Ohio Unemployment Tax Rate Calculation

Additionally if you live in a traditional tax base school district your unemployment compensation is also subject to school district income tax on your SD 100 return. Starting in 2021 Proposition 208 approved by voters on the November 3 2020.

Expect 300 Retroactive Ohio Unemployment Supplemental Checks The Second Half Of September That S Rich Recap In 2020 Unemployment Student Loan Payment Federal Emergency Management Agency

Expect 300 Retroactive Ohio Unemployment Supplemental Checks The Second Half Of September That S Rich Recap In 2020 Unemployment Student Loan Payment Federal Emergency Management Agency

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10.

Ohio unemployment tax rate calculation. Tax rates ranging from 10 to 37 the potential tax. Apr 2020 Jun 2020. 94603 3326 of excess over 44250.

Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. SUI tax rate by state. 326016 4413 of excess over 110650.

Remember if you worked at least 20 weeks but not during the base period Ohio permits the use of an alternative base period PDF to. 10 That extra 600 is also taxable after the first 10200. The calculator will return an estimated weekly benefit rate of 0 if it appears that you do not meet the eligibility requirements described above.

Biden vs Trump Income Tax Calculator. Jul 2020 Sep 2020. Ohio Unemployment Insurance BENEFITS CHART - 2021 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application.

Weekly benefit amount 40000 Minus earnings deducted -12000 Equals benefit amount paid 28000. The maximum amount of taxable wages per employee per calendar year is set by statute and is currently 9000. To calculate the amount of unemployment insurance tax payable TWC multiplies their amount of taxable wages by the employers tax rate.

Employers with questions can call 614 466-2319. The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year. To do this just divide your average weekly wage by 2.

You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing. 31618 2850 of excess over 22150. Here is a list of the non-construction new employer tax rates for each state and Washington DC.

Ohio State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you get a 90 tax credit on FUTA. Your weekly unemployment compensation will either be 50 of your weekly wage or a maximum number based on the number of dependents you have whichever is lower. Jan 2020 Mar 2020.

It includes a tax break on up to 10200 of unemployment benefits earned in 2020. For all filers the lowest bracket applies to income up to 22150 and the highest bracket only applies to income above 221300. There are more than 600 Ohio cities and villages that add a local income tax in addition to the state income tax.

Payments for the first quarter of 2020 will be due April 30. Rates range from 0 to 4797. The taxable wage base for calendar years 2018 and 2019 is 9500.

Ohio local income taxes which are referred to unofficially as the RITA Tax range from 05 to 275. 241612 3802 of excess over 88450. If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the 2017 rate is 62 the 2018 rate is 60 the 2019 rate is.

45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. To calculate the earnings deduction. When you pay SUTA taxes on time and file IRS Form 940 your FUTA tax rate goes down as low as 04.

Oct 2020 Dec 2020. Compute 50 of your average weekly wage. This calculator uses the average weekly state benefit amount reported by the Department of Labor from January 2020 to November 2020 to calculate total unemployment compensation and.

It provided an additional 600 per week in unemployment compensation per recipient through July 2020. The taxable wage base for calendar year 2020 and subsequent years is 9000. So if your average wage was 1200 this would be 600.

SUI tax rates range from 03 to 90. How to Calculate and Pay State Unemployment Tax SUTA. Note that some states require employees to contribute state unemployment tax.

The taxable wage base may change from year to year. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Total earnings in week 20000 Minus earnings exemption 20 of 40000 - 8000 Equals earnings deduction 12000 To calculate amount of benefits paid.

