How To Find Unemployment Payer Id Number

Log on using your username and password then go to the Unemployment Services menu to access your 1099-G tax formsIf you have questions about your user name and password see our frequently asked questions for accessing online benefit services. This is also the number for our collections unit.

1099 G Unemployment Compensation 1099g

1099 G Unemployment Compensation 1099g

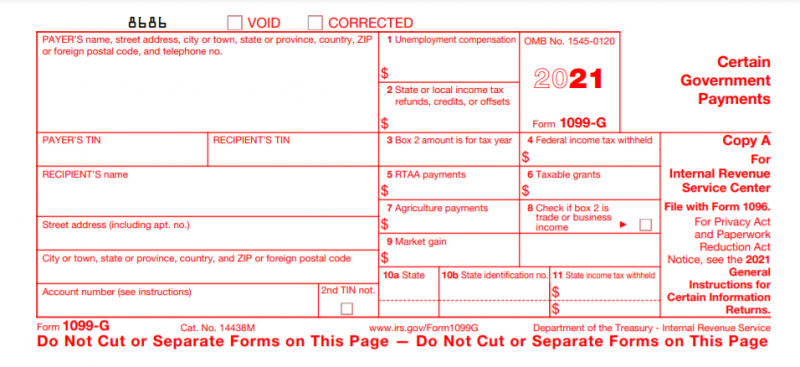

The Form 1099-G reports the total taxable unemployment benefits paid to you from the Tennessee Department of Labor Workforce Development for a calendar year and the federal income tax withheld if applicable.

How to find unemployment payer id number. Claimant Identification Number Your Customer Identification Number CID is an 11 digit number unique to you. Your nine-digit federal tax ID becomes available immediately upon verification. View the list of state agencies to find contact information for your state unemployment agency.

If I have questions concerning information on my 1099G how do I contact someone within unemployment insurance. The the Maryland Department of Labor Federal ID is. We also send this information to the IRS.

You can find this number on any prior documentation we have sent you. Ive heard through the grapevine that its not being mailed until the 29th and I can not wait that long and dont want to have to come back later and amend my. Phone number including area code.

To help offset your future tax liability you may voluntarily choose to have 10 percent of your weekly Unemployment Insurance benefits withheld and. Apply for an EIN with the IRS assistance tool. Department of Labor website.

Is there a way to get the Payer Federal Identification number required to file a 1099-G without having a copy of the form. The online 1099-g for alabama doesnt list it. Some states may use the Employers State ID Number located on the W-2 between boxes 15 and 16.

Claim ID also referred to as Claimant ID in letters. Enter your 1099G in FederalWages IncomeUnemployment. For questions about an Unemployment Insurance UI claim address change appeal Direct Deposit expired password Extended Benefits tax form 1099 or other IDES services for individuals.

STATES THAT TAX UNEMPLOYMENT BENEFITS. Do I use the same Payers Identification number for Federal and State tax forms. All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form.

If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns. What is the Payers Federal Identification number. Email ui1099esdwagov For identification when sending email include your.

You may access your IRS Form 1099-G for UI Payments for current and previous tax years on MyUI portal by entering your social security number and four-digit personal identification number PIN. It will guide you through questions and ask for your name social security number address and your Doing Business As DBA name. This Site Might Help You.

Go through the screens very carefully making sure to enter any federalstate tax you had withheld from the unemployment. Once you know this you can find the number on documents from the IRS or SSA. Thank you for using TurboTax.

Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. Nj Unemployment 1099. The 1099-G form is available as of January 2021.

State ID 07-506284E Federal ID 86. Contact your state agency to find out which number they require. If you are found ineligible to receive unemployment insurance benefits you will receive a determination explaining the reason.

Box 6123 - Mail Drop 589C Phoenix Arizona 85005. You will answer a series of questions about the ownership of the business and the number of locations operated. If you want to know what your taxpayer number TIN is you will need to know whether youre looking for your EIN ITIN or SSN.

If you are unsure about which number to use visit the US. Note for reference purposes the State and Federal ID numbers are as follows. Every year we send a 1099-G to people who received unemployment benefits.

Department of Economic Security Special Programs Unit PO. Employers must register with the Texas Workforce Commission TWC within 10 days of becoming subject to the Texas Unemployment Compensation ActTWC provides this quick free online service to make registering as easy as possible. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

What is the EIN or state id number for New Jersey 1099-G form. After you are logged in you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. If you do not know your number you may obtain this by contacting the Unemployment Insurance Contact Center or a local WorkSource Oregon Office.

Your benefits are taxable and reportable on your federal return but you do not need to attach a copy of the Form 1099-G to your. Select option 5 for questions about 1099-G forms. If you disagree you may request a hearing within 30.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

People Now Receiving Tax Form Tied To Fake Unemployment Claims

People Now Receiving Tax Form Tied To Fake Unemployment Claims

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

My 1099 G On California S Edd Ui Online Has The Money Totals But There S No Info At All On Address Or Federal Id Number Which Turbotax S Form Is Asking For Help

My 1099 G On California S Edd Ui Online Has The Money Totals But There S No Info At All On Address Or Federal Id Number Which Turbotax S Form Is Asking For Help

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Post a Comment for "How To Find Unemployment Payer Id Number"