Does Ohio Have State Unemployment Tax

How to Obtain an Employer Account Number. The UI tax funds unemployment compensation programs for eligible employees.

Eighty years later the SUTA program is still in effect.

Does ohio have state unemployment tax. Alaska New Jersey and Pennsylvania collect. State and local taxes on unemployment Unemployment benefits are not subject to municipal income taxes in Ohio so nothing changes there the Regional Income Tax Agency confirmed. Additionally if you live in a traditional tax base school district your unemployment compensation is also subject to.

Ohio law is in conformity with federal law therefore the provisions applicable under federal law. Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. When you hear of someone collecting unemployment.

Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax. To receive your Unemployment tax account number and contribution rate immediately.

Visit the IRS website here for specific information about the IRS adjustment for tax year 2020. The amounts on this form are reported to the taxing agencies and matched with the amounts reported on your tax return. The money collected through SUTA tax continues to go into a state unemployment fund on behalf of that states employees.

In Ohio state UI tax is just one of several taxes that employers must pay. Highlighted below are two important pieces of information to help you register your business and begin reporting. The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019.

The IRS considers unemployment compensation taxable income. Taxation of unemployment benefits in Ohio I thought that unemployment benefits were not taxable by the state of Ohio. Ohio taxes unemployment compensation to the same extent it is taxed under federal law.

JFS-20106 Employers Representative Authorization for Taxes. The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. Unemployment benefits are taxable pursuant to federal and Ohio law.

New employers except for those in the construction industry will continue to pay at 27. Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes. However only 13 states are excluding 10200 of federal unemployment benefits from their residents tax liability for 2020.

To submit your quarterly tax report online please visit httpsericohiogov. Also used by employers to authorize the Ohio Department of Job and Family. As a result any unemployment compensation.

It is included in your federal adjusted gross income FAGI on your federal 1040. You will need to contact the agency that issued you the Form 1099-G to obtain the state ID number. The money you receive through state-sponsored unemployment insurance is considered taxable income and must be reported to the federal government.

Three others Arizona Ohio and Vermont didnt officially adopt the federal standard but their tax forms do allow eligible residents to claim the break essentially giving them the waiver. Through the State Unemployment Tax Act SUTA states levy a payroll tax on employers to fund the majority of their unemployment benefit programs. The fund is then used to pay state unemployment insurance to employees who have become unemployed through no fault of their own such as through company layoffs.

State Taxes on Unemployment Benefits. However the state does not tax unemployment benefits received as a result of work performed in any federally recognized Indian reservation in Oregon or other land in. 52 rows When you have employees you must pay federal and state unemployment.

Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. That would translate into incremental state taxes of 841 on 10200 in unemployment compensation. If my 1099G doesnt have the state ID number but I paid state taxes on my unemployment what should I do.

The Ohio Department of Taxation will help you find answers to questions about Ohio income taxes including who needs to file a return how and when to file finding the right tax forms and information about Ohios sales tax holiday. Depending on how much you earn during the year in. Residents with 150000 in taxable income pay a marginal state tax rate of 825 percent.

To check on your refund pay your taxes or file online visit TaxOhiogov. They are included in the gross income number taken from the federal filing to start the state tax form.

