Can Independent Contractors File For Unemployment In Ohio

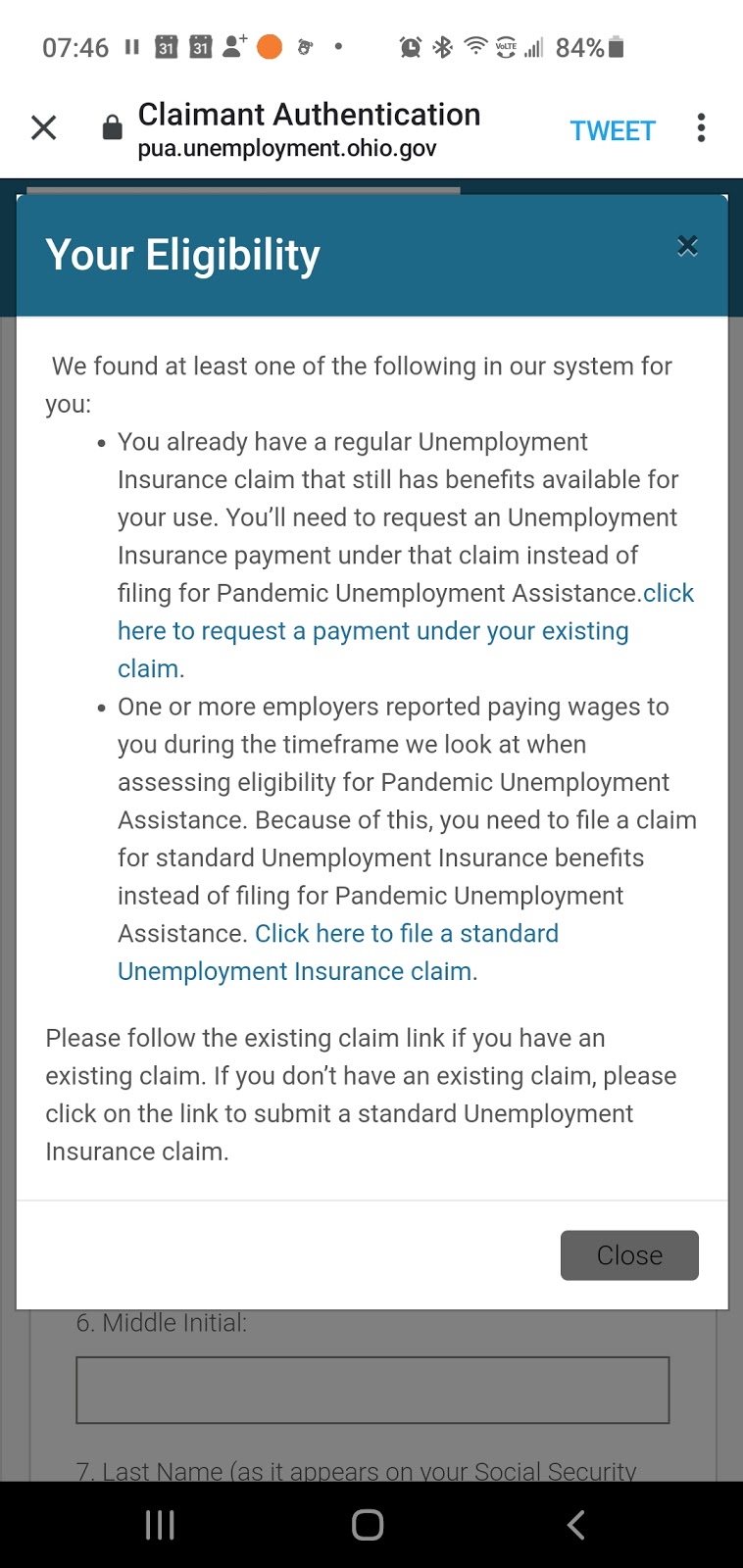

If you were self-employed a gig worker or an independent contractor or otherwise not eligible for regular unemployment no W-2 wages file a Pandemic Unemployment Assistance PUA claim. I was told I can file for unemployment.

Https Ohpsych Org Resource Resmgr Files Covid 19 Food Insecurities Questions And Answers Unempl Pdf

These benefits are being offered through the new federal Pandemic Unemployment Assistance PUA program.

Can independent contractors file for unemployment in ohio. The recently passed Coronavirus Aid Relief and Economic Security Act passed by Congress and signed by President Trump provides that real estate professionals will be eligible to apply for unemployment insurance benefits under the Pandemic Unemployment Assistance portion of the bill. In Ohio unemployment benefits are designed to provide workers with temporary income when a worker loses his job through no fault of his own. An employee under Ohio Workers Compensation law is a term of art and can include persons denominated by employers as independent contractors.

