Unemployment Wage Limits By State 2020

Complete and pay online at wwwlniwagov due 430 731 1031 131 WA Dept. Workers compensation insurance for medical costs and wage replacement if injured on the job.

Analysis These 10 States Have Seen The Highest Share Of Their Workforce File For Unemployment Amid Covid 19 U S Chamber Of Commerce

Analysis These 10 States Have Seen The Highest Share Of Their Workforce File For Unemployment Amid Covid 19 U S Chamber Of Commerce

The state has two wage bases.

Unemployment wage limits by state 2020. UI contributions owed are based on wages paid. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from. Change State Unemployment Insurance SUI rate.

1½ x HQW and 390 x minimum wage in effect in 1 qtr. The taxable wage base for the Federal Unemployment Tax Act FUTA you pay UI tax on each employees wages up to the taxable wage base you do not pay tax on wages exceeding the taxable wage base the taxable wage base in 2020 is 3160000. It provided an additional 600 per week in unemployment compensation per recipient through July 2020.

For more information you can also check out these articles for your reference. That extra 600 is also taxable after the first 10200. Wages 24 per dep up to 72.

370- 442 50 and ¼ wages over 50. We report the unemployment rate statewide and for the nation the number of people in Washingtons workforce and the number of jobs by industry. 9000 for employers whose SUI payments and returns are up-to-date with the agency and 9500 for employers whose SUI payments and returns are delinquent.

Find wage bases and limits 2015-2019. 2020 Federal Wage Base Limits Additional 9 assessed on employee wages exceeding 200000. You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10.

3 Provided the State law definition of suitable work does not permit the individual to limit his or her availability in such a way that the individual has withdrawn. Weighted schedule of BPW to HQW for of weeks x WBA 16-26. In no event shall the state taxable wage base increase beyond 13000 or decrease to less than 7000.

Employer FICA Wage Limits and Tax Rates 2020 2019 Social Security OASDI wage base 13770000 13290000 Medicare HI wage base No Limit No Limit. State unemployment tax report 1 each calendar quarter per employer Unemployment benefits for employees who lose their jobs. Excess wages are reported for unemployment-insurance benefits purposes but are subtracted from the employees total wages so they do not pay taxes on the amount above the taxable wage base 56500 in 2021.

Two-thirds of the statewide average weekly wage multiplied by 52 or. Once an experience rate is assigned that rate is applied to the wage base in effect during that year. State unemployment insurance taxes are based on a percentage of the taxable wages an employer pays.

2 Nebraska will implement a. For example in 2007 employers in the best positive-rate class were assigned a tax rate of 0372 percent and would pay only 11234 for each employee who makes at least the 30200 wage base. 35 rows receive 325 per week in unemployment benefits.

20 rows Some states apply various formulas to determine the taxable wage base others use a. You paid wages of 1500 or more to employees in any calendar quarter during 2019 or 2020 or. Taxable Wage Bases 2018 2021.

See Section 2880362 RSMo. The taxable wage base can be increased by 1000 or decreased by 500 for any year depending on the average balance of the Unemployment Compensation Trust Fund of the four preceding calendar quarters. Of Labor Industries.

