Unemployment Tax Rate South Carolina

The American Rescue Plan a 19 trillion Covid relief bill waived. States unemployment tax.

Best Criminal Justice Schools In South Carolina

Best Criminal Justice Schools In South Carolina

State Taxes on Unemployment Benefits.

Unemployment tax rate south carolina. We offer services including assistance finding qualified workers instructions on how to pay your unemployment tax information about qualifying for a tax credit and more. Is your state saying no to the 10200 unemployment tax breakBetween March and April 2020 unemployment soared to 148. Note that some states require employees to contribute state unemployment tax.

Caroline Coleburn CColeburnTV November 12 2020 That was a shock that we didnt think they could withstand explained DEW Executive Director Dan. 8 hours agoCHARLOTTE NC. In South Carolina the base tax rate for a new employer under Department of Employment Workforce law is 155 percent plus applicable surcharge of the total taxable wages.

Mississippi North Carolina New York Rhode Island South Carolina or. Federal taxable income determines South Carolina income tax liability so fill out the state form SC1040 using information from the federal 1040 form. Colorado for example charges a tax rate of 463 so for 10200 in unemployment benefits thats a 472 payment.

South Carolinas unemployment-taxable wage base is to remain at 14000 in 2021 unchanged from 2020. You will be taxed at the regular rate for any federal unemployment. Under South Carolina law tax rate schedules adjust automatically each year.

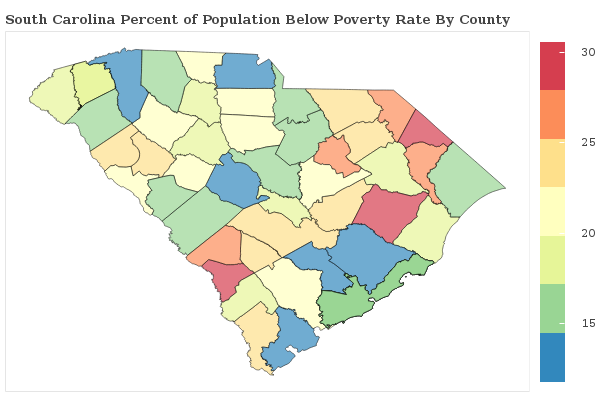

The unemployment rate in our state is 51. Recently it has been slightly decreasing each year and has ranged from around 20 down to around 14. SUI tax rate by state.

What the American Rescue Plan does is exempt the first 10200 of federal unemployment benefits from your taxable income. 20 rows Tax Rates. You will be taxed at the regular rate for any federal unemployment benefits above 10200.

3 on taxable income from 3070 to. Department of Employment and Workforce is here to help you with your business needs. The state UI tax rate for new employers also known as the standard beginning tax rate also can change from one year to the next.

South Carolina Department of Employment and Workforce website. The unemployment tax rate for new employers is the rate for experienced employers assigned to Rate Class 12 which is to be 055. The rate usually applies for.

After the registration is complete you will receive an Employer Account Number EAN and can begin to file wage reports and maintain your account via the online system. The American Rescue Plan passed last month included a tax relief provision that waives taxes on up to 10200 of unemployment benefits meaning more. Unemployment tax credit.

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. Director Dan Ellzey announce that despite the pandemic unemployment insurance tax rates for 863 of South Carolina employers will remain unchanged or decrease for 2021 and there will be. In regards to taxes unemployment benefits are generally treated as income.

State Income Tax Range. Welcome To South Carolina State Unemployment Insurance Tax System Employers who have paid wages in covered employment must register for an employer account. Unemployment compensation is fully taxable in South Carolina.

The 2020 SUI tax rates will range from 006 to 546 including the additional 006 contingency surchargeWithin the rate schedule employer tax rates decreased between 0062 and 1191 due to the elimination of the solvency surcharge. Here is a list of the non-construction new employer tax rates for each state and Washington DC. After 12 consecutive months of liability as of June 30 the employer may have his state employment insurance tax rate reduced based on.

The rate includes a base rate of 049 and an administrative assessment of 006.

2019 South Carolina Manufacturing Facts Nam

2019 South Carolina Manufacturing Facts Nam

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

South Carolina Tax Forms 2020 Printable State Sc 1040 Form And Sc 1040 Instructions

