Vt Unemployment Independent Contractor

The purpose of unemployment insurance benefits is to provide short term replacement of lost wages to individuals who lose their jobs through no fault of their own. Ten states have begun sending unemployment benefits to self-employed workers and independent contractors who are eligible for such payments for the first time under the CARES Act.

Connecticut Unemployment Law Independent Contractors Vs Employees

Connecticut Unemployment Law Independent Contractors Vs Employees

Full-time Part-time Temporary Seasonally Probationary On or off your premise.

Vt unemployment independent contractor. The money for unemployment benefits is solely funded by employers by paying taxes into the unemployment insurance trust fund. Pandemic Unemployment Assistance PUA. PUA benefits are available if you dont qualify for regular Unemployment Insurance benefits.

The new program is one way Congress boosted unemployment insurance for 2020 to help ease the economic pain for a record number of out-of-work Americans. Box 488 Montpelier 05601-0488. Department of Labor offices are currently closed due to COVID-19Please contact the Department by phone.

This will allow for unemployment insurance benefits to individuals not eligible for regular Unemployment Insurance such as the self-employed. People who have used all their regular UI benefits as well as any extended benefits. Box 488 Montpelier 05601-0488.

Funding will be provided by the federal government and distributed by the state similar to Disaster Unemployment. For unemployment insurance independent contractors must meet both of those requirements and be able to show that they regularly work for. If you are now eligible for unemployment because of COVID-19 for example because you dont have much work history or you are an independent contractor you will receive between 191week half of the state average unemployment benefit in the last quarter and 513week in Pandemic Unemployment Assistance PUA.

People with a limited work history. The Virginia Unemployment Compensation Act 602-212C provides that Services performed by an individual for remuneration shall be deemed to be employment subject to this title unless the Commission determines that such individual is not an employee for purposes of the Federal Insurance Contributions Act and the Federal Unemployment Tax Act based upon application of the 20 factors set forth in. For unemployment insurance purposes may include someone who is otherwise considered to be an independent contractor As an employer you may be liable for unemployment insurance coverage regardless if the services are performed.

It is not enough to assume for example that if someone is an independent contractor for federal tax purposes he or she would be an independent contractor for purposes of unemployment insurance or workers compensation insurance. Under the current classifications some hiring. This will allow for unemployment insurance benefits to individuals not eligible for regular Unemployment Insurance such as the self-employed.

Information For SELF-EMPLOYED and INDEPENDENT CONTRACTORS VT Dept of Labor. Vermonters who are independent contractors or self-employed will soon be allowed to file for unemployment benefits. Information For Self-Employed and Independent Contractors Element of CARES Act Pandemic Unemployment Assistance PUA.

Although the Vermont Department of Labor briefly advised the self-employed and independent contractors on its website that they should apply for unemployment. Vermont Department of Labor 5 Green Mountain Drive PO. According to the Vermont Department of Labor employers that are uncertain about whether they have hired an independent contractor can contact the Department for.

Vermont Department of Labor 5 Green Mountain Drive PO. But still self-employed and independent contractors are not covered by state unemployment benefits because they dont pay into the system. Unemployment Insurance has been in existence since 1939.

Gig workers and sole proprietors are not typically eligible for unemployment benefits because they do not pay into the payroll tax that funds the program. According to the Seven Days In Vermont a worker qualifies as an independent contractor for workers comp only if he or she is doing work. Element of CARES Act.

Department of Labor offices are currently closed due to COVID-19Please contact the Department by phone.

