Unemployment Not Taxable Agi

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person collected in 2020.

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

President Biden signed the American Rescue Plan into law on March 11.

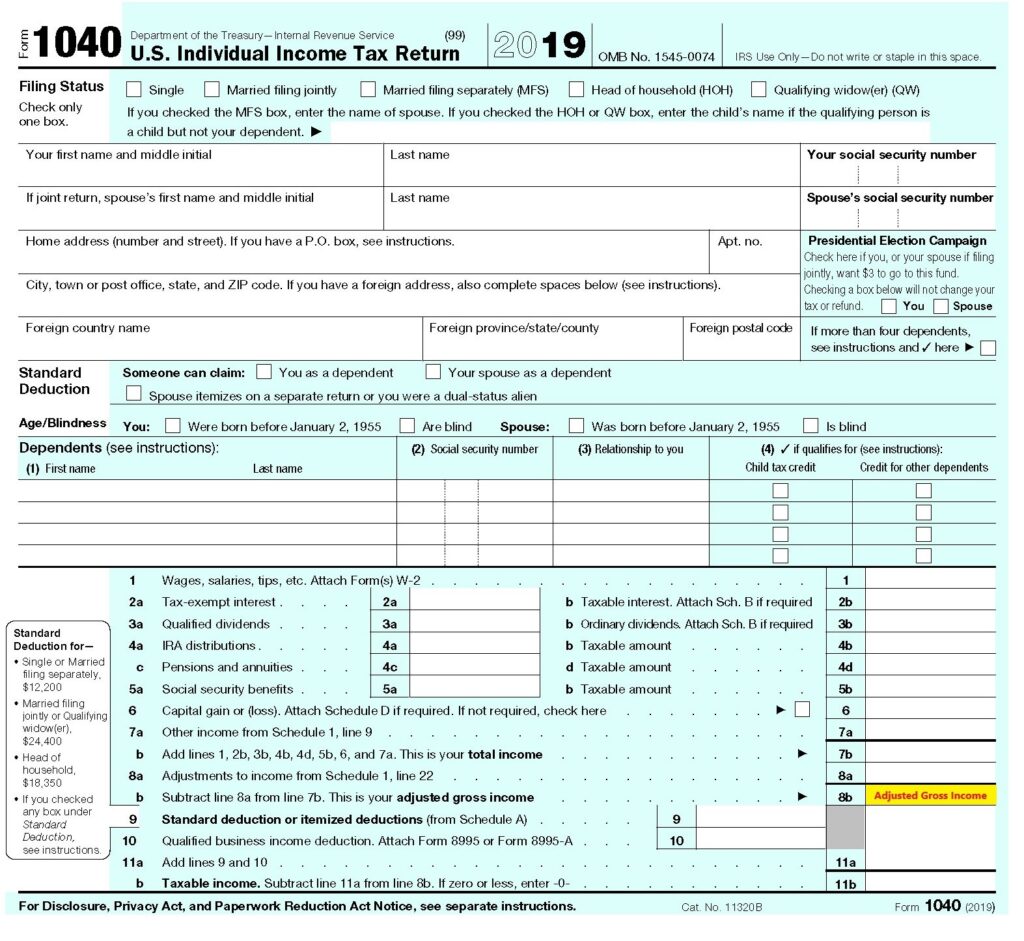

Unemployment not taxable agi. The Illinois Department of Revenue IDOR is currently reviewing the federally enacted American Rescue Plan Act of 2021 that includes a retroactive provision making the first 10200 per taxpayer of 2020 unemployment benefits nontaxable for individuals with an Adjusted Gross Income of less than 150000. 10200 unemployment tax break The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits collected last year. If you already filed with unemployment included on return.

