What Is Virginia Unemployment Tax Rate

Virginias unemployment tax rates for experienced employers range from 01 to 62 in 2020 a spokeswoman for the state Employment Commission said Jan. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays Mailing Address PO.

Virginia Performs Measuring What Matters To Virginians

Virginia Performs Measuring What Matters To Virginians

If youre a new employer your rate will be between 251 and 621.

What is virginia unemployment tax rate. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. For example taxpayers in Colorado pay a flat 463 on. The wage base for SUI is 8000 of each employees taxable income.

According to the release Unemployment Insurance Employer Tax Rates for 2021 are assigned by the previous calendar year from July 1 2019 to June 30 2020. If you change addresses you must give the VEC the new address to receive your 1099G. Federal and Virginia law exempt Tier 2 vested dual benefits as well as certain other Railroad Retirement Act benefits and Railroad Unemployment Insurance benefits from income tax.

For 2020 the standard tax rate for new employers is 25 and the tax rate for new. 2 on up to 3000 of taxable income. Here is a list of the non-construction new employer tax.

Virginia State Unemployment Tax Virginia has State Unemployment Insurance SUI which ranges from 011 to 621. Unlike the Federal Income Tax Virginias state income tax does not provide couples filing jointly with expanded income tax brackets. It provided an additional 600 per week in unemployment compensation per recipient through July 2020.

State Taxes on Unemployment Benefits. Virginia Relay call 711 or 800-828-1120. The state UI tax rate for new employers also known as the standard beginning tax rate also changes from one year to the next.

To apply for Virginia unemployment benefits click here The most recent figures for. Box 26441 Richmond VA 23261-6441. State Income Tax Range.

Virginias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Virginias. 10 That extra 600 is also taxable after the first 10200. The Virginia Employment Commission will send you and the IRS Form 1099G at the years end detailing the benefits you received plus any federal tax withholdings elected.

Someone who received 10200 or more in unemployment benefits and is in the 10 tax bracket could save 1200 on federal income taxes assuming. In recent years it has been comprised of a Base Tax Rate thats been steady at 25 plus so-called add-ons consisting of a Pool Cost Charge and Fund Building Charge. We make no promises that the sum you receive will be equal to what the calculator illustrates.

Others may qualify for an experience base rate or receive an assigned base tax rate. 52 rows SUI tax rate by state. The Unemployment Tax Waiver Could Save You Thousands of Dollars This tax break could provide a tax savings of thousands of dollars depending on.

The Virginia unemployment rate fell to 52 percent in February while total nonfarm payroll employment decreased by 3700 Changes in these measures since April 2020 primarily reflect the effects of the coronavirus COVID-19 pandemic and efforts to contain it. Anonymously report Unemployment Insurance Fraud to the VEC by calling 1-800-782-4001. There are no taxes on unemployment benefits in Virginia.

Work Opportunity Tax Credit WOTC is a federal tax credit available to all private sector businessesIt was designed as an incentive to employers to hire individuals in certain targeted groups who consistently experience high rates of unemployment due to a variety of employment barriers. New Virginia employers receive the initial base tax rate of 25 plus add-ons until eligible for a calculated rate. The amount to be subtracted is the benefit amount that was included in federal adjusted gross income as a taxable pension or annuity and that was not already.

Virginia collects a state income tax at a maximum marginal tax rate of spread across tax brackets. State tax wont necessarily amount to much though depending on the respective tax rate.