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Free Arkansas Independent Contractor Agreement Pdf Word

Free Arkansas Independent Contractor Agreement Pdf Word

Https Labor Vermont Gov Sites Labor Files Doc Library Fraud Pdf

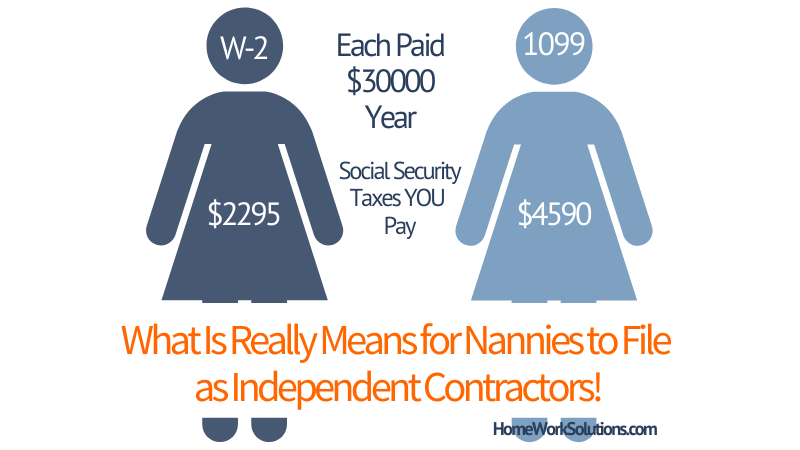

How Does A Nanny File Taxes As An Independent Contractor

How Does A Nanny File Taxes As An Independent Contractor

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

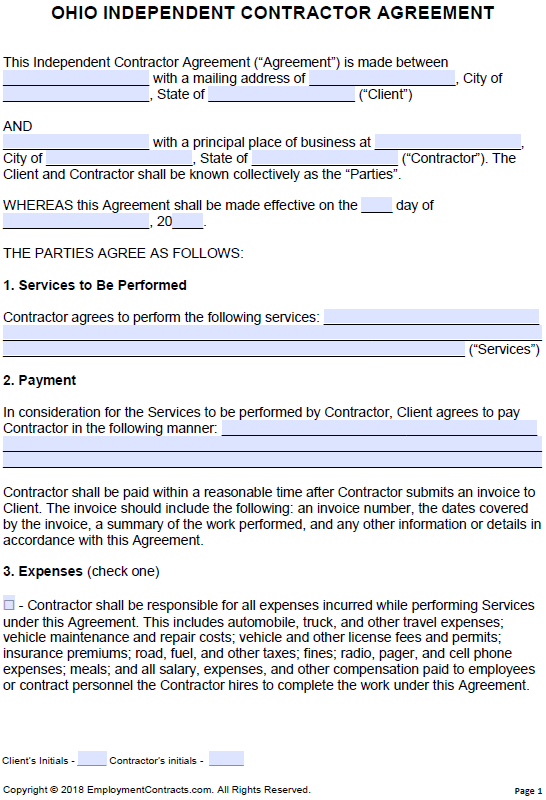

Free Ohio Independent Contractor Agreement Pdf Word

Free Ohio Independent Contractor Agreement Pdf Word

Information For Self Employed And Independent Contractors Vt Dept Of Labor Vbsr

Information For Self Employed And Independent Contractors Vt Dept Of Labor Vbsr

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

How To Apply For Unemployment As An Independent Contractor Money

