What Is Ohio Unemployment Insurance Law

In Ohio you generally are considered a liable employer under the Ohio unemployment compensation law if you meet either of the following requirements. Ohio Unemployment Insurance is an option for residents who have lost employment through no fault of their own.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio law allows that 20 of your weekly benefit amount be exempted from any earnings you may receive before a deduction is made.

What is ohio unemployment insurance law. 18 was signed into law. This incorporates recent federal tax changes into Ohio law effective immediately. Ohio Unemployment Insurance Law Compensation amounts administered by the state are determined by the amount you were earning before being laid off.

Bidens Unemployment state benefit extension now ending August in revised. You paid wages of 1500 or more to employees in covered employment in any. Also it is supposed to last for four months I believe not sure what happens if your unemployment ends before the four months ends.

We first encourage employers to engage in dialogue with an employee who expresses reluctance to return to work about the measures that employers are taking to help employees feel safe. State Unemployment Insurance Law and Legal Definition State Unemployment Insurance UI is an insurance program for unemployed citizens of the US. An example of how this is computed appears below.

You have at least one employee in covered employment for some portion of a day in each of 20 different weeks within either the current or the preceding calendar year. Under Ohio law most employers are required to pay contributions for unemployment insurance. ODJFS is required by law to ensure that unemployment benefits are issued in accordance with established eligibility requirements.

Such determination is done under the state laws. Ohio unemployment fac status. Requests must be submitted to the agency in writing.

Ohio residents applying for unemployment. Money to fund unemployment benefits comes from employer taxes which means employees dont pay any part of the costs to fund unemployment benefits. Highlighted below are two important pieces of information to help you register your business and begin reporting.

To pay that back would be a huge cost to Ohio businesses who are trying desperately to recover. The State in the form of UI assistance set by both Federal and State law. Under this program weekly insurance payments are made to individuals who have lost their jobs for reasons beyond their control.

As a result any unemployment. Ohio Law allows for the consideration of waivers of forfeiture and interest. In Ohio the Ohio Department of Job and Family Services is responsible for administering.

If the weekly benefit amount is 40000 and weekly earnings are 20000. Ohio taxes unemployment compensation to the same extent it is taxed under federal law. Specifically federal tax changes related to unemployment benefits in the federal American Rescue Plan Act ARPA of 2021 will impact some individuals who have already filed or will soon be filing their 2020 Ohio IT 1040 and SD 100 returns due by May 17 2021.

Each state administers a separate unemployment insurance program but all states have to follow the guidelines established by federal law. To calculate the earnings deduction. Billings and Credits Unemployment Insurance Tax 17 Credits Result from repayments of erro neously paid benefits or an offset of.

Work for such an employer is covered employment. Of Labor the American Rescue Plan Act expanded the number of weeks many will be able to get unemployment insurance benefits. 1 day agoAccording to the US.

Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. Total earnings in week 20000. Unemployment Insurance is a state-federal program that provides cash benefits to eligible workers who are currently unemployed through no fault of their own.

In most situations you are considered a liable employer under the Ohio unemployment law if you meet either of the following requirements. 1 day agoDue to the COVID pandemic Ohio is already over 14 billion in unemployment compensation debt. The Ohio Department of Job and Family Services administers unemployment insurance benefits for workers in the state who have become unemployed through no fault of their own.

G In accordance with section 303c3 of the Social Security Act and section 3304a17 of the Internal Revenue Code of 1954 for continuing certification of Ohio unemployment compensation laws for administrative grants and for tax credits any interest required to be paid on advances under Title XII of the Social Security Act shall be paid in a timely manner and shall not be paid directly or indirectly by an equivalent reduction in the Ohio unemployment taxes. You have at least one employee in covered employment for some portion of a day in each of 20 different weeks within either the current or the preceding calendar year or. State Taxes on Unemployment Benefits.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

How My Personal Experience Exposed Massive Ohio Unemployment Fraud Letter From The Editor Cleveland Com

How My Personal Experience Exposed Massive Ohio Unemployment Fraud Letter From The Editor Cleveland Com

Https Ccao Org Wp Content Uploads Hdbkchap070 1994 Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Free Ohio Unemployment Compensation Labor Law Poster 2021

Free Ohio Unemployment Compensation Labor Law Poster 2021

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Ohio Unemployment Compensation Benefits Gov

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

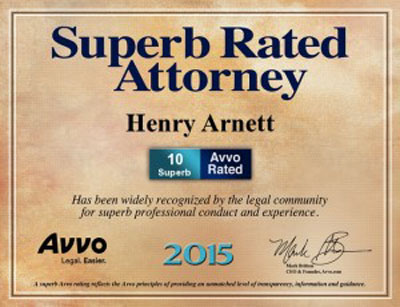

Columbus Ohio Unemployment Compensation Livorno Arnett Co Lpa

Columbus Ohio Unemployment Compensation Livorno Arnett Co Lpa

Ohio Offers Employers Relief For Covid 19 Related Work Disruptions

Ohio Offers Employers Relief For Covid 19 Related Work Disruptions

What You Should Know About Unemployment Compensation

Https Jfs Ohio Gov Releases Pdf Odjfs News Release Federal Benefits Extension 1 11 21 Stm

In Face Of Coronavirus State Policymakers Can Bolster Unemployment Compensation System

In Face Of Coronavirus State Policymakers Can Bolster Unemployment Compensation System

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Post a Comment for "What Is Ohio Unemployment Insurance Law"