What Is The Pa Unemployment Tax Rate For 2020

Though theres no state disability insurance in Pennsylvania there is unemployment compensation. The Office of UC Tax Services plans to issue the Contribution Rate Notice for calendar year 2021 Form UC-657 no later than December 31 2020.

What Employers Need to Know.

What is the pa unemployment tax rate for 2020. Wages subject to unemployment contributions for employers remains at 10000. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents if any. 260 per pack of 20 cigaretteslittle cigars 013 per stick Malt Beverage Tax.

The employee rate for 2020 remains at 006. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office. Pennsylvania Unemployment Tax.

Important Tax Facts for 2020. Through the State Unemployment Tax Act. The Interest Factor was 110 in 2019 but in 2020 it is reduced to 000.

FREE Paycheck and Tax Calculators. During the most recent recession Pennsylvanias unemployment trust fund became insolvent which resulted in the need to borrow from the federal government through a Title XII Loan. 9 That extra 600 is also taxable after the first 10200.

See Malt Beverage Tax Rate Table. Your FUTA tax rate. 13 states are not offering the federal tax break on 2020 returns.

Employers who received their 2020 UC Contribution Rate Notice with this mailing date will have the following important tax deadlines. 1 percent for Allegheny County 2 percent for Philadelphia. Your 2021 assigned rate in the range of 22 to 135 depends on your experience over fiscal years 2017 - 2019.

Rates for 2021 range from 12905 to 9933 with new employers responsible for a rate of 3689. An LLC must pay UC contributions on wages paid to its employees. The maximum experience-based contribution tax rate is099333 this includes the 54 percent Surcharge and the 050 percent Additional Contributions tax.

The Office of Unemployment Compensation UC Tax Services mailed the Pennsylvania Contribution Rate Notice for calendar year 2020 Form UC-657 on Dec. One reason for this is the decrease of one of the components that make up the tax rate. Range of Rates for Calendar Year 2020 The minimum experience-based contribution tax rate is012905 this includes the 54 percent Surcharge and the 050 percent Additional Contributions tax.

19 federal relief bill waives 10200 in unemployment benefits from 2020 tax returns. 52 rows SUI tax rate by state. Pennsylvanias unemployment website is propped up by an obsolete 40-year-old mainframe thats been taxed by a surge in claims during the pandemic.

All chargeable benefits paid to former employees from July 1 2019 to June 30 2020 will not impact your tax rate for 2021. For Pennsylvania unemployment compensation UC tax purposes a limited liability company LLC may be an employing entity like any other form of business entity. Effective July 1 2019 tax rates are 38712 for Philadelphia residents and.

It provided an additional 600 per week in unemployment compensation per recipient through July 2020. Mandatory Postings for Employers. Its own tax rate for.

Wage bases have increased over the years with the current base at 10000 for 2021. City of Philadelphia Wage Tax. Colorado has a flat income tax rate of 455 the approval of Proposition 116 which appeared on the November 2020 ballot reduced the rate from 463 to.

Tax rates for 2019 range from 23905 to 110333. Additional information is available here. Alaska New Jersey and Pennsylvania collect state unemployment tax from both employers and employees.

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. Wages subject to unemployment contributions for employees are unlimited. Income Tax Range.

PA Sales Use and Hotel Occupancy Tax. 1 2020 total tax rates for experienced employers are to range from 12905 to 9933 and are to include a 075 state adjustment factor a 54 solvency surcharge and a 05 additional contributions tax. Employer UC tax services important information Pennsylvania Department of Labor Industry website November 2019 As a result the calendar year 2020 employer state unemployment insurance SUI experience tax rates will range from 12905 to 99333 down from 23905 to 110333 for 2019.

The 10 percent deduction is based on your gross weekly benefit rate ie the amount of benefits payable before deductions for earnings benefit reduction. Here is a list of the non-construction new employer tax.

