Unemployment Benefits Estimator Ohio

18 was signed into law. Apr 2020 Jun 2020.

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

This month Ohios tax revenues exceeded the monthly estimate by 41 million or 26 percent and remain 43 percent above the estimate for the fiscal year-to-date.

Unemployment benefits estimator ohio. Use the calculator to estimate your Ohio weekly benefit amount WBA for unemployment compensation. 3 for statistical purposes. New Mixed Earners Unemployment Compensation MEUC program New federal legislation created the Mixed Earner Unemployment Compensation MEUC program for individuals who are eligible for traditional unemployment benefits but who also have documentation of at least 5000 in self-employment earnings from the most recent taxable year prior to their unemployment benefit year.

If earnings are equal to or greater than your weekly benefit amount no benefits will be paid. This incorporates recent federal tax changes into Ohio law effective immediately. The federal Consolidated Appropriations Act of 2021 signed on December 27 2020 extends and amends the following pandemic unemployment programs and benefits through March 13 2021 Pandemic Unemployment Assistance PUA Once implemented will provide up to.

Employee Resource Hub If you are out of work as a result of COVID-19 please review our key resource links and frequently asked questions to find out more about applying for unemployment and what you can expect after submitting a claim. OHIO HAS ONLY TWO WAYS TO FILE FORUNEMPLOYMENT COMPENSATION BENEFITS. Coronavirus and Unemployment Insurance.

Check the website for available services. Specifically federal tax changes related to unemployment benefits in the federal American Rescue Plan Act ARPA of 2021 will impact some individuals who have already filed or will soon be filing their 2020 Ohio IT 1040 and SD 100 returns due by May 17 2021. Service may be limited during nightly system updating.

Report it by calling toll-free. Ohio Weekly Benefit Amount Calculator. Ohios unemployment rate in February 2021 was 5 percent and the national rate was 62 percent.

File online at httpunemploymentohiogov 24 hoursday 7 daysweek. This is a dramatic improvement from one year ago. Ohio Unemployment Calculator Calculate your projected benefit by filling quarterly wages earned below.

This month Ohios tax revenues exceeded the monthly estimate by 41 million or 26 percent and remain 43 percent above the estimate for the fiscal year-to-date. Ohios unemployment rate in February 2021 was 5 percent and the national rate was 62 percent. Jan 2020 Mar 2020.

The calculator was last updated in March 2020. 1 day agoThe number of Americans applying for unemployment benefits rose last week to 744000 signaling that many employers are still cutting jobs even as. Weekly benefit amount 40000 Minus earnings deducted -12000 Equals benefit amount paid 28000 Holiday pay is deducted using the 20 earnings exemption.

You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing. You can also learn more about what you will need to file for unemployment. This calculator uses the average weekly state benefit amount reported by the Department of Labor from January 2020 to November 2020 to calculate total unemployment compensation and.

Learn about Ohio unemployment benefits from the Ohio Department of Job and Family Services. 2 as a record index for processing your claim. 4 to verify your eligibility for unemployment compensation and other public assistance benefits.

You must report all earnings even if they would not affect your weekly benefit amount. Jul 2020 Sep 2020. We created this calculator to aid you evaluate what you might obtain if you are entitled.

Oct 2020 Dec 2020. Ohio Unemployment Insurance BENEFITS CHART - 2021 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application. And 5 as otherwise required or permitted under applicable federal or state law including Chapter 4141 of the Ohio.

ODJFS will use your social security number 1 to report your unemployment compensation to the Internal Revenue Service as potentially taxable income. Claims Benefits and Extension. Please enter quarterly wages earned in the base period.

