Louisiana Unemployment Tax Form 1099-g

However the recipient is required to file a declaration of estimated tax if his Louisiana income tax liability can reasonably be expected to exceed 1000 after deducting all allowable credits RS. Digital copies of the.

California Unemployment Help Career Purgatory

California Unemployment Help Career Purgatory

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits.

Louisiana unemployment tax form 1099-g. Louisiana unemployment compensation is paid to eligible recipients by the Louisiana Workforce Commission which then issues the recipienG in the January t a Form 1099-following the year of payment. Check News and Announcements for details. If you didnt have an overpayment on your 2016 Louisiana return you will need to contact the Louisiana Department of Revenue.

Workers Claim Information for Unemployment Insurance. You will need to contact the agency that issued you the Form 1099-G to obtain the state ID number. According to the Louisiana Workforce Commission LWC pandemic-related unemployment benefits became a target of identity thieves who used stolen personal information to claim fraudulent unemployment payments in multiple states including Louisiana.

You will be issued Form 1099G at the end of January showing the amount of benefits paid to you as well as any federal income tax withheld at the time the benefits were paid. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk. View or Print Income Tax Form 1099-G.

An individual is generally required to report this income from the Form 1099-G on the individuals federal income tax return. LWC-ES 494 - Unemployment Insurance Claimants Federal Income Tax Withholding Program. According to the Louisiana Workforce Commission LWC pandemic-related unemployment benefits became a target of identity thieves who used stolen personal information to claim fraudulent unemployment payments in multiple states including Louisiana.

The amounts on this form are reported to the taxing agencies and matched with the amounts reported on your tax return. Are Louisiana income taxes required to be withheld from payments reported on Form 1099 MISC. Anyone who receives a 1099-G tax form from LWC that documents unemployment benefits they did not receive or overstates benefits they did.

