Can I Collect Unemployment If I Am Self Employed In Pa

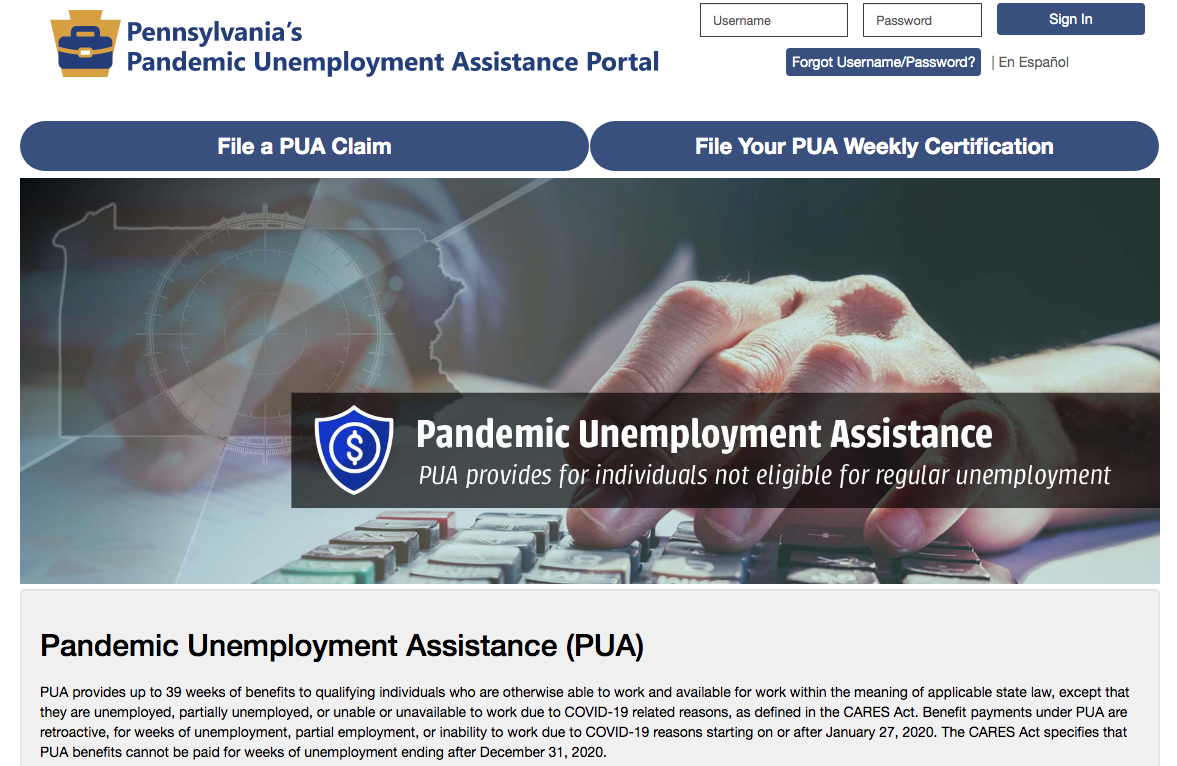

Individuals who do not provide documentation substantiating employmentself-employment or planned employmentself-employment within the required timeframe are not. Under the PUA program self-employed workers u sually excluded from unemployment benefits are entitled to unemployment if they meet certain criteria.

Self-Employment During the Base Year Services performed in self-employment do not qualify as base year employment and will not be used to establish financial eligibility for benefits.

Can i collect unemployment if i am self employed in pa. Self-employed Pennsylvanians who receive compensation through the PUA program are also eligible for the. Federal CARES Act Update. After you file you will receive a notice of financial determination indicating whether you are financially eligible.

But coronavirus legislation has changed that at least temporarily. Self-employed workers independent contractors gig economy workers and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed partially unemployed or unable or. These people will be able to completely recover their lost income and business expenses via unemployment benefits with no limitations on how they spend the received funds Barnes says.

With the recent introduction of new unemployment and relief benefits for self-employed professionals though your eligibility may change. Traditionally self-employed professionals are ineligible for unemployment benefits because they generally do not make contributions to the unemployment taxes that these benefits come from. Section 241 of the Continued Assistance Act creates a new requirement for individuals to submit documentation substantiating employment or self-employment or planned employmentself-employment.