Http Www Ohiomfg Com Wp Content Uploads 08 26 16 Hr Odjfs Ppt Uctestimony Pdf

Oh Odt It 501 Fill Out Tax Template Online Us Legal Forms

Oh Odt It 501 Fill Out Tax Template Online Us Legal Forms

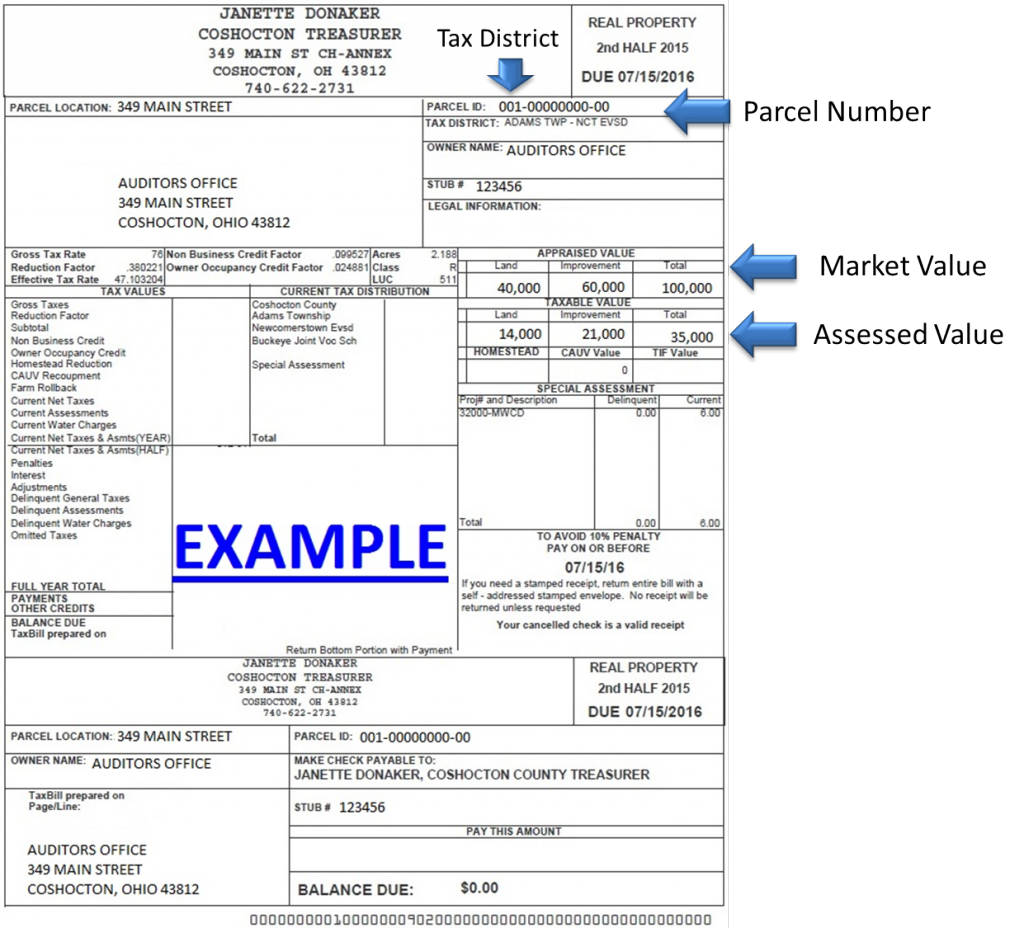

How To Estimate Taxes Coshocton County Auditor

How To Estimate Taxes Coshocton County Auditor

Income School District Tax Department Of Taxation

Income School District Tax Department Of Taxation

Https Tax Ohio Gov Portals 0 Forms Ohio Individual Individual 2002 20021040intronly Pdf