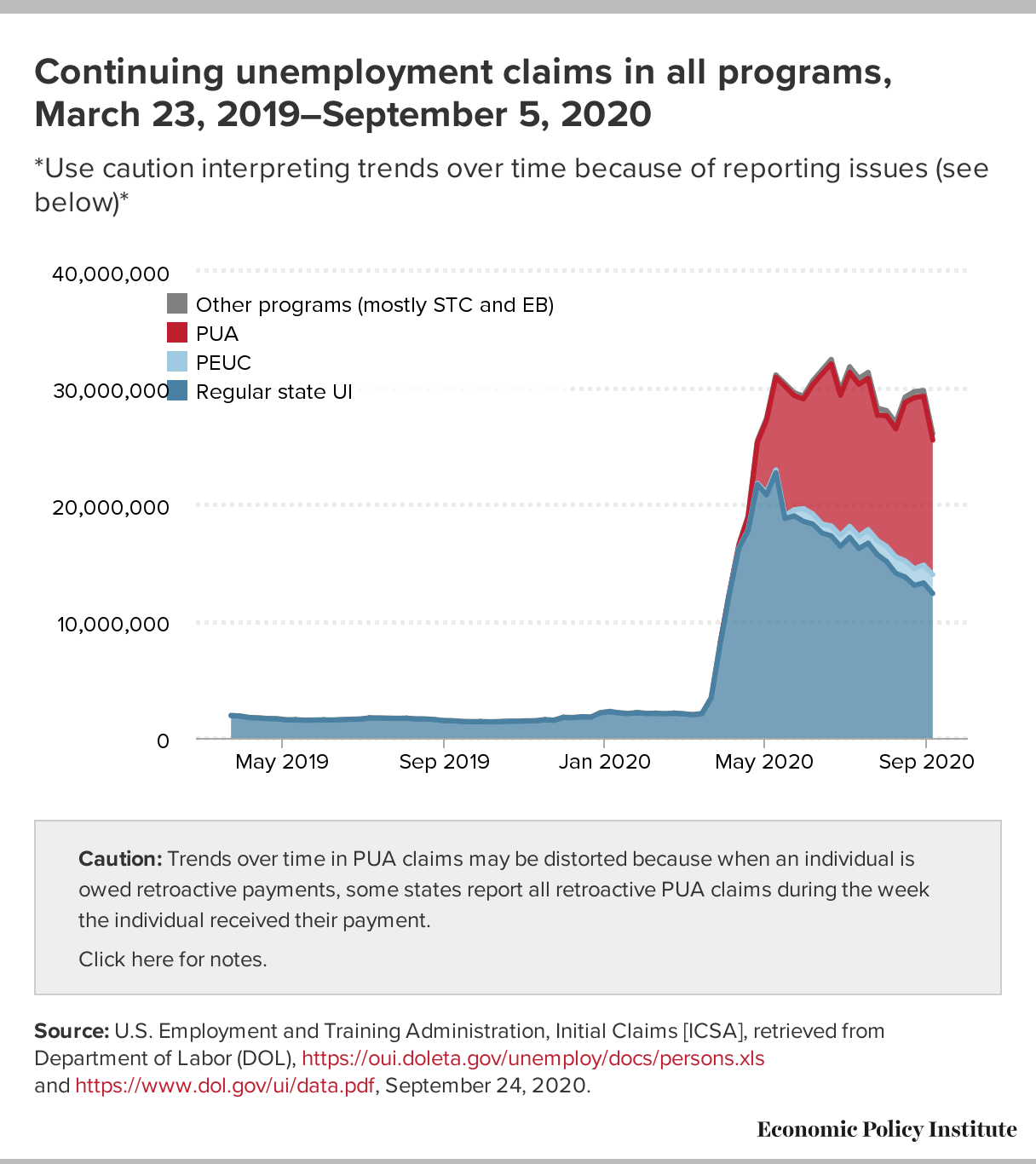

The worst positive-rate class was assigned a tax rate of 1240 percent resulting in a tax of 37448 when multiplied by the 30200 wage base. 10-20 which states that though the States have flexibility B. In 2020 regular unemployment benefit payments.

The amount over the taxable wage base of 56500 500 in the example is considered excess wages. Open the February 2021 monthly employment report State and Seattle. 2020 Retirement Plan Contribution Limits The following are the maximum annual elective deferrals.

This contradicts the US Department of Labor letter Dated March 122020 Unemployment insurance Program Letter No. The monthly employment report is a comprehensive report on Washingtons job market. Or wages in 2 qtrs with wages in 1 qtr sufficient to qualify for maximum WBA and total BPW taxable wage base.

56 rows States are required to maintain an SUI wage base of no less than the limit set under FUTA. Under the general test youre subject to FUTA tax on the wages you pay employees who arent household or agricultural employees and must file Form 940 Employers Annual Federal Unemployment FUTA Tax Return for 2020 if. The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA wage base of 7000 per employee although most states wage bases exceed the required amount.

The taxable wage base is 15000 in wages per employee per calendar year in 2019 and 2020. The taxable wage base in 2021 is 3240000. 2020 State Unemployment Insurance Wage Bases 1 Michigan.

This is to ensure we stay compliant with your state tax laws and regulations. This should answer your concern for today.