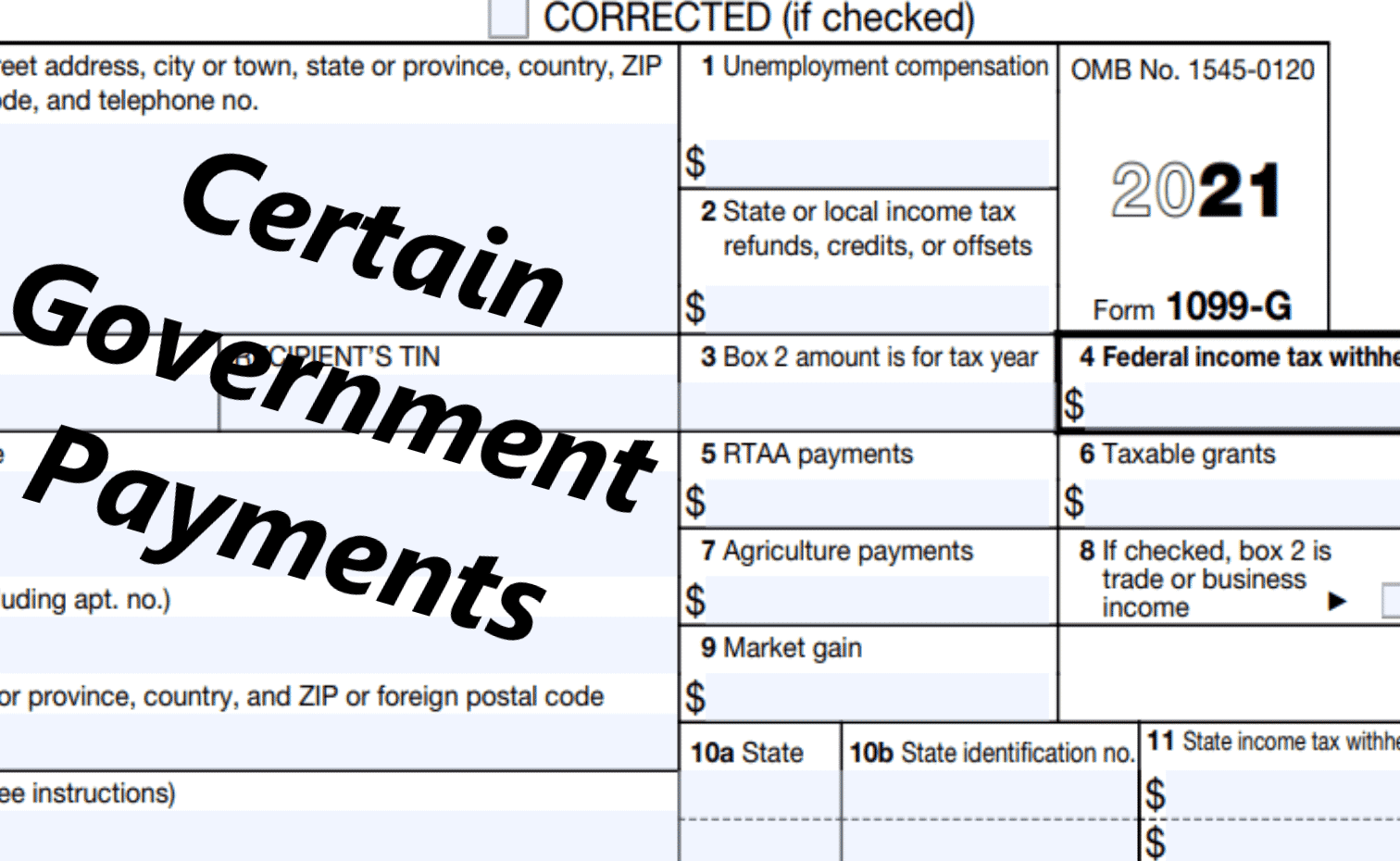

If you received unemployment benefits in 2020 you should have also received a mailed statement or an online version of the Form 1099-G Certain Government Payments from your state unemployment. Find out when all state tax returns are due. If you itemize deductions.

This may program and received a payment from that program the payer must issue a separate Form 1099-G to report this amount to you. Unemployment Insurance Federal Tax Withholding. The IRS considers unemployment compensation to be taxable incomewhich you.

The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020. 15 rows Unemployment recipients can now access their 2020 tax form 1099-G in HiRE. Unemployment compensation program or to a governmental paid family leave has received a payment as a nominee that is taxable to you.

BATON ROUGE La. Louisiana laws regulating the unemployment compensation system including Administrative Rules outlining the appeal process for unemployment claims. If you received unemployment benefits this year you can expect to receive a Form 1099-G Certain Government Payments that lists the total amount of compensation you received.

- The Louisiana Workforce Commission LWC has begun the process of mailing 698000 1099-G forms to individuals who received unemployment benefits in 2020. Anyone who receives a 1099-G tax form from LWC that documents unemployment benefits they did not receive or overstates benefits they did. LWC - Form 130 Approved Training PDF LWC - Certificate Of Attendance PDF.

Addresses for Mailing Returns. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. The amount on the 1099G is not reduced by any repayments you may have made for overpaid benefits.

Click here for a link to the Louisiana Department of Revenue Contact Us page. If you received a Form 1099-G it will be reported to the IRS. Benefits Rights Information PDF Easy Call Instructions PDF UI Federal Income Tax Withholding Form PDF Eligibility Review Form PDF Frequently Asked Questions about Benefits.

If you receive a 1099-G for benefits for which you did not apply take action. Any UI benefits you receive are taxable income. They may need to issue a corrected Form 1099-G.

Unemployment recipients can now access their 2020 tax form 1099-G in HiRE.

