Unemployment Work In Ohio Live In Kentucky

Andy Beshear announced Monday a measure. They are reciprocal states.

Unemployment Fraud Stealing From Most Needy Kentuckians Hoosiers Wbir Com

Unemployment Fraud Stealing From Most Needy Kentuckians Hoosiers Wbir Com

If you live in Ohio you will only pay taxes in Ohio even though you work in Kentucky.

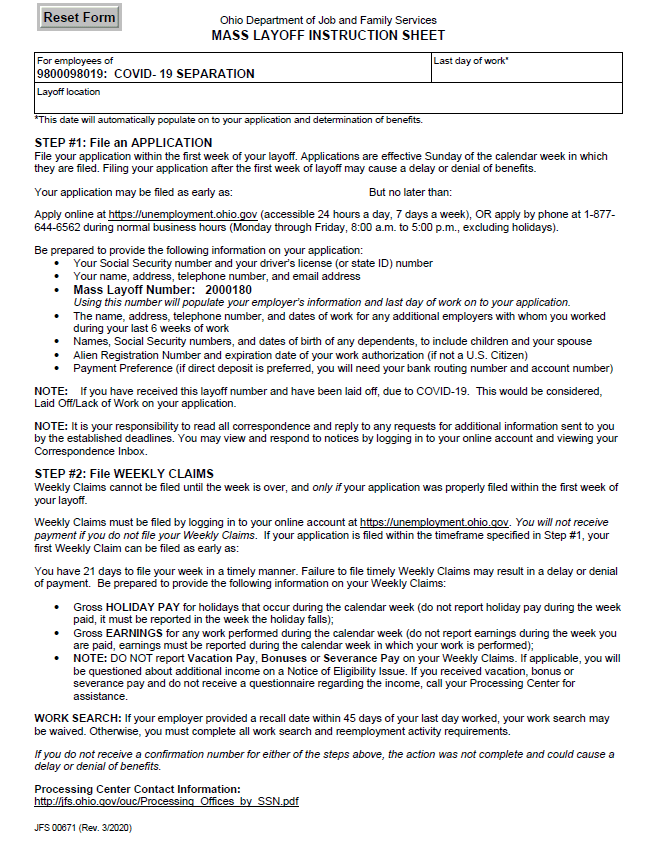

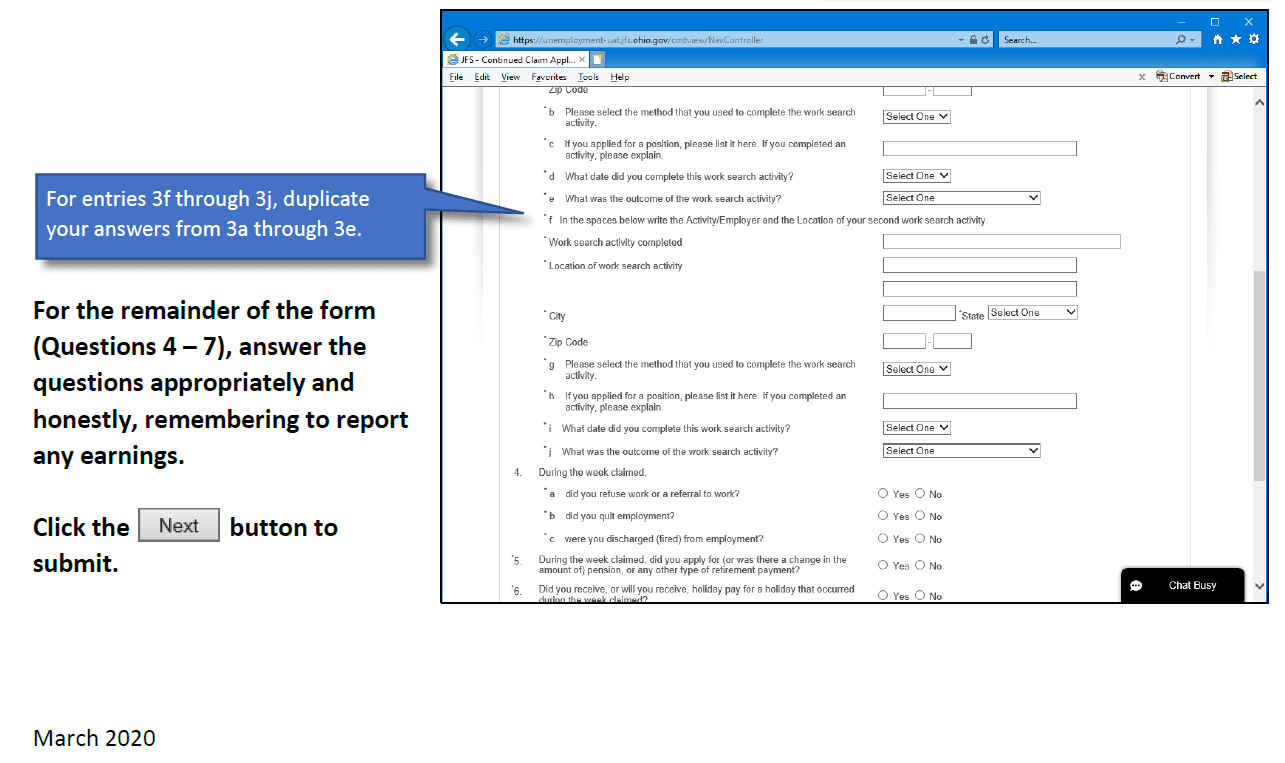

Unemployment work in ohio live in kentucky. The Tennessee Department of Labor told. Around 17 million. I am a college student that lives with my parents in Ohio but I work in Indiana.

Ohio and Kentucky have a reciprocal agreement. Shouldnt Kentucky give the taxes I paid to them to ohio. Your work done in Ohio is only taxed in Kentucky so if you paid Ohio tax you will get it all back.

She planned to be one of the. You have an interstate claim because Kentucky manages your claim but you live in another state. Im confused on this.

I filed an Ohio tax return and I am getting a refund. Ohio has a recipricol agreement with Kentucky. To ensure that the Ohio return is not generated simply answer no to the question if you lived or worked outside of Kentucky.

I filed a Ky tax return and indicates I owe almost 4000. The governors of Ohio Kentucky and Indiana have all updated their states unemployment rules in the wake of the global coronavirus pandemic. I am confused since I thought I wouldnt owe Ky taxes if I lived in Ohio all year.

Since Kentucky and Ohio have recipricol tax agreements you only have to file in one state. UI benefits help cover the gap in lost wages while you are between jobs. In addition the waiting period for eligible Ohioans to receive unemployment benefits will be waivedApply here.

A Kentucky resident return and an Ohio nonresident reciprocal return. Regional offices in the state have been closed for more than three years. I made 13316 in.

This applies regardless of where you are currently living. For the state returns you will have only two. The lesson here.

Because of the reciprocal agreement you are not considered to have worked in Ohio. No you will not need to file in Ohio. I paid state taxes on the W-2 from Kentucky.

Yes your benefits will be reduced by any severance you recieve. If two states have a reciprocal agreement and an individual lives in one of those states and works in the other the individual will only be subject to the income tax in the state where he lives. If you performed work in Ohio but live in Indiana you must file an interstate unemployment clam with Ohio as your liable state and Indiana as your agent state.

If I live in ohio and work in Kentucky and my tax returns say I owe taxes in ohio. With workers telecommuting for their jobs or moving after layoffs interstate unemployment claims are more common than most people assume. If the only Ohio based income you had was from your employer then no you do not have to file an Ohio return.

Ohio makes an exception to their filing. HYDE PARK Ohio WKRC - Lowanda Waller has never had to file for unemployment benefits but that changed Wednesday for the restaurant worker and mother of four. Unemployment Insurance UI is an employer-paid insurance program that provides you with benefits when youre separated from a job at no fault of your own.