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Unemployment Insurance Ui Program Data Labor Market Information

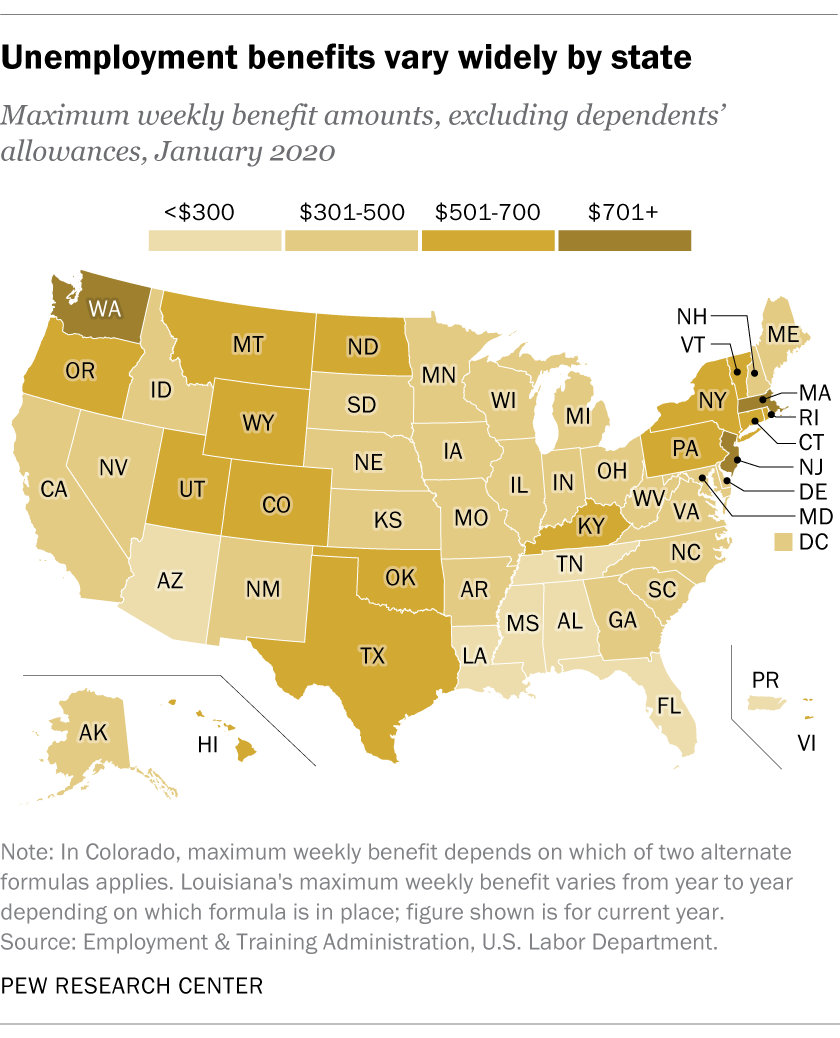

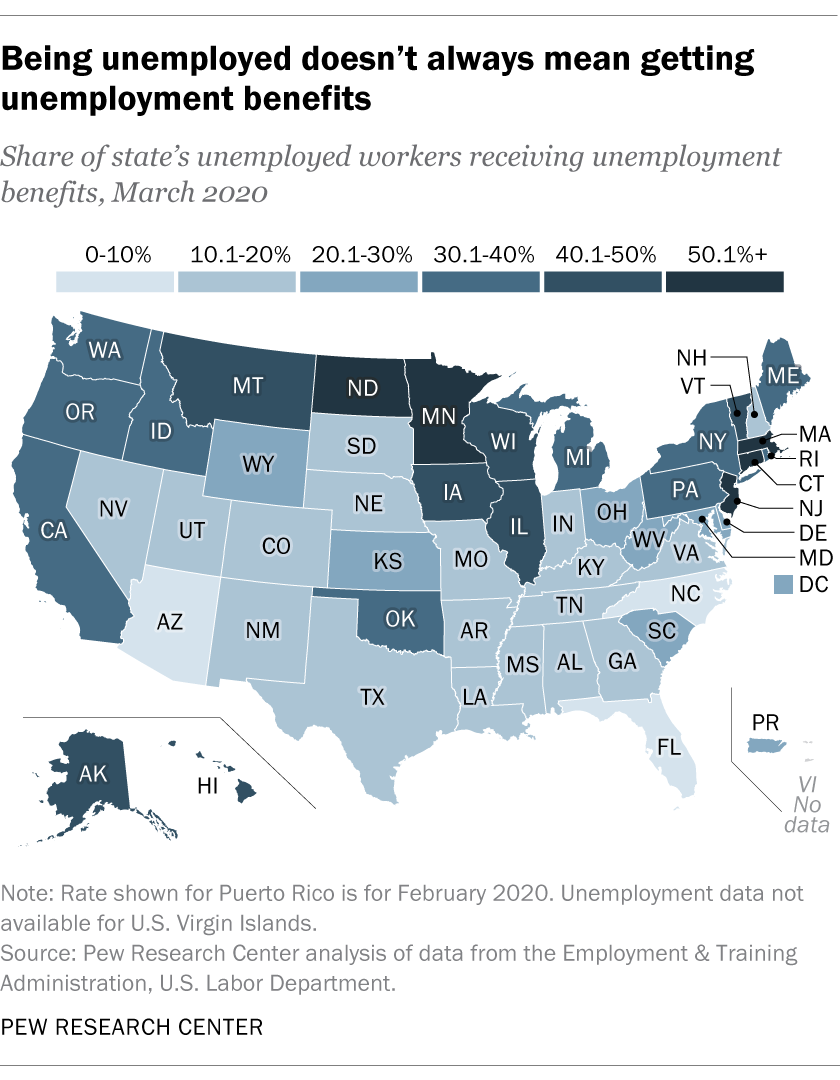

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Many Workers Have Exhausted Their State S Regular Unemployment Benefits The Cares Act Provided Important Ui Benefits And Congress Must Act To Extend Them Economic Policy Institute

Many Workers Have Exhausted Their State S Regular Unemployment Benefits The Cares Act Provided Important Ui Benefits And Congress Must Act To Extend Them Economic Policy Institute

