Unemployment Tax Break Ohio

Usually claimants would have to pay tax on this benefit. Additionally if you live in a traditional tax base school district your unemployment compensation is.

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Unlike with federal income tax on unemployment compensation UC Ohio gave claimants no option to have them withheld by the state.

Unemployment tax break ohio. Changes in how unemployment benefits are taxed for tax year 2020 Read More Did you receive a 1099-G. Unemployment Benefits for Tax Year 2020. However 13 states are not waiving taxes on unemployment benefits for 2020.

The IRS considers unemployment compensation taxable income. If you got unemployment income last year and your state isnt offering a tax break on your first 10200 of benefits you may need to gear up for a tax bill when you. The latest 19 trillion stimulus package created a new tax break for tens of millions of workers who received unemployment benefits last year.

These states are requiring residents to pay taxes on unemployment. The IRS will conduct a recalculation in two phases for those who already filed their taxes. Arizona taxes unemployment compensation to the same extent as it is taxed under federal law.

Its great that Americans wont have to pay taxes on 10200 of unemployment income. The American Rescue Plan a 19 trillion Covid relief bill waived. The nearly 2 million Ohioans who collected unemployment benefits in 2020 are in line for a big break on their federal taxes under the 19.

As of March 29 13 states have not conformed with the federal unemployment tax break according to recent data from HR Block. The break is the result of a compromise between Democrats and Republicans. Under the American Rescue Plan those who received federal unemployment benefits in 2020 will receive a 10200 tax break when they file a federal income tax return this year.

It is included in your federal adjusted gross income FAGI on your federal 1040. Prepare for a state tax bill. 2 days agoThe new tax break is essentially a waiver on the first 10200 of federal unemployment benefits each recipient received during 2020.

You might want to do more than just wait Last Updated. The exclusion is 10200 per person so spouses filing a joint return can avoid paying taxes on up to 20400. Nearly every Ohioan who received unemployment.

Obtain detailed information regarding your 1099-G by clicking here. Unemployment benefits are not subject to municipal income taxes in Ohio so nothing changes there the Regional Income Tax Agency confirmed. With the pandemic and recession far from over the General Assembly should reduce or eliminate these UC taxes.

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. Because Ohios income tax begins with federal adjusted gross income your unemployment compensation is also taxable to Ohio on your IT 1040 return. That tax break will put a lot of extra.

1 day agoA good problem to fix. The agency will start with taxpayers eligible for a break on up 10200 of unemployment benefits. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break.

IRS delays tax due date to May 17 As Americans file their tax returns for 2020 --. Three others Arizona Ohio and Vermont didnt officially adopt the federal standard but their tax forms do allow eligible residents to claim the break essentially giving them the waiver. Along with the tax break Bidens bill also extended the 300 a week in federal unemployment benefits until September 6.

State Taxes on Unemployment Benefits. Ohio income tax update.

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Postpones Tax Filing Deadline To May 17 Matching The Irs Revised Deadline For Federal Taxes Cleveland Com

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Ohio Urges Victims Of Unemployment Fraud To Act Now To Avoid Tax Troubles Strauss Troy Co Lpa

Ohio Urges Victims Of Unemployment Fraud To Act Now To Avoid Tax Troubles Strauss Troy Co Lpa

Income Tax Season 2021 What To Know Before Filing In Ohio Across Ohio Oh Patch

Income Tax Season 2021 What To Know Before Filing In Ohio Across Ohio Oh Patch

Income School District Tax Department Of Taxation

Income School District Tax Department Of Taxation

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

Standard Deduction Vs Itemized Tax Deduction What S Better Standard Deduction Deduction Tax Deductions