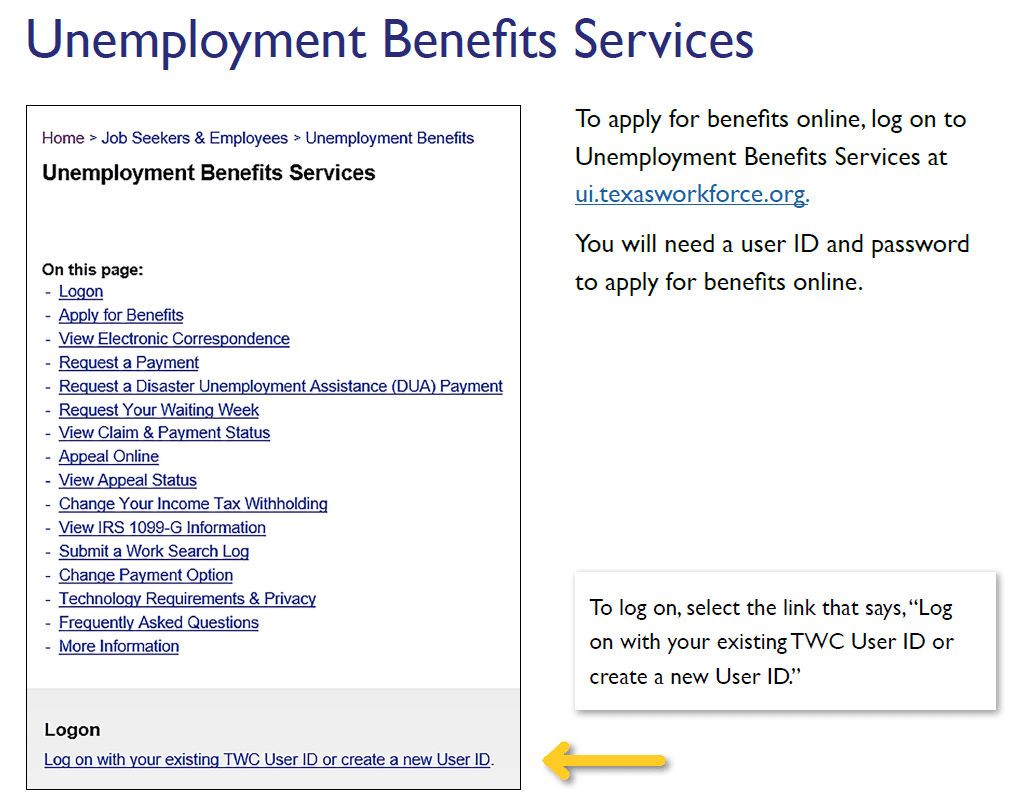

Since you live in KY you can file your unemployment claim in KY. You should file in your home state since your state taxes world wide incomeHowever if you did not complete one of the following forms you will have to file in Ohio in order to get any refundYou have to file in your home state also in this instance. 2 days agoKENTUCKY WFIE - Those in Kentucky can now make appointments to meet for in-person unemployment insurance assistance.

I need to either redo my 2018 taxes andor speak to who in IL at unemployment office to make sure they transfered what was withheld from each check-- to the state of ky. You are able to file and recieve benefits since you were not fired due to your own misconduct. The benefits are not based on need and theyre paid out in weekly payments as long as you meet eligibility requirements and report on a weekly basis.

This means that if you live in one of these states but work in the other youll only need to file a return for the state in which you live. If all of your work history for the base period took place in Kentucky you must file for unemployment benefits in Kentucky. Therefore youll need to file a Kentucky State Return.

I live in Kentucky but work in Indiana. The number 166000 comes from Ohio Unemployment Director Kimberly Henderson who said in early January the state had to stop that many IRS 1099-G forms from going out. You have to file for unemployment in the state you work in not the state you live in.

Kentucky and Ohio are reciprocal states which means they have an agreement that you only pay state taxes where you live. I thought that would go to Ohio. Tennessee and Florida do not have state tax and no return is required for either.

Unemployment Insurance How It Works And How To Apply Wku Public Radio

Unemployment Insurance How It Works And How To Apply Wku Public Radio

State Auditor Kentucky S Unemployment Office Ignored At Least 400 000 Emails

State Auditor Kentucky S Unemployment Office Ignored At Least 400 000 Emails

Unemployment Problems Still Plaguing Residents In Kentucky And Ohio

Unemployment Problems Still Plaguing Residents In Kentucky And Ohio

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Unemployment Problems Still Plaguing Residents In Kentucky And Ohio

Unemployment Problems Still Plaguing Residents In Kentucky And Ohio

Beshear Increases Capacity Limits At Ky Businesses Offers Exciting New Vaccine Timeline

Beshear Increases Capacity Limits At Ky Businesses Offers Exciting New Vaccine Timeline

Kentucky Contracts With Global Accounting Giant To Clear Out Backlog Of Unemployment Claims

Kentucky Contracts With Global Accounting Giant To Clear Out Backlog Of Unemployment Claims

Ohio Unemployment Compensation Benefits Gov

Live Blog How Coronavirus Is Impacting Life In Kentucky Wku Public Radio

Live Blog How Coronavirus Is Impacting Life In Kentucky Wku Public Radio

New Economic Data Show Appalachia S Struggles Amid Coal S Decline

New Economic Data Show Appalachia S Struggles Amid Coal S Decline

Unemployment Problems Still Plaguing Residents In Kentucky And Ohio

Unemployment Problems Still Plaguing Residents In Kentucky And Ohio

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Kentucky Unemployment Rate Recovers To Pre Pandemic Levels But Number Is Deceiving Wku Public Radio

Kentucky Unemployment Rate Recovers To Pre Pandemic Levels But Number Is Deceiving Wku Public Radio

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Ohio Kentucky Raise Unemployment Insurance Tax Rates On Employers Wkrc

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Gov Beshear Offered Self Quarantine Unemployment Now State Is Backtracking And Billing 89 3 Wfpl News Louisville

Gov Beshear Offered Self Quarantine Unemployment Now State Is Backtracking And Billing 89 3 Wfpl News Louisville

Post a Comment for "Unemployment Work In Ohio Live In Kentucky"