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

Mdol Covid 19 Unemployment Insurance Information Page

Mdol Covid 19 Unemployment Insurance Information Page

38 Million Have Applied For Unemployment But How Many Have Received Benefits Rand

38 Million Have Applied For Unemployment But How Many Have Received Benefits Rand

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

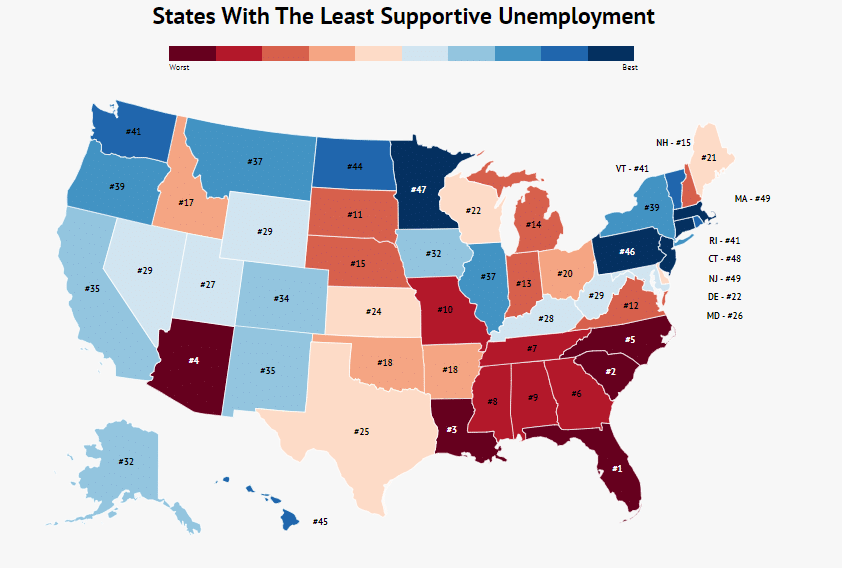

