COVID-19 and unable to qualify for regular unemployment benefits.

PUA Login false Coronavirus and Unemployment Insurance Benefits. Unemployment benefits will be available for eligible individuals who are requested by a medical professional local health authority or employer to be isolated or quarantined as a consequence of COVID-19 even if they are not. To collect through Ohios partial unemployment program you must earn less than your weekly benefit amount and work less than full-time hours.

You should be partially or totally unemployed while applying for unemployment benefits. An executive order issued by Governor DeWine expands flexibility for Ohioans to receive unemployment benefits during Ohios emergency declaration period. Heres how to get these tax benefits.

Report it by calling toll-free. Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis.

Business Card Template Printable Unique Free Sample Business Card Template Free Printable Business Cards Free Business Card Templates Card Templates Printable

Business Card Template Printable Unique Free Sample Business Card Template Free Printable Business Cards Free Business Card Templates Card Templates Printable

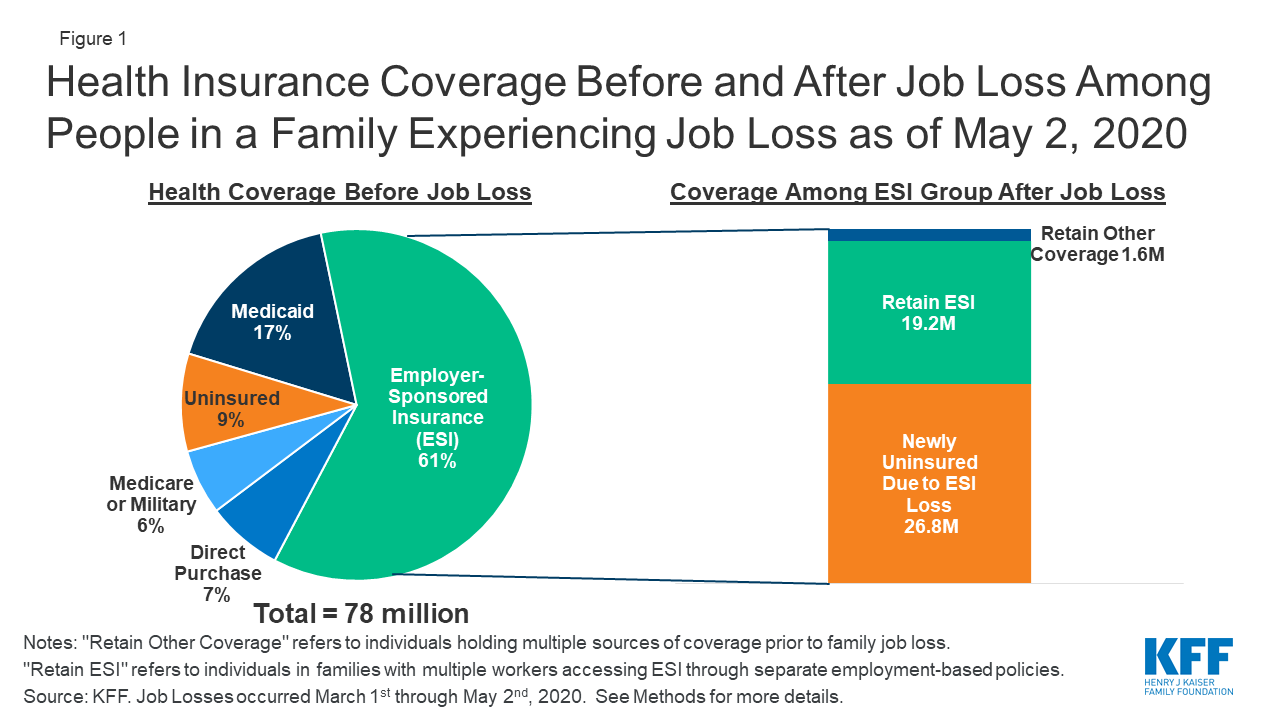

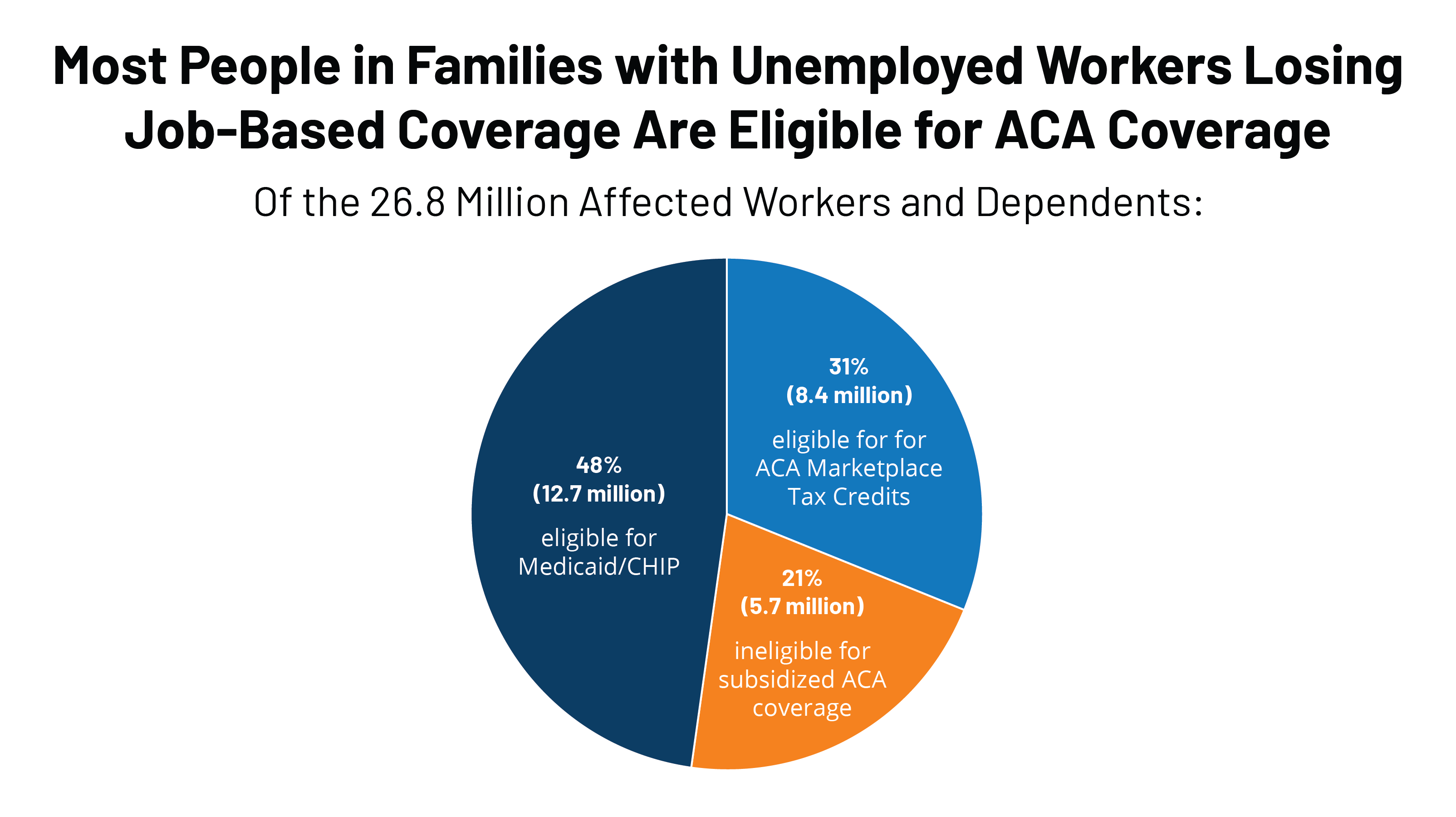

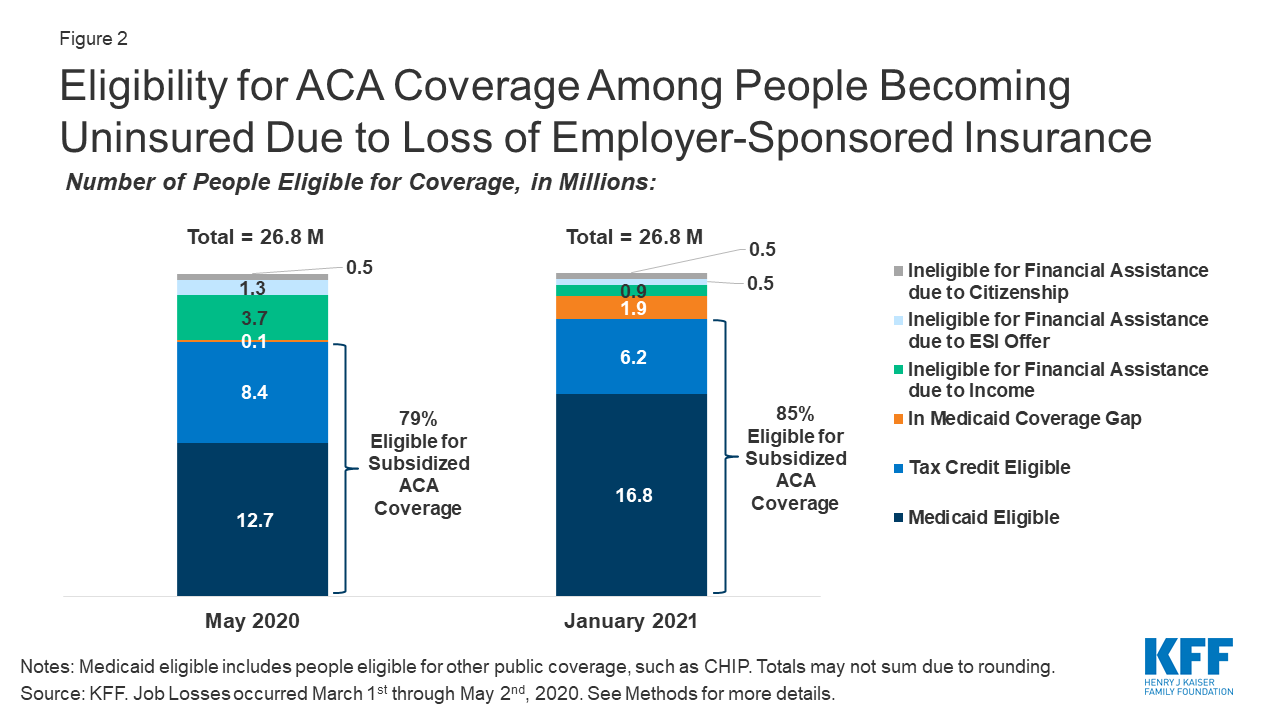

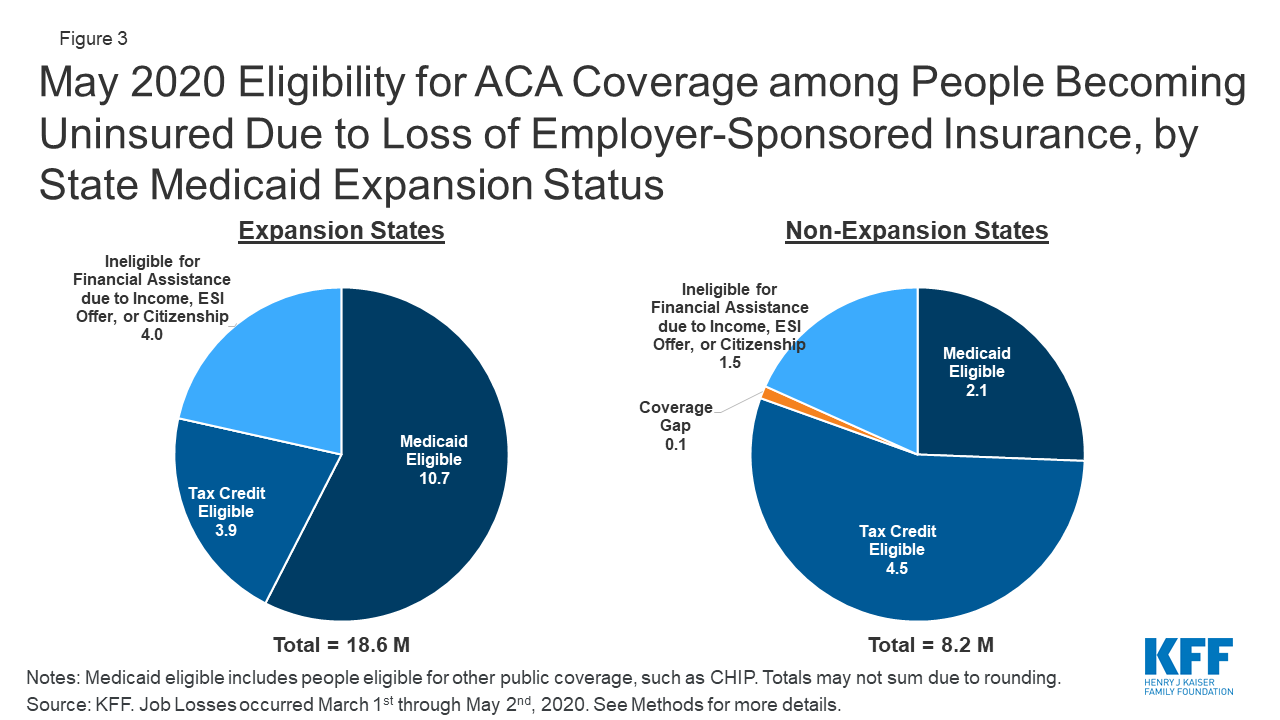

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Benefit Changes Redeterminations Requirements Affected By Coronavirus The Center For Community Solutions

Benefit Changes Redeterminations Requirements Affected By Coronavirus The Center For Community Solutions