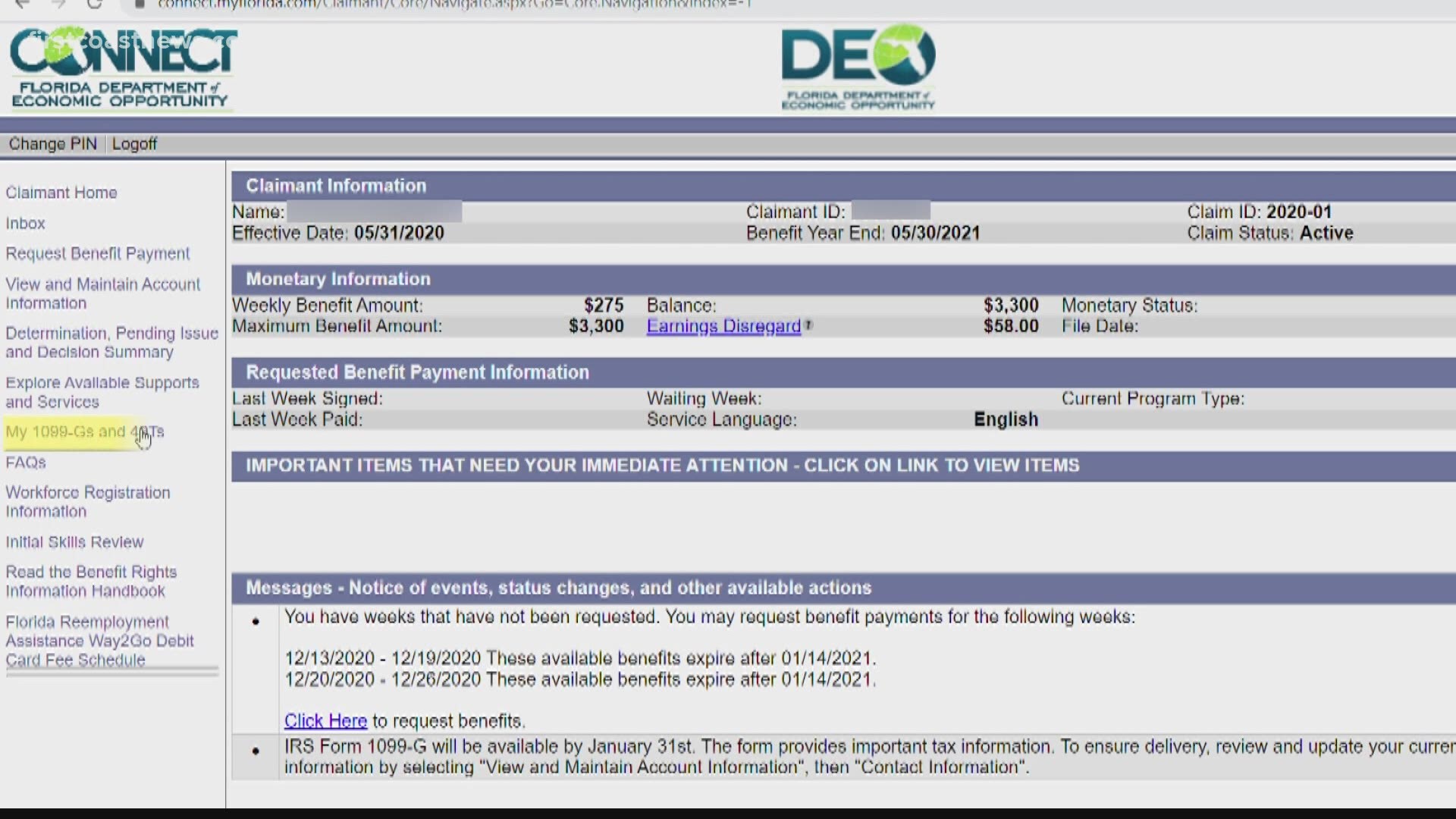

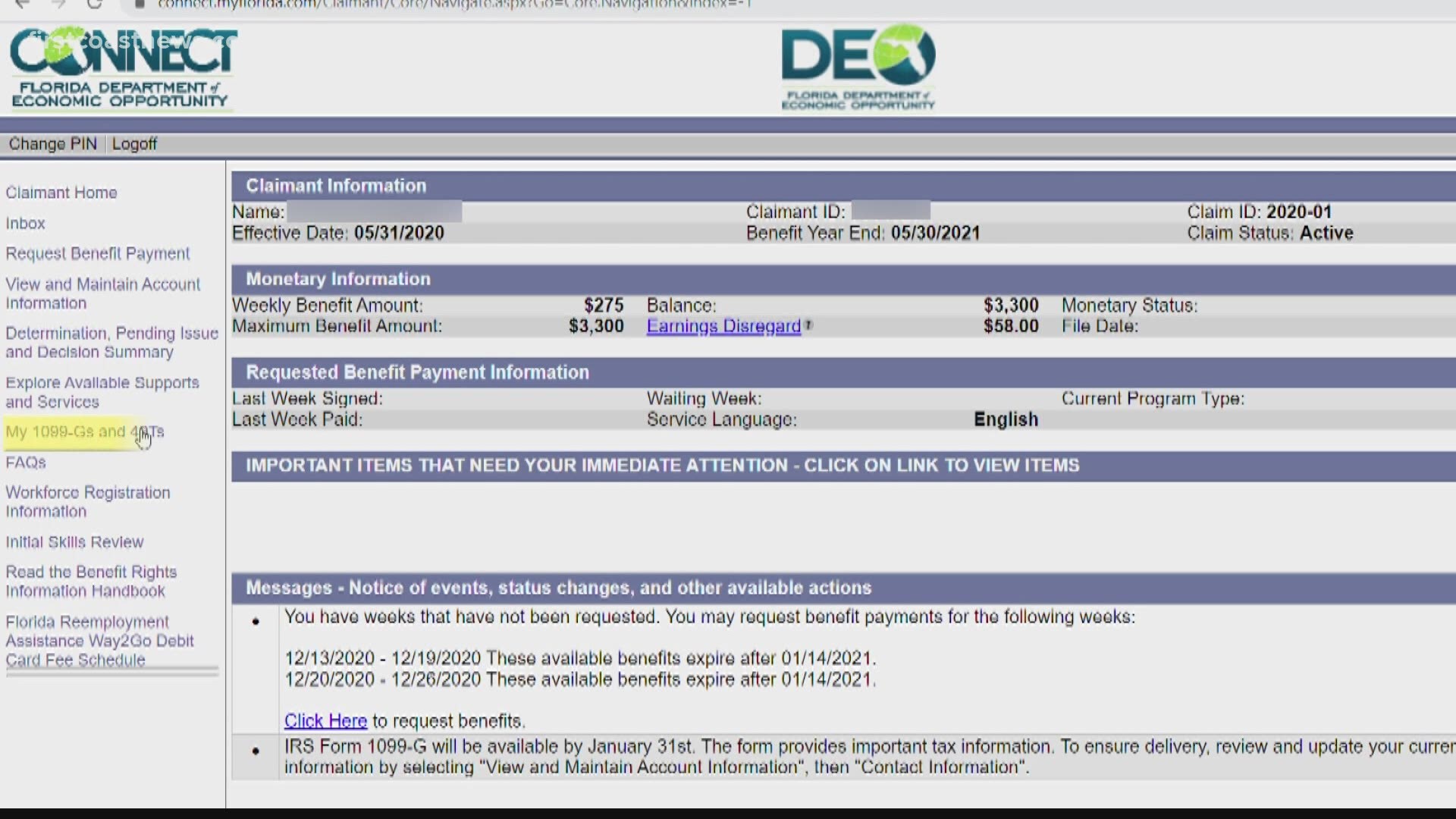

Floridians Report Tax Documents With Inaccurate Information Wfaa Com

Floridians Report Tax Documents With Inaccurate Information Wfaa Com

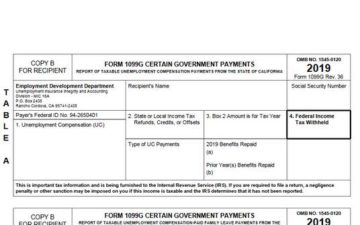

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

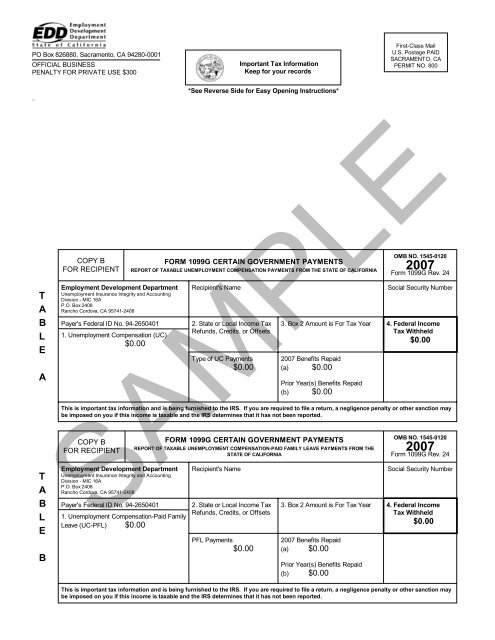

Irs Form 1099g Employment Development Department State Of

Irs Form 1099g Employment Development Department State Of

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

I Got Unemployment In Florida How Will My Taxes Be Affected 12newsnow Com

I Got Unemployment In Florida How Will My Taxes Be Affected 12newsnow Com

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Surprise Tax Forms Show Extent Of Unemployment Fraud In Us

Surprise Tax Forms Show Extent Of Unemployment Fraud In Us

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

What Is A 1099 Form 1099 Form 1099 Form Know How

What Is A 1099 Form 1099 Form 1099 Form Know How

1099 G Form 2021 Irs Forms Zrivo

1099 G Form 2021 Irs Forms Zrivo

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Amazon Com Egp Irs Approved 1099 G Laser Tax Form Government Payments State Or Payer Copy C Quantity 100 Recipients Office Products

Amazon Com Egp Irs Approved 1099 G Laser Tax Form Government Payments State Or Payer Copy C Quantity 100 Recipients Office Products

Post a Comment for "Louisiana Unemployment Tax Form 1099-g"