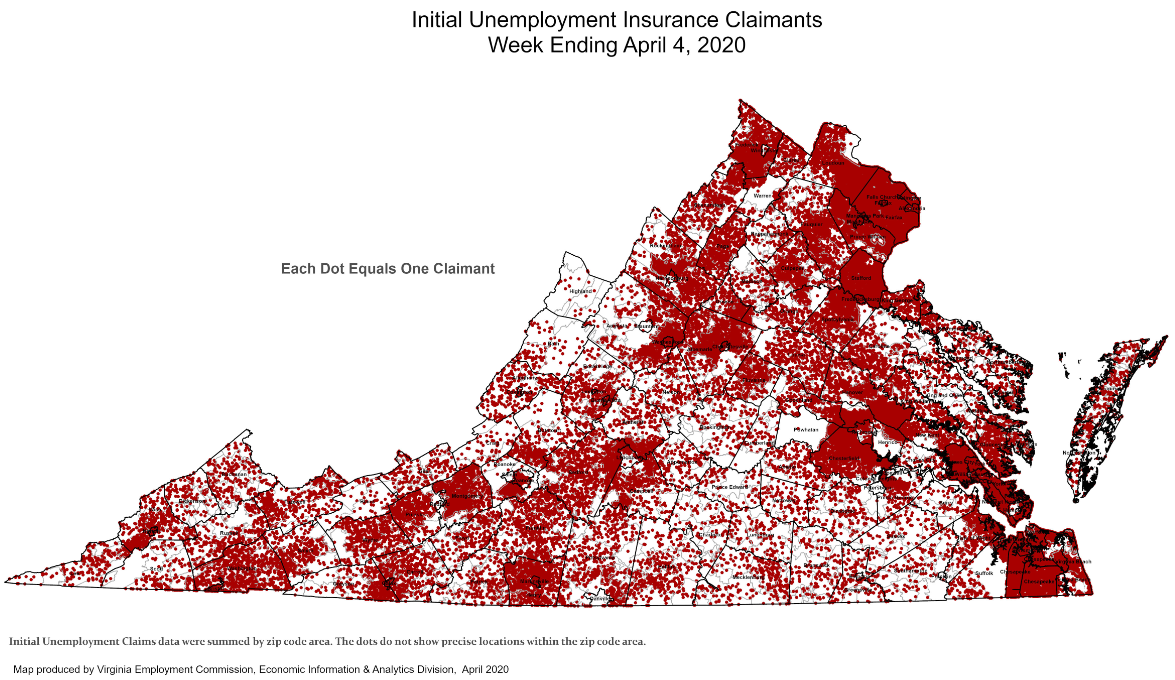

Virginia S Unemployment Insurance Weekly Claims For Week Ending April 4th Virginia Employment Commission

Virginia S Unemployment Insurance Weekly Claims For Week Ending April 4th Virginia Employment Commission

Africa Unemployment Rate Males 2018 Africa Human Development Unemployment Rate

Africa Unemployment Rate Males 2018 Africa Human Development Unemployment Rate

Unemployment Benefits For The Jobless

Unemployment Benefits For The Jobless

Virginia Unemployment Insurance Tax Rates To Be Kept In Check Washington Business Journal

Virginia Unemployment Insurance Tax Rates To Be Kept In Check Washington Business Journal

Free Employee Verification Form Template Best Of Job Verification Form Job Information Finding A New Job Mind Map Template

Free Employee Verification Form Template Best Of Job Verification Form Job Information Finding A New Job Mind Map Template

Are 97 Of The Nation S 100 Poorest Counties In Red States Appalachia West Virginia Appalachian

Are 97 Of The Nation S 100 Poorest Counties In Red States Appalachia West Virginia Appalachian

Florida Tops Baby Boomer House Rental Markets South Florida Real Estate House Rental Florida

Florida Tops Baby Boomer House Rental Markets South Florida Real Estate House Rental Florida

Virginia Performs Measuring What Matters To Virginians

Virginia Performs Measuring What Matters To Virginians

May 2020 Employment A Happy Surprise Oregon Office Of Economic Analysis Economic Analysis Employment Marketing Data

May 2020 Employment A Happy Surprise Oregon Office Of Economic Analysis Economic Analysis Employment Marketing Data

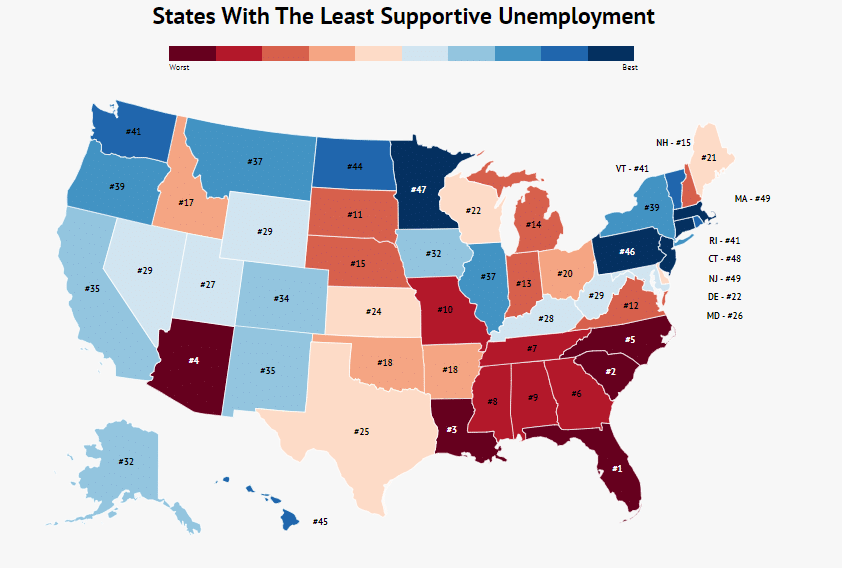

Here Are The States With The Least Supportive Unemployment Systems Zippia

Here Are The States With The Least Supportive Unemployment Systems Zippia

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

Ranking Corporate Income Taxes On The 2020 State Business Tax Climate Index The Online Tax Guy Business Tax Income Tax Tax

