Unemployment Tax Break American Rescue Plan

Taxes are already a headache but if you claimed unemployment in 2020 you might also have a heart attack after reporting benefits as yearly income on your federal tax return. The federal tax break went into effect in President Joe Bidens 19 trillion American Rescue Plan.

American Rescue Plan Exclusion Of Unemployment Compensation Marcum Llp Accountants And Advisors

American Rescue Plan Exclusion Of Unemployment Compensation Marcum Llp Accountants And Advisors

The 19 trillion American Rescue Plan signed into law last week includes a welcome tax break for unemployed workers.

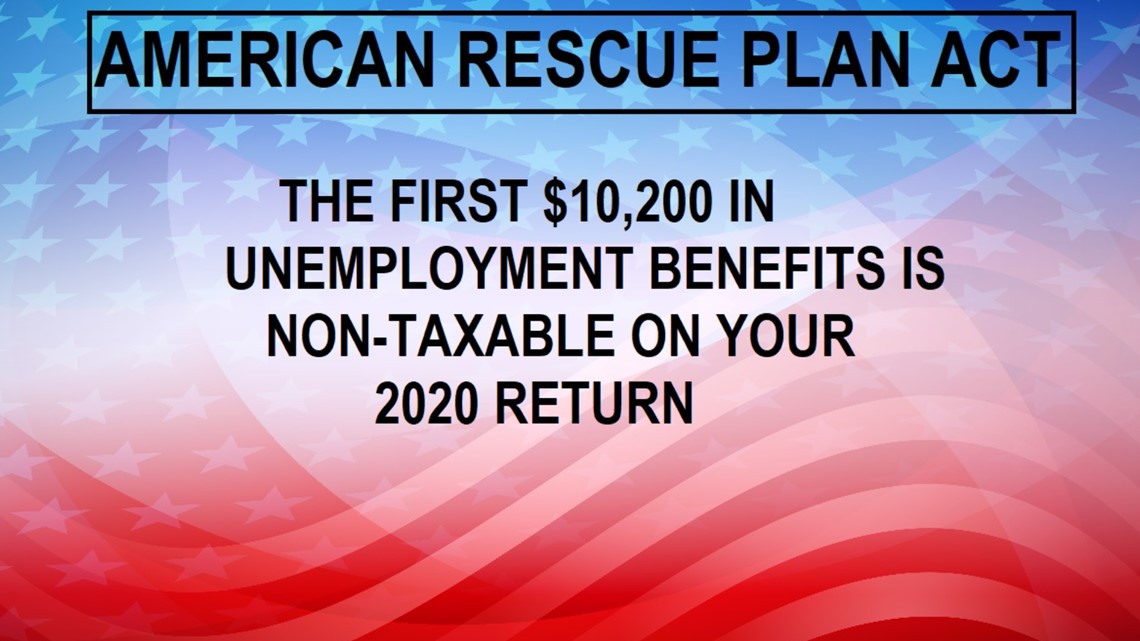

Unemployment tax break american rescue plan. It now allows for the first 10200 of 2020 unemployment benefits to be tax free or 20400 for married couples filing jointly for households reporting an. The American Rescue Plan signed into law on March 11 2021 includes a provision that makes the first 10200 of unemployment nontaxable for each taxpayer who made less than 150000 in 2020. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

When filling out your 2020 Colorado income tax return you must add back the amount of any unemployment compensation. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person in 2020. There are several tax breaks for individuals to take note of.

The law waives federal income taxes on up to 10200 in unemployment insurance. Up to 10200 of. The tax break isnt available to those who earned 150000 or more.

American Rescue Plans Individual Tax Breaks The signing of the American Rescue Plan comes just a few days before extended unemployment benefits were scheduled to start running out. Amounts over 10200 are still taxable and if your modified Adjusted Gross Income AGI is over 150000 you cant exclude any unemployment income. Even though jobless benefits count as income for tax purposes the newly-signed 19 trillion American Rescue Plan will not impose federal income tax on the first 10200 in unemployment benefits a.

Before the American Rescue Plan Act ARPA was signed on March 11 2021 unemployment compensation was taxable income and now ARPA provides a new federal tax break for unemployment benefits received in 2020. On March 31 2021 the IRS released a statement stating that people who fil. The measure waived taxes on up to 10200 unemployment benefits received in.