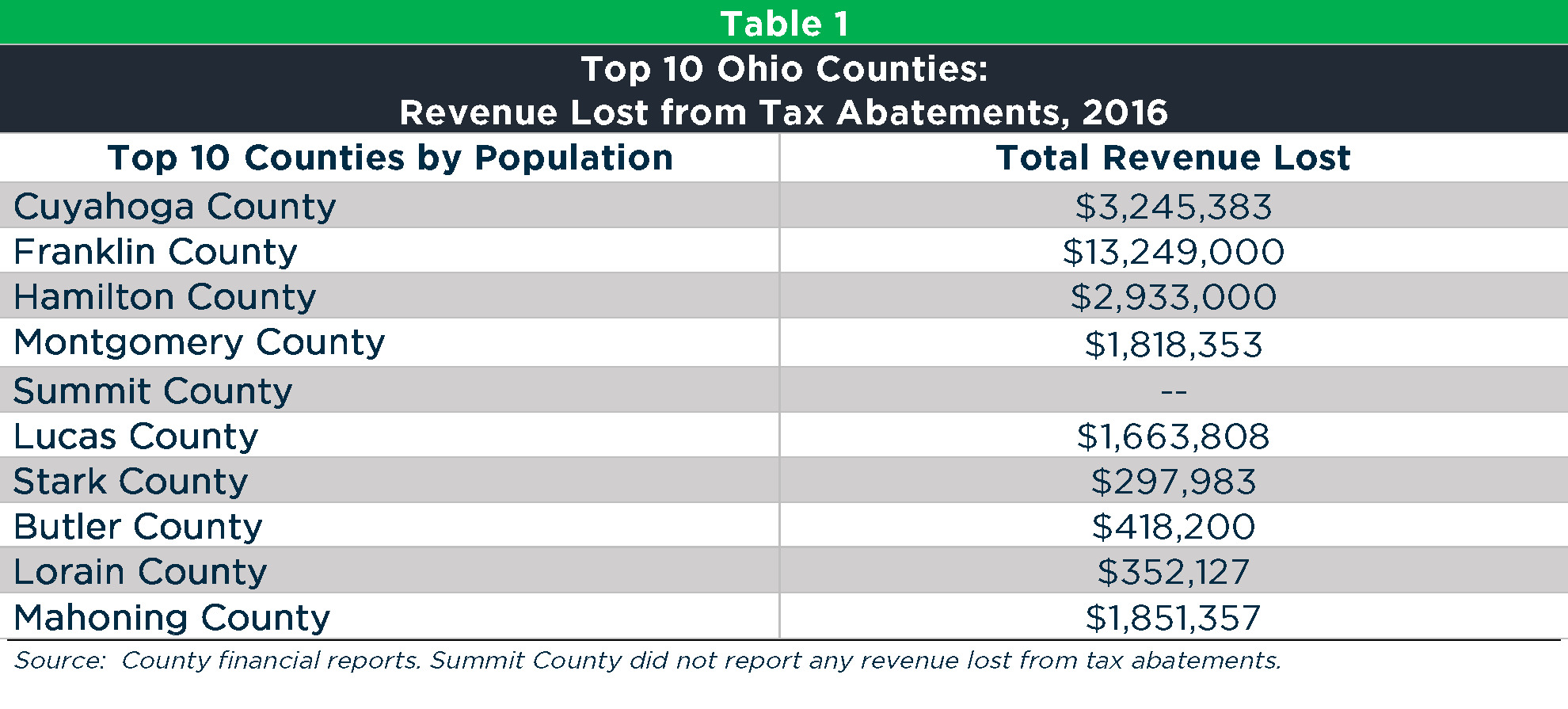

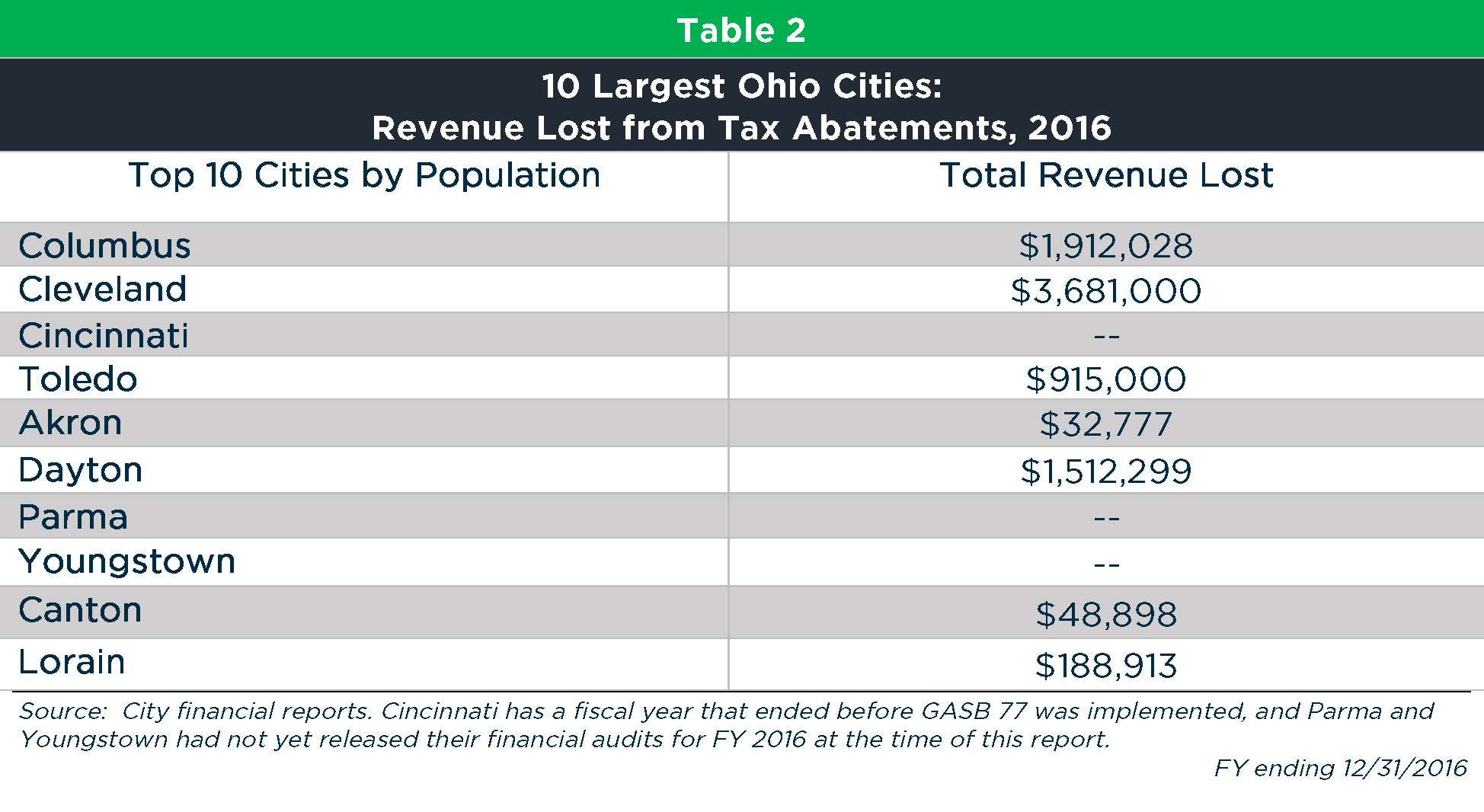

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency

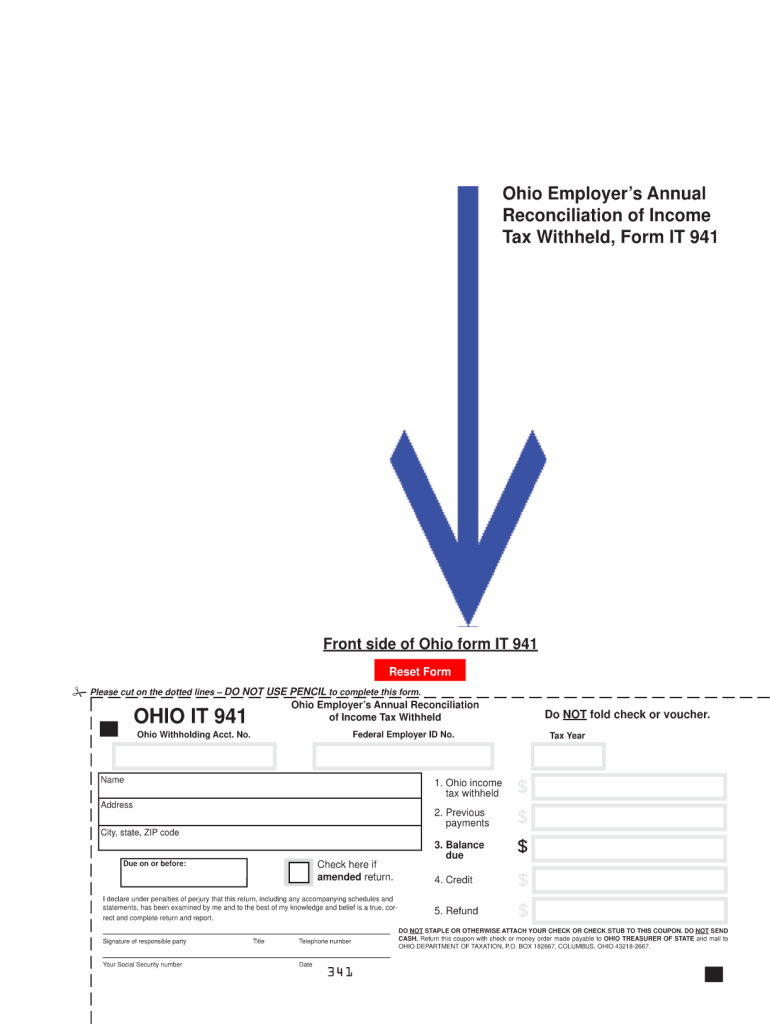

Oh It 941 Fill Out Tax Template Online Us Legal Forms

Oh It 941 Fill Out Tax Template Online Us Legal Forms

Income Ohio Residency And Residency Credits Department Of Taxation

Income Ohio Residency And Residency Credits Department Of Taxation

Ohio S Poor Tax Climate At The Heart Of The State S Economic And Fiscal Woes Tax Foundation

Ohio S Poor Tax Climate At The Heart Of The State S Economic And Fiscal Woes Tax Foundation

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency

Https Tax Ohio Gov Portals 0 Forms Municipal Income Ohiocity Ohiocitytaxform Pdf

Ohio Oh State Tax Refund Ohio Tax Brackets Taxact Blog

Ohio Oh State Tax Refund Ohio Tax Brackets Taxact Blog

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency

Bw98 Tax Book Quark File Ohio Department Of Taxation

Bw98 Tax Book Quark File Ohio Department Of Taxation

Ohio S Poor Tax Climate At The Heart Of The State S Economic And Fiscal Woes Tax Foundation

Ohio S Poor Tax Climate At The Heart Of The State S Economic And Fiscal Woes Tax Foundation

Post a Comment for "Ohio Unemployment Tax Rate Calculation"