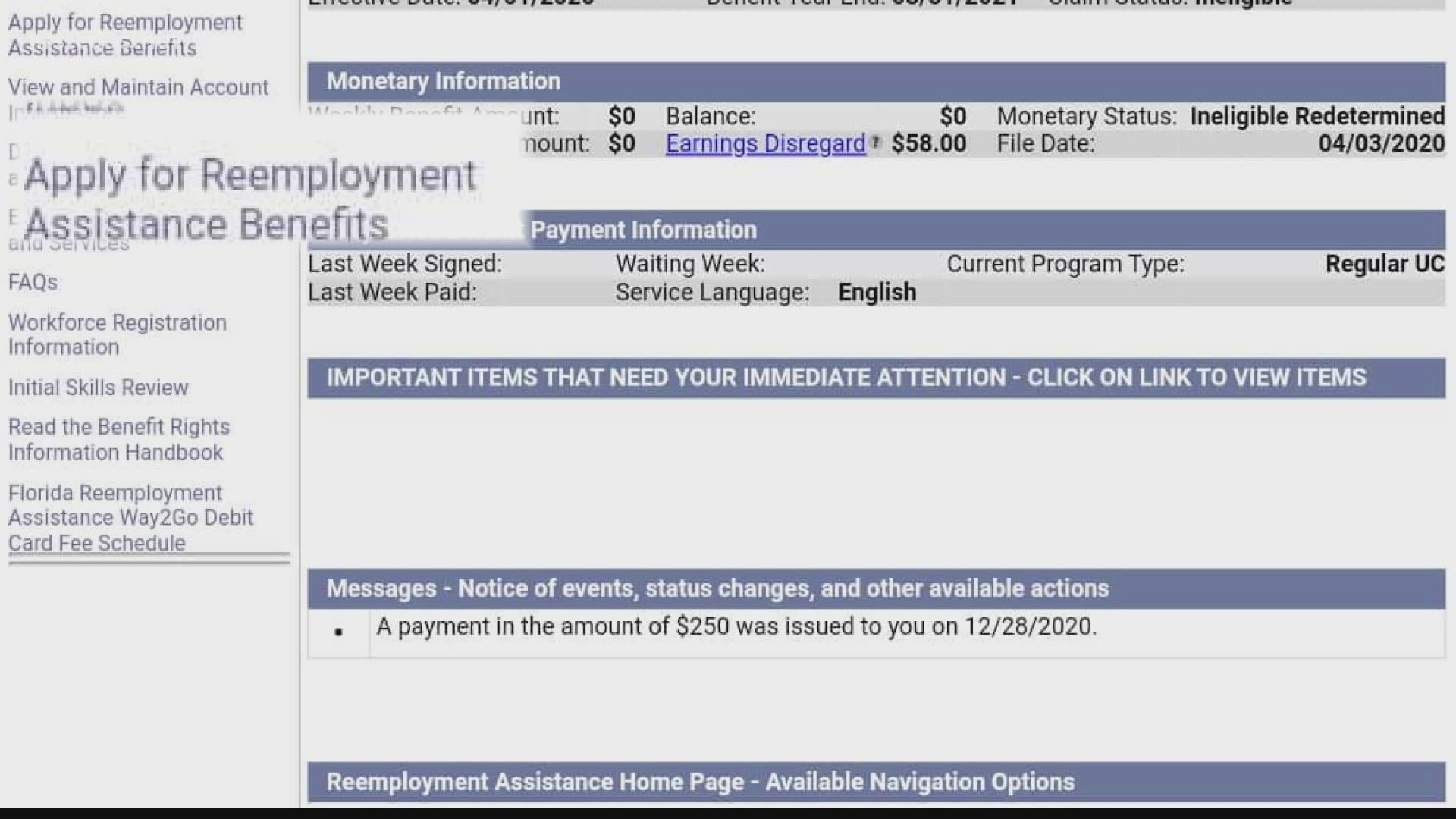

Unemployed Floridians Switched To State Programs 10tv Com

Unemployed Floridians Switched To State Programs 10tv Com

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

Classification And Compensation

