How To End Unemployment Pa

Your MBA is your weekly benefit rate WBR multiplied by the number of credit weeks in your base year. If you then become unemployed again before your claim has expired please reopen your claim on the UC website Pandemic Unemployment Assistance PUA File PUA Initial Claim.

Pa Unemployment Benefits Can Be Backdated Up To 52 Weeks

Pa Unemployment Benefits Can Be Backdated Up To 52 Weeks

Benefits are provided through the state unemployment offices and information on eligibility will be posted online.

How to end unemployment pa. Click the Additional Benefit Payment History link. That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax breaks like the earned income tax. It already passed the House of.

Pennsylvania is operating its Benefit Year End extensions differently from New Jersey. In order to cancel your unemployment claim you can. In general the good cause requirement will be satisfied if you had a compelling reason for quitting it left you no choice other than to quit and you made every effort to keep your job.

As a result of the COVID-19 pandemic a historic surge of people are seeking unemployment compensation. The CARES Act specifies that PUA benefits cannot be paid for weeks of unemployment ending after April 10 2021. Pennsylvania allows you to earn 30 of your unemployment benefit before it deducts the rest of your earnings from your payment.

The American Rescue Plan Act ARPA was signed into law on March 11 and it includes another expansion of federal unemployment benefits. Many states have dedicated website links and call numbers when it. Weve made progress in meeting this unprecedented demand for unemployment benefits in Pennsylvania but know more must be done.

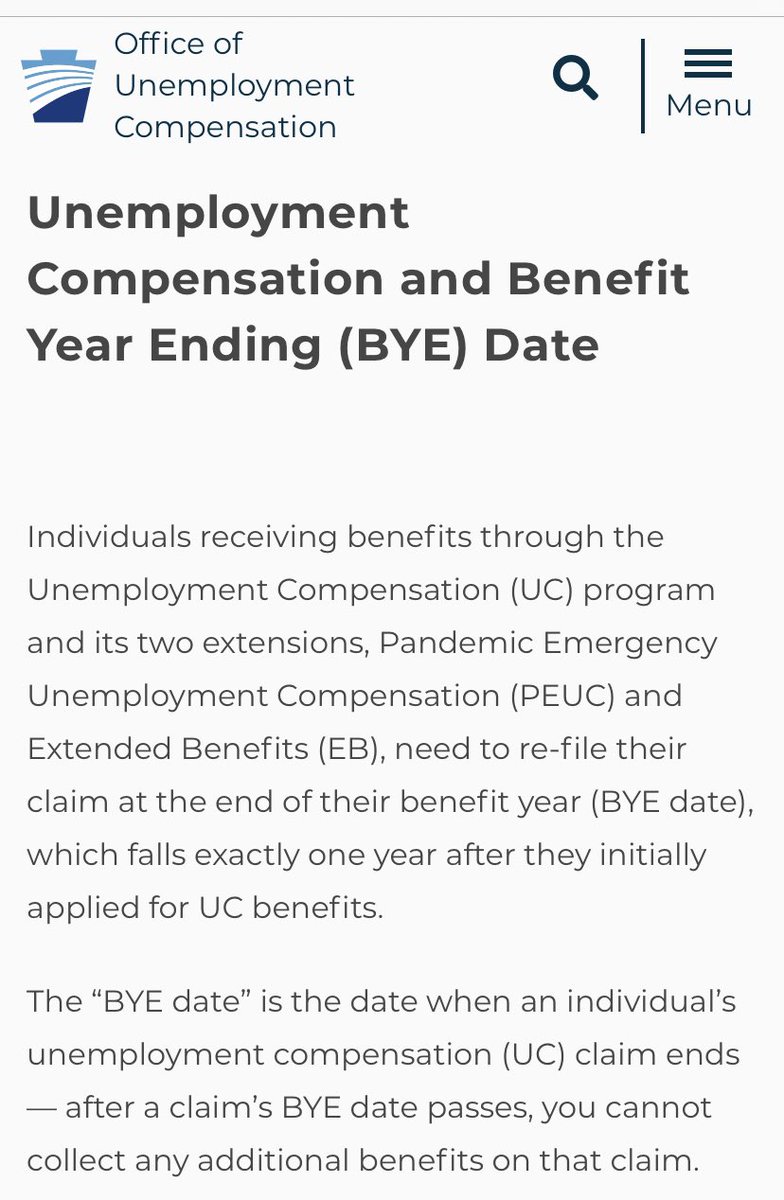

For more information review our Benefit Year End Process video for a walkthrough on where to access your BYE date from your online account. In general PUA provides up to 79 weeks of unemployment benefits to individuals not eligible for regular unemployment compensation. Click here for PUA Claimant Guide File a regular unemployment.