In those states the 10200 exclusion will not be recognized. Under the American Rescue Plan those who received federal unemployment benefits in 2020 will receive a 10200 tax break when they file a federal income tax return this year. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment.

Signed on March 11 the 19 trillion American Rescue Plan exempts from federal tax up to 10200 of unemployment benefits received in 2020 or. Colorado taxes all unemployment benefits. Under the American Rescue Plan signed into law Thursday the IRS will make the first 10200 in unemployment benefits from 2020 tax-free.

Heres what you need to know. Americans who received unemployment benefits last year can claim a special new tax break included in the 19 trillion American Rescue Plan Act recently signed by President Biden. State Taxes on Unemployment Benefits.

Under the legislation known as the American Rescue Plan households do not have to pay federal income taxes on up to 10200 in 2020 unemployment insurance benefits if. The American Rescue Plan excludes from income up to 10200 of unemployment compensation paid in 2020 which means you wont have to pay tax on unemployment income of up to 10200. If you are married and your spouse also received unemployment both of you can exclude 10200.

The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020. The 19 trillion Covid relief measure limits that break to. This video covers the unemployment taxes for 2020 under the American Rescue Plan.

However in 13 states taxpayers wont find the revenue department so generous. The American Rescue Plan includes a 10200 tax break for individuals who claimed unemployment benefits in 2020.

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

Tas Tax Tips American Rescue Plan Act Of 2021 Individual Tax Changes Summary By Year Taxpayer Advocate Service

Taxes Waived On Up To 10 200 Of Unemployment Benefits Collected Wtsp Com

Taxes Waived On Up To 10 200 Of Unemployment Benefits Collected Wtsp Com

Biden 2021 American Rescue Plan Passed In Congress 1400 Stimulus Checks Payment Updates And Extra Weeks Of Unemployment Benefits Extensions Aving To Invest

Biden 2021 American Rescue Plan Passed In Congress 1400 Stimulus Checks Payment Updates And Extra Weeks Of Unemployment Benefits Extensions Aving To Invest

American Rescue Plan To Deliver Lifeline To Machinists Union Members In Critical Industries Iamaw

American Rescue Plan To Deliver Lifeline To Machinists Union Members In Critical Industries Iamaw