Classification And Compensation

Welcome To Athens County Job And Family Services

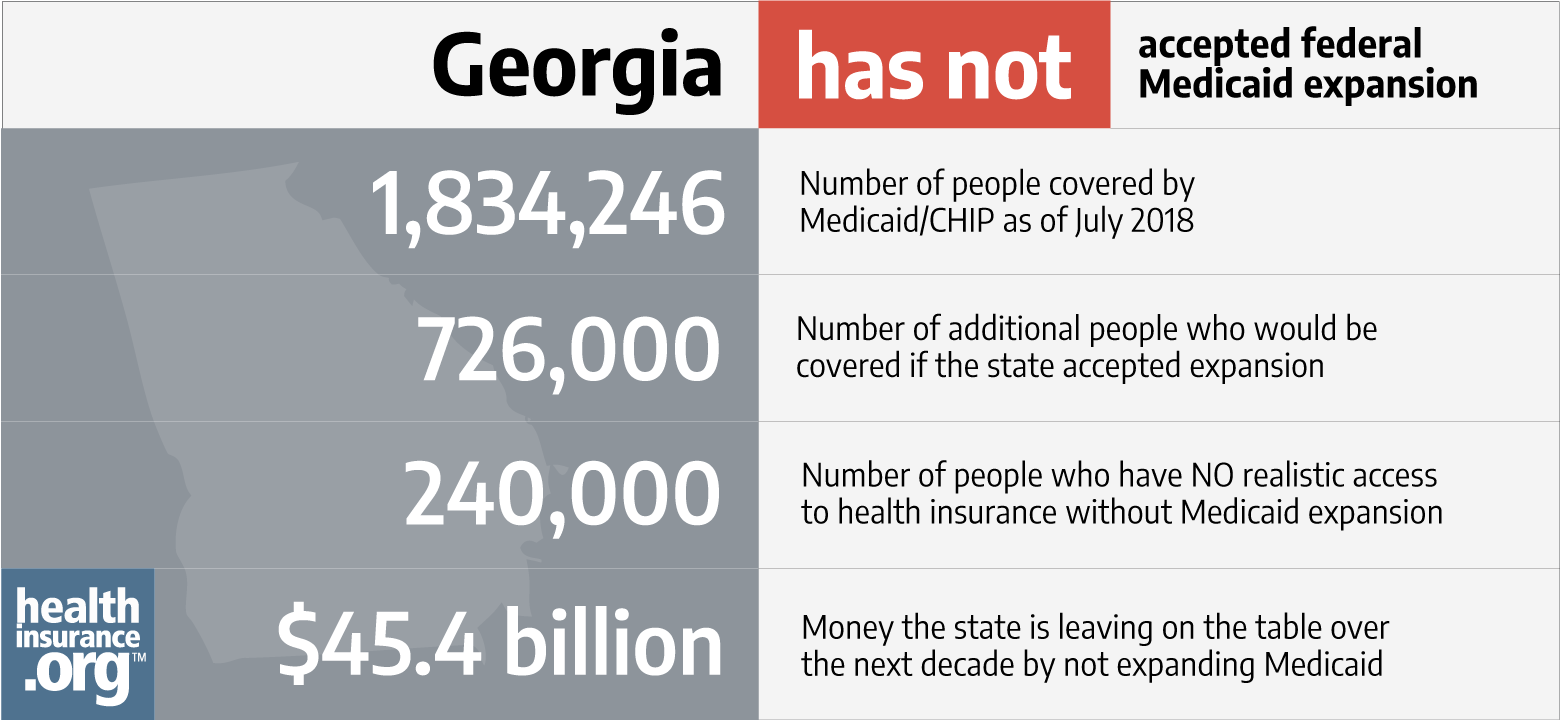

Georgia And The Aca S Medicaid Expansion Healthinsurance Org

Georgia And The Aca S Medicaid Expansion Healthinsurance Org

