Nj Unemployment Reduction In Hours

Fake Old Converse Shoes not in the US March 23 2020 at 619 pm. Less than full-time means that you are not working more than 80 of the usual hours for your occupation for example if a 40 hour work week is common in your occupation you may be able to receive benefits if you work 32 hours or less.

Nj Labor Department To Begin Making Pua Payments To Sole Proprietors And Independent Contractors Njbia New Jersey Business Industry Association

Nj Labor Department To Begin Making Pua Payments To Sole Proprietors And Independent Contractors Njbia New Jersey Business Industry Association

How we calculate partial Unemployment Insurance benefits.

Nj unemployment reduction in hours. The Department will consider work to be suitable where it pays at least 80 of the claimants average weekly wage including the value of benefits. Depending on the income earnings allowance for your state you may not receive full. When you claim your weekly benefit you will let us know if you worked that week.

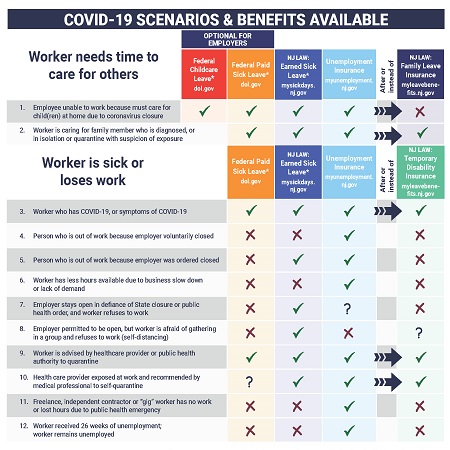

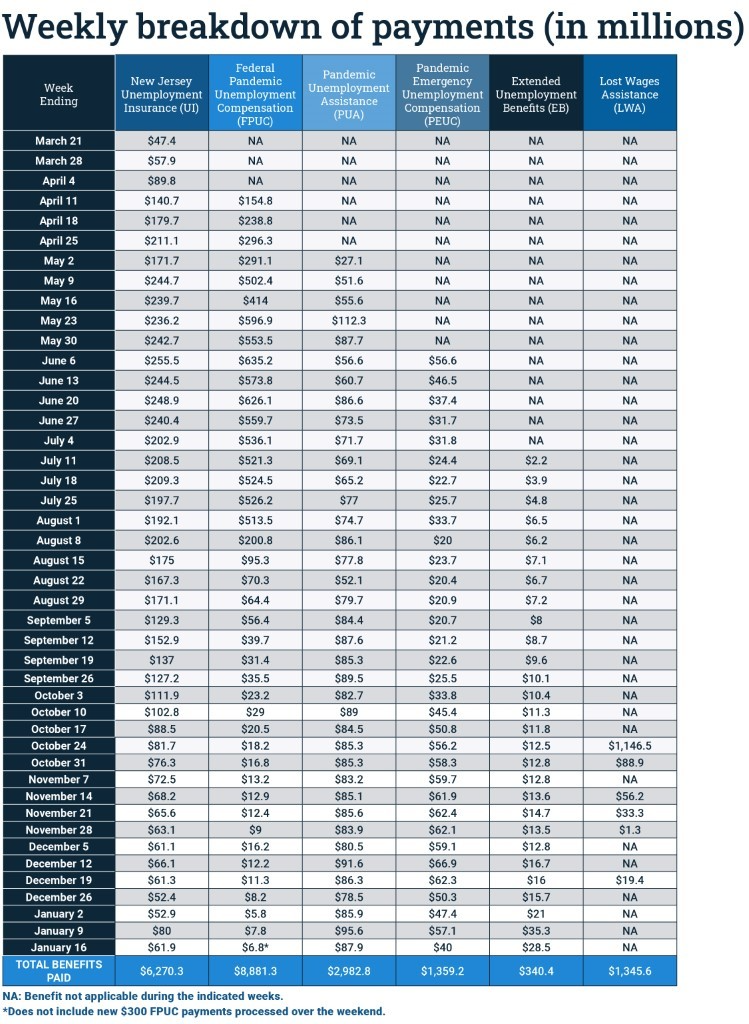

Expanded Unemployment in New Jersey During the COVID-19 Pandemic On March 11 2021 President Biden signed into law a 19 trillion COVID-19 relief bill known as the American Rescue Plan ARP. Under an approved Shared-Work program workers who have their hours of work reduced may receive short-time Unemployment benefits for the lost hours of work while continuing to work at reduced hours with a continuation of their health insurance pension coverage and other benefits. Unemployment Benefits for Reduced Hours.

