Unemployment Tax Rate Alabama

Your association knows how hard you work to avoid paying more unemployment taxes said Alabama Retail Association President Rick Brown. This an employer-only tax.

Alabama Tax Revenues Remarkably Resilient In 2020 Public Affairs Research Council Of Alabama

Employers with previous employees may be subject to a different rate.

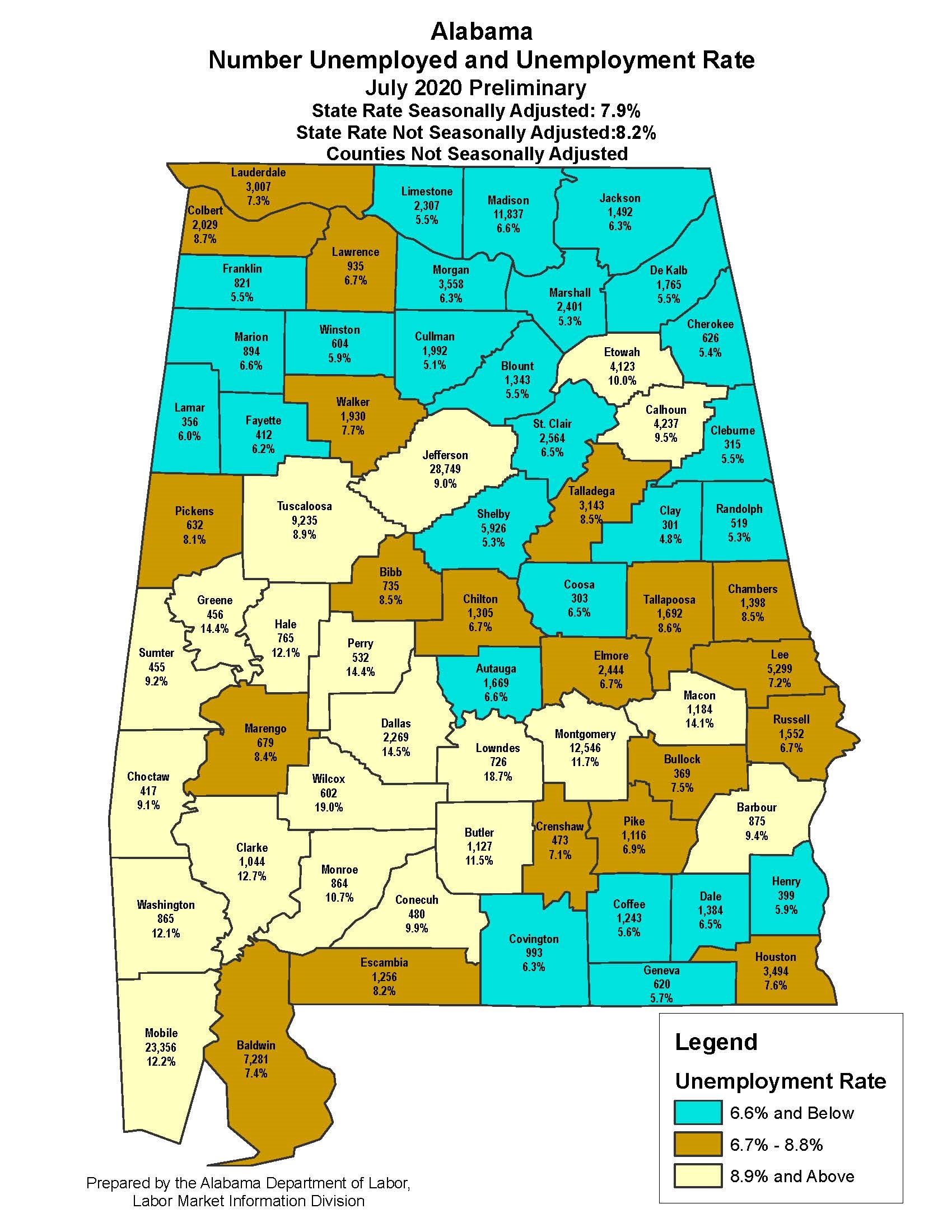

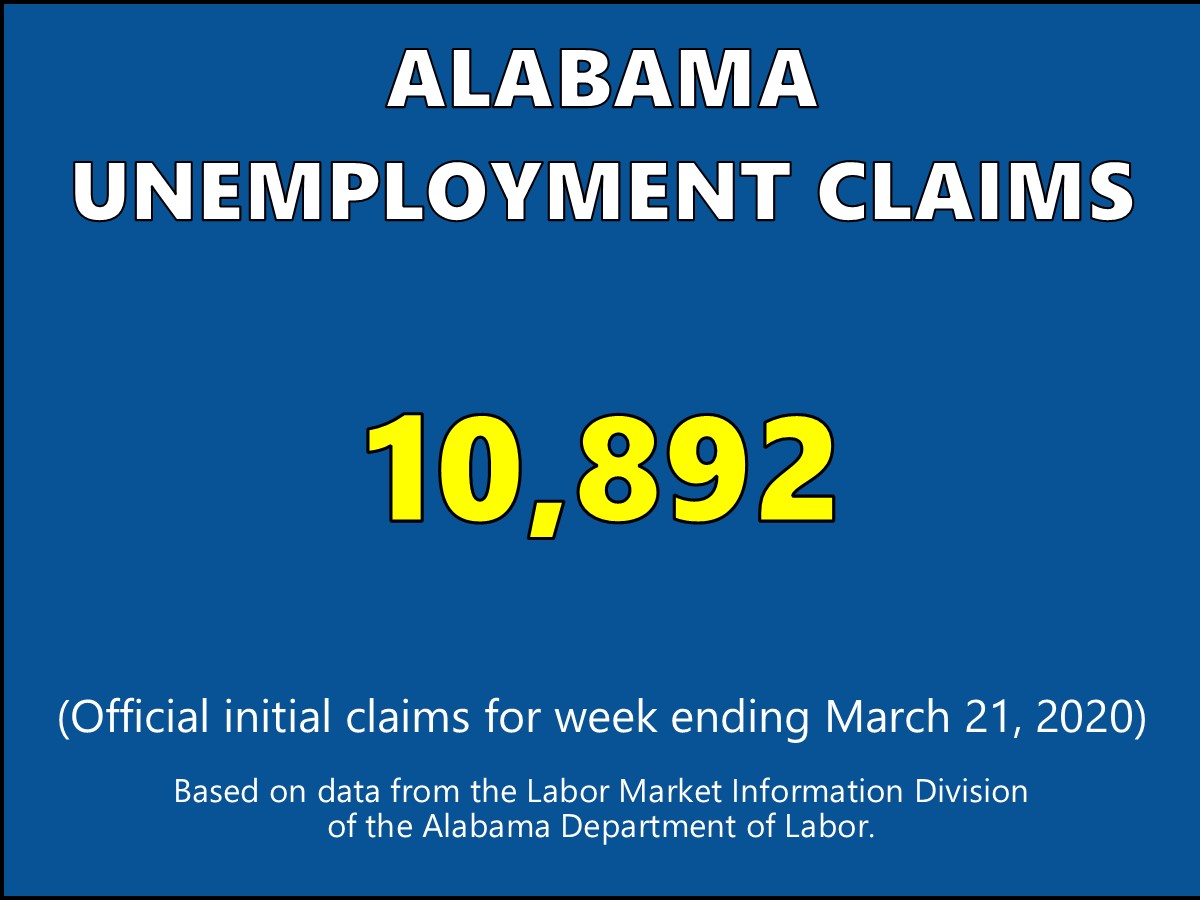

Unemployment tax rate alabama. Unemployment benefits taxed in Alabama explained By Kate Smith May 19 2020 at 408 PM CDT - Updated May 19 at 935 PM HUNTSVILLE Ala. Alabama Department of Labor secretary Fitzgerald Washington announced today that Alabamas preliminary seasonally adjusted January 2021 unemployment rate is 43 down from December 2020s revised rate of 47 and above January 2020s rate of 27. Alabama Department of Labor will collect basic employer information that will aid in accessing available applications.