Ranking Corporate Income Taxes On The 2020 State Business Tax Climate Index The Online Tax Guy Business Tax Income Tax Tax

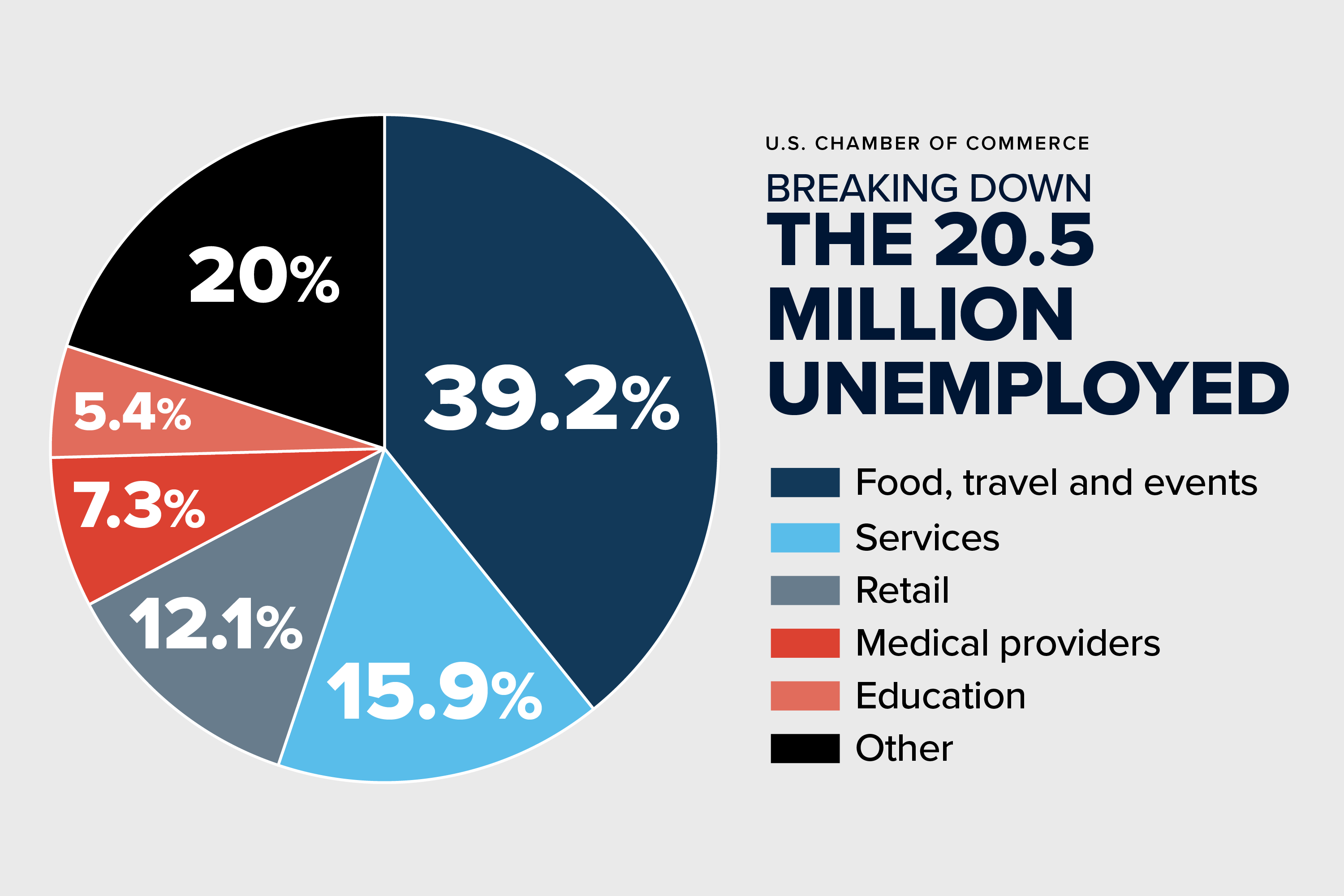

Analysis Breaking Down The Unemployment Crisis By Industry U S Chamber Of Commerce

Analysis Breaking Down The Unemployment Crisis By Industry U S Chamber Of Commerce

Virginia Performs Measuring What Matters To Virginians

Virginia Performs Measuring What Matters To Virginians

Employment Appeal Tribunal Employment 16 Year Old Uk Virginia Employment Commission Infographic Resume Template Infographic Resume Infographic Templates

Employment Appeal Tribunal Employment 16 Year Old Uk Virginia Employment Commission Infographic Resume Template Infographic Resume Infographic Templates

What Is Wotc Work Opportunity Tax Credit Work Opportunities Tax Credits Empowerment

What Is Wotc Work Opportunity Tax Credit Work Opportunities Tax Credits Empowerment

Post a Comment for "What Is Virginia Unemployment Tax Rate"