Economy Of South Carolina Wikipedia

South Carolina Retirement Taxes And Economic Factors To Consider

South Carolina Tax And Labor Law Summary Care Com Homepay

South Carolina Tax And Labor Law Summary Care Com Homepay

South Carolina U S Department Of Labor

South Carolina U S Department Of Labor

Moving To South Carolina The Truth About Living Here

Moving To South Carolina The Truth About Living Here

Sc Works Trident Coronavirus Updates Sc Works Trident

Sc Works Trident Coronavirus Updates Sc Works Trident

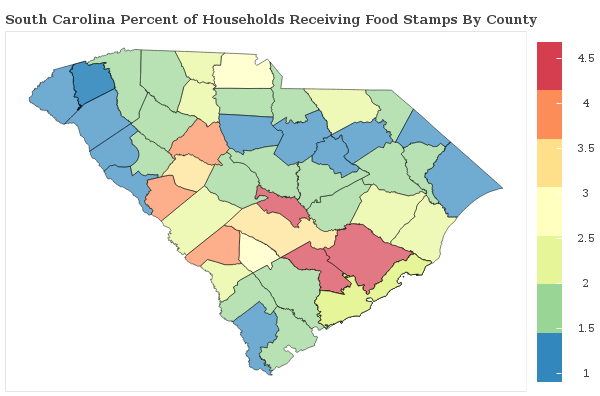

South Carolina Welfare Learn And Find Benefits

South Carolina Welfare Learn And Find Benefits

Immigrants In South Carolina American Immigration Council

Immigrants In South Carolina American Immigration Council

South Carolina Welfare Learn And Find Benefits

South Carolina Welfare Learn And Find Benefits

South Carolina Remote Work Resources Virtual Vocations

South Carolina Remote Work Resources Virtual Vocations

1040ez Tax Calculator The Bank Of South Carolina

1040ez Tax Calculator The Bank Of South Carolina

Sc Works Trident Coronavirus Updates Sc Works Trident

Sc Works Trident Coronavirus Updates Sc Works Trident

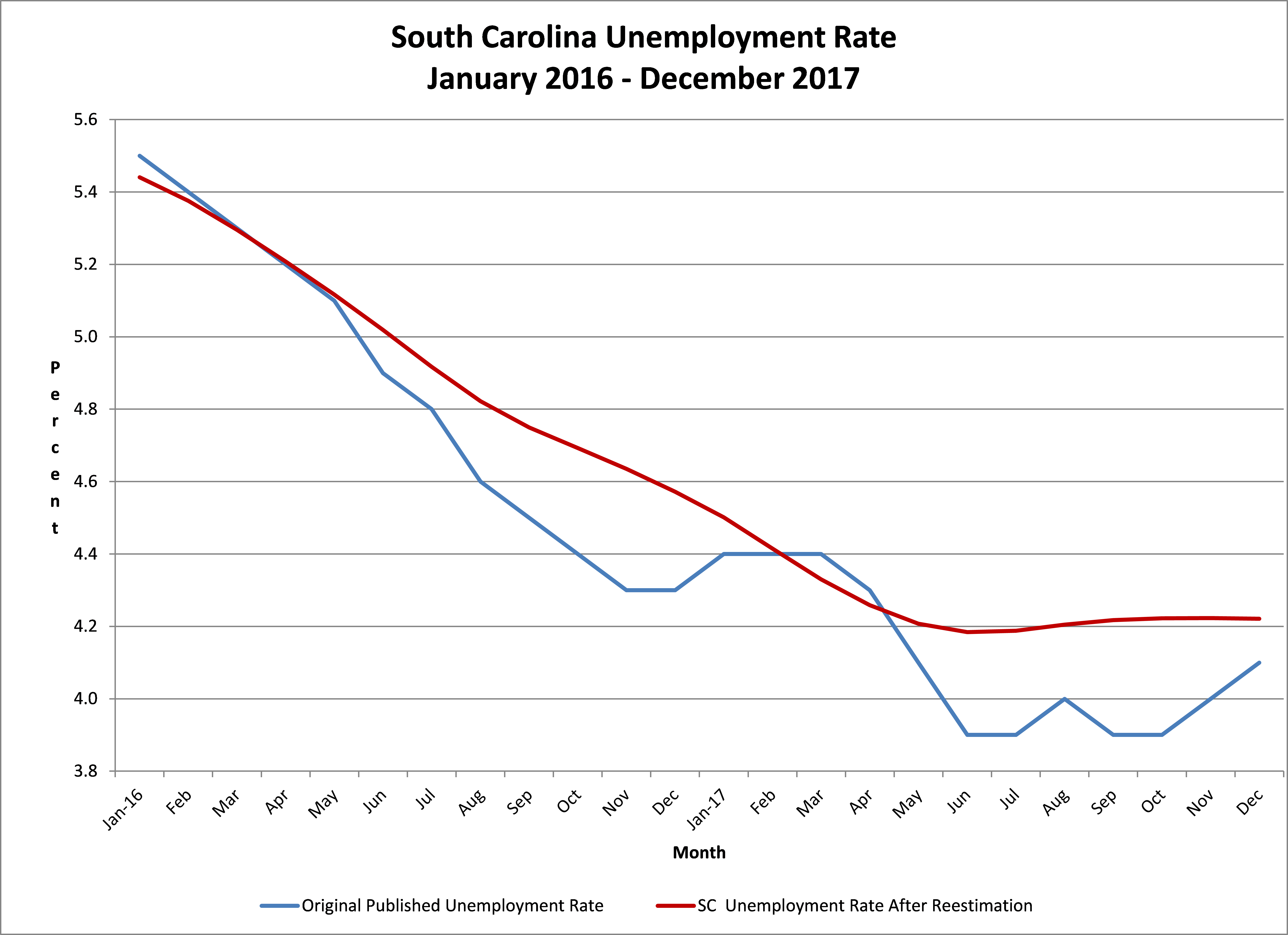

South Carolina Unemployment Rate Averages 4 3 In 2017 Sc Department Of Employment And Workforce

South Carolina Unemployment Rate Averages 4 3 In 2017 Sc Department Of Employment And Workforce

The True Cost To Start A South Carolina Llc Optional Required

The True Cost To Start A South Carolina Llc Optional Required

Sc Works Trident Coronavirus Updates Sc Works Trident

Sc Works Trident Coronavirus Updates Sc Works Trident

South Carolina Income Tax Calculator Smartasset

South Carolina Income Tax Calculator Smartasset

Post a Comment for "Unemployment Tax Rate South Carolina"