Do You Pay Taxes On Unemployment In Ohio

This is due to the fact that the major industry in Ironton was the coal-fired electrical plant there. The IRS and most states consider unemployment payments as taxable income which means that you have to pay tax on these payments and report them on your return.

How To Write Bank Letters In 2020 Money Financial Help Offshore Bank

How To Write Bank Letters In 2020 Money Financial Help Offshore Bank

If you file your application during 2021 you must have an average weekly wage of at least 280 before taxes or other deductions.

Do you pay taxes on unemployment in ohio. Unemployment checks in Ohio normally amount to no more than half the lost weekly income topping out at 480 for a single person or 647 for someone with at least three dependents. 5 Depending on the number of dependents you have this might be more or less than what an employer would have withheld from your pay. The change in a bill signed by Gov.

What are the consequences of failing to file or pay unemployment insurance taxes. The IRS considers unemployment benefits taxable income When filing for tax year 2020 your unemployment checks will be counted as. Your 1099-G will have the information youll need to transfer to your tax return.

Some states will mail out the 1099G. Please visit unemploymentohiogov click on the Report Identity Theft button and complete the form so that we can investigate the claim that was filed and take appropriate actionsThis can include correcting the 1099-G form that you were sent. The average weekly wage is determined by dividing your total wages earned during the base period from any employer who pays unemployment contributions by the total number of.

The Ohio Department of Taxation will help you find answers to questions about Ohio income taxes including who needs to file a return how and when to file finding the right tax forms and information about Ohios sales tax holiday. It is included in your federal adjusted gross income FAGI on your federal 1040. The IRS considers unemployment compensation taxable income.

Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. Federal income tax is withheld from unemployment benefits at a flat rate of 10. Can employers file tax returns using alternate methods.

You can use Form W-4V Voluntary Withholding Request to. With this new law if your household income is less than 150000 the first 10200 of unemployment per taxpayer will be tax free on your federal tax return but any amount you receive above that will be taxed. The City of Ironton if I recall correctly is the only city in Ohio that taxes unemployment.

As of December 27 2020 an additional 300 in unemployment benefits will be added to. Unemployment compensation is taxable on your federal return. Mike DeWine Wednesday brought.

How do I correct previous quarterly tax reports. State Taxes on Unemployment Benefits. As a result any.

A record number of tax forms will be going out this month to Ohioans who must pay taxes on unemployment benefits they received in 2020. Additionally if you live in a traditional tax base school district your unemployment compensation is also subject to. You will have to enter a 1099G that is issued by your state.

The UI tax funds unemployment compensation programs for eligible employees. If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax. Youll have to pay taxes on the remaining amount if you received more than 10200 in unemployment compensation.

Taxation of unemployment benefits in Ohio. Ohio taxes unemployment compensation to the same extent it is taxed under federal law. In Ohio state UI tax is just one of several taxes that employers must pay.

COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received. 1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a three-year period that would be needed to pay. Where can I obtain Employment Tax Forms and Publications.

The money you receive through state-sponsored unemployment insurance is considered taxable income and must be reported to the federal government. Unemployment compensation has its own line Line 7 on Schedule 1. To check on your refund pay your taxes or file online visit TaxOhiogov.

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

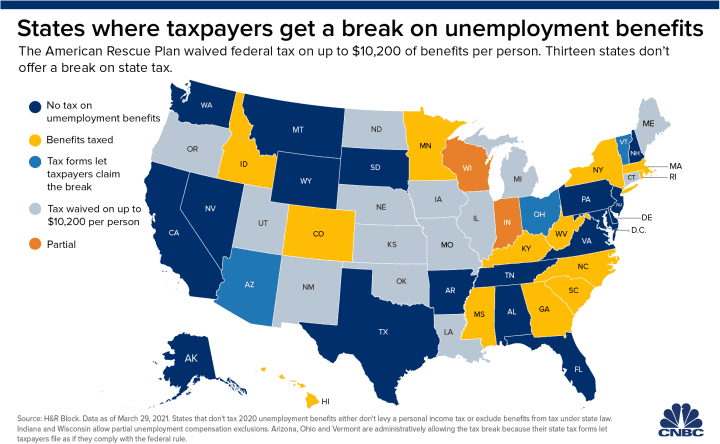

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Expect 300 Retroactive Ohio Unemployment Supplemental Checks The Second Half Of September That S Rich Recap In 2020 Unemployment Student Loan Payment Federal Emergency Management Agency

Expect 300 Retroactive Ohio Unemployment Supplemental Checks The Second Half Of September That S Rich Recap In 2020 Unemployment Student Loan Payment Federal Emergency Management Agency

Seven Things About Salary Calculator You Have To Experience It Yourself Salary Calculator Salary Calculator Salary No Experience Jobs

Seven Things About Salary Calculator You Have To Experience It Yourself Salary Calculator Salary Calculator Salary No Experience Jobs

Employment Based Green Card Interview Questions 2018 Employment Zanesville Ohio Employme This Or That Questions Employment Application Interview Questions

Employment Based Green Card Interview Questions 2018 Employment Zanesville Ohio Employme This Or That Questions Employment Application Interview Questions

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Can You Solve The Equation Real Estate Fun Real Estate Memes Real Estate

Can You Solve The Equation Real Estate Fun Real Estate Memes Real Estate

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

10 Questions Retirees Often Get Wrong About Taxes In Retirement Kiplinger Corporate Business Card Design This Or That Questions Tax

10 Questions Retirees Often Get Wrong About Taxes In Retirement Kiplinger Corporate Business Card Design This Or That Questions Tax

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Pin By Brian J Boskovitch On Unoy Tetri In 2020 Activities Day Ohio

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

5 Facts About The Minimum Wage Minimum Wage Wage District Of Columbia

5 Facts About The Minimum Wage Minimum Wage Wage District Of Columbia

Post a Comment for "Do You Pay Taxes On Unemployment In Ohio"