Website Available For Reporting Unemployment Fraud In Ohio Wkbn Com

Website Available For Reporting Unemployment Fraud In Ohio Wkbn Com

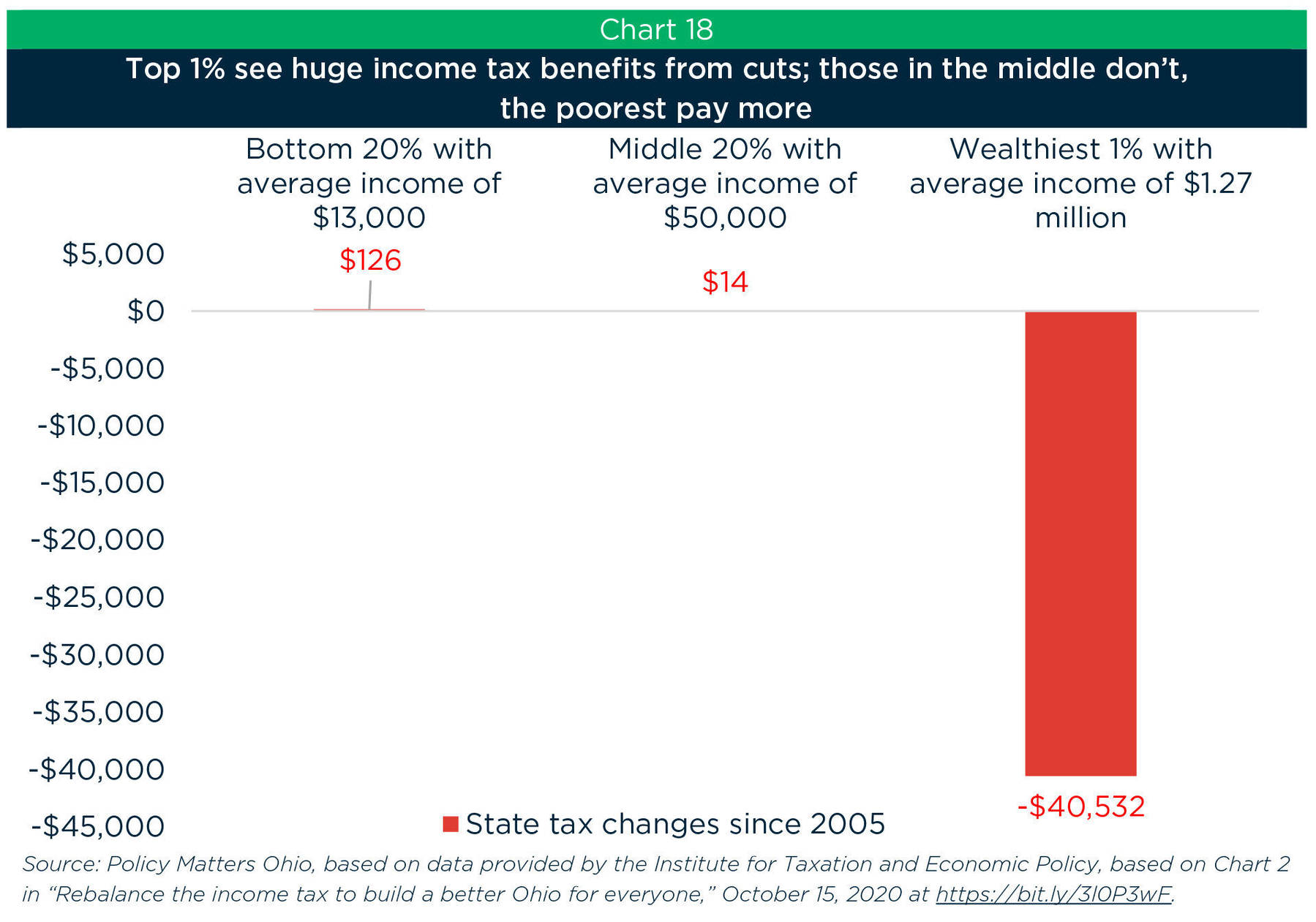

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

Ohiomeansjobs Centers Office Of Workforce Development Ohio Department Of Job And Family Services

Ohiomeansjobs Centers Office Of Workforce Development Ohio Department Of Job And Family Services

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Ohio Hospital Association Ohio Hospital Association

Ohio Hospital Association Ohio Hospital Association

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

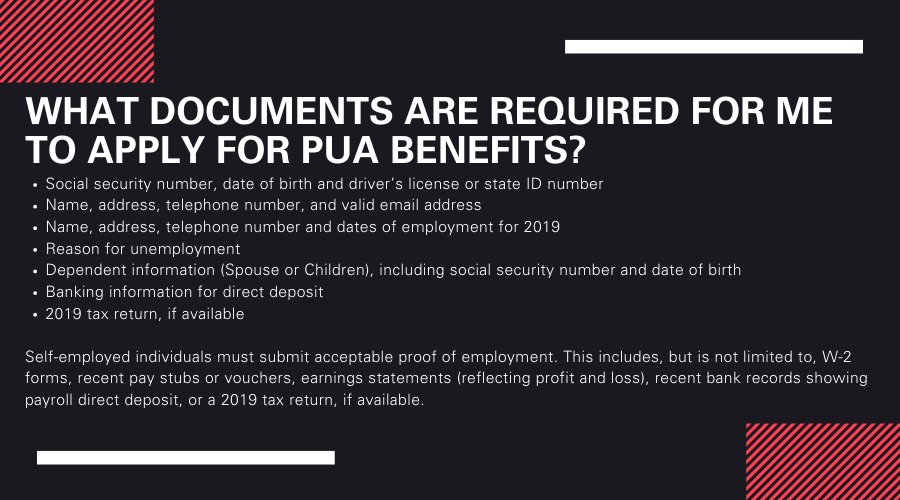

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Post a Comment for "Does Ohio Have State Unemployment Tax"