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

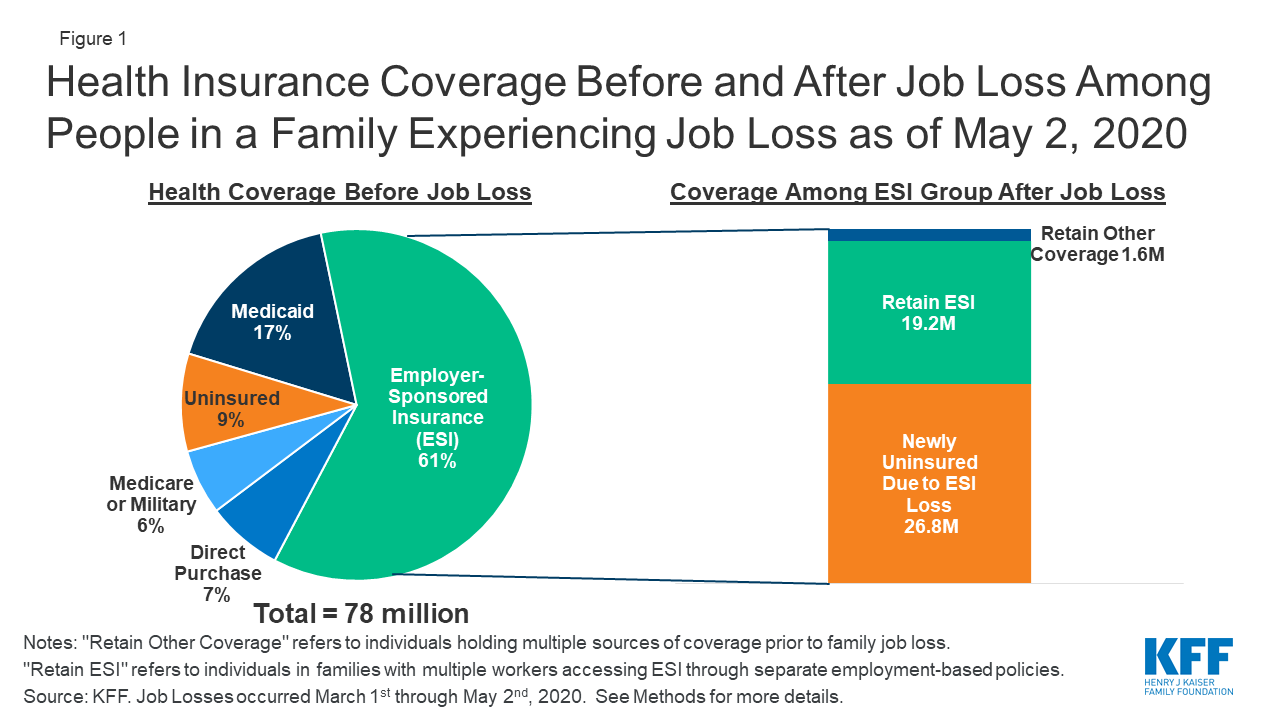

Changes In Income And Health Coverage Eligibility After Job Loss Due To Covid 19 Data Note 9345 Kff

