What Is Federal Unemployment Tax Rate For 2019

You must pay federal unemployment tax based on employee wages or salaries. Iowa law requires Iowa Workforce Development establish the tax table to determine the unemployment tax rate for eligible employers each year.

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Marginal Income Tax Rates Work And What If We Increased Them

For a list of state unemployment tax agencies visit the US.

What is federal unemployment tax rate for 2019. This means the effective federal tax rate is 06 percent. 259 on up to 54544 of taxable. Only the employer pays FUTA tax.

The FUTA rate is 60 and employers can take a credit of up to 54 of taxable income if. 52 rows Generally unemployment taxes are employer-only taxes meaning you do. The FUTA tax rate is 6 of the first 7000 of wages though many businesses qualify for a tax credit that lowers it to 06.

The 7000 is often referred to as the federal or FUTA wage base. FUTA tax rate. Tax rates will be the second lowest allowed by law.

Your 2021 assigned rate in the range of 22 to 135 depends on your experience over fiscal years 2017 - 2019. The tax applies to the first 7000 you paid to each employee as wages during the year. State Income Tax Range.

It is not deducted from the employees wages. What Is the Federal Unemployment Tax Act. State Taxes on Unemployment Benefits.

All chargeable benefits paid to former employees from July 1 2019 to June 30 2020 will not impact your tax rate for 2021. DES MOINES IOWA Iowa Workforce Development officials announced today that the unemployment tax rate table will remain unchanged for 2019. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office.

Payroll greater than 500000. Payroll less than 500000. Employer identification number EIN Name not your trade name Trade name if any Address.

The FUTA tax rate is 60. Only employers pay FUTA tax. The FUTA tax is 6 0060 on the first 7000 of income for each employee.

Do not collect or deduct FUTA tax. For more information refer to the Instructions for Form 940. When the United States Department of Labor certifies that the states unemployment compensation program meets federal requirements employers that pay their state unemployment tax on time and in full receive a 54 percent credit to be applied against their their FUTA tax rate.

Use Form 940 to report your annual Federal Unemployment Tax Act FUTA tax. You owe federal unemployment taxes if you paid at least 1500 in wages during any calendar quarter in the current or previous year. Employers Annual Federal Unemployment FUTA Tax Return Department of the Treasury Internal Revenue Service.

For the 2019 tax year all 50 states are eligible for the full 54 tax credit. An employers tax rate determines how much the employer pays in state Unemployment Insurance. Today employers must pay federal unemployment tax on 6 of each employees eligible wages up to 7000 per employee.

Most employers pay both a federal and a state unemployment tax. The Office of UC Tax Services plans to issue the Contribution Rate Notice for calendar year 2021 Form UC-657 no later than December 31 2020. Department of Labors Contacts for State UI Tax Information and Assistance.

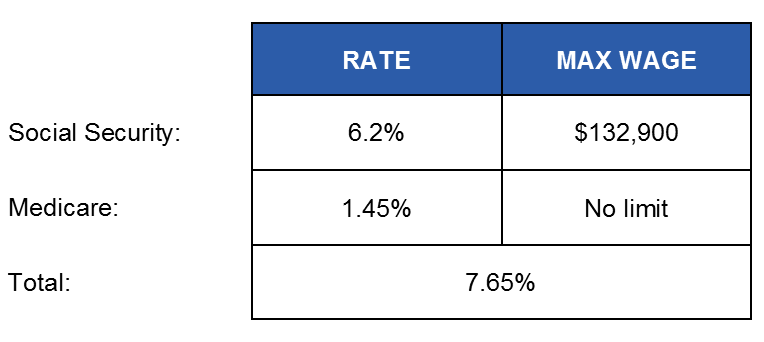

5 rows Additional Medicare Tax. Consequently the effective rate works out to 06 0006. Taxable wage base.

Employees do not pay FUTA taxes. Usually your business receives a tax. The revenue from this tax is used to.

NYS Unemployment Insurance Total UI Contribution Rates UI Rate RSF Total. The FUTA tax rate is 60 percent. The Department of Labor announces at the end of each year which states are eligible to receive the full 54 tax credit.

Most employers receive a maximum credit of up to 54 0054 against this FUTA tax for allowable state unemployment tax. The Federal Unemployment Tax Act FUTA is a federal law that requires businesses to pay annually or quarterly to fund unemployment benefits for employees who lose their jobs. Only the US Virgin Islands isnt because they failed to repay their outstanding federal unemployment insurance loans by November 10 2019.

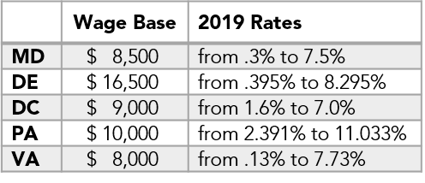

Your state wage base may be different based on the respective states rules. Most employers pay both a Federal and a state unemployment tax. Together with state unemployment tax systems the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs.

Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. A 09 additional Medicare tax must be withheld from an individuals.

Futa Tax Learn How To Calculate The Federal Futa Tax

Futa Tax Learn How To Calculate The Federal Futa Tax

What Is The Futa Tax 2021 Tax Rates And Info Onpay

What Is The Federal Unemployment Tax Rate In 2020

What Is The Federal Unemployment Tax Rate In 2020

.jpg?sfvrsn=b82e8f1f_2) Employer Tax Rates Employers Kdol

Employer Tax Rates Employers Kdol

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

What Is Futa Tax Rate Due Dates More

What Is Futa Tax Rate Due Dates More

What Are Fica And Futa Employers Resource

What Are Fica And Futa Employers Resource

Us Tax Burden On Labor Tax Burden On Labor In The United States

Us Tax Burden On Labor Tax Burden On Labor In The United States

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

Are Employers Responsible For Paying Unemployment Taxes

Are Employers Responsible For Paying Unemployment Taxes

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

Post a Comment for "What Is Federal Unemployment Tax Rate For 2019"