PUA Login false Coronavirus and Unemployment Insurance Benefits. The short answer - YesREALTORS are eligible for unemployment benefits. Neither independent contractors nor their clients or customers pay state or federal unemployment taxes.

The services of an individual that is determined to be an independent contractor under contract to perform a special service for an employer are excluded from covered employment. Expanded Eligibility Resource Hub The new federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filer. Normally self-employed and 1099 earners such as sole independent contractors freelancers gig workers and sole proprietors do not qualify for unemployment benefits.

I am a independent contractor in Ohio. The short answer is DEPENDSthe Ohio workers compensation system protects employees who are injured or contract illnesses on the job. Mar 30 2020.

Ordinarily when youre an independent contractor you cant collect unemployment if youre out of work. However the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic. One of these programs the Pandemic Unemployment Assistance PUA program is specifically for independent contractors and those.

We use cookies to give you the best possible experience on our website. The new program is one way Congress boosted unemployment insurance for 2020 to help ease the economic pain for a record number of out-of-work Americans. - Answered by a verified Lawyer.

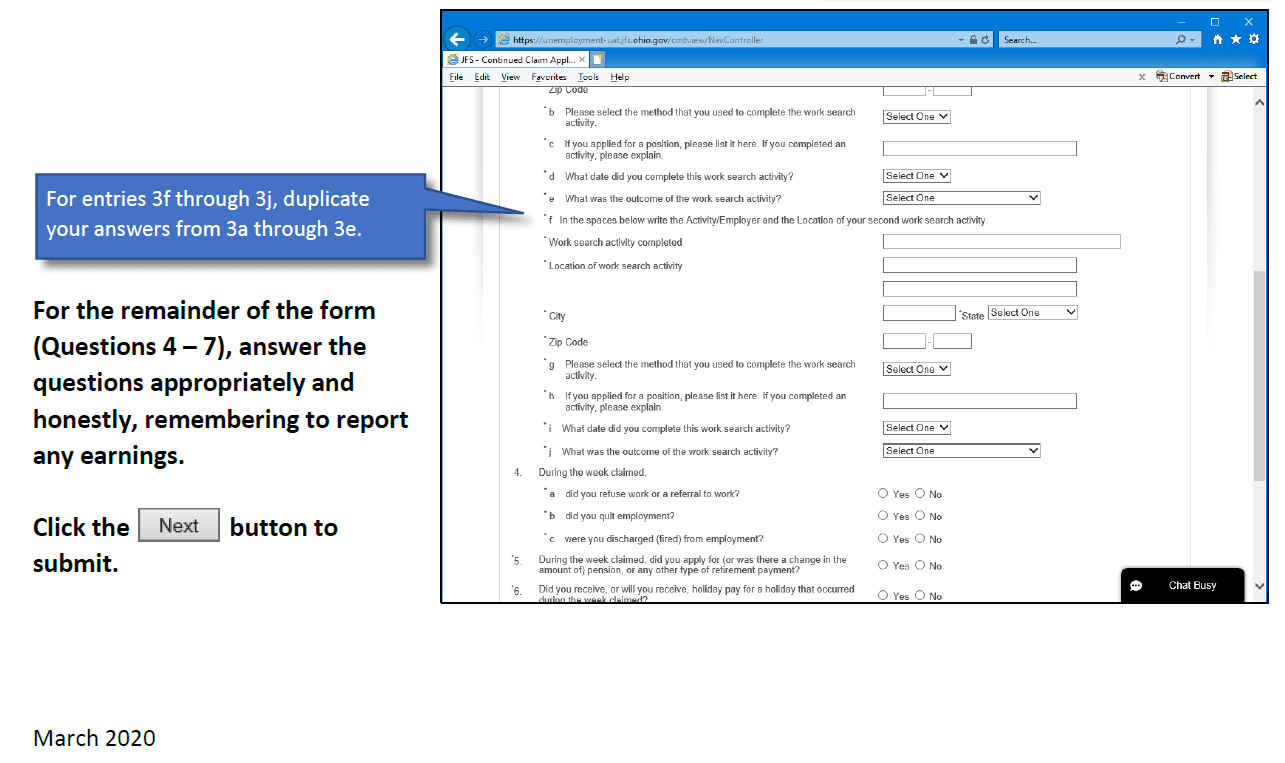

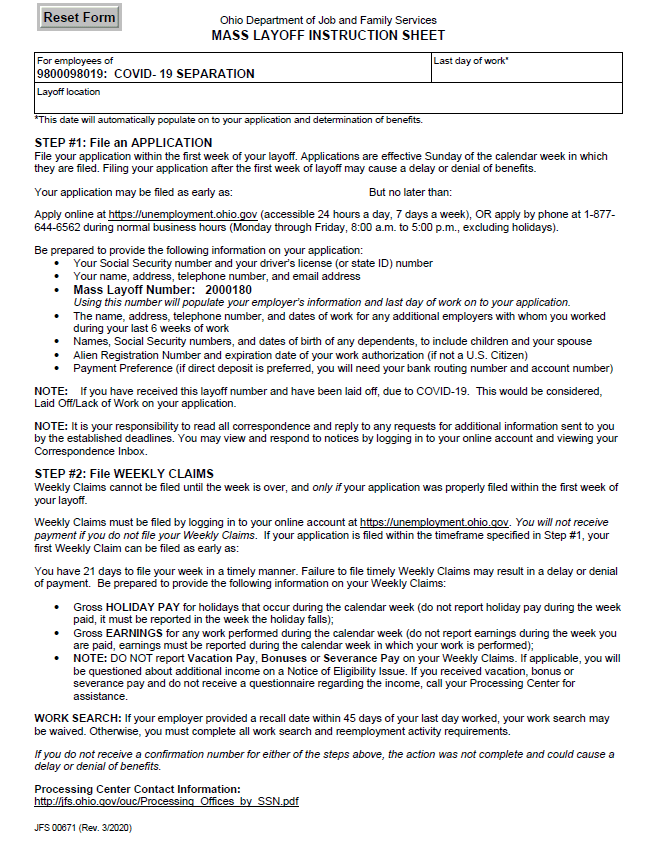

The application for unemployment insurance benefits for SELF-EMPLOYED INDEPENDENT CONTRACTORS and GIG ECONOMY WORKERS will become available SUNDAY April 26 2020. Hair dressers gig drivers landscapers freelancers and other independent contractors who work for themselves normally dont qualify for unemployment benefits. The person hiring them does not control how they perform those services.