Changes In Income And Health Coverage Eligibility After Job Loss Due To Covid 19 Data Note 9345 Kff

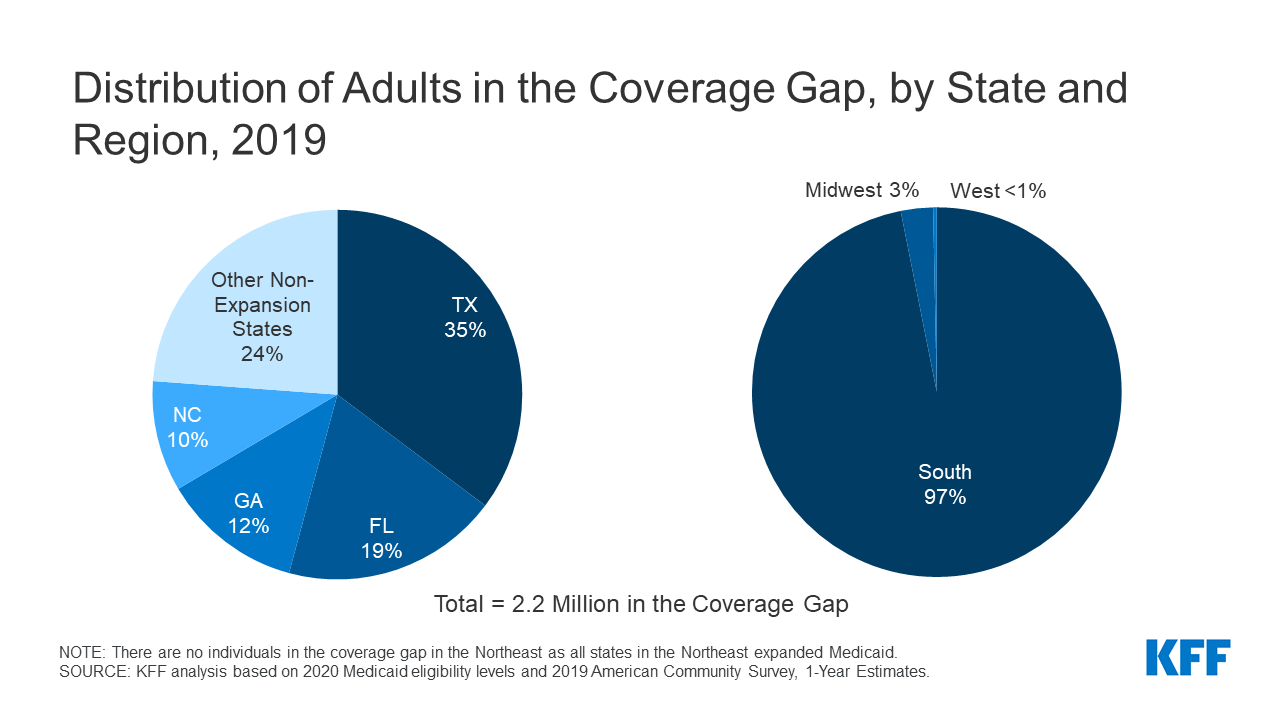

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Welcome To Athens County Job And Family Services