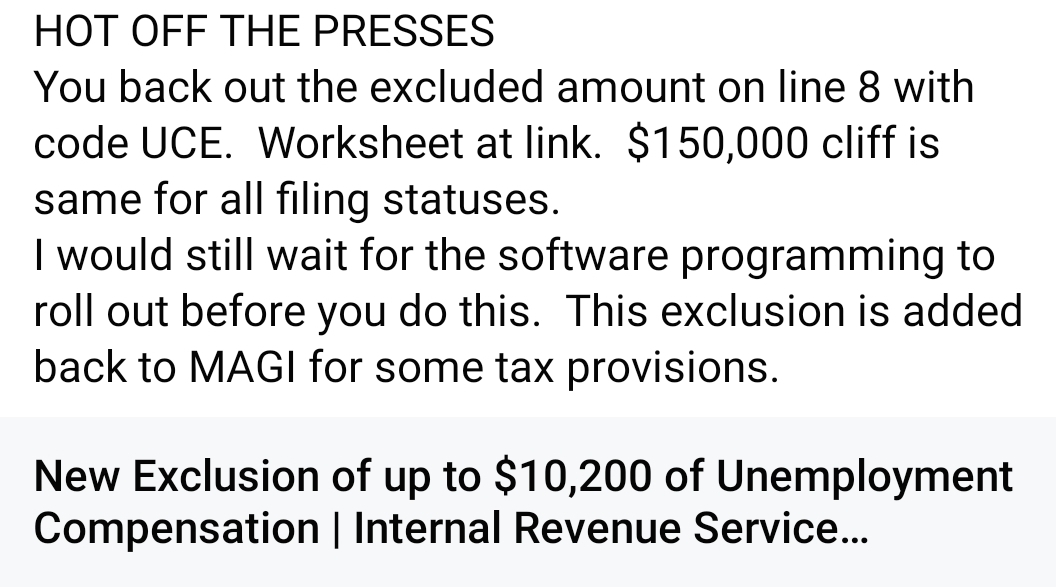

If your modified AGI is 150000 or more you cant exclude any unemployment compensation. 3 If you filed your taxes before the American Rescue Plan was passed you had to pay taxes on the full amount of your unemployment benefits. The law includes a provision that makes a taxpayers first 10200 of unemployment benefits non-taxable at.

Up to 10200 in unemployment payments is tax-free. 2 days agoJobless benefits are taxable income but the 19 trillion American Rescue Plan contained a provision saying the feds would not assess income tax on. This is to not allow a double deduction on the CA return given the beginning point of the CA return is the Federal AGI.