Counties and Metropolitan Areas are comparable to the not seasonally adjusted labor force data. You will be taxed at the regular rate for any federal unemployment benefits above 10200. Unemployment taxes are paid 100 by the employer and are what make up the Alabama Unemployment Insurance Trust Fund.

If youre a new employer youll pay a flat rate of 27. It provided an additional 600 per week in unemployment compensation per recipient through July 2020. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10.

10 That extra 600 is also taxable after the first 10200. 2021 Tax Rate Notices. The unemployment tax paid by Alabama businesses is going to essentially double.

At the end of January the Alabama Department of Labor will send out its final tax rates for 2021. See SUI Taxable Wages. Tax rates range from 065 to 68 and include an employment security assessment of 006.

This is one you dont. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. State Unemployment Tax Rate In Alabama the new employer SUI state unemployment insurance rate is 270 percent on the first 8000 of wages for each employee.

In September 2020 the department had estimated the shared costs would be 13 with a 195 minimum rate. The 115 rate is the minimum rate under Schedule D. 52 rows SUI tax rate by state.

Your unemployment insurance tax bill is based on several factors. 1 2020 unemployment tax rates for experienced employers are to be determined with Schedule D and are to range from 065 to 68 the spokeswoman told Bloomberg Tax in an email. Alabama defines wages for state unemployment insurance SUI tax purposes as every form of compensation paid for personal services.

Alabama doesnt have state disability insurance but it does have unemployment insurance which covers those unemployed through no fault of their own. Alabamas unemployment-taxable wage base is 8000. Certain types of payments are specifically excluded.