Here Are The States With The Least Supportive Unemployment Systems Zippia

Here Are The States With The Least Supportive Unemployment Systems Zippia

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

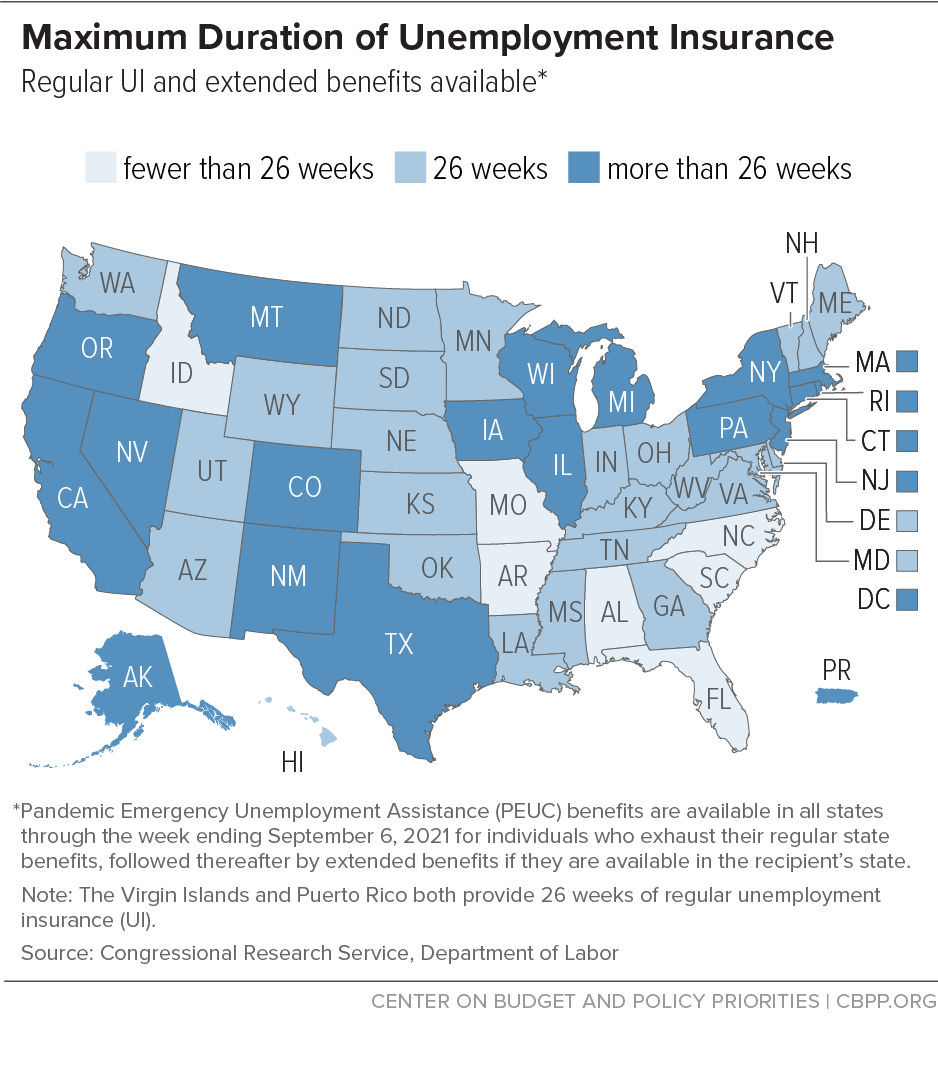

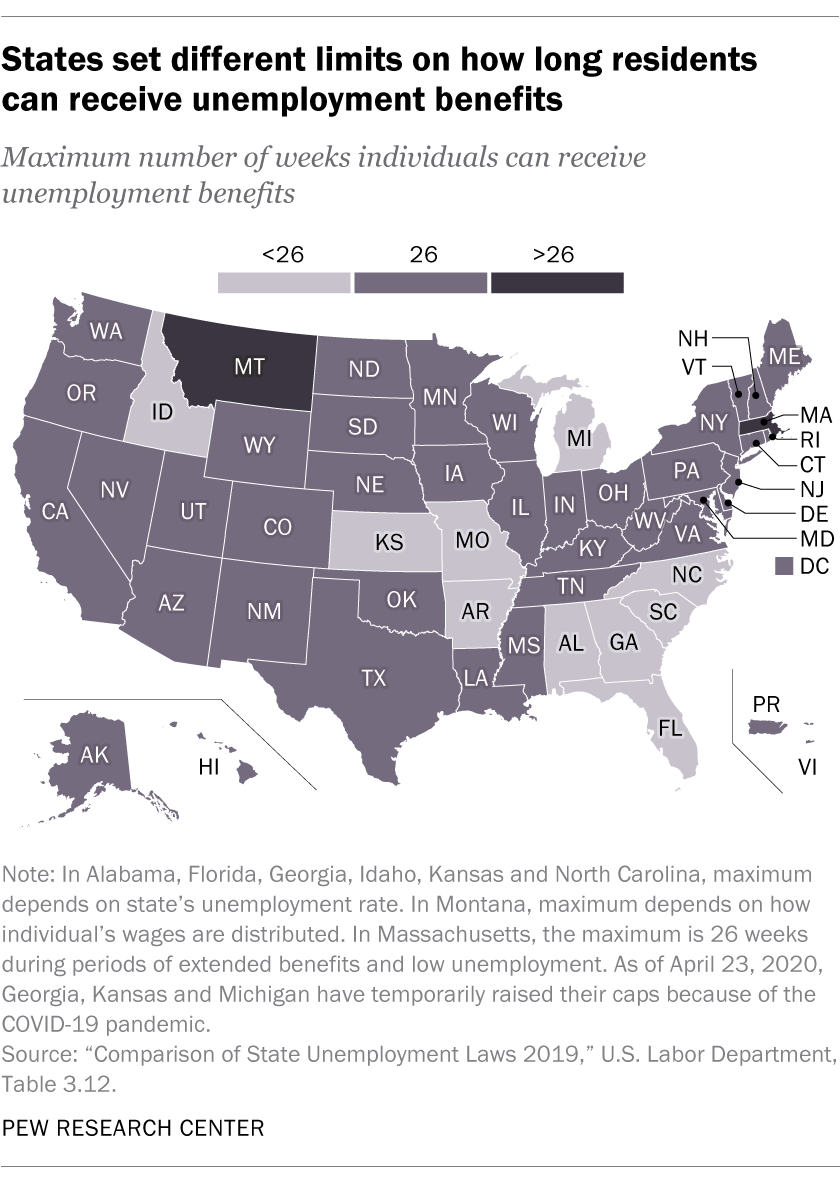

Maximum Duration Of Unemployment Insurance Center On Budget And Policy Priorities

Maximum Duration Of Unemployment Insurance Center On Budget And Policy Priorities

