Missouri Unemployment Independent Contractor

Ten states have begun sending unemployment benefits to self-employed workers and independent contractors who are eligible for such payments for the first time under the CARES Act. From March 21-28 Missouri saw over 104000.

Eligibility For Unemployment Benefits Missouri Labor

Eligibility For Unemployment Benefits Missouri Labor

JOSEPH Mo More than 327000 Missourians have filed for unemployment in the last five weeks.

Missouri unemployment independent contractor. LOUIS COUNTY Mo. Jefferson City MO The Missouri Department of Labor and Industrial Relations DOLIRs Division of Employment Security DES is encouraging the self-employed gig workers and independent contractors whose businesses have been impacted by the coronavirus to apply for unemployment assistance. Misclassifying workers is wrong and against the law.

Missourians that are self-employed or independent contractors can apply for unemployment assistance. The new program is one way Congress boosted unemployment insurance for 2020 to help ease the economic pain for a record number of out-of-work Americans. The individual is an independent contractor who is unemployed partially unemployed or unable or unavailable to work because the COVID-19 health emergency has severely limited their ability to continue performing their customary work activities.

April 7 2020. The state of Missouri is encouraging the self-employed independent contractors and gig workers to apply for unemployment. This payment to eligible claimants will begin for the week ending January 2 2021 and will continue until the week ending September 4 2021.

Under the Pandemic Unemployment Assistance PUA program those who qualify will. UInteract uinteractlabormogov is an easy-to-use mobile-friendly online Unemployment Insurance application that is available to workers and employers 247. As such they are responsible for reporting their income and paying the appropriate state and federal taxes.

By Austin Huguelet Springfield News-Leader Monday Mar 30 2020 at 303 PM. Missouri is not yet able to process unemployment claims from independent contractors and people who are self-employed even though the federal government has temporarily extended benefits to those workers during the coronavirus outbreak. Take the assessment to see if your workers should be classified as employees or independent contractors.

Outside Local Calling Area 800-320-2519. How to file for unemployment in Missouri under the CARES Act. Self-employed people gig workers and independent contractors can now apply for unemployment assistance.

The Federal Pandemic Unemployment Compensation FPUC program provides that eligible claimants shall receive an additional 300 per week payment. View the unemployment rate and number of initial claims for unemployment by Missouri county for each month. Missouri uses the IRS 20-factor test PDF Document as a guide in determining if a worker is an employee.

The Missouri Department of Labor will begin. Missouri law defines who is an employee and who is an independent contractor based on the relationship between the business and the person performing the work. Gig workers and independent contractors.

Thanks to the Coronavirus Aid Relief and Economic Security CARES Act many artists and creative workers who cobble their incomes together from multiple sources will soon be eligible for safety net unemployment benefits. Under Missouri law wages paid to employees are subject to employment taxes paid by the employer. SPRINGFIELD Until Missouris government gets guidance from the US Labor Department those workers may be not be approved for unemployment.

Louis Realty Securities Co 344 Mo. The Missouri Supreme Court has defined an independent contractor as one who exercising an independent employment contracts to do a piece of work according to his own methods without being subject to the control of his employer except as to the result of his work Vaseleou v. Independent contractors are considered self-employed.

Misclassified workers miss out on things like health insurance unemployment benefits workers compensation coverage and employer tax contributions. When an independent contractor provides a service or product the service recipient does not have to withhold employment taxes pay social security taxes FICA or pay unemployment tax. The CARES Act signed into law on March 27 expands eligibility to nontraditional workers such as independent contractors.

Ninety percent of claimants are able to file online without assistance. Independent Contractors The determination of whether an individual is an employee or independent contractor is important for several reasons for Missouri unemployment tax purposes.