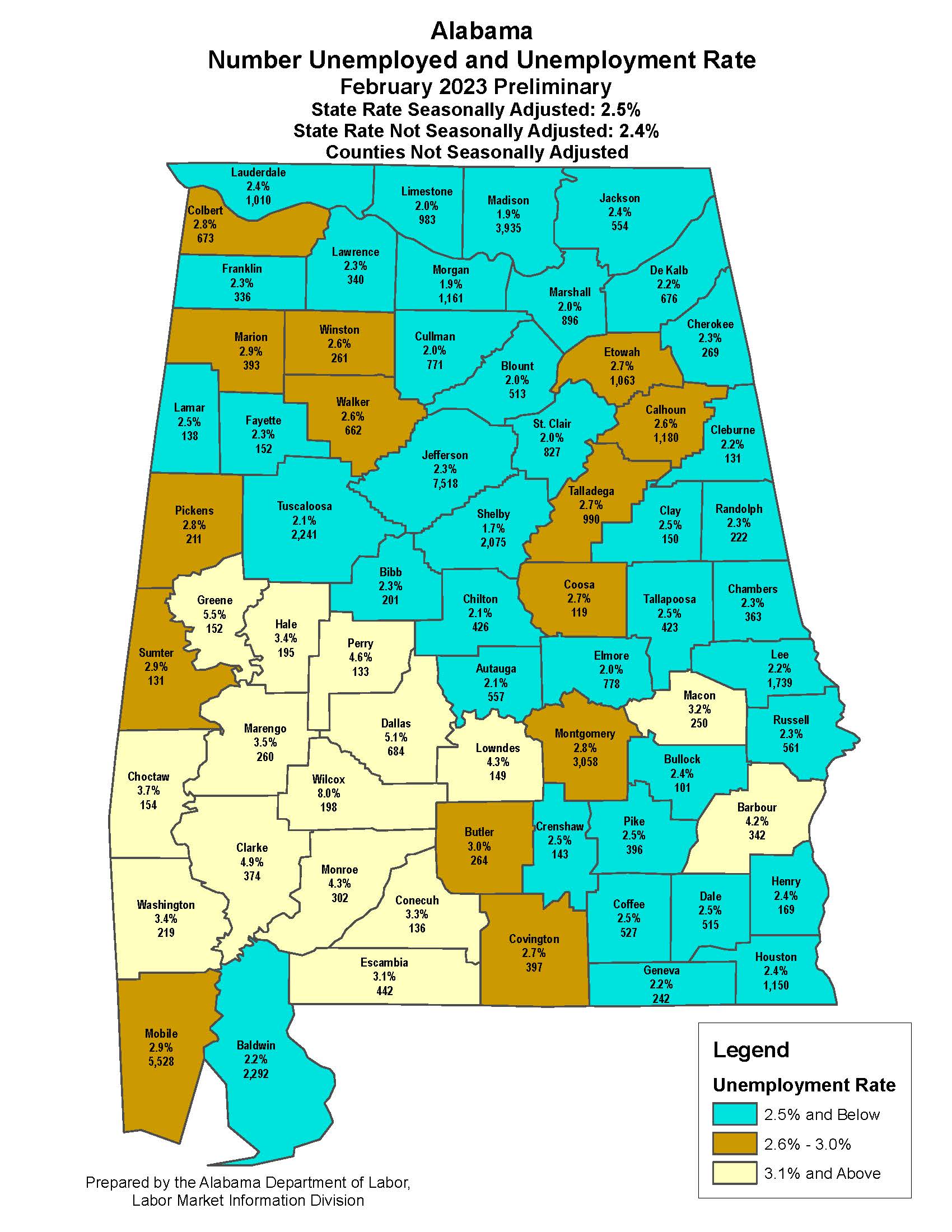

Estimates prepared by the Alabama Department of Labor in Cooperation with the Bureau of Labor Statistics based on 2020 benchmark. 28 rows An excerpt of the Tax Rate Table contained in Section 25-4-54f of the Alabama Unemployment. Some you control and some you dont.

Here is a list of the non-construction new employer tax. Alabamas unemployment tax rates are to be unchanged for 2020 a spokeswoman for the state Labor Department said Dec. The unemployment tax rate for new employers is 27 in 2021 unchanged from 2020.

Seventy percent of Alabama employers are at the lowest of the states 22 unemployment tax experience ratings. The average per-employee rate paid by employers will jump from an average of 52 to 100 or more. View ADOL Schedule D rate chart for 2021.

The wage base is 8000 for 2021 and rates range from 065 to 68. At the 195 rate they will pay 3120 the Alabama Labor Department says. P Preliminary r Revised.

Starting in 2021 Proposition 208 approved by. Its a 92 percent increase said Alabama Department of Labor spokeswoman Tara Hutchinson. WAFF - If youre one of the millions of Americans suddenly out of work and relying on unemployment benefits because of the pandemic youre probably saving every penny you can.

You can take the tax break if you have an adjusted gross income of less than 150000. The SUI tax rates are based on one of four tax rate schedules established by law. Wage and Tax Reporting File a quarterly unemployment compensation report Forms UC-CR-4 and UC-10-R both as an individual or as a third party filer with Power of Attorney POA on file with.

