Unemployment Tax Form Mississippi

For married couples each spouse can exclude up to 10200. Purchase Hunting Fishing License.

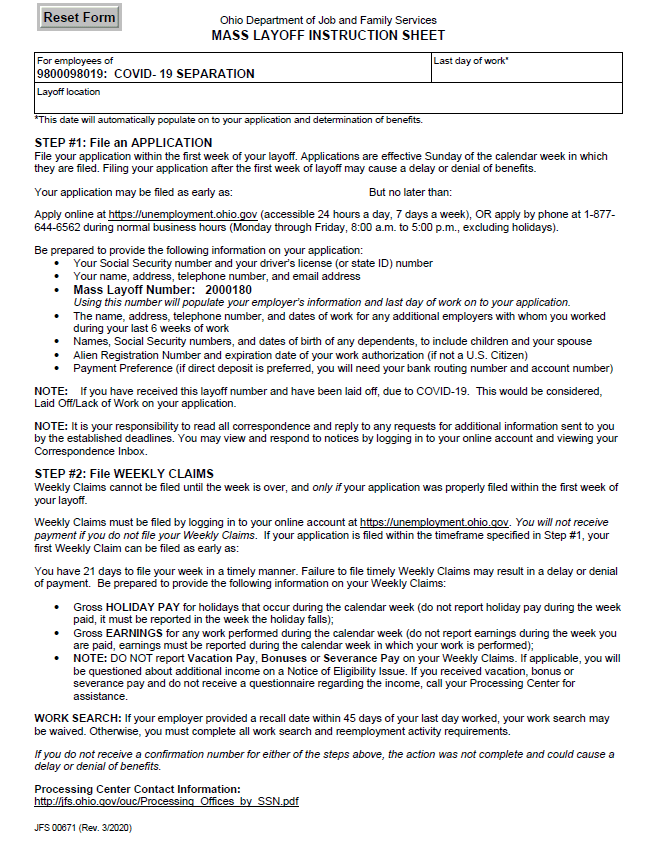

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

As a Mississippi employer subject to UI tax your small business must establish a Mississippi UI tax account with the Mississippi Department of Employment Security MDES.

Unemployment tax form mississippi. Welcome to The Mississippi Department of Revenue The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. An equal opportunity employer and program MDES has auxiliary aids and services available upon request to those with disabilitiesThose needing TTY assistance may call 800-582-2233. Mississippi residents are fully taxed on their unemployment compensation.

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment. It is not a bill and you should not send any type of payment in response to the form. Once you have completed the form you may either e-mail it as an attachment to candsmdesmsgov or fax it to 601-321-6173 or print it out and mail it to.

You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. State Taxes on Unemployment Benefits. In either case youll be completing Form UI-1.

Registering Reporting and Filing Employer Resources. March 20 2021 at 941 am. Mississippi Department of Employment Security Tax Department PO.

Adjustments - This box includes cash payments and income tax refunds used to pay back overpaid benefits. Funded by the US. If a professional preparer handles your taxes you should give this form to the preparer along with your other tax information such as W-2 forms.

You can register for an account with MDES either online or on paper. June 7 2019 340 PM. TaxWatch What to do if you already filed taxes but want to claim the 10200 unemployment tax break Last Updated.

Helping Mississippians Get Jobs. If you received unemployment benefits this year you can expect to receive a Form 1099-G Certain Government Payments that lists the total amount of compensation you received. 3 on taxable income from 3001 to 5000.

Renew Your Driver License. The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return. Unemployment resources for employers including posters names of tax field representatives a reference guide and more.

The Mississippi Department of Employment Security is an equal opportunity employer. As an employer in Mississippi you are required to do certain things as it related to the Unemployment Insurance Tax program. Unemployment Insurance Tax is paid by the employer.

This website provides information about the various taxes administered access to online filing and forms. Unemployment Compensation - This box includes the dollar amount paid in benefits to you during the calendar year. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b.

State Income Tax Range. The number is in Box 1 on the tax form. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return.

Look for a job. Section 27-7-901 of the Mississippi Code provides that the amount of winnings reported on W-2G 1099 or other informational return from Mississippi casinos are not included in Mississippi income and no income tax credit is allowed for the amount of withholding. The information on the 1099-G tax form is provided as follows.

Mississippi Department of Employment Security. Department of Labor through the Mississippi Department of Employment Security. Department of Employment Security - Employer Resources and Forms.

An equal opportunity employer and program MDES has auxiliary aids and services available upon request to those with disabilitiesThose needing TTY assistance may call 800-582-2233. Individuals should receive a Form 1099-G showing their total unemployment compensation last year. Department of Labor through the Mississippi Department of Employment Security.

Funded by the US. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Download the Employer Change Request form. If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G. Box 22781 Jackson MS 39225-2781.

2014-The Mississippi Department of Employment Security MS Tax Production 20210401-1201. The amount on Form 1099-G is a report of income you received from the Mississippi Department of Revenue.

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

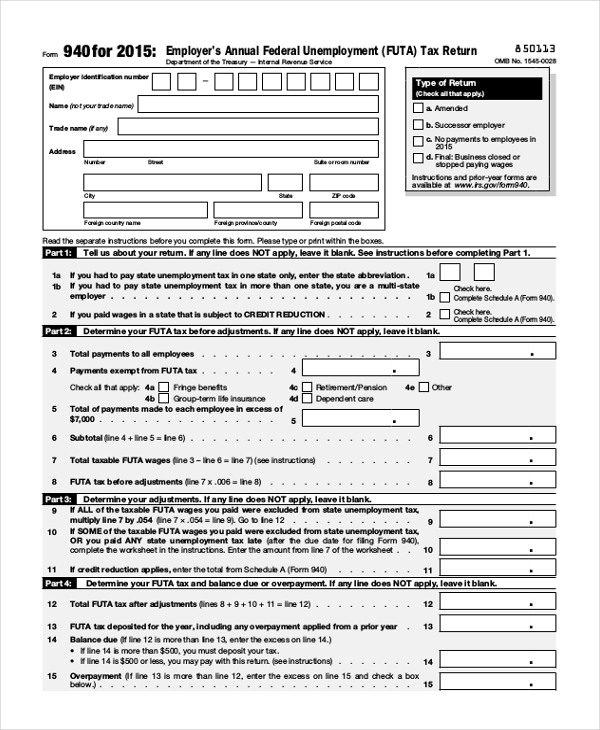

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Covid 19 And Unemployment In Mississippi Weekly Updates Mississippi Today

Covid 19 And Unemployment In Mississippi Weekly Updates Mississippi Today

Mdes Streamlines Service Phone Numbers

Mdes Streamlines Service Phone Numbers

Mississippi State Tax H R Block

Mississippi State Tax H R Block

Free 10 Sample Tax Exemption Forms In Pdf

Free 10 Sample Tax Exemption Forms In Pdf

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

Free 7 Sample Tax Forms In Pdf

Free 7 Sample Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Free 8 Sample Payroll Tax Forms In Pdf Excel Ms Word

Free 8 Sample Payroll Tax Forms In Pdf Excel Ms Word

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Http Www Mdhs Ms Gov Wp Content Uploads 2020 03 Employment Wage Verification Form Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Post a Comment for "Unemployment Tax Form Mississippi"