Who qualifies Under the relief law people who are self-employed including independent contractors and gig workers and not eligible for regular unemployment insurance can still receive unemployment benefits if they are unable to work or are working reduced hours due to the coronavirus. 04 May 2020 By Kristen M. To be excluded employment it must be established by the employer that the contractor is free from direction or control over the service being performed.

Ten states have begun sending unemployment benefits to self-employed workers and independent contractors who are eligible for such payments for the first time under the CARES Act. For independent contractors not eligible for Unemployment Compensation benefits impacted by the coronavirus the Disaster Unemployment Assistance DUA program provides unemployment benefits to individuals who have become unemployed as a direct result of a Presidentially declared major disaster. Legitimately actual independent contractors are legally self-employed and as such.

Once they are up and running retroactive benefits will be provided. With this Covid 19 going on I cant work. Because these benefits are provided for by taxes paid by employers only employees and not independent contractors were eligible.

OHIO Self-employed part-time workers and independent contractors filing 1099 forms for taxes will be able to begin the process to apply for unemployment benefits Friday the Ohio Department of. Ohio law identifies 20 factors that can be used to help identify whether an employer-employee relationship exists. However Congress has passed the Coronavirus Aid Response and Economic Security Act.

While the program was originally scheduled to end by December 31 2020 new legislation has extended the program through March 13 2021. Independent contractors may provide services for a company but they operate their own businesses. But these arent normal times.

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Lawmakers Grill Unemployment Chief Over System Inefficiencies Wosu Radio

Ohio Lawmakers Grill Unemployment Chief Over System Inefficiencies Wosu Radio

Https Jfs Ohio Gov Releases Pdf Odjfs News Release Federal Benefits Extension 1 11 21 Stm

