Missouri Unemployment Tax Registration

DES is aware that the US Department of Labor has issued new guidance to states regarding the expansion of eligibility for workers who declined work due to pandemic safety concerns. Equal Opportunity ProgramEmployer TDD.

Violation of Section 32057 may result in criminal prosecution.

Missouri unemployment tax registration. A Missouri Unemployment Insurance Tax Registration can only be obtained through an authorized government agency. If you have an existing account with the Missouri Department of Revenue you can update your registration to add additional tax types using the application. 99999999 8 digits Apply online at the MO Online Business Registration Portal to receive the number within 5-10 days.

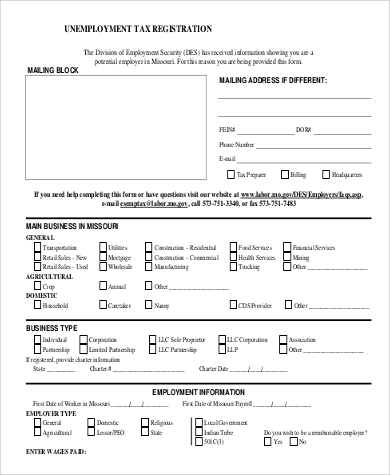

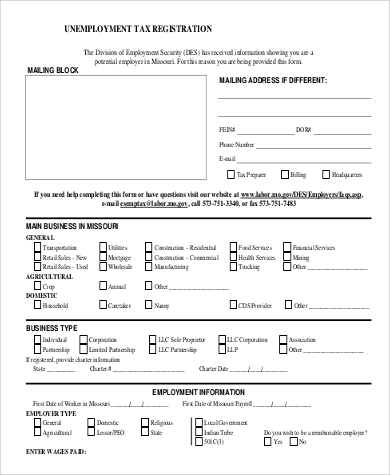

Auxiliary aids and. To register on paper use Form MODES-2699-5 Unemployment Tax Registration. MO Withholding Account Number.

Unemployment Tax Registration MODES-2699 The Division uses the Unemployment Tax Registration to determine whether an entity is liable for unemployment tax as a new or successor employer. MISSOURI DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS DIVISION OF EMPLOYMENT SECURITY UNEMPLOYMENT TAX REGISTRATION FOR DIVISION USE ONLY SUTA LIA 2699 ID The Division of Employment Security DES has received information showing you are a potential employer in Missouri. The form must be completed even if the entity is not liable so that the Division can follow up at a time when liability may have been achieved or eliminate the entity from further follow-ups.

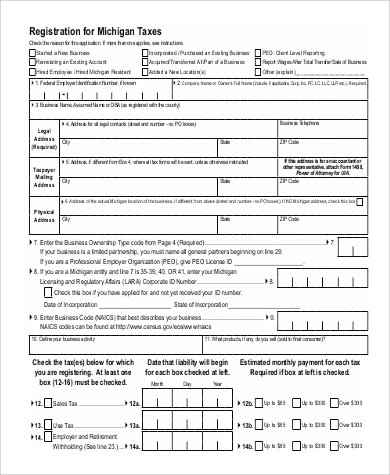

By contacting the Department of Revenue. Employers must register for the appropriate accounts in order to hire employees to process payroll and to file tax. Separate licenses for businesses wanting to operate as a motor fuel supplier permissive supplier.

Income tax withholding and state unemployment tax New employers in Missouri can register for both of these taxes together by visiting the Missouri Online Business Registration website. Contact Number-- Ext. The system will automatically save partial registration information once the initial details have been entered.

The Missouri Division of Employment Security is an equal opportunity employerprogram. If you need to add unemployment tax to your existing account visit httpsuinteractlabormogov. Harbor Compliance provides payroll tax registration services in every state to help your company hire employees and process payroll on time.

Accessing confident information made available through Portal subjects the user to all the conditions of Section32057 RSMO Confidentiality of Tax Returns and Department Records. Once the registration is complete liable employers will receive a TWC Tax Account Number and may be able to file wage reports and submit unemployment tax payments online. Eligible claimants may receive up to 20 weeks of unemployment insurance benefits through the stateBefore applying check to see if you qualify for unemployment.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Missouri Unemployment Insurance Tax Registration. Register for employer identification accounts. 8008337352 TTY 402-471-0016 For Assistance with Unemployment Insurance Auxiliary aids and services are available upon request to.

Employer Registration Required Information. Click Continue at the bottom of the page to begin the process and make sure to register for withholding tax and unemployment tax. In most states the two payroll taxes are withholding and unemployment insurance aka unemployment tax and unemployment compensation.

Find an existing Withholding Account Number. There is no fee to register your business with DES. For this reason you are being provided this form.

In most states the two payroll taxes are withholding and unemployment insurance aka unemployment tax and unemployment compensation. Harbor Compliance provides payroll tax registration services in every state to help your company hire employees and process payroll on time. Unemployment benefits including this additional 300 per week payment are subject to federal and state income taxes.

The information to register this Employer is being submitted by. To register a business utilize the online registration system or submit a Missouri Tax Registration Application Form 2643. Blank forms are available for download from the Publications and Forms section of the DOL website.

Incomplete registrations will be accessible. On Form MO-941 Employers Return of Income Taxes Withheld. Also a business selling batteries andor new tires should register to collect and remit a fee to the department.

Licensing requirements for Missouri employers. The registration process takes approximately 20 minutes. To download a registration form that you can print and take with you click here but remember it is better to register online rather than with a printed form.

To register online use Missouris Online Business Registration OBR portal.

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Missouri Unemployment Insurance Tax Audit Health Insurance Quote Insurance Quotes Affordable Health Insurance

Missouri Unemployment Insurance Tax Audit Health Insurance Quote Insurance Quotes Affordable Health Insurance

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

3 11 154 Unemployment Tax Returns Internal Revenue Service

3 11 154 Unemployment Tax Returns Internal Revenue Service

Https Labor Mo Gov Sites Labor Files Pubs Forms Modes 2699 9 Pdf

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Missouri Unemployment Tax Registration Fill Online Printable Fillable Blank Pdffiller

Missouri Unemployment Tax Registration Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Missouri Unemployment Tax Registration"