Here S What Unemployed Hoosiers Should Know About The American Rescue Plan

Here S What Unemployed Hoosiers Should Know About The American Rescue Plan

Tax Waiver For Unemployment Benefits Leads To Questions Kake

Tax Waiver For Unemployment Benefits Leads To Questions Kake

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

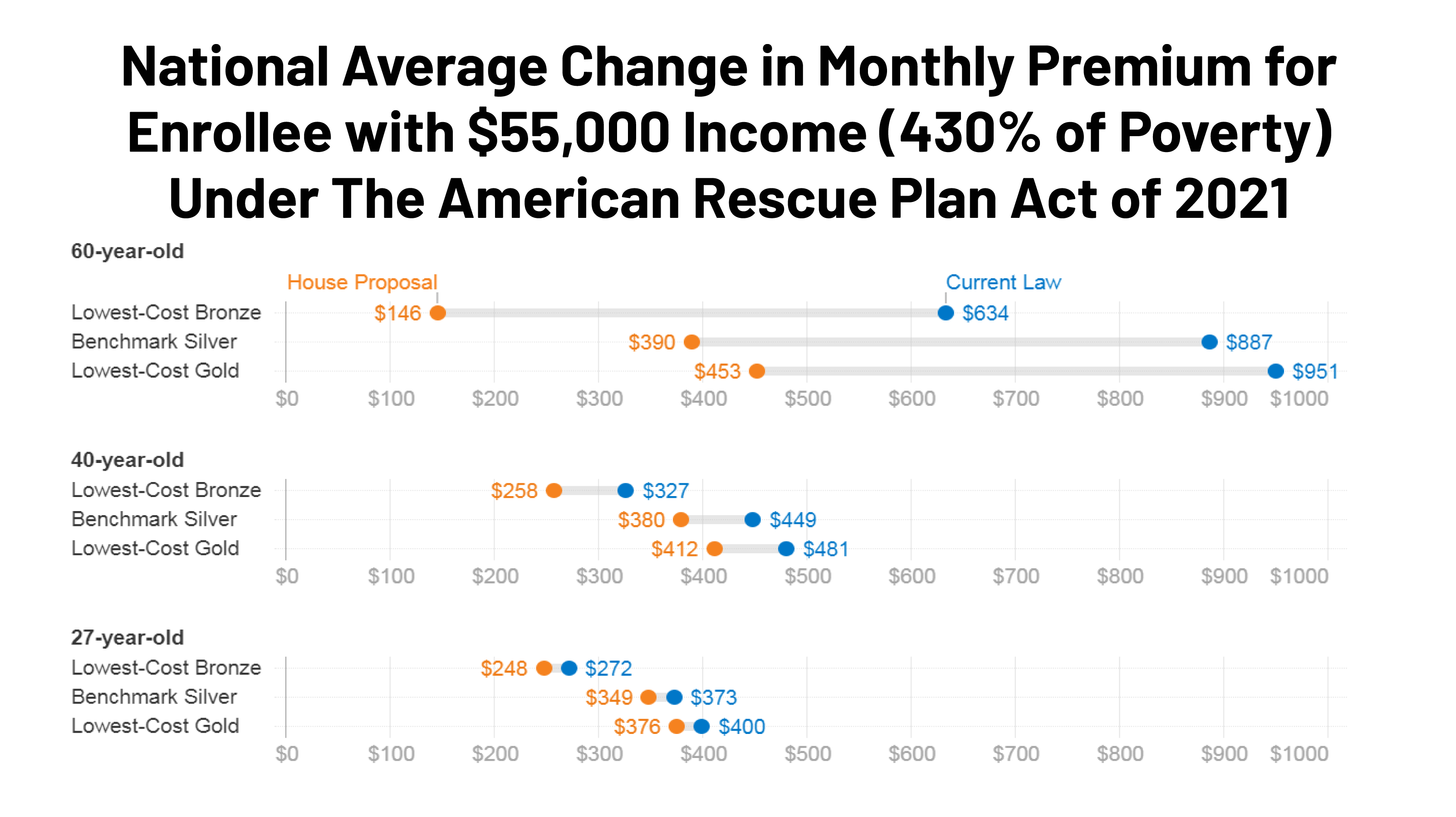

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

Impact Of Key Provisions Of The American Rescue Plan Act Of 2021 Covid 19 Relief On Marketplace Premiums Kff