New Ohio Tax Conformity Bill Passes Hw Co Cpas Advisors

New Ohio Tax Conformity Bill Passes Hw Co Cpas Advisors

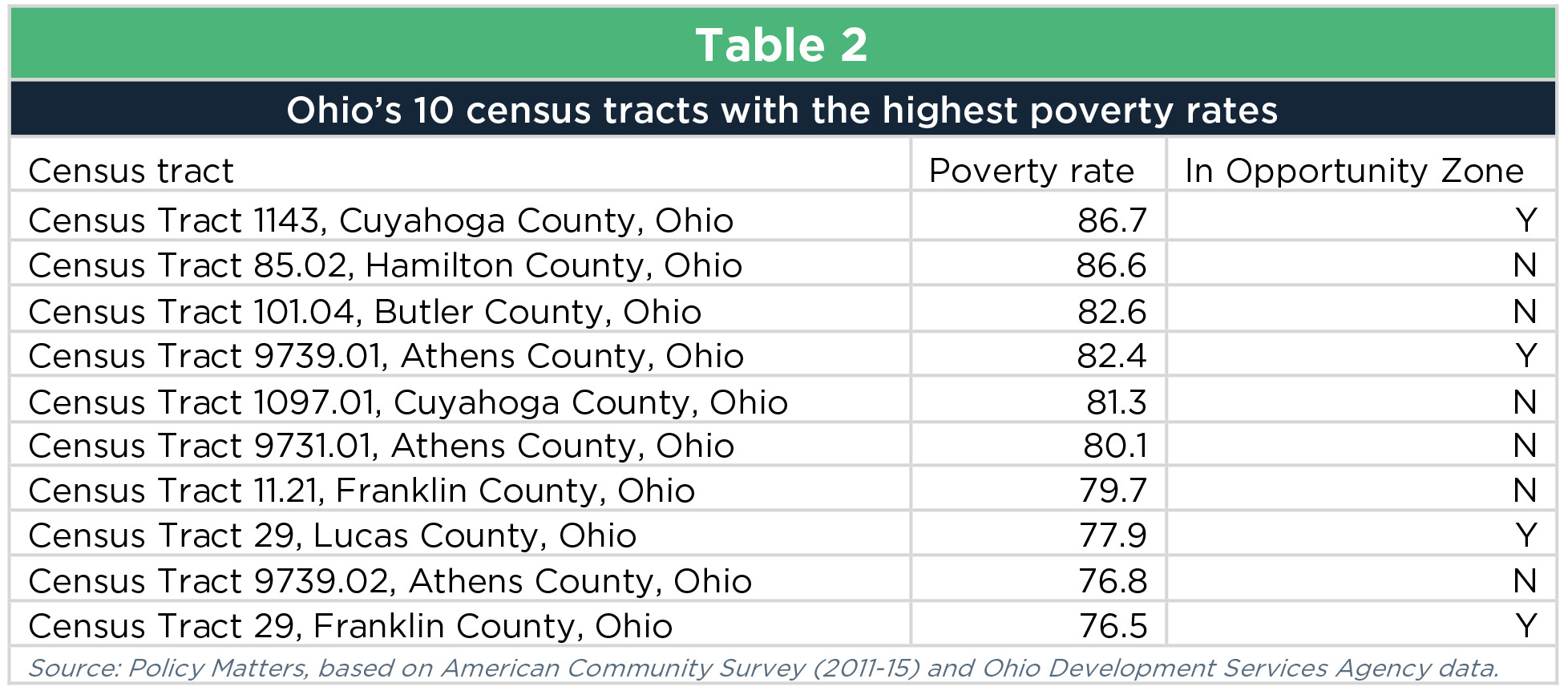

Assessing Opportunity Zones In Ohio

Assessing Opportunity Zones In Ohio

Expect 300 Retroactive Ohio Unemployment Supplemental Checks The Second Half Of September That S Rich Recap In 2020 Unemployment Student Loan Payment Federal Emergency Management Agency

Expect 300 Retroactive Ohio Unemployment Supplemental Checks The Second Half Of September That S Rich Recap In 2020 Unemployment Student Loan Payment Federal Emergency Management Agency

