Unemployment Tax Rate Wisconsin

Work Search FAQ - Requirements for weekly work search actions. Wisconsins unemployment-taxable wage base is to be 14000 in 2021 unchanged from 2020.

Wisconsin State Quarter The Dairy State 30th State To Gain Statehood In 1848 Wisconsin State Wisconsin State Quarters

Wisconsin State Quarter The Dairy State 30th State To Gain Statehood In 1848 Wisconsin State Wisconsin State Quarters

Treasury Form 940 Employers Annual Federal Unemployment FUTA Tax Return.

Unemployment tax rate wisconsin. In recent years the lower-tier rate has been between 325 and 360 and the higher-tier rate has been between 340 and 410. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. Payroll less than 500000.

Taxable wage base 14000 2021 Tax Rate Table. To avoid assessment of interest on the deferred amount employers must comply with certain requirements. 1 2021 unemployment tax rates for experienced employers are to be determined with Schedule D unchanged from 2020 the department said on its website.

An individual who receives payments in 2021 will be sent a 2021 Form 1099-G and should report the appropriate amounts on his or her 2021 federal and Wisconsin income tax returns. The rate ranges from 0 all the way up to 12 on the first 14000 in wages paid to each employee in a calendar year. Starting in 2021 Proposition 208 approved by.

Employers and agents with online access can also view account information including tax rates using our Internet reporting application Employer UI Account Information. Unemployment tax credit. After three years in business unemployment tax rates can fluctuate.

Government units and statutory nonprofit organizations are exempt from taxation under. Colorado for example charges a tax rate of 463 so for 10200 in unemployment. Unlike other states Wisconsin has a two-tiered rate system.

Employers with a first quarter tax liability of 100000 or more can defer paying up to 60 of the total liability to future quarters. As an employer in Wisconsin you have to pay unemployment insurance to the state. New employers with payroll less than 500000 pay a lower rate than those with payroll of 500000 or more.

State tax wont necessarily amount to much though depending on the respective tax rate. The FUTA 940 tax does not recognize Wisconsins exclusion so since state UI taxes are not paid on the officers wages the employer is required to pay the FUTA tax on the officers wages at the full rate of 60. Compliance with the federal law is established by filing US.

In 2021 21 of employers saw a tax increase. If youre a new employer you will pay 305 if your payroll is less than 500000 and 325 if your payroll is above 500000. If you have any questions please contact us at BTAESPdwdwisconsingov or 608 266-7027.

Are Wisconsin income taxes withheld from my unemployment compensation. Thats not out of the ordinary according to Wisconsin Department of. Payroll greater than 500000.

If you have incurred unemployment tax liability for a calendar year and wish to pay your Wisconsin UI taxes by January 31 of the following year to receive the full Federal UI tax credit and avoid interest and penalties. After you are logged in you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. For those with taxable payroll of at least 500000 the tax rate is to be 310 down from 345.

See Part 4-Account Reporting. Fraud FAQ - Reporting benefit fraud and avoiding penalties. Wisconsin income taxes are only withheld from your unemployment compensation upon request.

For experienced employers with a taxable payroll of less than 500000 over the 12-month period ended June 30 2020 rates are to range from zero to 12. ACH Debit Payments FAQ - Payment option for employers to pay unemployment insurance taxes. FinancingTax Rate - How UI program is financed and how an employer tax rate is determined.

Like Indiana and Wisconsin offer a partial tax break on benefits. For example taxpayers in Colorado pay a flat 463 on. Taxable wage base.

The federal withholding is 10 of the weekly amount payable and the state withholding is 5 of the weekly amount payable. Generally if you are subject to Wisconsins UI Law you will also be subject to the Federal Unemployment Tax Act FUTA. The rate recently has decreased.

For new construction employers with taxable payroll of less than 500000 the unemployment tax rate is to be 290 for 2021 down from 330 in 2020.