If you are eligible you will be advised on how to collect when your regular unemployment benefits end. However remember to file claims for weeks you were unemployed before you returned to work. What Happens When You Find Employment.

To apply for unemployment benefits using the Pandemic Unemployment Assistance PUA extension provision approved under the CARES act you need to apply via your regular states unemployment agency. Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended return to get their maximum refund. New York pays partial benefits if.

March 14 will be the last day for bonus unemployment checks unless President Joe Bidens 19 trillion COVID-19 relief plan gets through Congress before. The PA Department of Labor and Industry. Your benefit year expires one year 52 weeks after your application for benefits AB date.

If you no longer wish to continue to file for unemployment benefits for example because you have become fully employed simply stop filing your bi-weekly claim. Log in to the PA Claims website. Unemployment Benefits and COVID-19.

If you have exhausted unemployment benefits. ARPA benefits are available beginning with the week ending March 20 2021 and payable through September 4 2021. If you happen to receive an unemployment check while you are working make sure to call your unemployment counselor to let them know.

However you must have at least 18 credit weeks to qualify for benefits. For applications on or after 12-27-20 benefits can only be retroactive starting on or after an Effective date of 12-6-20. Pandemic Unemployment Assistance PUA has been extended with the enactment of the American Rescue Plan Act of 2021 ARPA.

For example states such as New York California Texas Pennsylvania Minnesota and Ohio each offer 26 weeks of unemployment benefits through the traditional state-funded unemployment. We understand this is frustrating and hear your complaints. Full-time Work If you return to work full time with your former employer or a new employer you are no longer eligible for benefits.

Stop filing your weekly certification. If you quit your job you wont be eligible for unemployment benefits unless you had good cause for quitting. If you are currently collecting unemployment benefits.

Call send a letter or email to your unemployment counselor letting them know that you have found a new job.

Pennsylvania Workers Can Apply For Additional 300 In Unemployment Benefits Next Week Pittsburgh Post Gazette

Pennsylvania Workers Can Apply For Additional 300 In Unemployment Benefits Next Week Pittsburgh Post Gazette