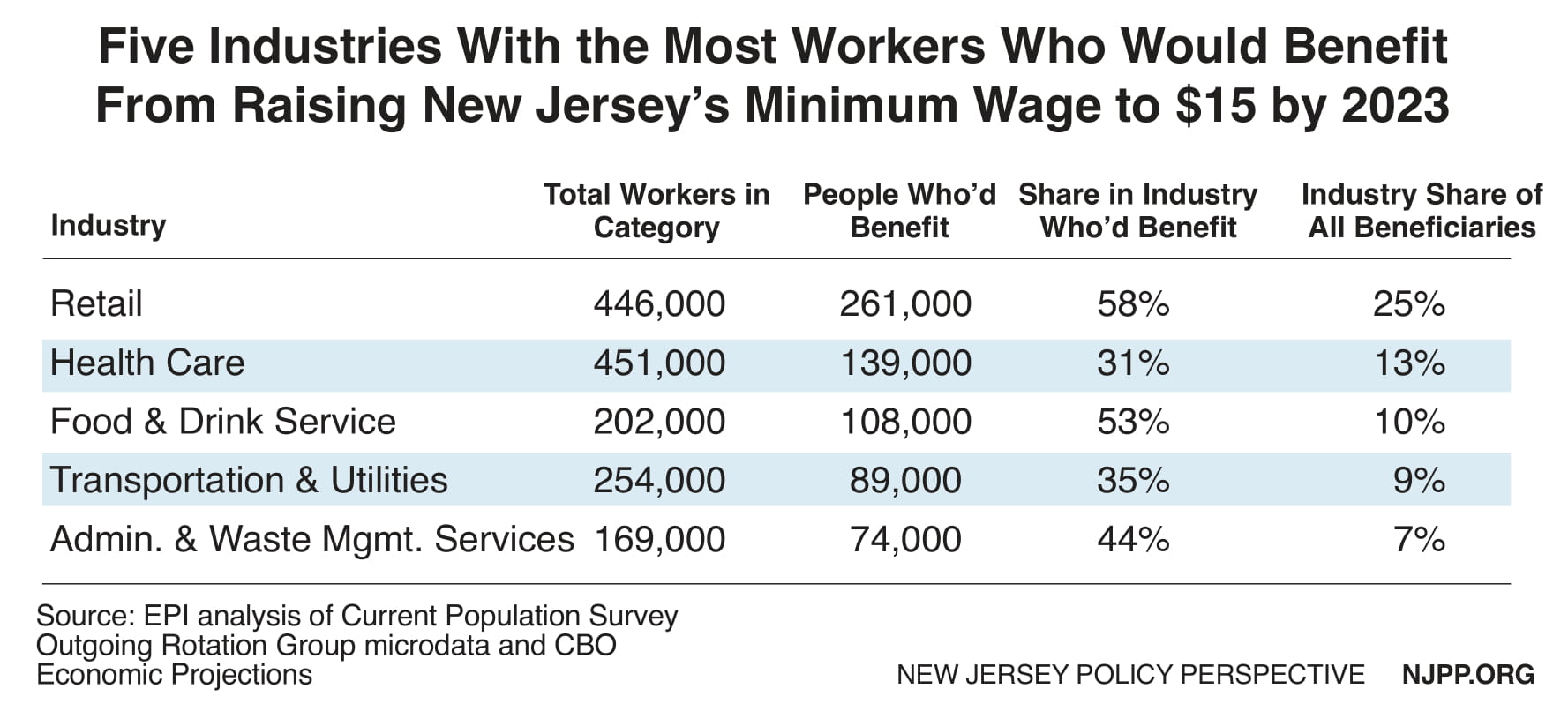

You must meet the requirements to collect partial unemployment. Please refer to New Jerseys Minimum Wage Chart for scheduled increases. However effective January 1 2021 the suggested rate is a minimum of 413 per hour.