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Pandemic Unemployment Assistance Pua Federal Pandemic Unemployment Compensation Fpuc Government Of Guam Department Of Labor

Pandemic Unemployment Assistance Pua Federal Pandemic Unemployment Compensation Fpuc Government Of Guam Department Of Labor

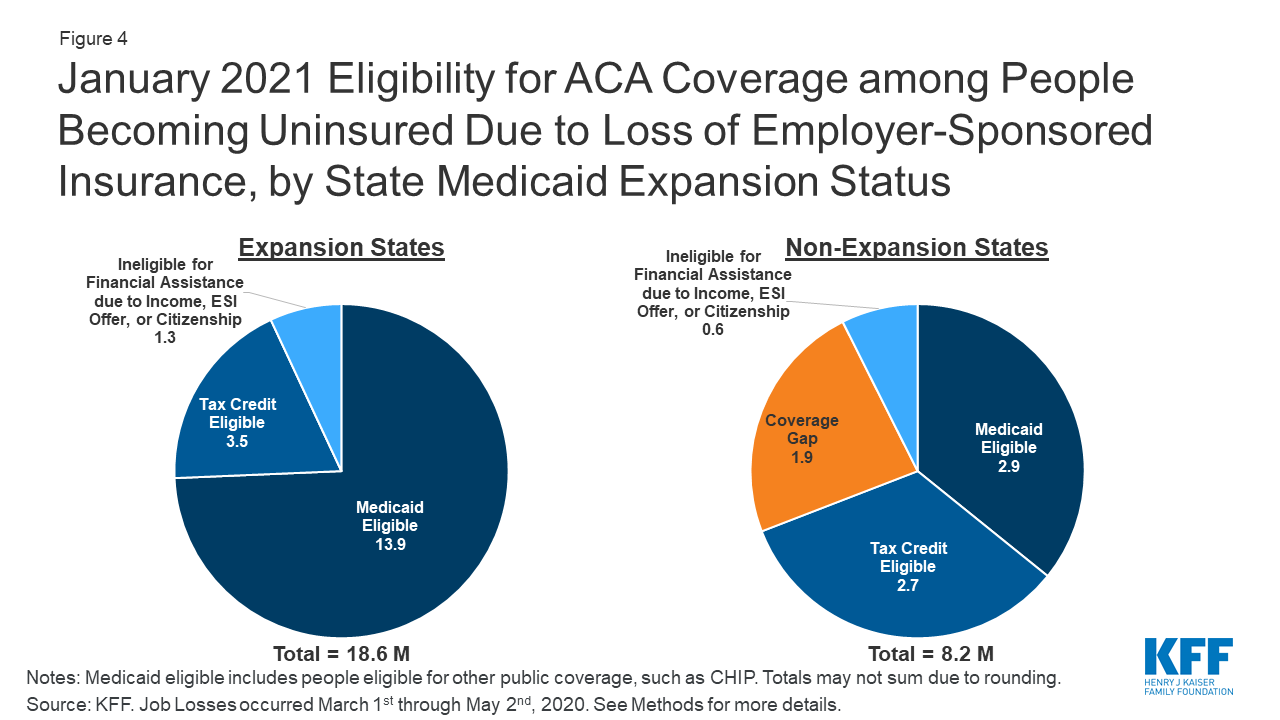

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Welcome To Athens County Job And Family Services

Paycor Employee Login Paycor Signon View Check Stubs Gmail Sign Login Problem Solving

Paycor Employee Login Paycor Signon View Check Stubs Gmail Sign Login Problem Solving

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Eligibility For Aca Health Coverage Following Job Loss Data Note 9466 Kff

Post a Comment for "State Of Ohio Unemployment Qualifications"