Unemployment Not Taxable For 2020

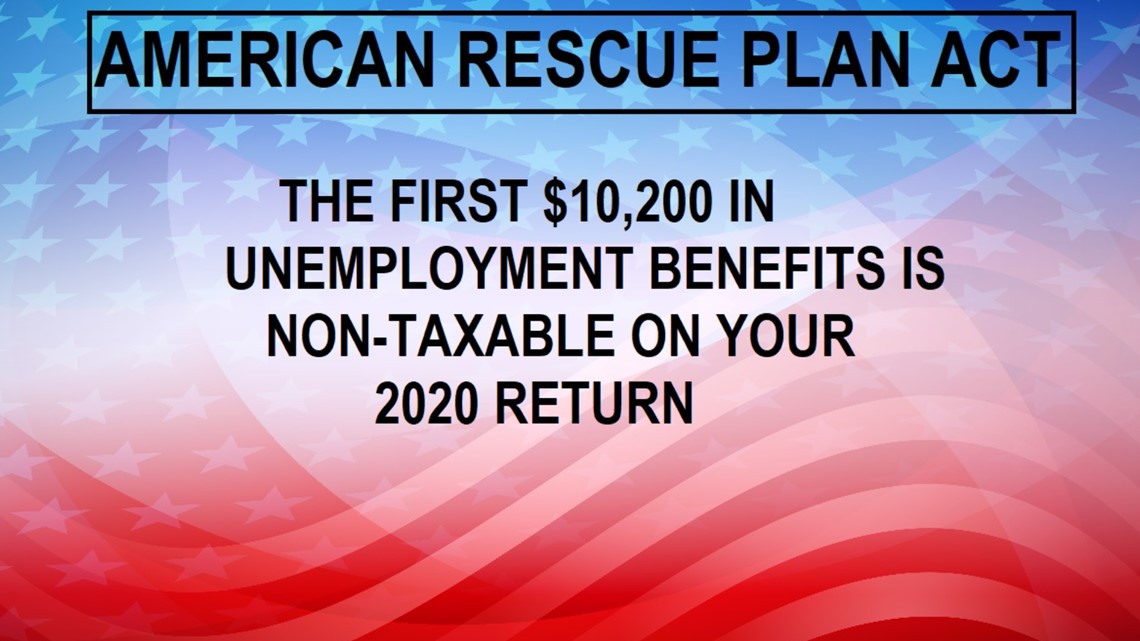

The good news is that up to 10200 of those benefits received in 2020 are tax-free thanks to the American Rescue Plan Act of 2021. The tax forgiveness on up to 10200 in unemployment benefits was a key part of the economic stimulus package passed earlier this month.

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Unemployment not taxable for 2020. Many of these may have been first-time filers and unaware that unemployment benefits are taxable income. If youve already filed your. The American Rescue Plan Act of 2021 has saved the tax season for millions of Americans who received unemployment benefits in 2020.

In fact a number of states wont let tax-filers exclude that 10200 from their 2020 income. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from federal tax for people with an adjusted gross income. Unemployed workers can waive up to 10200 in unemployment benefits received in 2020 from their taxable income.

Under the changes in the new tax law a person who was unemployed for some or all of 2020 could potentially save thousands in taxes. The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax.

Unemployment tax credit. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns. New York will continue to apply state income tax to 2020 unemployment benefits in full despite the federal government exempting the first 10200.

Between mid-March and late August 2020 574 million Americans had filed for unemployment. The American Rescue Plan signed into law on March 11 2021 includes a provision that makes the first 10200 of unemployment nontaxable for each taxpayer who made less than 150000 in 2020. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400.

COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable. That led to tax bills for millions of Americans as well as calls for the taxes. Tax impact of benefits Unemployment benefits are included along with your other income such as wages salaries and bank interest For tax year 2020 the first 10200 of unemployment income are tax free for taxpayers with an AGI of less than 150000.

As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the pandemic will find that up to 10200 of those benefits will be exempt from taxes. Many jobless Americans didnt have federal. 9 hours agoThe researchers estimate that taxes were withheld on just 40 of unemployment payments throughout 2020.

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on. The list of states not giving a tax break. Instead of paying taxes on the full amount of unemployment.

Someone who received 10200 or more in unemployment benefits. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Prachi Ca I Will File Indian And Candian Corporate And Personal Tax Returns For 20 On Fiverr Com Tax Tax Return Tax Refund

Prachi Ca I Will File Indian And Candian Corporate And Personal Tax Returns For 20 On Fiverr Com Tax Tax Return Tax Refund

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Taxable Or Not Taxable Video Logos Recipes Gaming Logos

Taxable Or Not Taxable Video Logos Recipes Gaming Logos

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Post a Comment for "Unemployment Not Taxable For 2020"