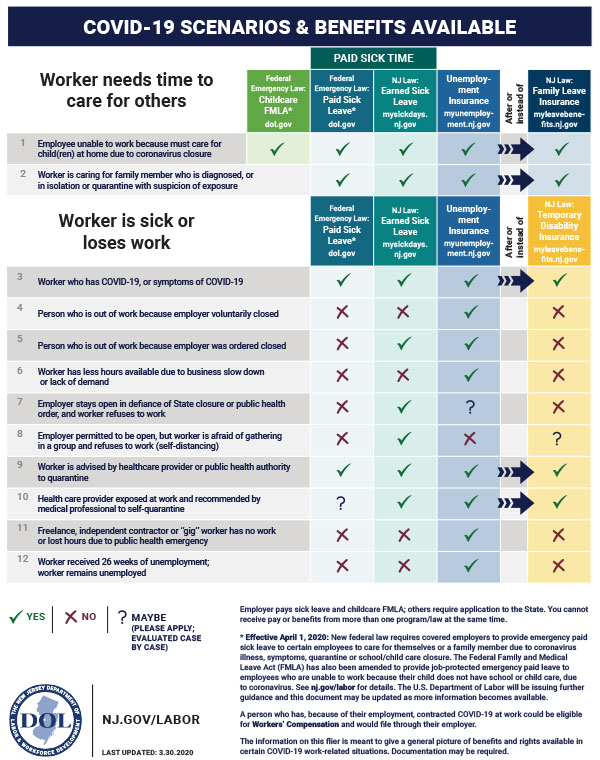

Partial unemployment-reduction in hours An employer who has at least 10 employees may apply to the division for approval to provide a Shared Work program. Additionally New Jersey workers have the right to accrue up to 40 hours of earned sick time. In some states experiencing a significant reduction of hours at your job counts as loss of work which qualifies you for state unemployment benefits.

See question 4 above for more detail on suitable work. Pandemic Unemployment Assistance PUA provides up to 75 weeks of benefits up until September 4 2021 to NJ workers who are 1 not eligible for unemployment benefits in any stateincluding self-employed workers independent contractors gig workers 2 otherwise able and available to work except that they are unemployed partially. Working the same hours at half pay you dont.

For earnings greater than. The hourly rate is up to your employer. This varies by claim so the Department of Labor and Workforce Development may contact your current employer for more information when you first file for benefits.

Anyone currently receiving unemployment in any amount will also receive the 300 weekly supplemental benefit. For example if a person normally works 40 hours a week they cannot work more than 32 hours in a week to be eligible. If you got a 50 reduction in hours and therefore 50 of your pay but the same per hour youd be able to file for unemployment for the other hours missed.

First you must work less than 80 percent of the full-time hours for that occupation. One of the requirements for unemployment insurance benefits is that you report your income each week. For more information on NJ Earned Sick Leave click here.

201-601-4100 Central New Jersey. The Department will also consider a reduction in hours. 732-761-2020 South New Jersey.

Additionally if the person earns 20 or less of their weekly benefit rate the person would receive the full weekly benefit. If the hourly rate plus tips does not equal at least the minimum wage per hour the employer is required to make up the difference. To be eligible for partial benefits you cannot work more than 80 percent of the hours normally worked in the job.

Under ARP the 300 per week federal unemployment supplement on top of whatever your state provides is extended until September 6 2021. For example if you worked a 40-hour week you wont be able to get benefits. We will ask how many hours you worked and how much you earned gross for that week.

For separations occurring before July 1 2010 the New Jersey requirement is having at least four weeks of new employment earning at least six times the weekly benefit rate and being separated from the new employment for a non-disqualifying reason. 888-795-6672 you must call from a phone with an out-of-state area code New Jersey Relay. NJ workers currently claiming federal benefits will receive an additional 25 weeks.