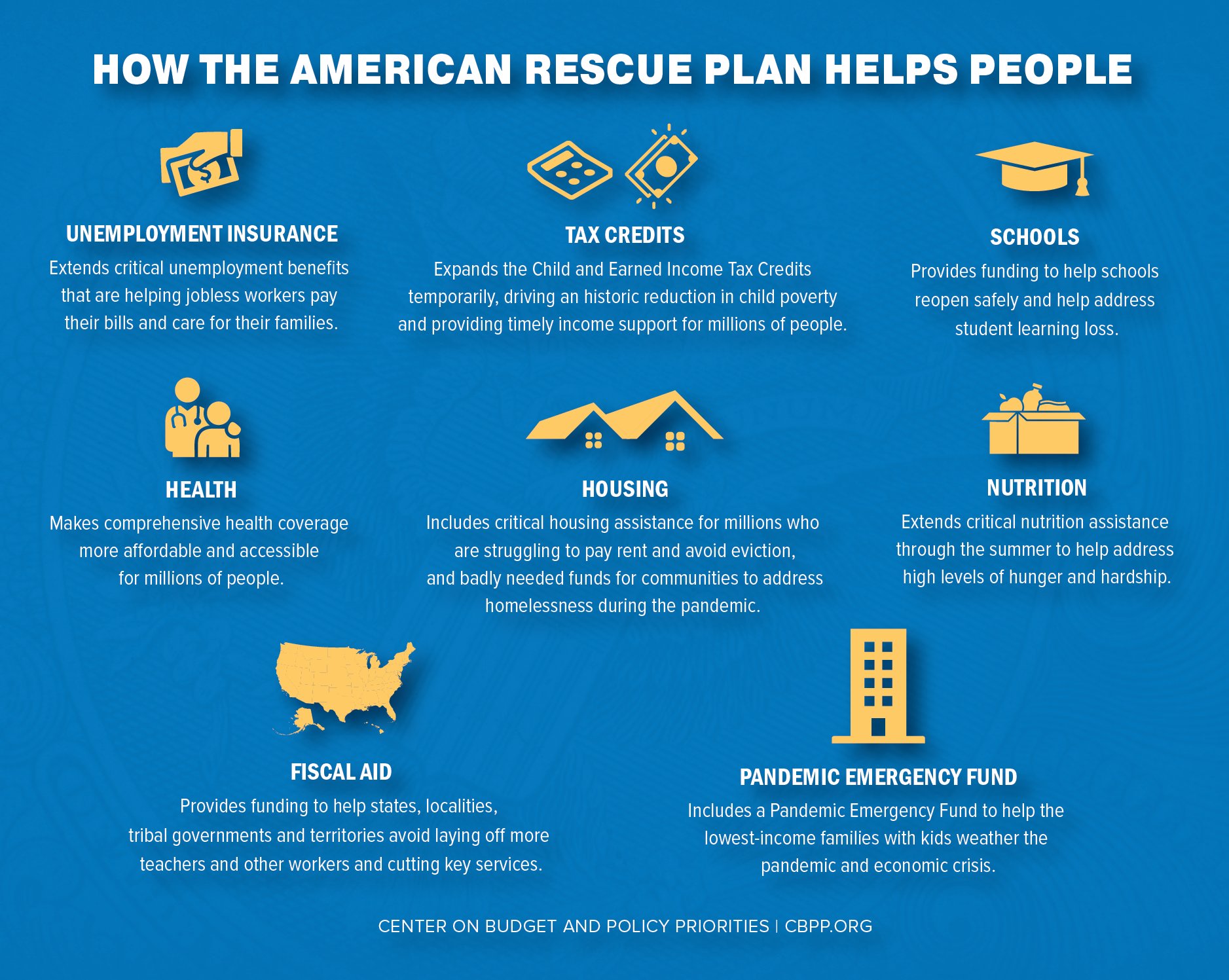

How The American Rescue Plan Helps People Center On Budget And Policy Priorities

How The American Rescue Plan Helps People Center On Budget And Policy Priorities

American Rescue Plan Act Of 2021 Wikipedia

American Rescue Plan Act Of 2021 Wikipedia

Colorado Unemployment Office Expects No Gap In Payments After Congress Passes New Relief Plan

Colorado Unemployment Office Expects No Gap In Payments After Congress Passes New Relief Plan

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

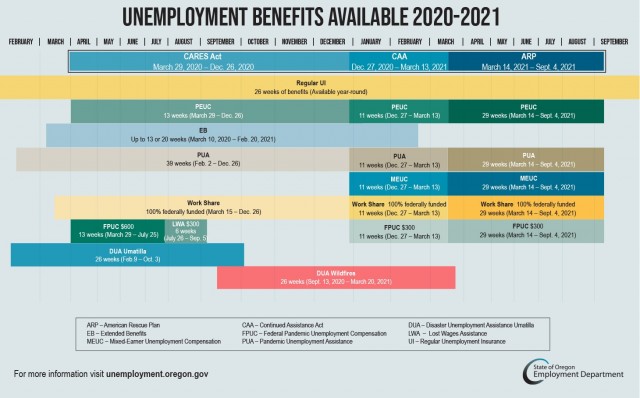

Oed Unemployment American Rescue Plan Act Of 2021

Oed Unemployment American Rescue Plan Act Of 2021

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Biden 2021 American Rescue Plan Passed In Congress 1400 Stimulus Checks Payment Updates And Extra Weeks Of Unemployment Benefits Extensions Aving To Invest

Biden 2021 American Rescue Plan Passed In Congress 1400 Stimulus Checks Payment Updates And Extra Weeks Of Unemployment Benefits Extensions Aving To Invest

Chart What S In The 1 9 Trillion Stimulus Package Statista

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Post a Comment for "Unemployment Tax Break American Rescue Plan"