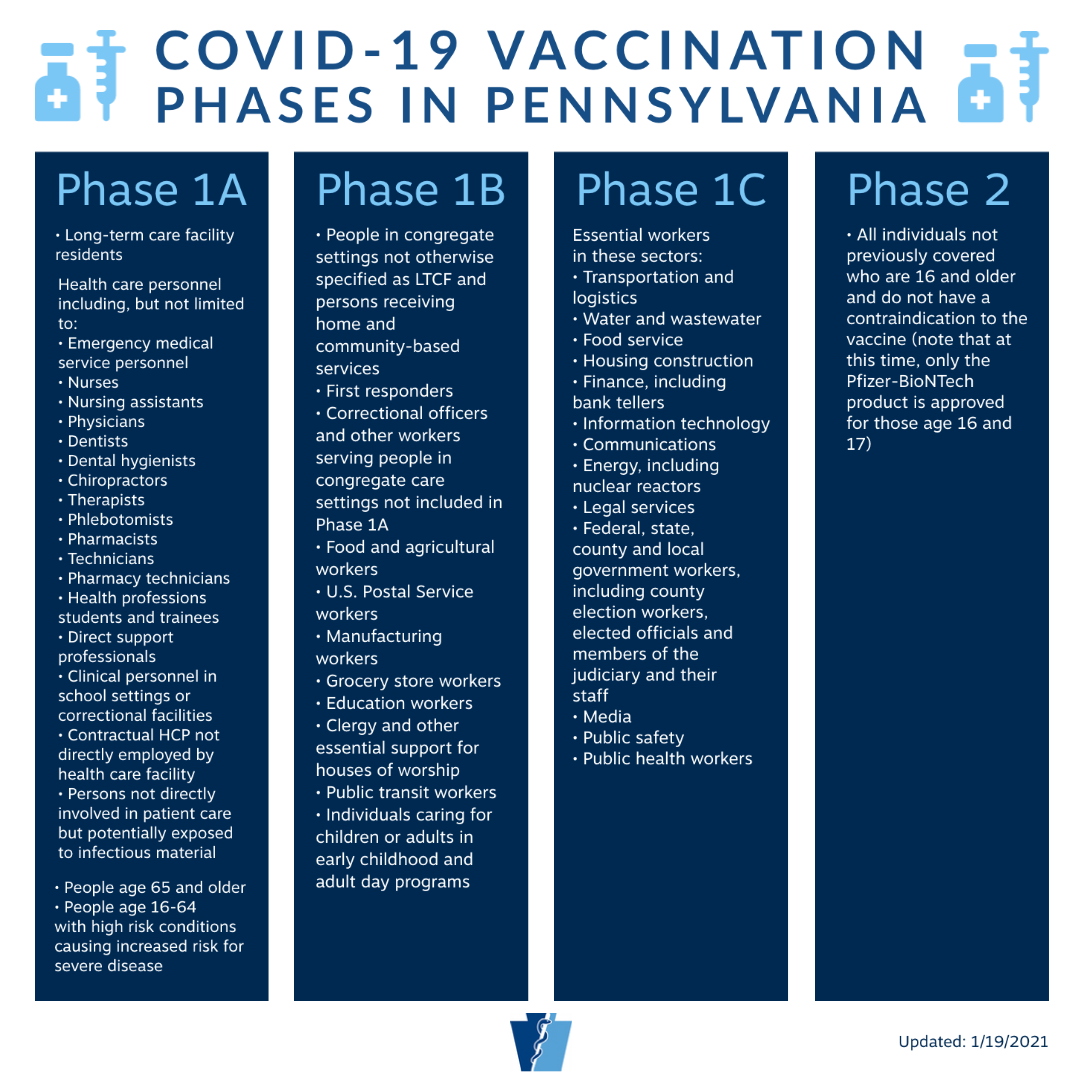

You may be ineligible for benefits if you are self-employed setting up a business or have ownership interest in a business. How COVID-19 is affecting the self-employed. Under new coronavirus laws self-employed workers are now eligible for unemployment benefits.

ARP makes PUA benefits available through Labor Day 2021 and increases the maximum duration of these benefits from 50 to 79 weeks. In addition to employees who have traditionally been eligible to collect unemployment insurance compensation the CARES Act extends benefits to workers who have not qualified for unemployment benefits in the past including independent contractors self-employed and gig workers and the long-term unemployed who have exhausted their benefits. You can now apply for Pandemic Unemployment Assistance PUA expanded eligibility for individuals who have traditionally been ineligible for unemployment benefits eg.