How To Apply For Unemployment As An Independent Contractor Money

Free Colorado Independent Contractor Agreement Word Pdf Eforms

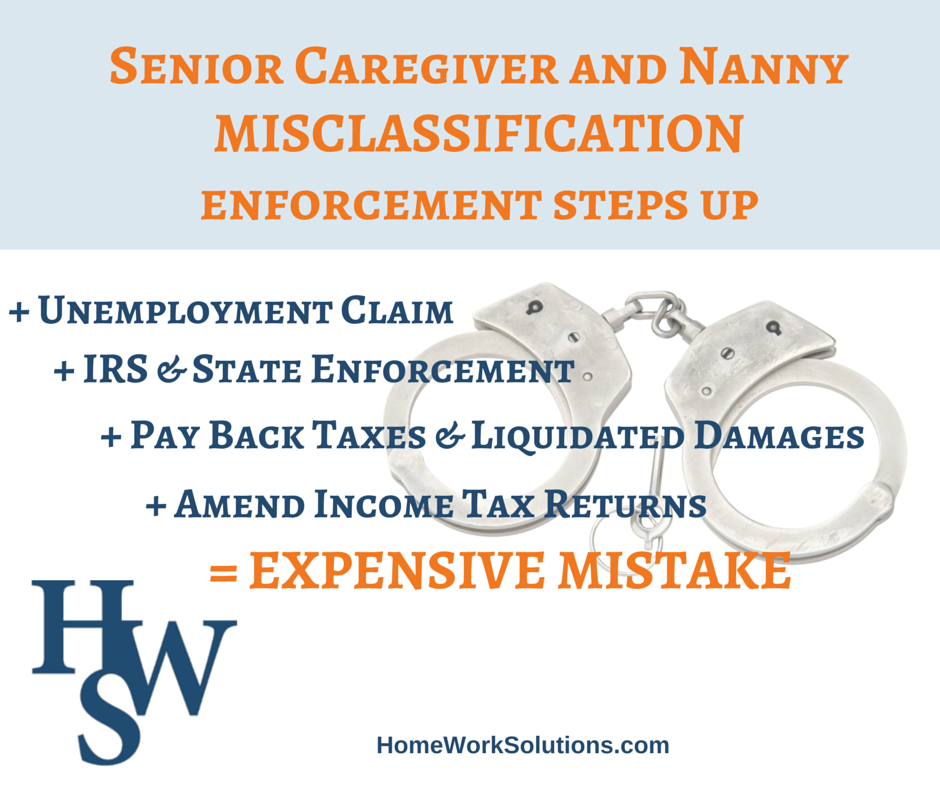

The Nanny Or Senior Caregiver Independent Contractor Myth

The Nanny Or Senior Caregiver Independent Contractor Myth

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Templates Pdf Word Eforms

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Contractors

Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Contractors

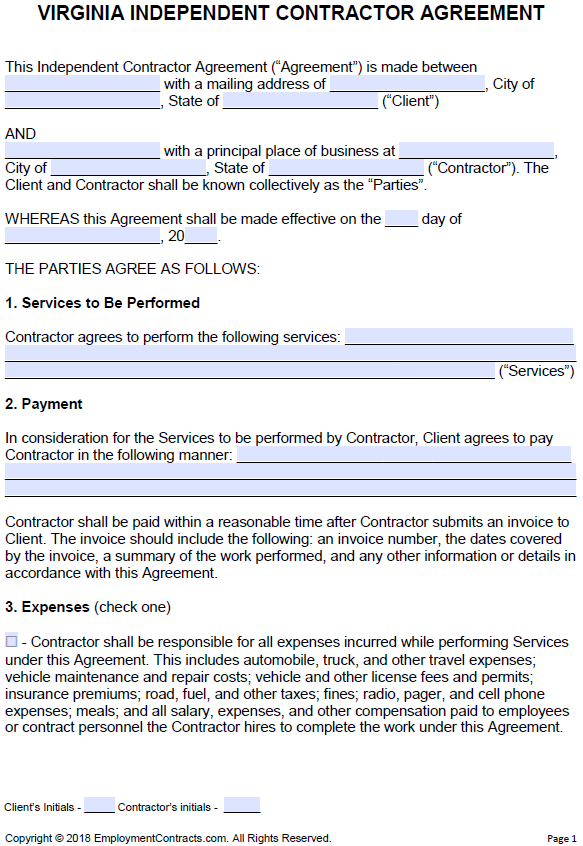

Free Virginia Independent Contractor Agreement Pdf Word

Free Virginia Independent Contractor Agreement Pdf Word

Totality Of The Circumstances Determines Employee Or Independent Contractor Employee Or Independent Contractor

Totality Of The Circumstances Determines Employee Or Independent Contractor Employee Or Independent Contractor

Post a Comment for "Vt Unemployment Independent Contractor"