Ohio Unemployment Tax Reporting

To receive your Unemployment tax account number and contribution rate. The IRS considers unemployment compensation taxable income.

Questions regarding the W-21099 Upload Feature can be directed to the Employment Tax Division at.

Ohio unemployment tax reporting. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Also used by employers to authorize the Ohio Department of Job and Family Services to furnish information directly to a. The guidance provides several tax filing scenarios but many OSCPA members have asked about taxpayers who previously filed federal and Ohio tax returns and are waiting for IRS to issue a refund based on the unemployment benefits deduction.

Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. The Gateway populates previously reported employees and wage data. In Ohio employers are required to submit their Quarterly Tax Return electronically.

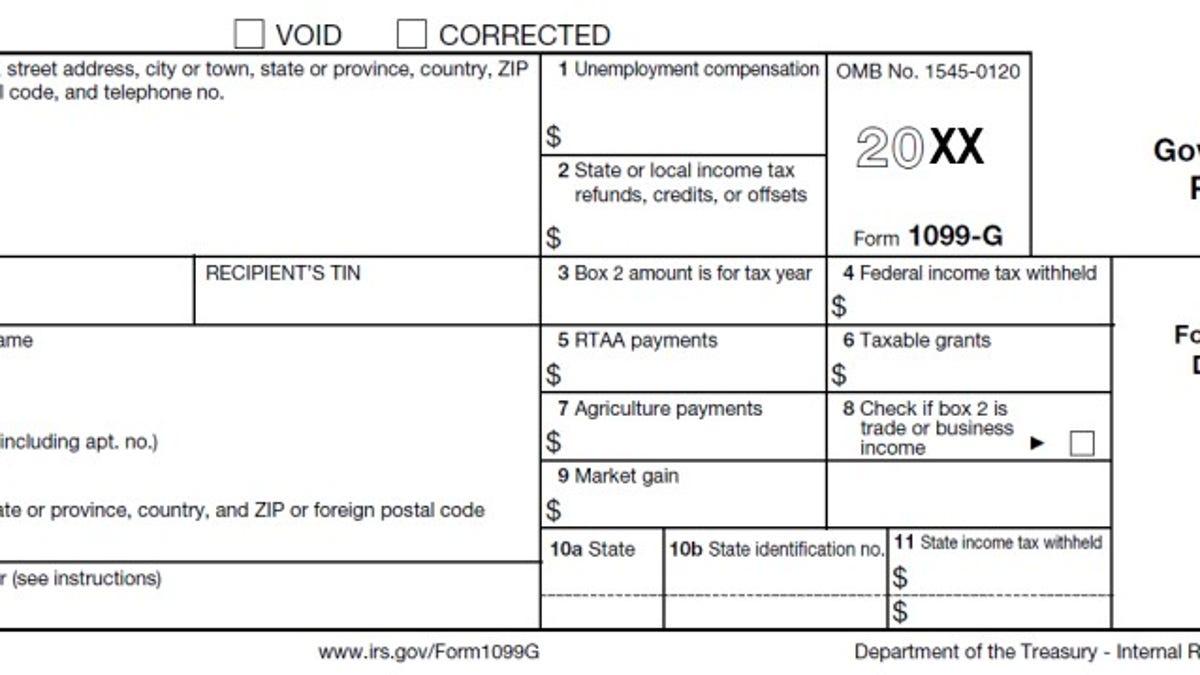

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. Payments for the first quarter of 2020 will be due April 30. Unemployment benefits are taxable pursuant to federal and Ohio law.

1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a. The change in a bill signed by Gov. Ask questions get answers and join our large community of tax.

That you have been using to certify for weekly benefits to get your 1099G from the states site. IncomeStatementsEWTtaxstateohus or by calling. The Quarterly Wage Reporting Tool QWRT is an offline tool designed to help employers and third-party administrators TPAs manage employee data and file quarterly unemployment tax reports.

Or you might need to go to your states unemployment website and use the password etc. Changes in how Unemployment Benefits are taxed for Tax Year 2020. The Ohio Business Gateway is another option available to submit current quarter unemployment reports and payments.

QWRT allows users to import data from other sources to generate quarterly unemployment compensation wage reporting files in a format that is accepted by ODJFS. On March 31 2021 Governor DeWine signed into law Sub. Additionally if you live in a traditional tax base school district your unemployment compensation is.

17 hours agoThe processing of your tax return should not be delayed while your report of unemployment identity theft is under investigation. Report it by calling toll-free. It is included in your federal adjusted gross income FAGI on your federal 1040.

COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received. When you enter wage information the Gateway automatically calculates the taxable wages and contributions taxes due for you and provides payment options. If you DID apply andor receive unemployment benefits from ODJFS.

ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns. For employers approved by the Office of Unemployment Insurance Operations to submit reports by paper please use the Ohio Unemployment Quarterly Tax Return JFS-20125. Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis.

Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes. Employers with questions can call 614 466-2319. W-2 Upload Frequently Asked Questions.

Updated W-21099 Upload Feature NOW LIVE on the Ohio Business Gateway. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. How to Obtain an Employer Account Number.

1099 Upload Frequently Asked Questions. Unemployment compensation is taxable on your federal return. As such ODT issued guidance on April 6 related to the unemployment benefits deduction for tax year 2020.

To submit your quarterly tax report online please visit httpsericohiogov. 18 which incorporates recent federal tax changes into Ohio law effective immediately. Mike DeWine Wednesday brought.

You will have to enter a 1099G that is issued by your state. JFS-20106 Employers Representative Authorization for Taxes. Some states will mail out the 1099G.

Ohio Income Tax Update. Specifically federal tax changes related. The American Rescue Plan of 2021 provides for a one-time exemption of 10200 per person in unemployment benefits to individuals and couples who earned 150000 or less last year.

I believe Ohio just announcedposted they are excluding the Unemployment tax on benefits received to conform with the IRC. Highlighted below are two important pieces of information to help you register your business and begin reporting.

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Roth Ira Contribution Cheat Sheet Infographic Inside Your Ira Roth Ira Contributions Roth Ira Roth Ira Investing

Roth Ira Contribution Cheat Sheet Infographic Inside Your Ira Roth Ira Contributions Roth Ira Roth Ira Investing

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Which Tax Form Should You Use For Your Federal Income Tax Returns Income Tax Return Tax Attorney Federal Income Tax

Which Tax Form Should You Use For Your Federal Income Tax Returns Income Tax Return Tax Attorney Federal Income Tax

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Unemployment Tax Troubles Wrong 1099 G Amounts Benefits Id Theft Don T Mess With Taxes

Post a Comment for "Ohio Unemployment Tax Reporting"