Do I Have To File Taxes If My Income Is Less Than 6000

Citizens or resident aliens for the entire tax year for which theyre inquiring. Unearned income is more than 1050.

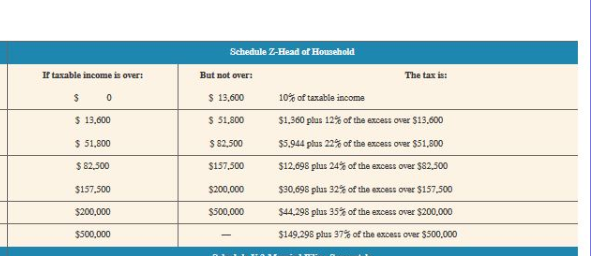

Use The Following Table To Answer Questions 1 4 1 If A Person S Income Is 6 000 How Much Does He Pay In Taxes Bartleby

Use The Following Table To Answer Questions 1 4 1 If A Person S Income Is 6 000 How Much Does He Pay In Taxes Bartleby

But if they earned income.

Do i have to file taxes if my income is less than 6000. Several online tax software providers participate in IRS Free File. However if youre retired from your previous career and working part time in another field you may still have to file a return if you earn more than your filing threshold. In other words if your child only makes money from working the bar for being taxed is quite a bit higher than it would be if all they did was cash dividend checks.

If married the spouse must also have been a US. Generally you must pay taxes on income including. As long as it was wage income and not self employment income and you had no other income then no you dont have to.

Filing Status Age at December 31 2013 Gross Income Single Under 65 10000 65 or older 11500 Married Filing Jointly Under 65 both 20000 65 or older both 22400 Under 65 one 21200 Married Filing Separately. Combined income totals more than the larger of 1050 or earned income up to 6000 plus 350. If it was self employment income the cut off is 400 so you probably do have to.

The tool is designed for taxpayers who were US. Citizen or resident alien for the entire tax year. If you do not pay your tax through withholding or do not pay enough tax that way you might have to pay estimated tax.

In this case you need to file a separate return if. If I made less than 5000 last year do I still need to file taxes. Earned income is more than 6350.

As long as you dont have a type of income that requires you to file a return for other reasons like self-employment income generally you dont need to file a return as long as your income is less than your standard deduction. Nonresidents Filing Tax Returns in the US. The answer to your question depends on how the 6000 in income was reported to you.

Filers who earn taxable income of less than the standard deduction dont typically need to file a federal tax return. Your unearned income money from dividends or interest is more than 1100 or Your earned income like wages is more than 12200 or. I know this sounds as.

Likewise if your child received 300 from babysitting and 200 of dividend income they would not have to file a tax return because 300 plus 200 is 500 which is less than 1100. But remember if Federal taxes were withheld from your earnings youll want to file a tax return to get any withholdings back. If you are not required to make estimated tax payments you may pay any tax due when you file your return.

Basic information to help you determine your gross income. But you must file a tax return to claim a refundable tax credit or a refund for withheld income tax. Retirees who dont earn a wage any longer may not have to file a tax return if their only income comes from Social Security.

Federal income tax withheld. If you are new to Canada or if you are just entering the workforce you may be wondering if filing a Canadian Income Tax return is a necessity and if so when do you have to file your first tax return. If you earned less than that the IRS doesnt require you submit a return.

If your unearned income is less than 1050 you dont have to file a tax return as long as your gross income is less than 6300. These include the additional tax on a qualified retirement plan such as. For additional information refer to Publication 583.

You are not required to file a tax return with the IRS. 10 hours agoIf you earned less than 72000 in 2020 you can file your taxes for free through the IRS Free File program. In some situations you may still have to file even with a low income but you can likely file free.

The general rule is that if your filing status is single and you were 65 or older at the end of 2015 then you. Find out if you have to file a tax return. Married couples under 65 who file their tax return jointly need to earn at least 24400 before they technically have to file taxes.

And if you are single under age 65 are not blind and are claimed as a dependent on another taxpayers return you will need to file if. Its often not legally necessary to file taxes under 10000 in income but it can be a good idea if youve had taxes withheld since otherwise you wont get a refund from the IRS. The Canada Revenue Agency CRA does require annual filing for most citizens but there are exceptions so lets have a look at who is required to file a Canadian T1 General tax return and when.