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Pennsylvania Pa State Tax H R Block

Pennsylvania Pa State Tax H R Block

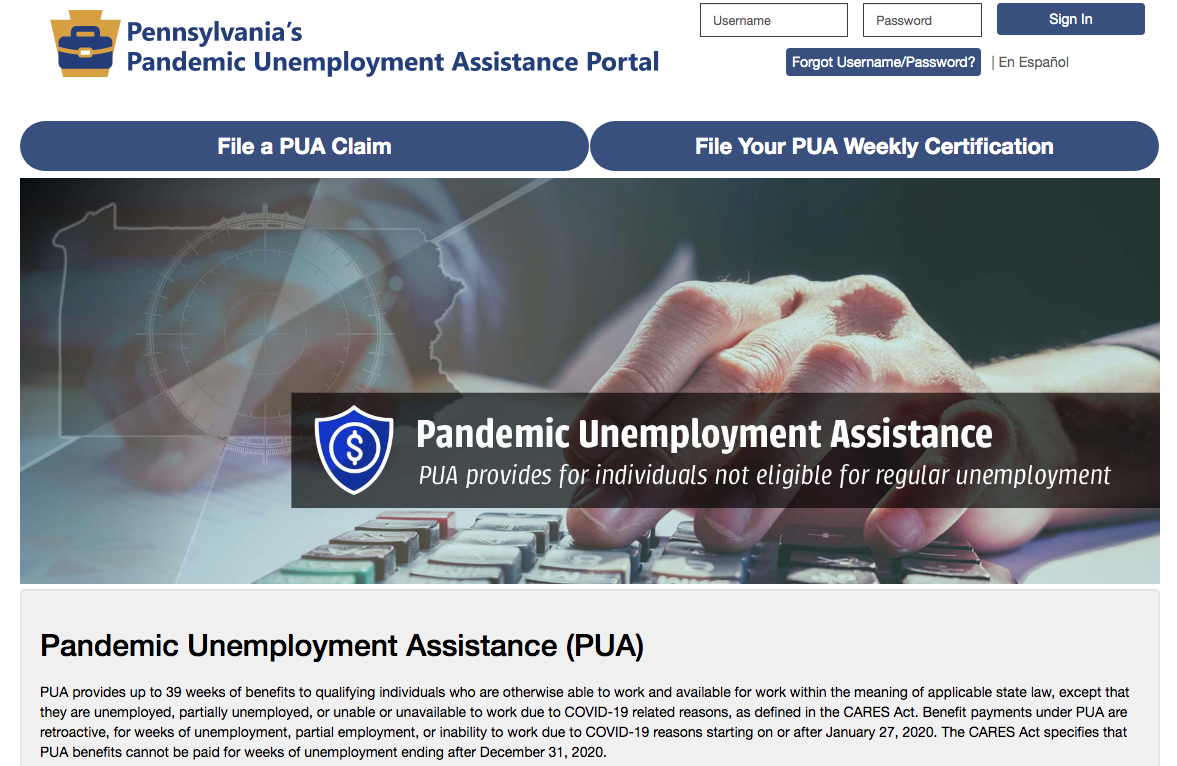

Pennsylvania Opens Web Portal For Pandemic Unemployment Assistance Benefits Coronavirus Dailyitem Com

Pennsylvania Opens Web Portal For Pandemic Unemployment Assistance Benefits Coronavirus Dailyitem Com

Pennsylvania Pa Department Of Labor And Industry Enhanced Unemployment Benefits Pua Peuc And Extra 300 Fpuc September 2021 Extensions And Payment Updates Aving To Invest

Pennsylvania Pa Department Of Labor And Industry Enhanced Unemployment Benefits Pua Peuc And Extra 300 Fpuc September 2021 Extensions And Payment Updates Aving To Invest

How To Change A New Jersey Driver S License To Pennsylvania In 2020 Drivers License New Jersey Money Management

How To Change A New Jersey Driver S License To Pennsylvania In 2020 Drivers License New Jersey Money Management

Victims Of Unemployment Fraud In Pa Are Blindsided By Tax Documents Pittsburgh Post Gazette

Victims Of Unemployment Fraud In Pa Are Blindsided By Tax Documents Pittsburgh Post Gazette

Pennsylvania Tax Rate H R Block

Pennsylvania Tax Rate H R Block

Https Www Uc Pa Gov Documents Uc Forms Uc 2010 Pdf

2019 Pennsylvania Payroll Tax Rates Abacus Payroll

2019 Pennsylvania Payroll Tax Rates Abacus Payroll

Filing An Unemployment Claim In Pennsylvania What To Do What You Need To Know Pennsylvania Capital Star

Filing An Unemployment Claim In Pennsylvania What To Do What You Need To Know Pennsylvania Capital Star

Https Www Uc Pa Gov Employers Uc Services Uc Tax Ucms Documents Ucms 20 20how 20to 20file 20a 20quarterly 20report 20online Pdf

Post a Comment for "What Is The Pa Unemployment Tax Rate For 2020"