The purpose of such a program is to stabilize an employers workforce during a period of economic disruption by permitting the sharing of the work remaining after a reduction in total hours of work. An individual who quits work may become eligible for future benefits after meeting a re-qualifying requirement. In addition to New Jerseys family leave benefits and earned sick leave your employer may provide you with federal paid sick leave to care for yourself if you have COVID-19 or need to quarantine.

For example if a job is changed from full-time to part-time. The federal American Rescue Plan Act was signed March 11 and extended unemployment benefits through Sept.

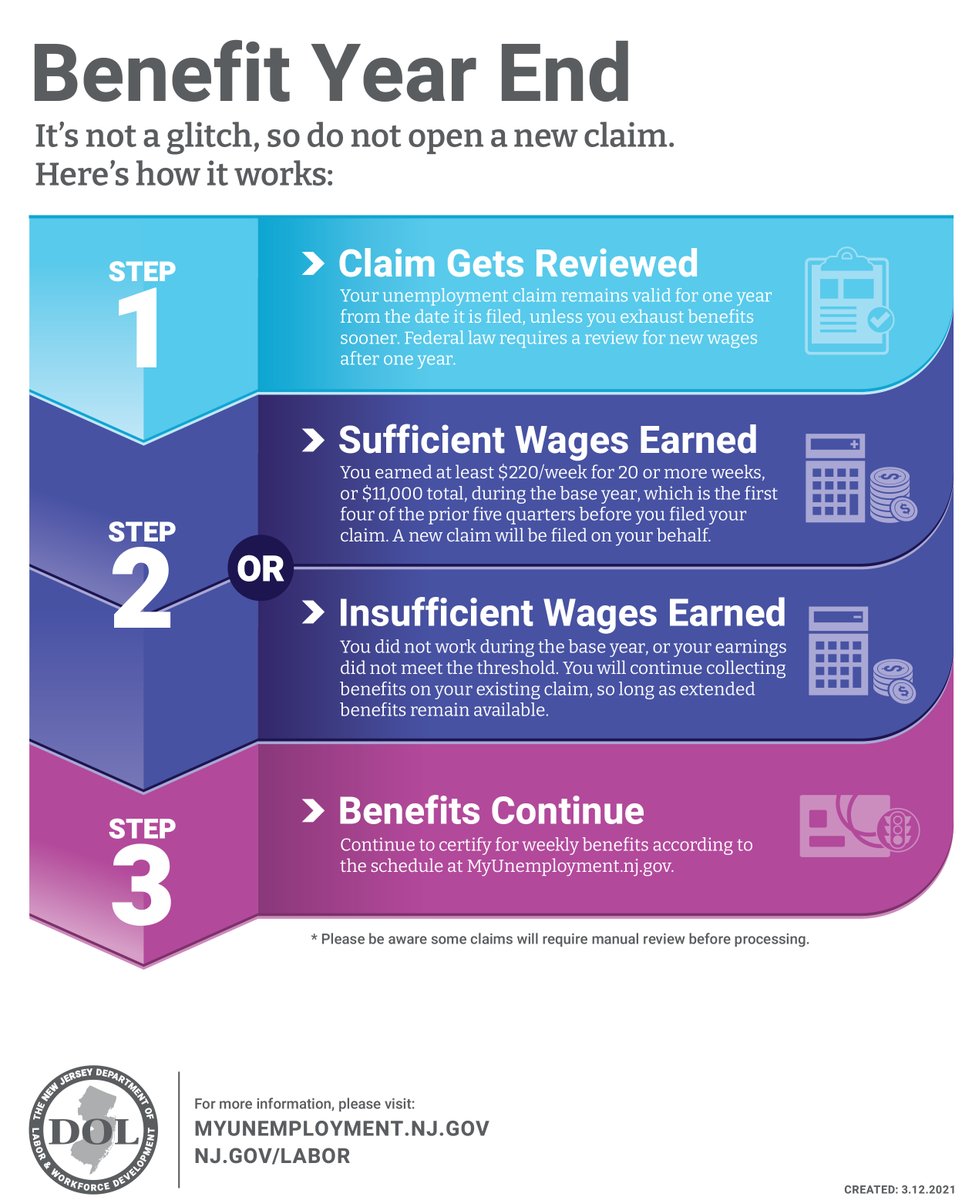

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

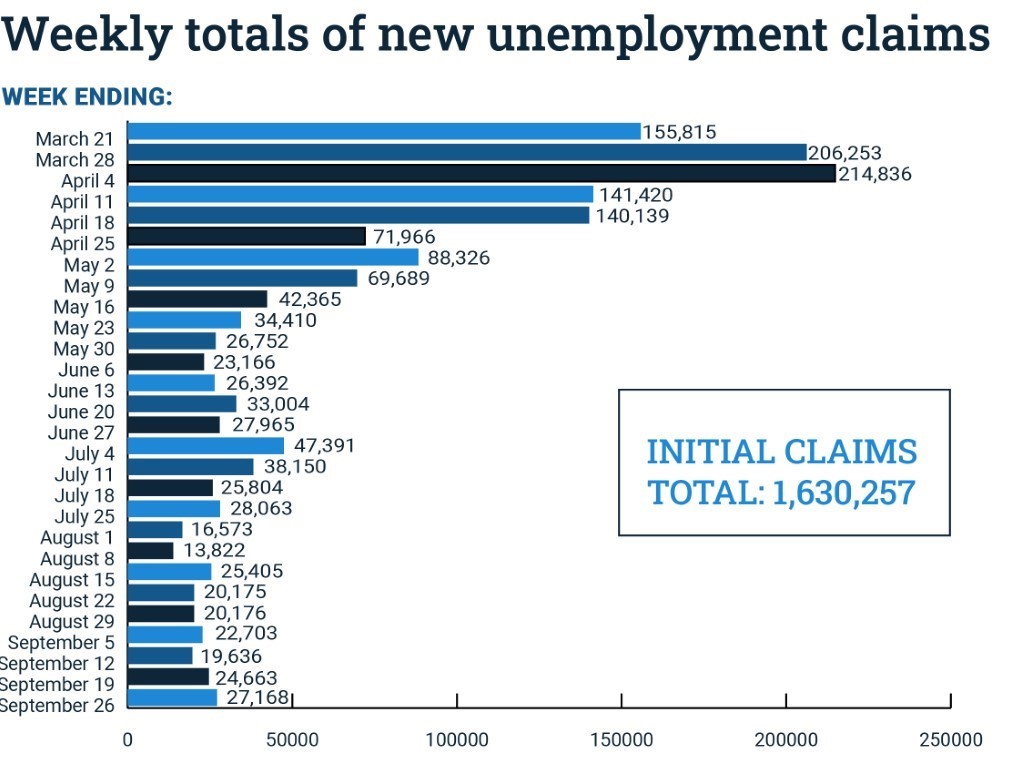

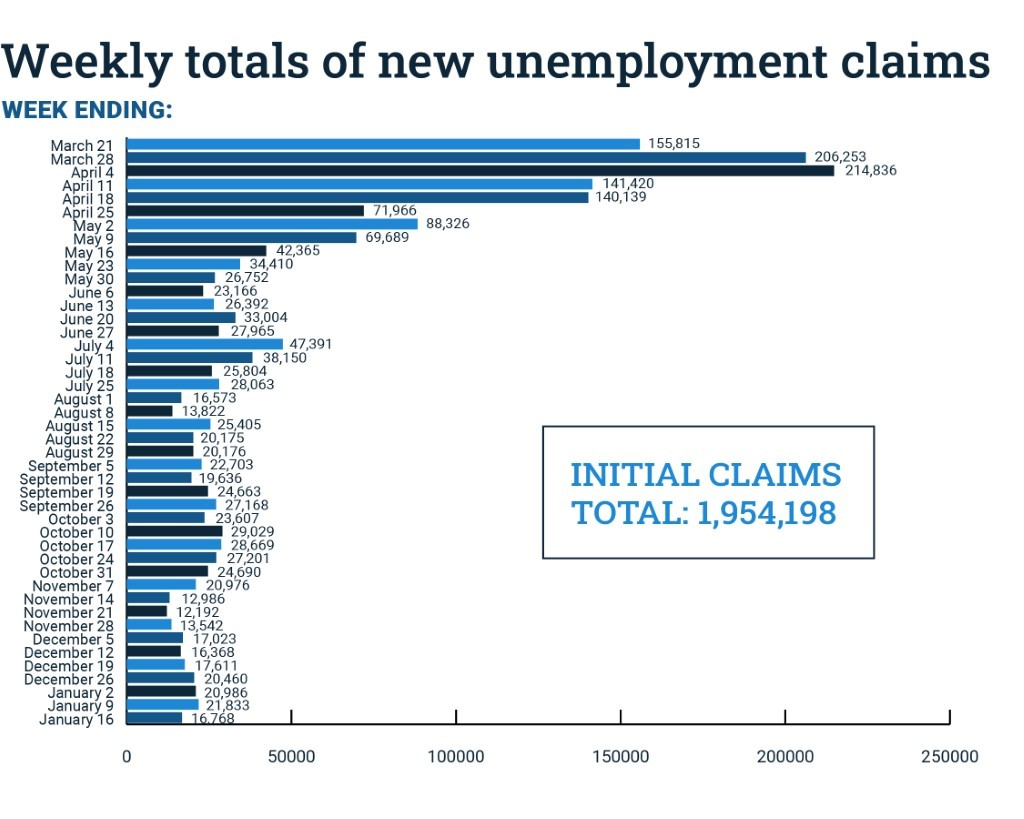

Njdol Nj Unemployment Claims Rise For 2nd Straight Week

Njdol Nj Unemployment Claims Rise For 2nd Straight Week

New Jersey Unemployment Tips Hotel Trades Council En

New Jersey Unemployment Tips Hotel Trades Council En

If You Re Unemployed Read This Dol Releases How To Guide On Answering Recertification Questions Roi Nj

If You Re Unemployed Read This Dol Releases How To Guide On Answering Recertification Questions Roi Nj