Youll have to file a tax return even if you dont earn these income thresholds if you owe any special taxes. For example in 2020 you dont need to file a tax return if all of the following are true for you. If you are an employee or a pensioner and the income profit is less than 2500 a year you might not have to complete a tax return but it is still your responsibility to report such income by contacting HMRC.

You may not have to file a federal income tax return if your income is below a certain amount. Those who are 65 or older and plan to file a single tax return can earn a minimum of 13850 before they have to pay any income taxes.

We Apply Knowledge Gained From Our Last Post To Show What Taxes Would Be Incurred In Five Common Situations Fac Stock Options Option Strategies Venture Capital

We Apply Knowledge Gained From Our Last Post To Show What Taxes Would Be Incurred In Five Common Situations Fac Stock Options Option Strategies Venture Capital

Budget Planner Bill And Expense Tracker List Printable Monthly Yearly Financial Planning List Instant Download Budget Planner Expense Tracker Budget Tracker

Budget Planner Bill And Expense Tracker List Printable Monthly Yearly Financial Planning List Instant Download Budget Planner Expense Tracker Budget Tracker

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

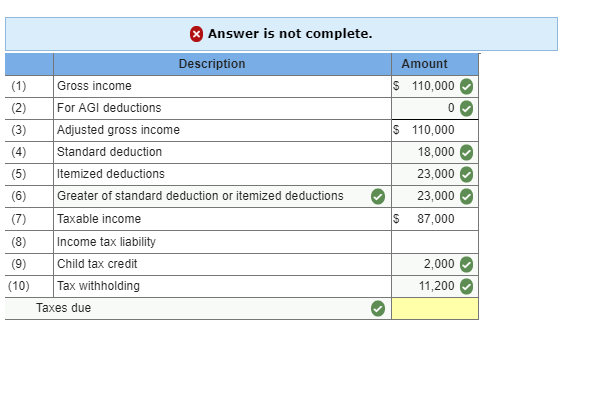

Solved Jeremy Earned 100 000 In Salary And 6 000 In Int Chegg Com

Solved Jeremy Earned 100 000 In Salary And 6 000 In Int Chegg Com

Roth Ira Contribution Cheat Sheet Infographic Inside Your Ira Roth Ira Contributions Roth Ira Roth Ira Investing

Roth Ira Contribution Cheat Sheet Infographic Inside Your Ira Roth Ira Contributions Roth Ira Roth Ira Investing

Do You Need To File A Tax Return In 2018

Do You Need To File A Tax Return In 2018

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Solved Jeremy Earned 100 000 In Salary And 6 000 In Int Chegg Com

Solved Jeremy Earned 100 000 In Salary And 6 000 In Int Chegg Com

It S Your Money Get It Back For Less Taxreturns Taxes Incometax Taxpayer Irs Filing Taxes Taxact Tax Software

It S Your Money Get It Back For Less Taxreturns Taxes Incometax Taxpayer Irs Filing Taxes Taxact Tax Software

Period Limitation Rule Require That The Irs Takes 3 Years To Audit Any Tax Returns For Correction And Assess Any Additional Tax The 3 Yea Irs Audit Tax Return

Period Limitation Rule Require That The Irs Takes 3 Years To Audit Any Tax Returns For Correction And Assess Any Additional Tax The 3 Yea Irs Audit Tax Return

If You Make Less Than 50 000 Don T Forget These 3 Tax Breaks The Motley Fool

If You Make Less Than 50 000 Don T Forget These 3 Tax Breaks The Motley Fool

Does Everyone Need To File An Income Tax Return Turbotax Tax Tips Videos

Does Everyone Need To File An Income Tax Return Turbotax Tax Tips Videos

2020 Tax Code 179 For Business Owners The Self Employed Carprousa

2020 Tax Code 179 For Business Owners The Self Employed Carprousa

6000 Tax Returns For Students Studentensteuererklarung Pt 1 Youtube

6000 Tax Returns For Students Studentensteuererklarung Pt 1 Youtube

Irs Letter 6000 Advanced Premium Tax Credit Recipients Non Filer Letter H R Block

Irs Letter 6000 Advanced Premium Tax Credit Recipients Non Filer Letter H R Block

Need Refund Fast How To Apply Tax Advance

Need Refund Fast How To Apply Tax Advance

Solved Jeremy Earned 100 000 In Salary And 6 000 In Int Chegg Com

Solved Jeremy Earned 100 000 In Salary And 6 000 In Int Chegg Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Post a Comment for "Do I Have To File Taxes If My Income Is Less Than 6000"