Alabama Department Of Labor News

Alabama Department Of Labor News

Alabama Department Of Labor News

Alabama Department Of Labor News

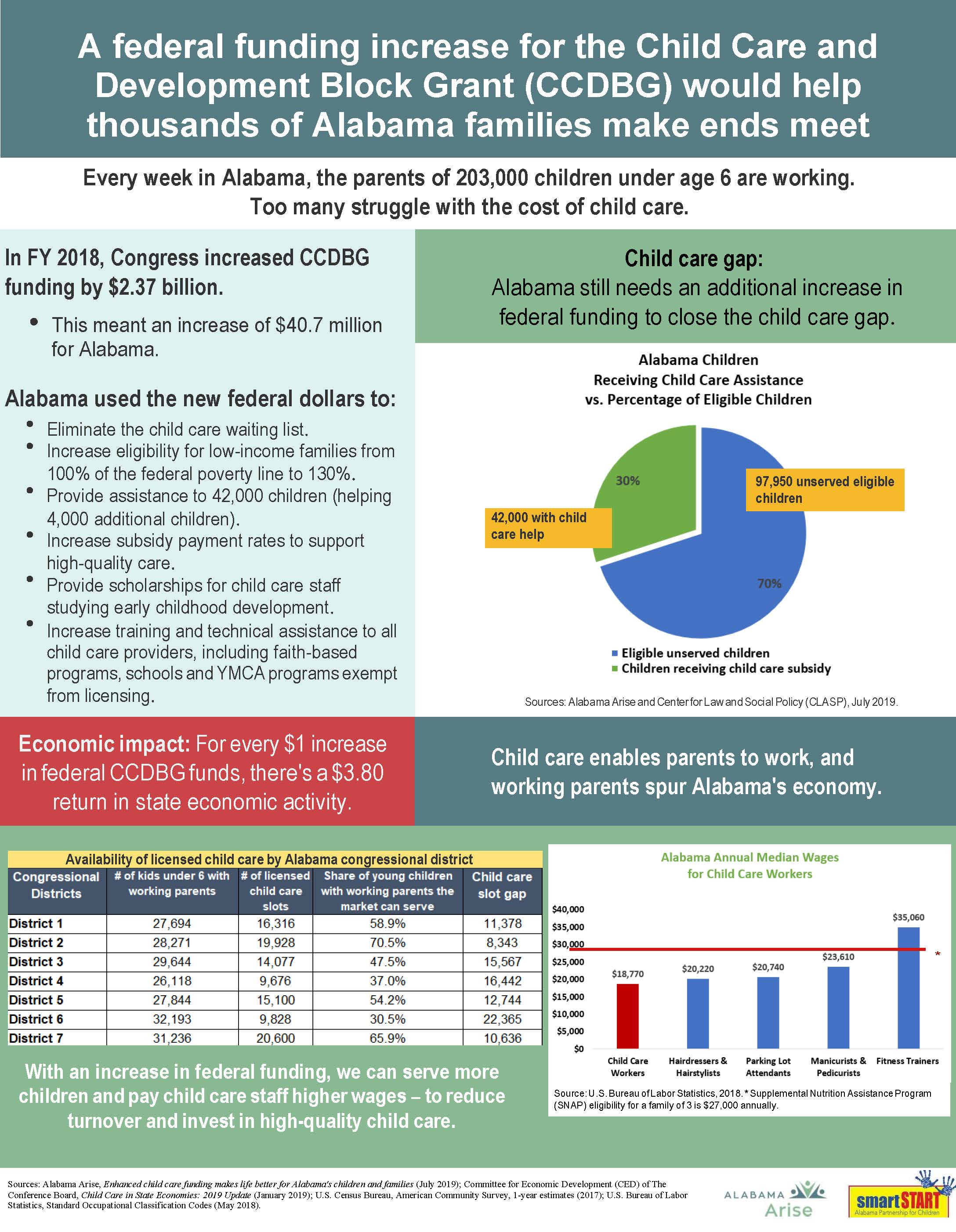

Enhanced Child Care Funding Makes Life Better For Alabama S Children And Families Alabama Arise

Enhanced Child Care Funding Makes Life Better For Alabama S Children And Families Alabama Arise