Self-employed workers independent contractors gig workers. Eligible claimants may now receive benefits for the first week that they are unemployed. The federal government has made it possible for states to pay unemployment benefits to self-employed people whove seen their business suffer because of the COVID-19 pandemic.

If youre an independent contractor and wondering if you are eligible to receive unemployment benefits check out our guide below. Under most regular unemployment insurance regulations independent contractors and self-employed workers cant collect unemployment benefits. Previously eligible claimants would not receive compensation for the first week of unemployment.

Visit our federal CARES Act page and frequently asked questions for PUA Federal Pandemic Unemployment Compensation FPUC and. Being self-employed usually means you cant get unemployment benefits when your business income dips or dries up. However for self-employed individuals without employees whose typical profit and business expenses combined are less than 950 per week the simplest option is to seek unemployment benefits.

People who are self-employed including independent contractors and gig workers and dont qualify for regular unemployment insurance can receive benefits if they are unable to. To be eligible for unemployment compensation you cant be fired for cause and you cant voluntarily quit your job unless there were specific reasons such as sexual harassment for instance. Services performed in self-employment are likewise not covered because they do not constitute employment under the PA UC Law.

Online applications are available through the Office of Unemployment Compensation. The Work Search and Waiting Week will continue to be suspended for the remainder of the COVID-19 Emergency Declaration.

Pennsylvania Pa Department Of Labor And Industry Enhanced Unemployment Benefits Pua Peuc And Extra 300 Fpuc September 2021 Extensions And Payment Updates Aving To Invest

Pennsylvania Pa Department Of Labor And Industry Enhanced Unemployment Benefits Pua Peuc And Extra 300 Fpuc September 2021 Extensions And Payment Updates Aving To Invest

Pennsylvania Pa Department Of Labor And Industry Enhanced Unemployment Benefits Pua Peuc And Extra 300 Fpuc September 2021 Extensions And Payment Updates Aving To Invest

Pennsylvania Pa Department Of Labor And Industry Enhanced Unemployment Benefits Pua Peuc And Extra 300 Fpuc September 2021 Extensions And Payment Updates Aving To Invest

Coronavirus Bulletin Board Aids Law Project

Coronavirus Bulletin Board Aids Law Project

Http Www Uc Pa Gov Documents Ucp 20forms Ucp 1 Pdf

Services Tannersville Pa Pa Careerlink Monroe County

Services Tannersville Pa Pa Careerlink Monroe County

Return Of Unemployment Payments For 400 000 Pennsylvanians Marred By System Crashes And Error Messages Cbs Pittsburgh

Return Of Unemployment Payments For 400 000 Pennsylvanians Marred By System Crashes And Error Messages Cbs Pittsburgh

Unemployed Pennsylvanians Will Get An Extra 300 A Week

Unemployed Pennsylvanians Will Get An Extra 300 A Week

Covid 19 Updates National Association Of Social Workers Pennsylvania Chapter

Covid 19 Updates National Association Of Social Workers Pennsylvania Chapter

Pennsylvania Workers Can Apply For Additional 300 In Unemployment Benefits Next Week Pittsburgh Post Gazette

Pennsylvania Workers Can Apply For Additional 300 In Unemployment Benefits Next Week Pittsburgh Post Gazette

Pa Department Of Labor Industry On Twitter If Your Unemployment Compensation Uc Claim Reaches Its Benefit Year End Bye Date Today You May Need To Reapply To Continue Receiving Benefits We Will

Pa Department Of Labor Industry On Twitter If Your Unemployment Compensation Uc Claim Reaches Its Benefit Year End Bye Date Today You May Need To Reapply To Continue Receiving Benefits We Will

Applying For Unemployment Benefits During Covid 19 My Clean Slate Pa

Pa Now Accepting Applications For Pandemic Unemployment Assistance Pua Benefits Fox43 Com

Pa Now Accepting Applications For Pandemic Unemployment Assistance Pua Benefits Fox43 Com

Coronavirus Bulletin Board Aids Law Project

Coronavirus Bulletin Board Aids Law Project

Pennsylvania Opens Web Portal For Pandemic Unemployment Assistance Benefits Coronavirus Dailyitem Com

Pennsylvania Opens Web Portal For Pandemic Unemployment Assistance Benefits Coronavirus Dailyitem Com

Post a Comment for "Can I Collect Unemployment If I Am Self Employed In Pa"