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

Did You Receive A 1099 G From The Ohio Department Of Taxation Or The Ohio Department Of Job And Family Services Department Of Taxation

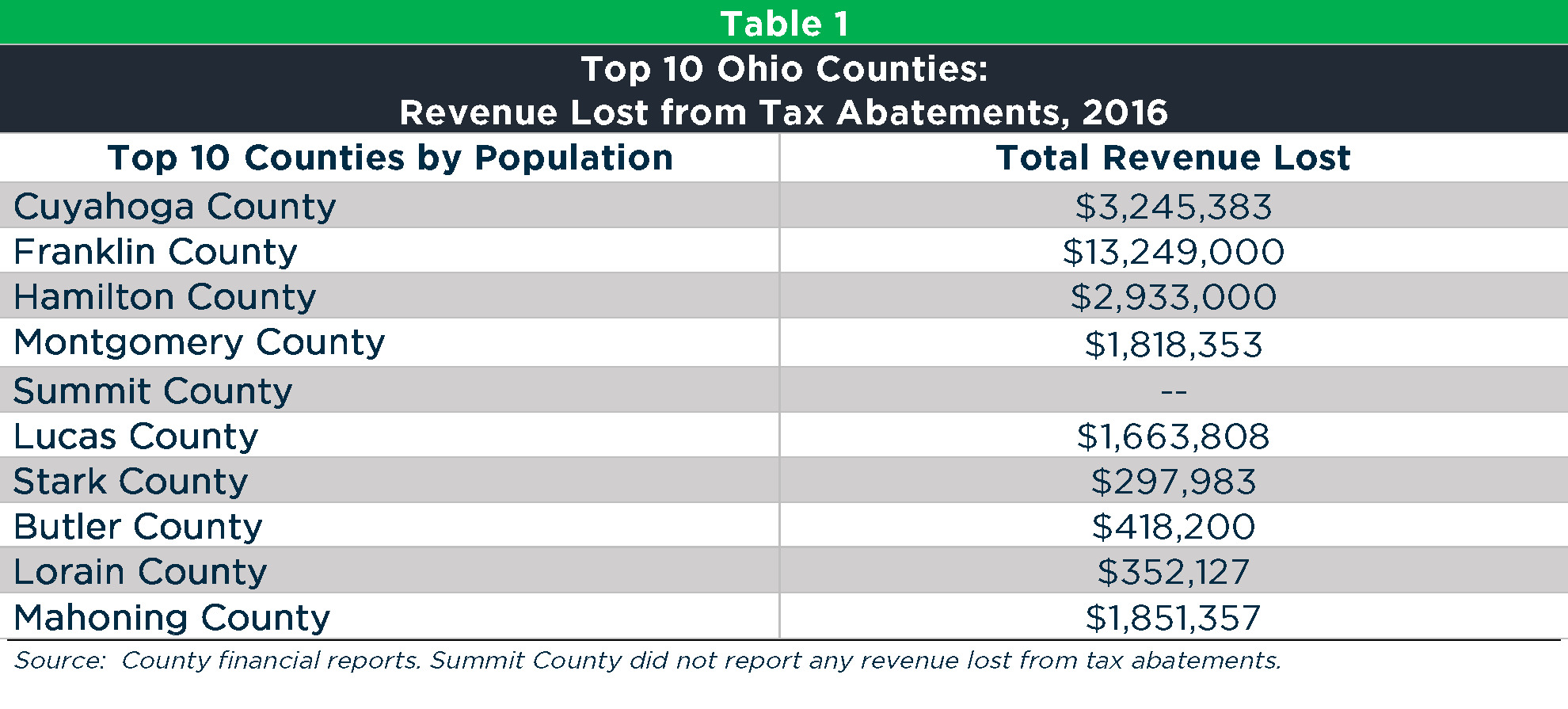

Local Tax Abatement In Ohio A Flash Of Transparency

Local Tax Abatement In Ohio A Flash Of Transparency

Post a Comment for "Unemployment Tax Break Ohio"