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

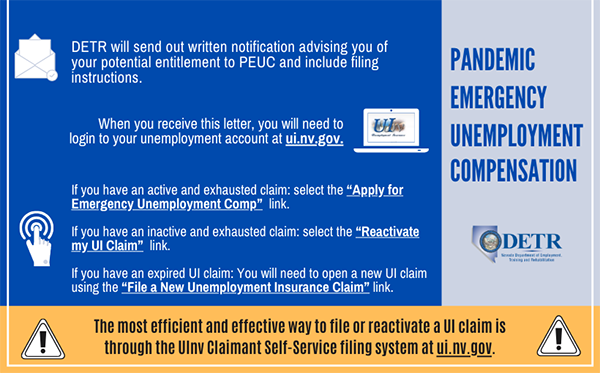

Coronavirus Bulletin Board Aids Law Project

Coronavirus Bulletin Board Aids Law Project

Coronavirus Bulletin Board Aids Law Project

Coronavirus Bulletin Board Aids Law Project

Pa Extends Benefits Window For Unemployment Compensation Whyy

Pa Extends Benefits Window For Unemployment Compensation Whyy

Pa Unemployment Applicants May Qualify For An Additional 600

Pa Unemployment Applicants May Qualify For An Additional 600

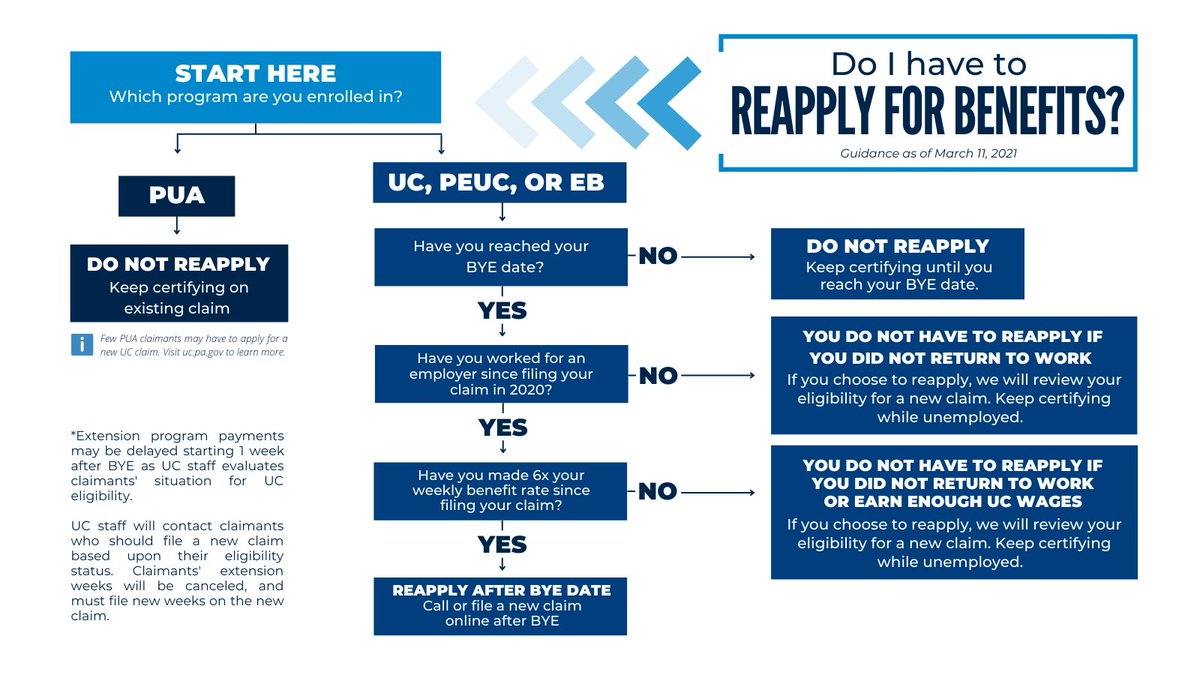

Pa Department Of Labor Industry On Twitter As A Reminder When You Reach Your Benefit Year End Bye Date The Next Steps Depend On 1 Which Program You Are Enrolled In And

Pa Department Of Labor Industry On Twitter As A Reminder When You Reach Your Benefit Year End Bye Date The Next Steps Depend On 1 Which Program You Are Enrolled In And

Pa Now Accepting Applications For Pandemic Unemployment Assistance Pua Benefits Fox43 Com

Pa Now Accepting Applications For Pandemic Unemployment Assistance Pua Benefits Fox43 Com

Http Www Uc Pa Gov Documents Ucp 20forms Ucp 1 Pdf

Top 5 Mistakes People Make Filing Unemployment That Could Delay Your Benefits Wpxi

Top 5 Mistakes People Make Filing Unemployment That Could Delay Your Benefits Wpxi

