Unemployment Rules In Ohio

Report it by calling toll-free. The Ohio Department of.

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

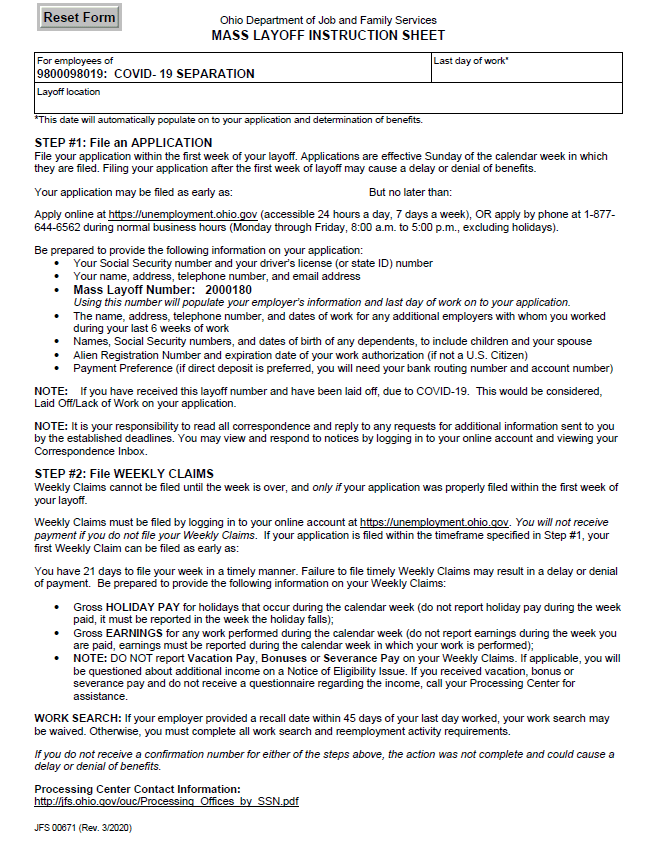

Ohio unemployment weekly claims are necessary to receive your benefits.

Unemployment rules in ohio. Unemployment benefits will be available for eligible individuals who are requested by a medical professional local health authority or employer to be isolated or quarantined as a consequence of COVID-19 even if they are not actually. An executive order issued by Governor DeWine expands flexibility for Ohioans to receive unemployment benefits during Ohios emergency declaration period. This incorporates recent federal tax changes into Ohio law effective immediately.

The state gives unemployed workers up to 26 weeks of Ohio unemployment compensation while they search for new work. Child tax credit calculator. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received. 18 was signed into law. 1 day agoThe legislation excludes only 2020 unemployment benefits from taxes a release from the IRS states.

G In accordance with section 303c3 of the Social Security Act and section 3304a17 of the Internal Revenue Code of 1954 for continuing certification of Ohio unemployment compensation laws for administrative grants and for tax credits any interest required to be paid on advances under Title XII of the Social Security Act shall be paid in a timely manner and shall not be paid directly or indirectly by an equivalent reduction in the Ohio unemployment taxes. In order to receive unemployment benefits in Ohio you must follow these rules. 1 day agoDuring the last unemployment crisis Ohio borrowed about 34 billion to pay unemployment benefits to workers.

Audits are performed to verify reported payroll and exclusion information and to answer any questions you may have regarding unemployment law. Since your weekly benefit amount is a result of your wages during the 18 months before your claim partial unemployment benefits tend to apply to those who lost a full-time job and could only find a replacement with less pay or hours. You should be partially or totally unemployed while applying for unemployment benefits.