Unemployment Delays Part 5 Wisconsin Unemployment

Unemployment Delays Part 5 Wisconsin Unemployment

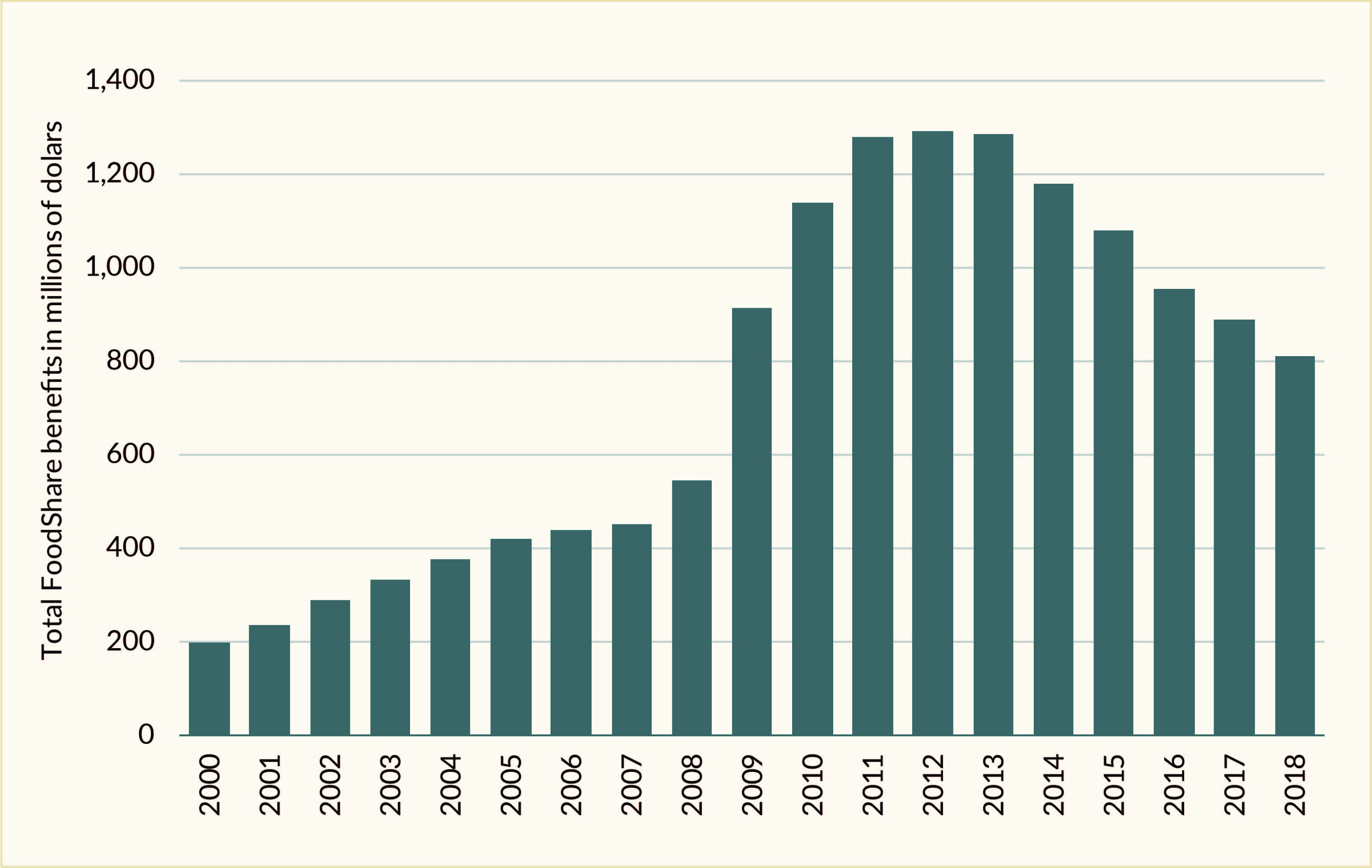

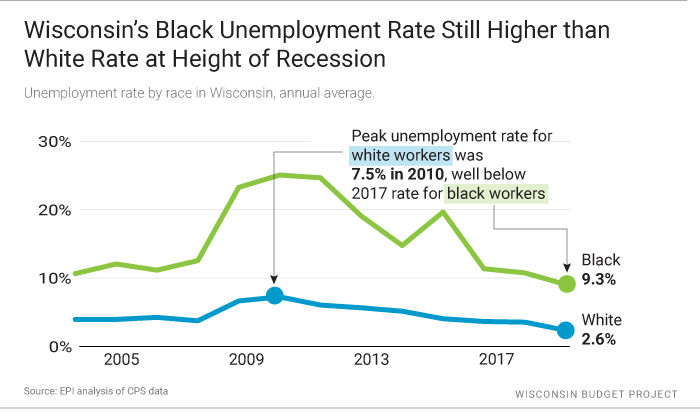

Wisconsin Budget The Black White Unemployment Gap Urban Milwaukee

Wisconsin Budget The Black White Unemployment Gap Urban Milwaukee

Profiles In Coverage Wisconsin S Badgercare Plus Bcp Program State Coverage Initiatives

10 Most Needed Jobs In The Future Ehow Marketing Jobs Tax Write Offs Job

10 Most Needed Jobs In The Future Ehow Marketing Jobs Tax Write Offs Job

Prices Surge As Drought Stunts Corn Crop Corn Crop Drought Stunts

Prices Surge As Drought Stunts Corn Crop Corn Crop Drought Stunts

Appleton Wisconsin Wi Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oregon Wisconsin Wi 53575 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wisconsin Budget 55 School Funding Referendums Approved School Budgeting Wisconsin

Wisconsin Budget 55 School Funding Referendums Approved School Budgeting Wisconsin