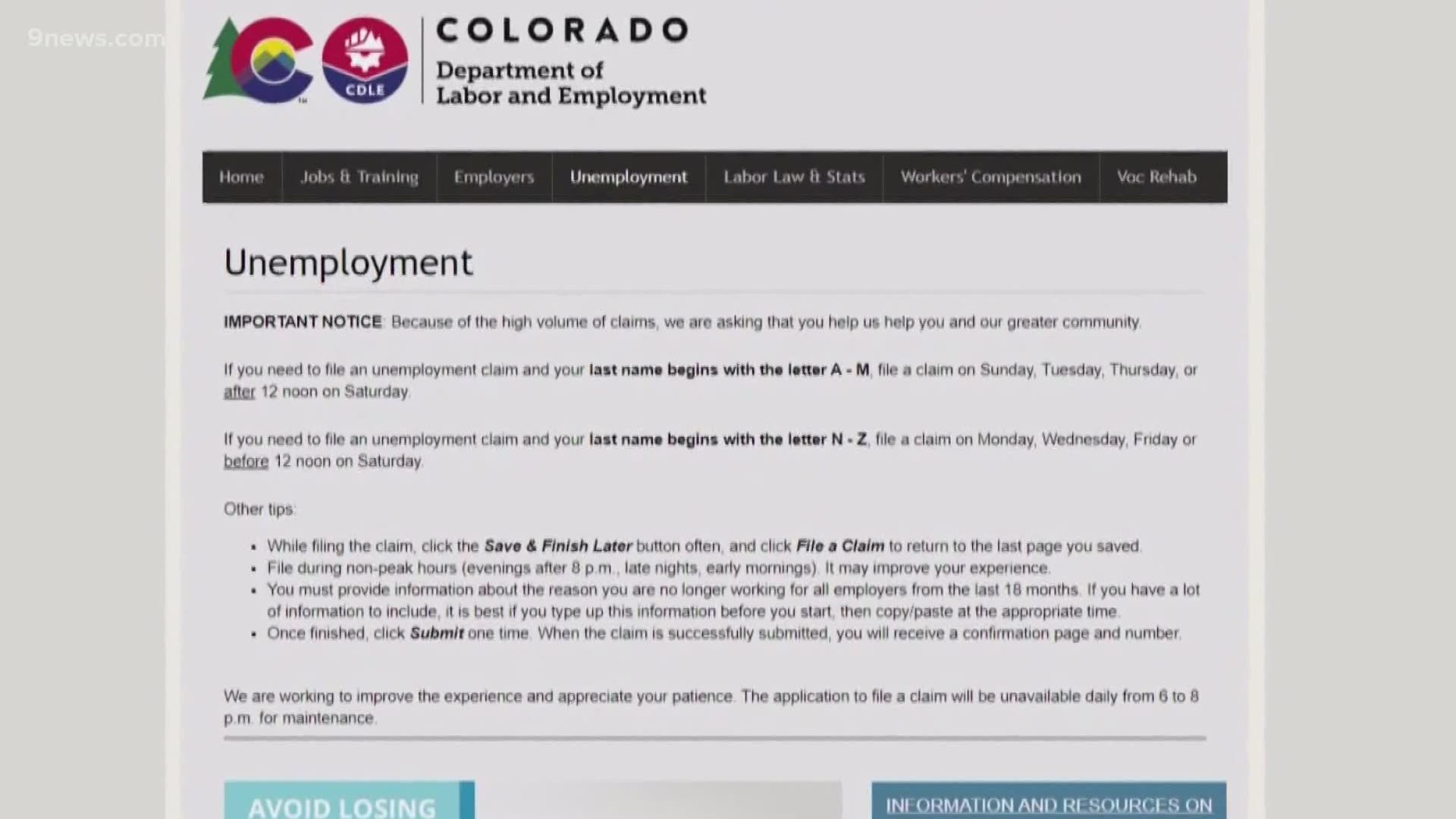

Here S How Colorado Self Employed Can Apply For Unemployment 10tv Com

Here S How Colorado Self Employed Can Apply For Unemployment 10tv Com

Ohio Unemployment For Independent Contractors Self Employed Worker

Ohio Unemployment For Independent Contractors Self Employed Worker

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Woub Public Media

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Woub Public Media

Q A Your Most Common Unemployment Questions The Lima News

Q A Your Most Common Unemployment Questions The Lima News

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Scam Targets Ohioans Who Receive Or Have Received Pandemic Unemployment Assistance The Statehouse News Bureau

Scam Targets Ohioans Who Receive Or Have Received Pandemic Unemployment Assistance The Statehouse News Bureau

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

Coronavirus In Ohio Up To 20 000 Barbers And Stylists Can T Access Unemployment Wosu Radio

Coronavirus In Ohio Up To 20 000 Barbers And Stylists Can T Access Unemployment Wosu Radio

Continued Unemployment Claims Hold Steady In Ohio But State Reports Drop In New Claims Amid Coronavirus Pandemic Cleveland Com

Continued Unemployment Claims Hold Steady In Ohio But State Reports Drop In New Claims Amid Coronavirus Pandemic Cleveland Com

Logan County Chamber Of Commerce

Logan County Chamber Of Commerce

Urgent Alert For Independent Contractors Or Self Employed Individuals Who Filed For Pandemic Unemployment Assistance Benefits In Ohio

Urgent Alert For Independent Contractors Or Self Employed Individuals Who Filed For Pandemic Unemployment Assistance Benefits In Ohio

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

1099 Workers Other Jobless Ohioans Not Previously Eligible Can Pre File For Benefits Friday The Statehouse News Bureau

Post a Comment for "Can Independent Contractors File For Unemployment In Ohio"