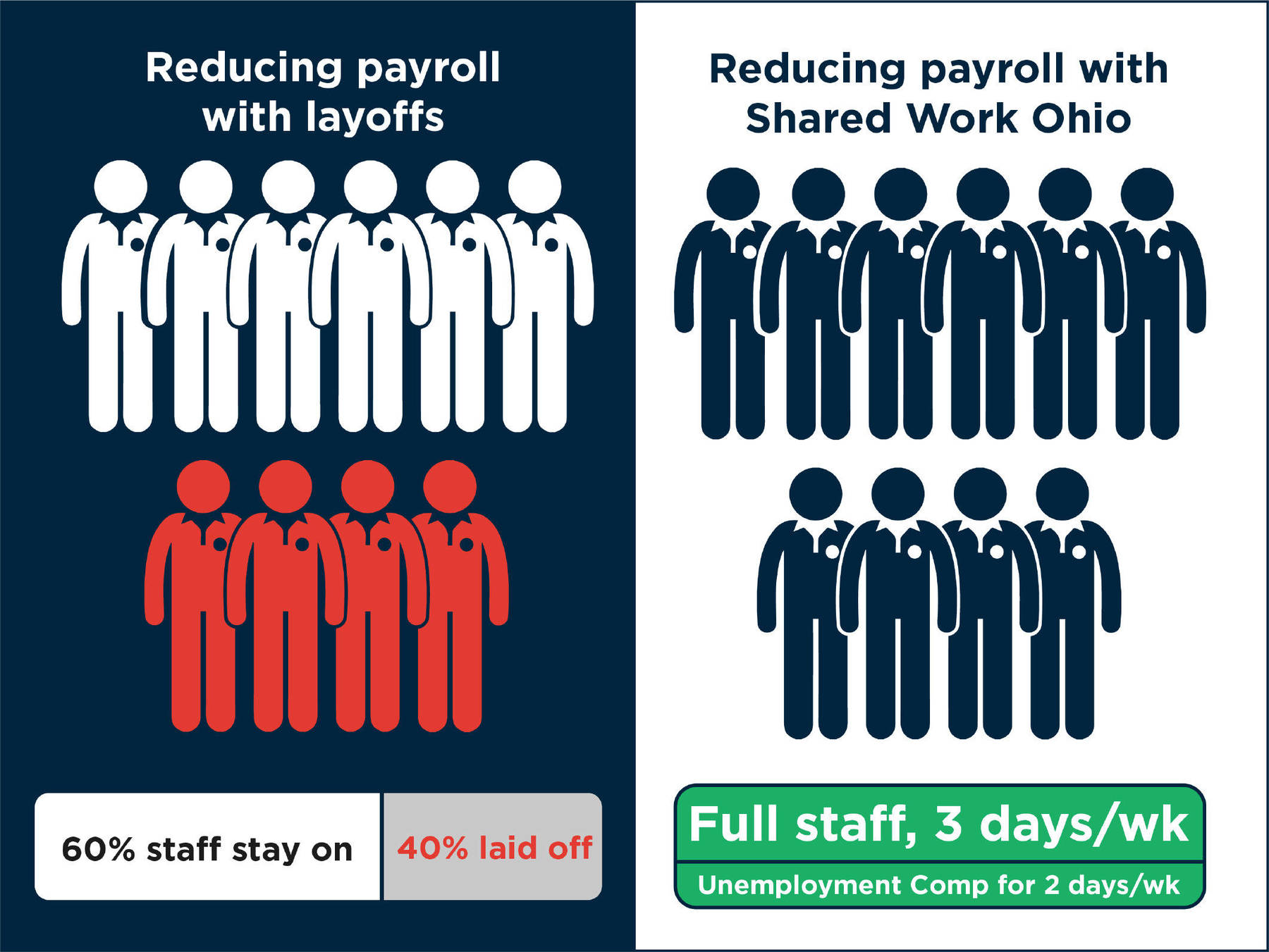

During that time Ohio employers were hit. The participating employee works the reduced hours each week and the Ohio Department of Job and Family Services ODJFS provides eligible individuals an unemployment insurance benefit proportionate to their reduced hours. You must be actively looking for a job and keeping a record of your job search.

ORC Sections 414118 and 414120 require employers to maintain records and to give the Ohio Department of Job and Family Services the authority to audit those records. Specifically federal tax changes related to unemployment benefits in the federal American Rescue Plan Act ARPA of 2021 will impact some individuals who have already filed or will soon be filing their 2020 Ohio IT 1040 and SD 100 returns due by May 17 2021. Coronavirus and Unemployment Benefits Frequently Asked Questions and answers for claimants and employers can be found here.

Be a resident of Ohio. To collect through Ohios partial unemployment program you must earn less than your weekly benefit amount and work less than full-time hours. In Ohio theres discussion in Columbus about whether state lawmakers will follow the federal law and pass legislation next week that would also exempt 10200 in unemployment.

Authority for this requirement is provided in Title III of the Social Security Act and the Internal Revenue Code of 1954 26 USC. 85 6011a 6050B and 6109a. You must file a weekly certification.

Apply for Unemployment Now Employee 1099 Employee Employer. The state uses this information to determine you are searching for work and failing to file them will end your benefits. If you are not a resident of Ohio but worked in Ohio at your last job you still have Ohio unemployment eligibility.

Under a SharedWork Ohio plan the participating employer reduces affected employees hours in a uniform manner. How much and when parents will receive payments under new rules. You must be able to work and are not disabled.

Federal law requires you to furnish your social security account number on the claim applications in order for your application to be processed. Must be physically able to work and available for work. You must be actively looking for a suitable new job.

Unemployment Compensation In Ohio

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Ohio Offers Employers Relief For Covid 19 Related Work Disruptions

Ohio Offers Employers Relief For Covid 19 Related Work Disruptions

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

Unemployment Compensation In Ohio

Avoid Layoffs With Shared Work Ohio

Avoid Layoffs With Shared Work Ohio

Unemployment Compensation In Ohio

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

How My Personal Experience Exposed Massive Ohio Unemployment Fraud Letter From The Editor Cleveland Com

How My Personal Experience Exposed Massive Ohio Unemployment Fraud Letter From The Editor Cleveland Com

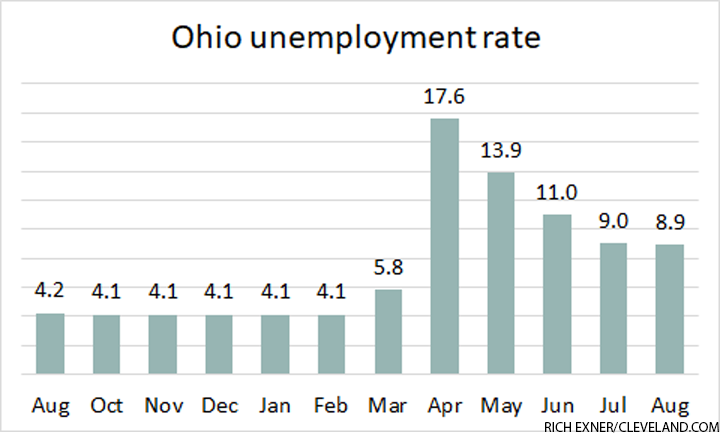

Ohio S Unemployment Rate Nearly Unchanged At 8 9 For August Cleveland Com

Ohio S Unemployment Rate Nearly Unchanged At 8 9 For August Cleveland Com

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Https Jfs Ohio Gov Releases Pdf 112420 Improved Unemployment Rate Impacts Extended Unemployment Benefits Stm

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

Logan County Chamber Of Commerce

Logan County Chamber Of Commerce

Post a Comment for "Unemployment Rules In Ohio"