Federal And State Income Tax Withholding Wisconsin Unemployment Insurance

Federal And State Income Tax Withholding Wisconsin Unemployment Insurance

Unemployment Delays Part 1 Wisconsin Unemployment

Unemployment Delays Part 1 Wisconsin Unemployment

Wisconsin S Unemployment Rate Skyrockets To 27 Percent The Daily Cardinal

Wisconsin S Unemployment Rate Skyrockets To 27 Percent The Daily Cardinal

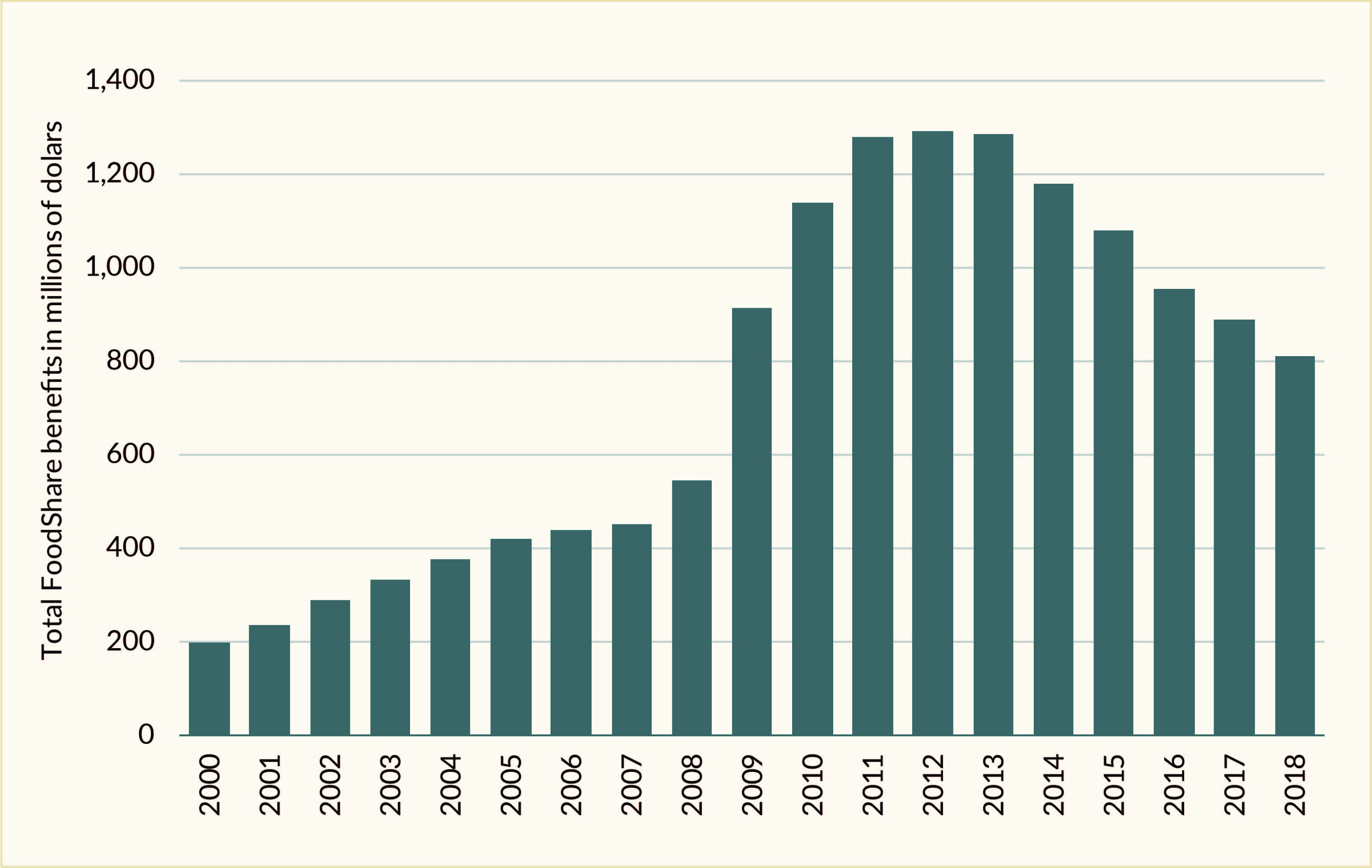

Declining Returns To Low Wage Work In Wisconsin Institute For Research On Poverty Uw Madison

Declining Returns To Low Wage Work In Wisconsin Institute For Research On Poverty Uw Madison

Unemployment Delays Part 5 Wisconsin Unemployment

Unemployment Delays Part 5 Wisconsin Unemployment

Greetings From Wisconsin Google Search Postcard Wisconsin Wisconsin State

Greetings From Wisconsin Google Search Postcard Wisconsin Wisconsin State

Wisconsin Budget The Black White Unemployment Gap Urban Milwaukee

Wisconsin Budget The Black White Unemployment Gap Urban Milwaukee

Oregon Wisconsin Wi 53575 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Federal And State Income Tax Withholding Wisconsin Unemployment Insurance

Federal And State Income Tax Withholding Wisconsin Unemployment Insurance

Post a Comment for "Unemployment Tax Rate Wisconsin"