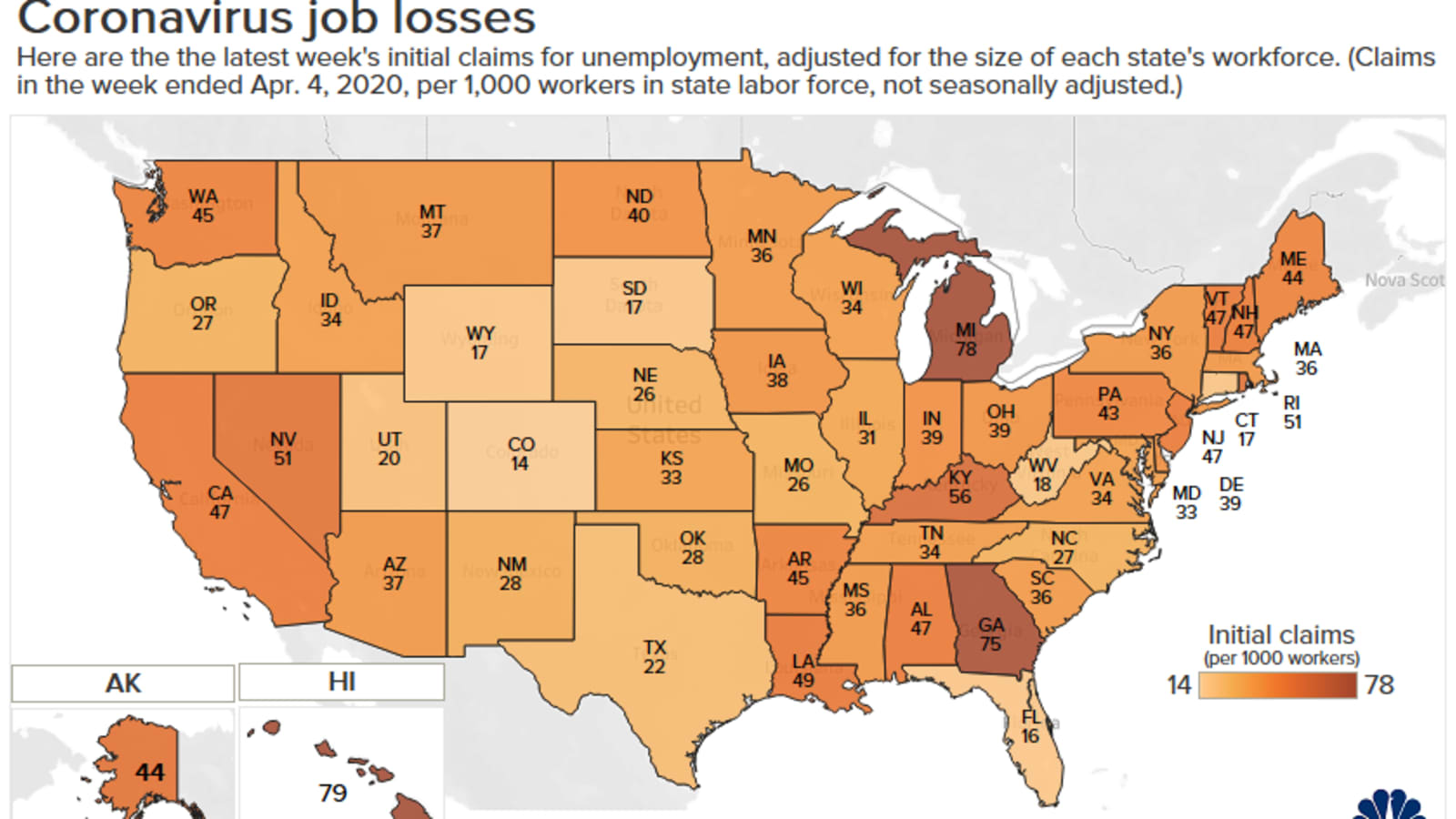

Coronavirus Map Which States Are Seeing The Most Job Losses Due To The Pandemic

Coronavirus Map Which States Are Seeing The Most Job Losses Due To The Pandemic

Unemployment Benefits What To Know If You Re Laid Off Again