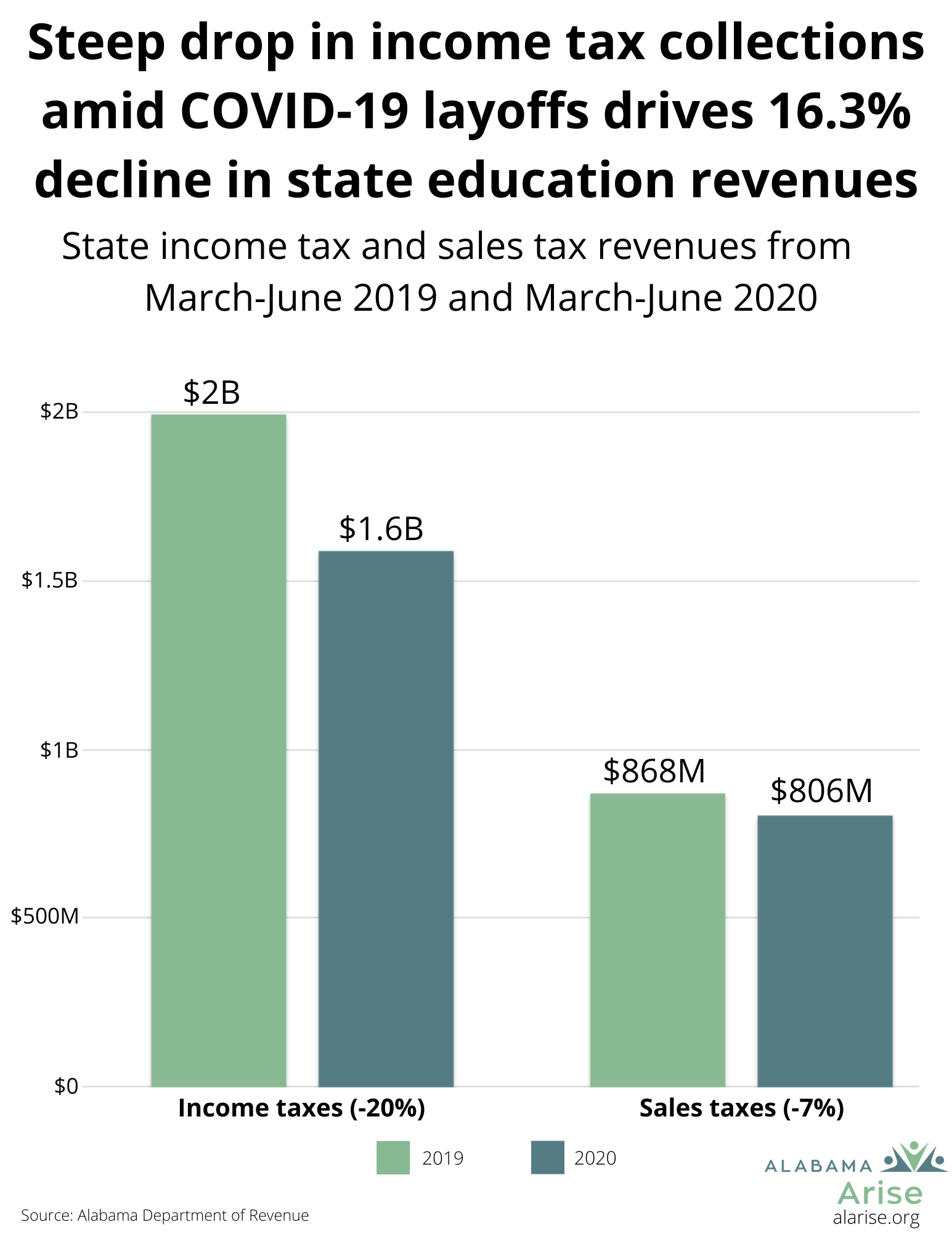

As Education Revenues Fall It S Time To Strengthen Alabama S Tax System Alabama Arise

As Education Revenues Fall It S Time To Strengthen Alabama S Tax System Alabama Arise

Historical Alabama Tax Policy Information Ballotpedia

Historical Alabama Tax Policy Information Ballotpedia

Alabama Department Of Labor News

Alabama Department Of Labor News

Alabama Department Of Labor Taking Away Unemployment Benefits For Those Refusing To Go Back To Work

Alabama Department Of Labor Taking Away Unemployment Benefits For Those Refusing To Go Back To Work