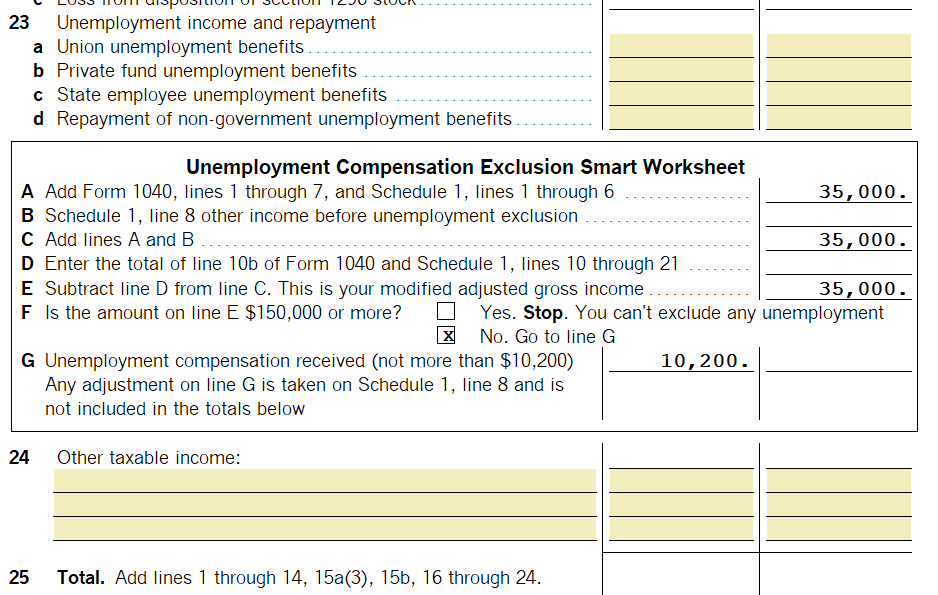

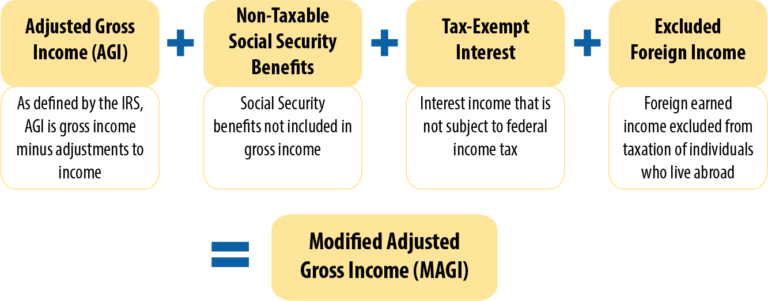

Although the excluded unemployment income is not included in your AGI the law specifies that the excluded unemployment income must be added back when calculating modified AGI for a number of specific tax benefits other than EITC. The 19 trillion Covid. Unemployed workers can waive up to 10200 in unemployment benefits received in 2020 from their taxable income.

For people who collected unemployment last year and have already filed their taxes theres nothing to do but wait until the IRS creates a form to amend their returns so they can take advantage of the new unemployment exemption. This tax break will be welcome news for. Your AGI will be reduced by the amount of unemployment income that is excluded.

The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take taxes out of your. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. You do not need to take any additional action with respect to their Colorado return.

Normally unemployment benefits are fully taxable by the IRS and must be reported on your federal tax return. All unemployment is taxable on state return not conforming. The tax benefit applies per person.

The American Rescue Plan Act which President Biden signed into law this month allows taxpayers who earned under 150000 in 2020 to qualify for the 10200 exclusion. The change will allow more taxpayers to qualify. One thing is certain.

For filing state taxes some states do not recognize the 10200 federal tax break. This tax break applies only to the 2020 federal income tax. If youve already filed your 2020 tax.

You can take the tax break if you have an adjusted gross income of less than 150000. Prior to Tuesday the IRS instructed taxpayers to include the unemployment income in modified AGI but now they can exclude unemployment benefits from modified AGI. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on.

This could possibly make you eligible for the EITC. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. Thanks to the American Rescue Plan which was passed and signed into law in March 2021 the full amount of unemployment benefits are not taxable.

The American Rescue Plan exempts the first 10200 of unemployment insurance benefits from federal income taxes as long as those benefits were received in 2020 and as long as your household adjusted gross income is less than 150000 adjusted gross income is generally your income before most deductions.

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Are Unemployment Benefits Taxable American Rescue Plan Act Arpa

Are Unemployment Benefits Taxable American Rescue Plan Act Arpa

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Stimulus Round 3 All You Need To Know Anash Org

Stimulus Round 3 All You Need To Know Anash Org

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Generating The Unemployment Compensation Exclusion Intuit Accountants Community

Generating The Unemployment Compensation Exclusion Intuit Accountants Community

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Solved Re Does Unemployment Count Towards Your Agi

Solved Re Does Unemployment Count Towards Your Agi

Minnesota Health Network Health Magi Subsidy And Income Information

Minnesota Health Network Health Magi Subsidy And Income Information

Got Unemployment Compensation Don T Rush To File Or Amend Just Yet Wiss Company Llp

Got Unemployment Compensation Don T Rush To File Or Amend Just Yet Wiss Company Llp

Unemployment Compensation Exclusion General Chat Atx Community

Unemployment Compensation Exclusion General Chat Atx Community

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Solved Re Does Unemployment Count Towards Your Agi

Solved Re Does Unemployment Count Towards Your Agi

Post a Comment for "Unemployment Not Taxable Agi"