How Is Ohio Unemployment Funded

Ohio approved for more than 700 million in federal unemployment funds. The unemployment compensation program is funded by payroll taxes from employers in the state.

270k Unemployment Claims On Hold Amid Concerns About Fraud

270k Unemployment Claims On Hold Amid Concerns About Fraud

Mike DeWine said Thursday that he thinks Ohio should use more than 1 billion from what the state will get in.

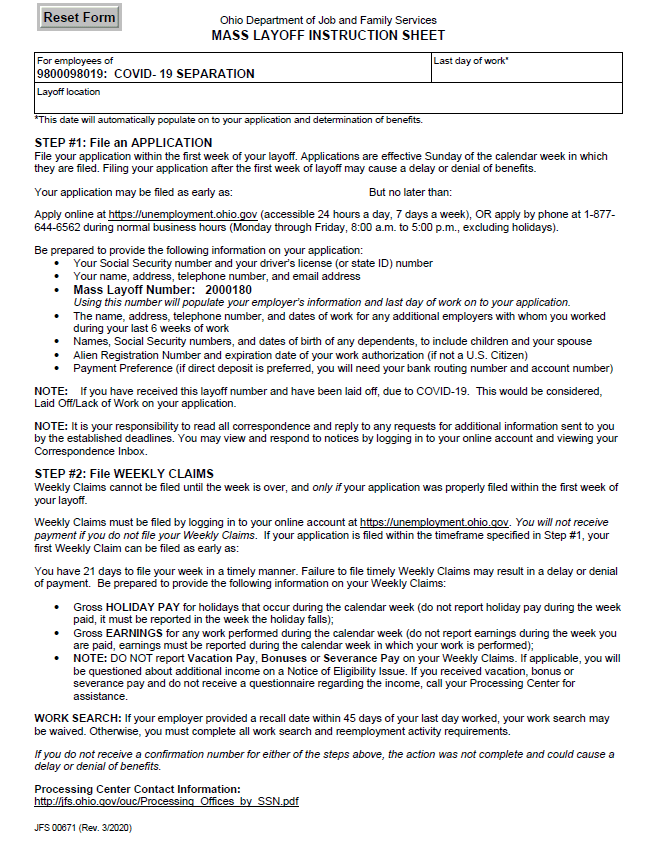

How is ohio unemployment funded. Full federal funding up from 50 funding of the first week of unemployment. Authorizes full federal funding of the first week of traditional unemployment benefits instead of 50. The unemployment systems and payments for Ohioans is under the purview of the Ohio Department of Jobs and Family Services and is funded from the Ohio Unemployment Trust FundThe money in the fund comes from a tax that employers pay the state.

Governor Mike DeWine says the state took out a federal loan for nearly 15 billion dollars to cover unemployment during the pandemic but he added the states revenue is recovering. 1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a three-year period that would be. Apply for Unemployment Now Employee 1099 Employee Employer.

Employers pay federal taxes of 6 percent on the first 7000 in annual income earned by every employee. COLUMBUS Ohio AP Ohio unemployment claimants would receive 300 in federal weekly unemployment assistance under an option provided by the White House that doesnt require extra state spending. AP PhotoJohn Minchillo File AP.

Based on recent DOL guidelines the 11 week funding extension to these program will only cover payments. Extra money for unemployment ohio december 2020. Federal funding of traditional unemployment benefits to help defray the costs to reimbursing employers governmental and nonprofit employers will increase from 50 to 75 Continuation of full.

The lost wages assistance program which pulls funding from the Federal Emergency Management. From time to time the Ohio Department of Job Family Services Office of Workforce Development OWD releases Requests for Proposals RFP targeting a specific program andor population. Continuation of full federal funding of Ohios premier layoff aversion program SharedWork Ohio.

The Department of Job and Family Services administers the unemployment compensation program in the state of Ohio. Workforce Areas are encouraged to apply for funding to. The taxes are part of the often-discussed payroll taxes all employers pay.

17 hours agoDeWine on Thursday proposed using some of Ohios federal stimulus funding to repay federal loans issued to keep the states unemployment benefits system solvent. The Ohio Department of Job and Family Services ODJFS has been approved to provide an additional 300 a week to Ohioans unemployed due to COVID-19 and receiving benefits Lt. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

Please visit unemploymentohiogov click on the Report Identity Theft button and complete the form so that we can investigate the claim that was filed and take appropriate actionsThis can include correcting the 1099-G form that you were sent. 1 Rates vary depending on how much an employer has paid in tax and how much in benefits its laid-off workers have received. Unemployment compensation is funded by a dedicated payroll tax on employers separate from the state budget.

Extends full federal funding for Ohios SharedWork program. Department of Labors Unemployment Insurance program is funded through unemployment insurance taxes paid by employers and collected by the state and federal government. 1 day agoOhio is looking to repay the money they borrowed from the federal government to cover increased demand for funding for the unemployment compensation fund.

Ohio employers pay tax on the first 9000 in each employees wages each year. Report it by calling toll-free. Authorizes 75 credits to reimbursing employers for traditional unemployment benefit charges.

The benefits program is structured to help unemployed workers meet financial obligations while searching for new employment.

Unemployment Provisions Stemming From Covid 19 Extended Dayton Chamber

Unemployment Provisions Stemming From Covid 19 Extended Dayton Chamber

134k Ohio Workers Will Soon Get Pandemic Unemployment Relief The Statehouse News Bureau

How Long Is 300 Lost Wages Assistance Lwa Unemployment Available For Aving To Invest

How Long Is 300 Lost Wages Assistance Lwa Unemployment Available For Aving To Invest

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Oh Department Of Job And Family Services Odjfs Extra 300 Fpuc Peuc Pua And Eb 2021 Unemployment Benefit Extensions News And Updates Aving To Invest

Ohio Oh Department Of Job And Family Services Odjfs Extra 300 Fpuc Peuc Pua And Eb 2021 Unemployment Benefit Extensions News And Updates Aving To Invest

Http Www Ohiomfg Com Wp Content Uploads 08 26 16 Hr Odjfs Ppt Uctestimony Pdf

Q A Your Most Common Unemployment Questions The Lima News

Q A Your Most Common Unemployment Questions The Lima News

Http Www Policymattersohio Org Wp Content Uploads 2014 11 Uc Es Pdf

Scam Targets Ohioans Who Receive Or Have Received Pandemic Unemployment Assistance The Statehouse News Bureau

Scam Targets Ohioans Who Receive Or Have Received Pandemic Unemployment Assistance The Statehouse News Bureau

States Prepare For Unemployment Funds To Run Out

States Prepare For Unemployment Funds To Run Out

Ohio Agrees To 300 Per Week In Unemployment Funding From Trump Executive Order Wdtn Com

Ohio Agrees To 300 Per Week In Unemployment Funding From Trump Executive Order Wdtn Com

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Unemployment To Pay 300 Weekly Benefit Under Trump Order The Statehouse News Bureau

Ohio Unemployment To Pay 300 Weekly Benefit Under Trump Order The Statehouse News Bureau

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Post a Comment for "How Is Ohio Unemployment Funded"