Coronavirus New Jersey Updates From May 2020 Abc7 New York

Coronavirus New Jersey Updates From May 2020 Abc7 New York

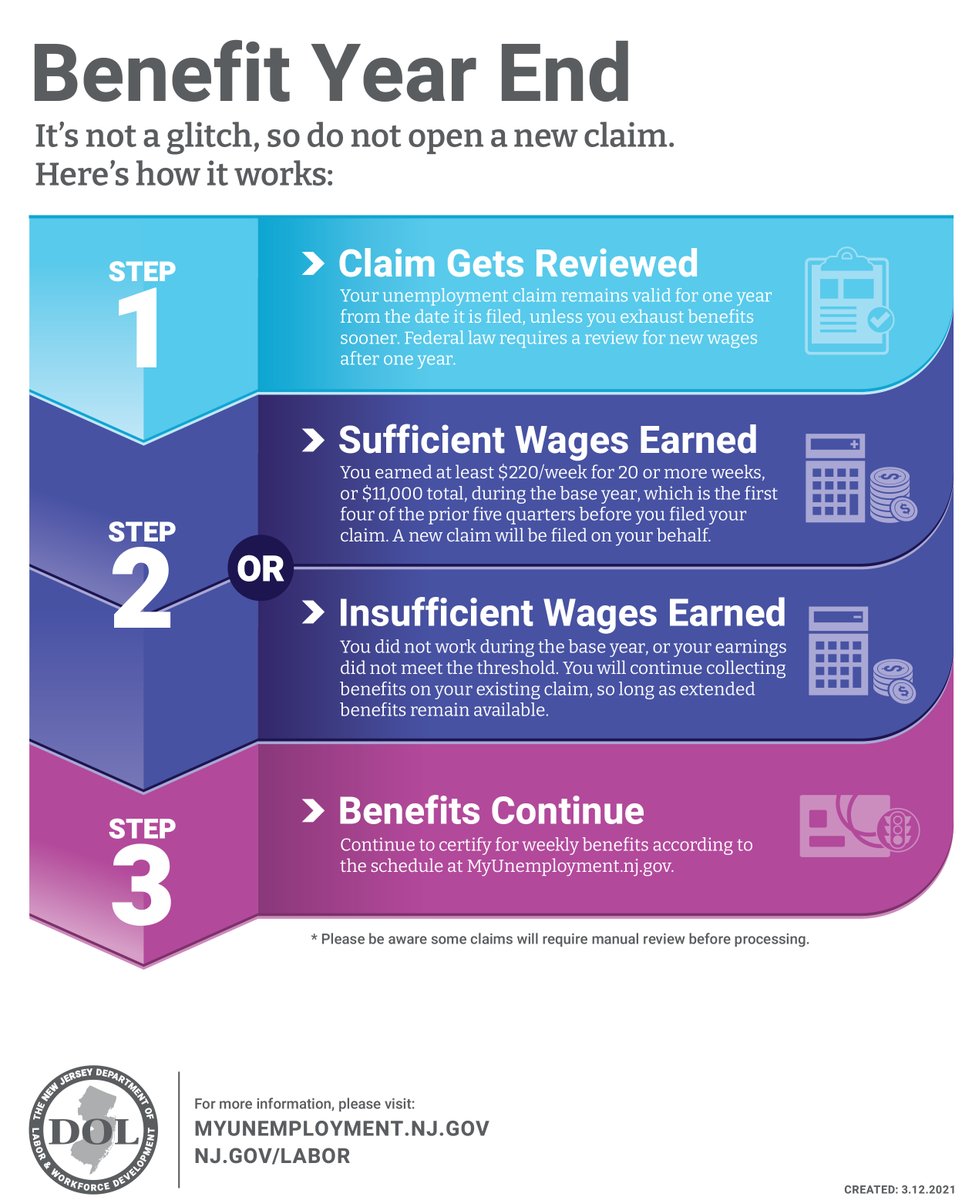

Nj Labor Department Njlabordept Twitter

Nj Labor Department Njlabordept Twitter

Nj Labor Department Njlabordept Twitter

Nj Labor Department Njlabordept Twitter

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Resources For Employers And Job Seekers Camden County Nj

Resources For Employers And Job Seekers Camden County Nj

Raising The Minimum Wage To 15 Is Critical To Growing New Jersey S Economy New Jersey Policy Perspective

Raising The Minimum Wage To 15 Is Critical To Growing New Jersey S Economy New Jersey Policy Perspective

Coronavirus News How To Apply For Unemployment In Pennsylvania Delaware New Jersey Amid The Covid 19 Outbreak 6abc Philadelphia

Coronavirus News How To Apply For Unemployment In Pennsylvania Delaware New Jersey Amid The Covid 19 Outbreak 6abc Philadelphia

Https Www Booker Senate Gov Download Unemployment Insurance

Njdol Jobless Residents Receive New Stimulus Payments

Njdol Jobless Residents Receive New Stimulus Payments

Njdol Jobless Residents Receive New Stimulus Payments

Njdol Jobless Residents Receive New Stimulus Payments

Nj Unemployment Rate Increases To 8 2 New Jersey Business Magazine

Nj Unemployment Rate Increases To 8 2 New Jersey Business Magazine

Nj Labor Department Processes 1 1m Weekly Unemployment Payments New Jersey Business Magazine

Nj Labor Department Processes 1 1m Weekly Unemployment Payments New Jersey Business Magazine

Disqualification New Jersey Employment Litigation Lawyers

Disqualification New Jersey Employment Litigation Lawyers

Faqs Nj Unemployment Guidance Njbia New Jersey Business Industry Association

Faqs Nj Unemployment Guidance Njbia New Jersey Business Industry Association

Nj Unemployment Claims Rise For 2nd Straight Week New Jersey Business Magazine

Nj Unemployment Claims Rise For 2nd Straight Week New Jersey Business Magazine

Post a Comment for "Nj Unemployment Reduction In Hours"