Https Lsem Org Wp Content Uploads 2020 05 Unemployment Slides For 5 7 2020 Pdf

Pandemic Unemployment Assistance Requires Certain Criteria

Pandemic Unemployment Assistance Requires Certain Criteria

Https Lsem Org Wp Content Uploads 2020 05 Unemployment Slides For 5 7 2020 Pdf

Missouri Department Of Labor Now Issuing 600 Dollar Federal Unemployment Ktts

Missouri Department Of Labor Now Issuing 600 Dollar Federal Unemployment Ktts

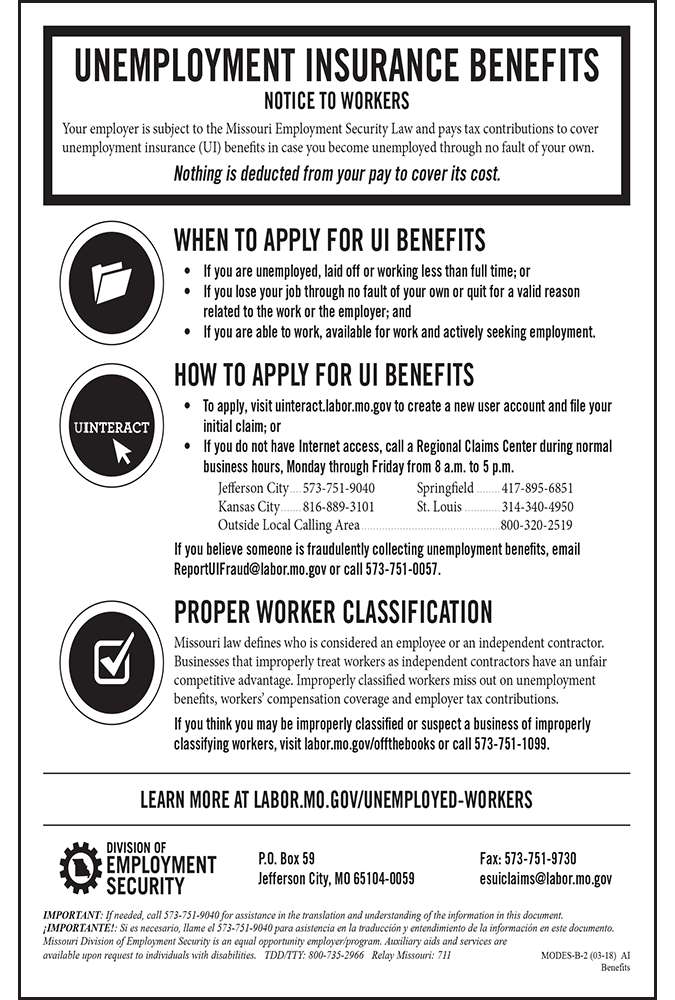

Missouri S Unemployment Insurance Posting Gets New Look Compliance Poster Company

Missouri S Unemployment Insurance Posting Gets New Look Compliance Poster Company

Small Business Owners Employees Caught In Limbo Waiting For State Unemployment Guidance News Headlines Kmov Com

Small Business Owners Employees Caught In Limbo Waiting For State Unemployment Guidance News Headlines Kmov Com

Missouri Isn T Yet Able To Process Unemployment Claims Of Gig Workers Coronavirus Stltoday Com

Missouri Isn T Yet Able To Process Unemployment Claims Of Gig Workers Coronavirus Stltoday Com

Wc 86 Instructions Missouri Labor

Wc 86 Instructions Missouri Labor

Missouri Isn T Yet Able To Process Unemployment Claims Of Gig Workers Coronavirus Stltoday Com

Missouri Isn T Yet Able To Process Unemployment Claims Of Gig Workers Coronavirus Stltoday Com

Missouri Encourages Self Employed Gig Workers To Apply For Unemployment Ktlo

Missouri Encourages Self Employed Gig Workers To Apply For Unemployment Ktlo

Eligibility For Unemployment Benefits Missouri Labor

Eligibility For Unemployment Benefits Missouri Labor

Help Topics For Unemployed Workers Missouri Labor

Help Topics For Unemployed Workers Missouri Labor

Missouri Begins Issuing 600 Payments To Unemployed Coronavirus Stltoday Com

Missouri Begins Issuing 600 Payments To Unemployed Coronavirus Stltoday Com

Free Missouri Independent Contractor Agreement Word Pdf Eforms

Post a Comment for "Missouri Unemployment Independent Contractor"