Alabama Department Of Labor News

Alabama Department Of Labor News

Alabama S Unemployment Tax Increasing Nearly Double Cbs 42

Alabama S Unemployment Tax Increasing Nearly Double Cbs 42

Alabama Tax Forms And Instructions For 2020 Form 40

Alabama Tax Forms And Instructions For 2020 Form 40

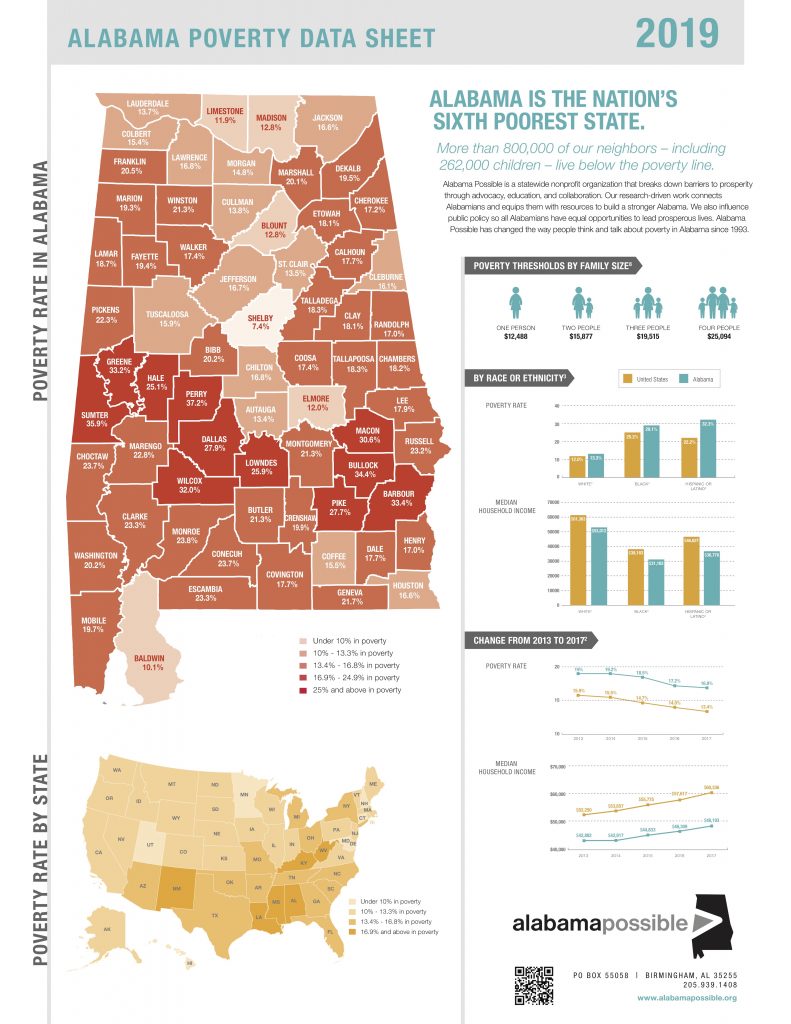

2019 Poverty Data Sheet 800 000 Alabamians Live Below Poverty Threshold Alabama Possible

2019 Poverty Data Sheet 800 000 Alabamians Live Below Poverty Threshold Alabama Possible

Governor Ivey Announces 300 Million In Cares Act Funds To Be Allocated To The Unemployment Insurance Trust Fund To Prevent Business Closures And Layoffs Office Of The Governor Of Alabama

Governor Ivey Announces 300 Million In Cares Act Funds To Be Allocated To The Unemployment Insurance Trust Fund To Prevent Business Closures And Layoffs Office Of The Governor Of Alabama

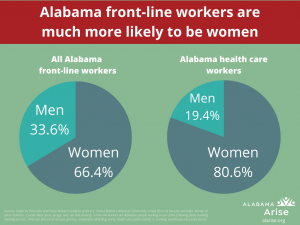

Working In Alabama During The Covid 19 Pandemic Who Faces The Danger Alabama Arise

Working In Alabama During The Covid 19 Pandemic Who Faces The Danger Alabama Arise

Marriage License Costs Increase 73 Percent Cullman Today Marriage License Cullman Marriage

Marriage License Costs Increase 73 Percent Cullman Today Marriage License Cullman Marriage

Alabama Department Of Labor News

Alabama Department Of Labor News

Alabama Jobless Rate At 4 3 Lowest Of Pandemic

Post a Comment for "Unemployment Tax Rate Alabama"