Coronavirus Bulletin Board Aids Law Project

Coronavirus Bulletin Board Aids Law Project

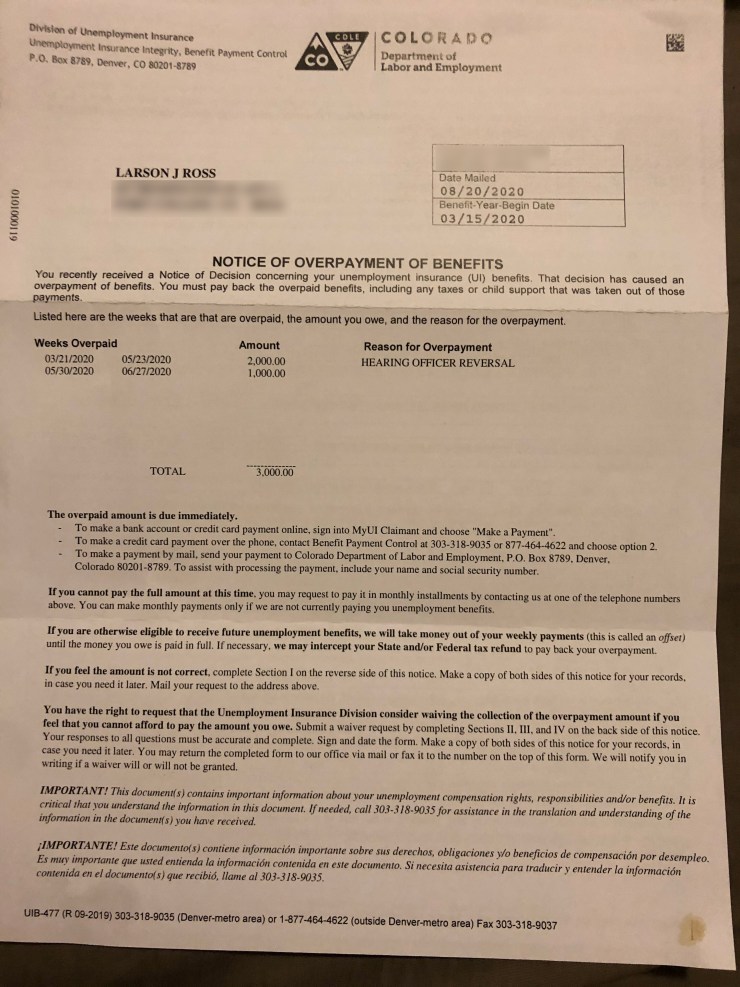

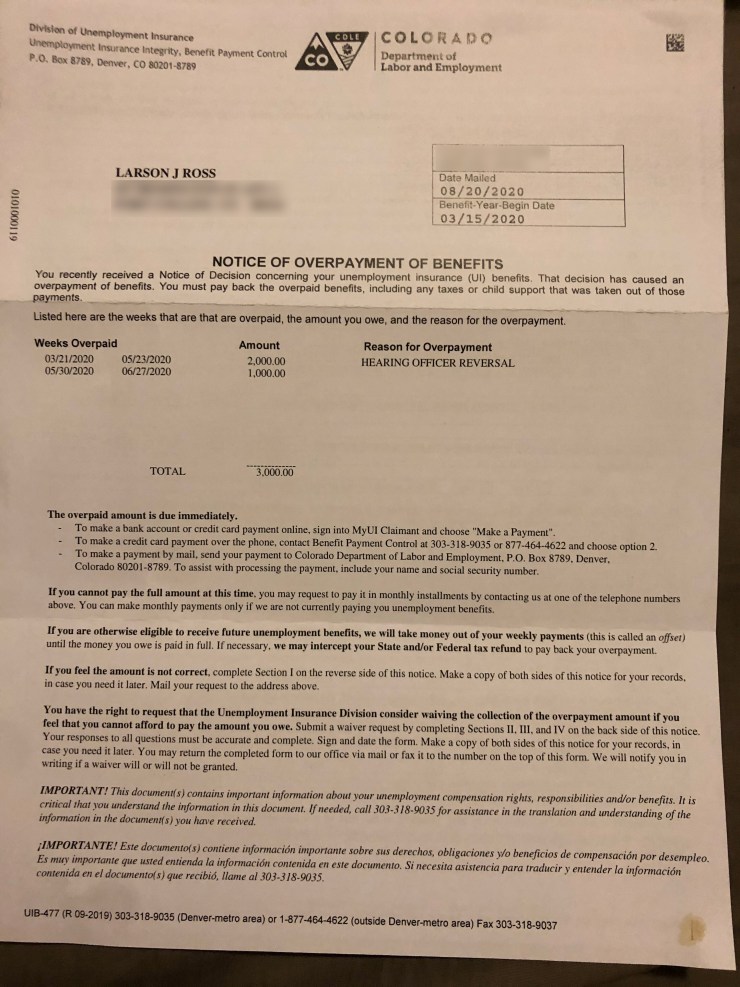

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Massive Unemployment Scam Strikes Up To 58 000 People In Pa Far More Than Previously Known Pittsburgh Post Gazette

Massive Unemployment Scam Strikes Up To 58 000 People In Pa Far More Than Previously Known Pittsburgh Post Gazette

Unemployed Pennsylvanians Will Get An Extra 300 A Week

Unemployed Pennsylvanians Will Get An Extra 300 A Week

Https Www Uc Pa Gov Unemployment Benefits Ucguide Documents Pa Uc Program Progression Pdf

Pa Department Of Labor Industry On Twitter As A Reminder When You Reach Your Benefit Year End Bye Date The Next Steps Depend On 1 Which Program You Are Enrolled In And

Pa Department Of Labor Industry On Twitter As A Reminder When You Reach Your Benefit Year End Bye Date The Next Steps Depend On 1 Which Program You Are Enrolled In And

Extended Unemployment Benefits Set To End This Week

Extended Unemployment Benefits Set To End This Week

Post a Comment for "How To End Unemployment Pa"