Unemployment Benefits What To Know If You Re Laid Off Again

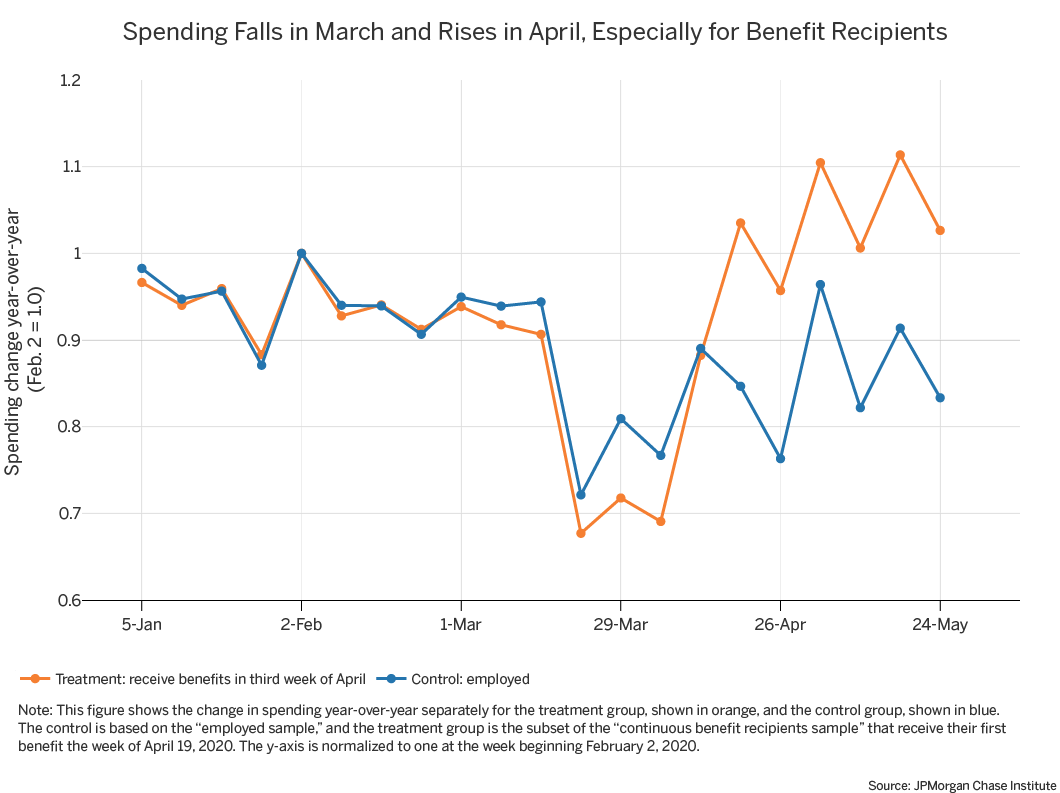

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

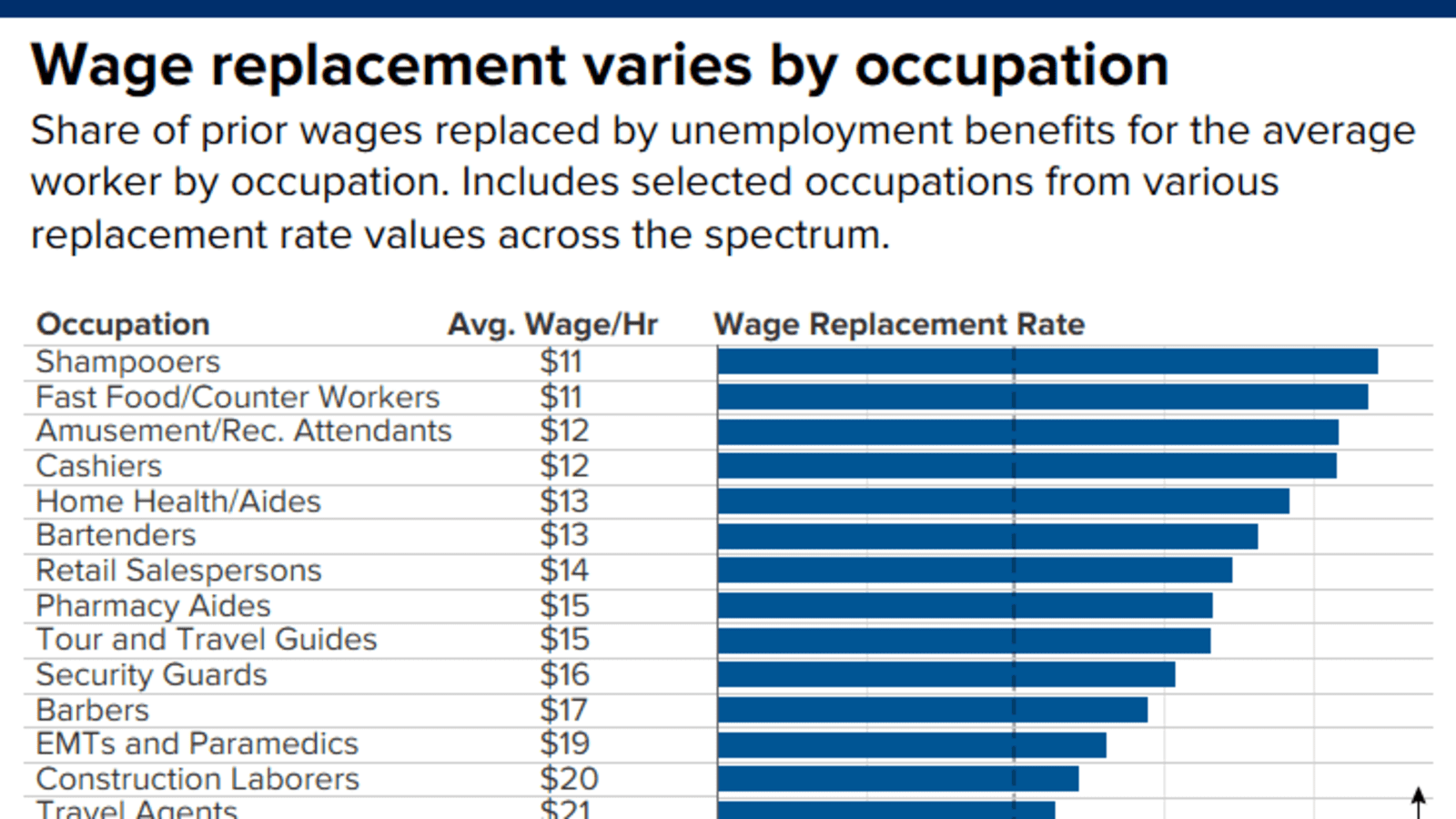

Unemployment Benefits Are Less Than Minimum Wage In Many States

Unemployment Benefits Are Less Than Minimum Wage In Many States

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Employer Tax Rates Employers Kdol

Employer Tax Rates Employers Kdol

Post a Comment for "Unemployment Wage Limits By State 2020"