How To Get Unemployment Benefits In Ohio Applications In United States Application Gov

How To Get Unemployment Benefits In Ohio Applications In United States Application Gov

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Base Period Calculator Determine Your Base Period For Ui Benefits

Base Period Calculator Determine Your Base Period For Ui Benefits

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

Ohio Weekly Benefit Amount Calculator Unemployment Real World Machine

Ohio Weekly Benefit Amount Calculator Unemployment Real World Machine

Ohio Unemployment Calculator Fileunemployment Org

Ohio Unemployment Calculator Fileunemployment Org

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

3 Ways To File An Ohio Unemployment Claim Wikihow

3 Ways To File An Ohio Unemployment Claim Wikihow

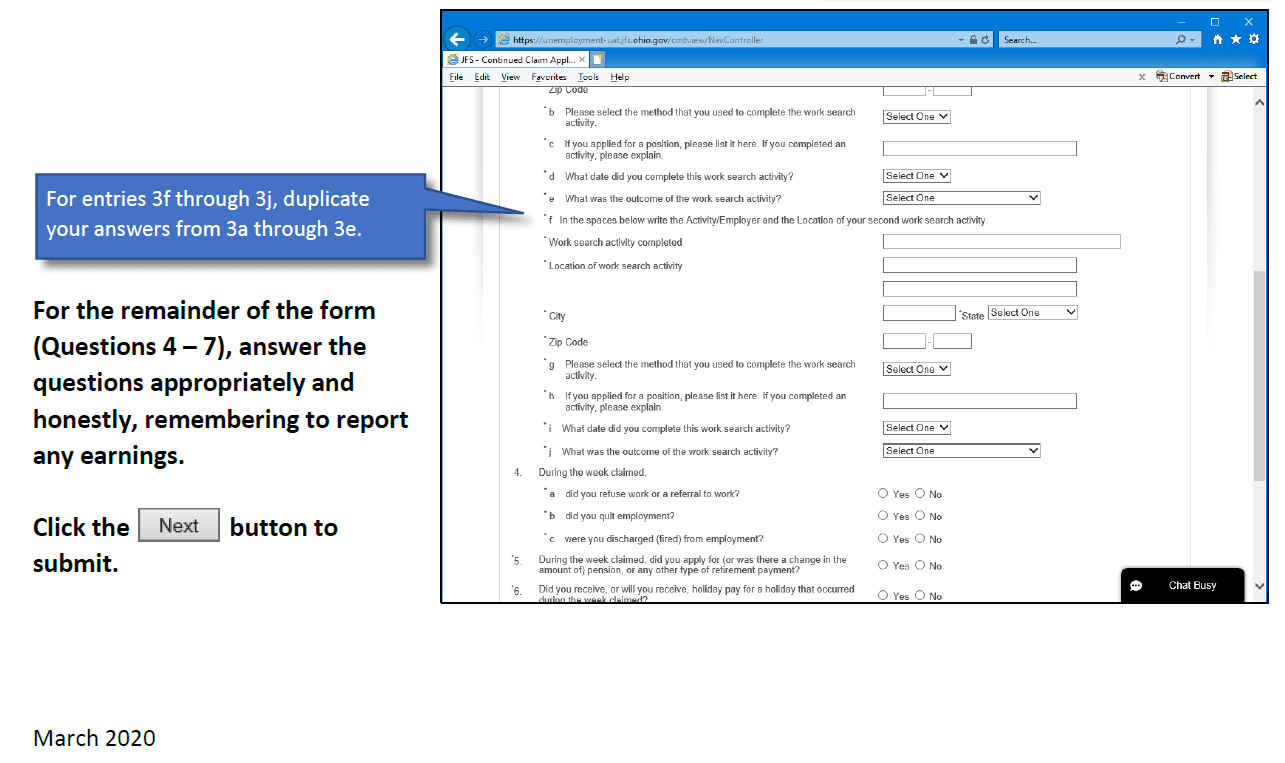

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio Department Of Job And Family Services Filing For Your Weekly Unemployment Benefits Youtube

Ohio Department Of Job And Family Services Filing For Your Weekly Unemployment Benefits Youtube

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Post a Comment for "Unemployment Benefits Estimator Ohio"