Unemployment Nj Extra 600

Federal Pandemic Unemployment Compensation. DOL enforces the Family and Medical Leave Act.

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Yes the extra 600 that the unemployed can receive as part of the expanded federal benefits is taxed by the federal government.

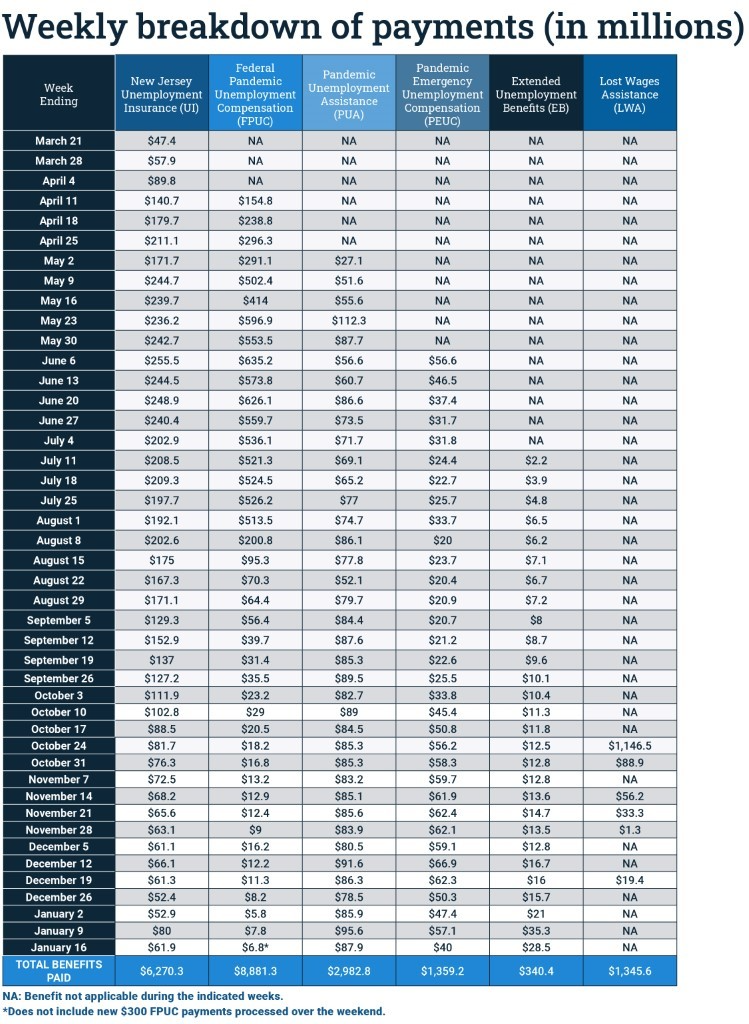

Unemployment nj extra 600. Lost Wages Assistance LWA also referred to as FEMA payments was a limited-time federal program that paid a 300 weekly supplemental benefit to most workers unemployed for a COVID-19 related reason during the weeks ending August 1 2020 through September 5 2020. You may also have been eligible for 600 per week on top of regular benefits retroactive to the week ending April 4 2020 through July 25 2020. Since March 15 Pennsylvania has distributed 135 billion under the program compared.

Unemployment benefits are not taxable for New Jersey. The New Jersey Division on Civil Rights enforces the NJ Family Leave Act and US. 1 House Democrats passed a 22 trillion relief package extending an extra 600-a-week unemployment check through January 2021.

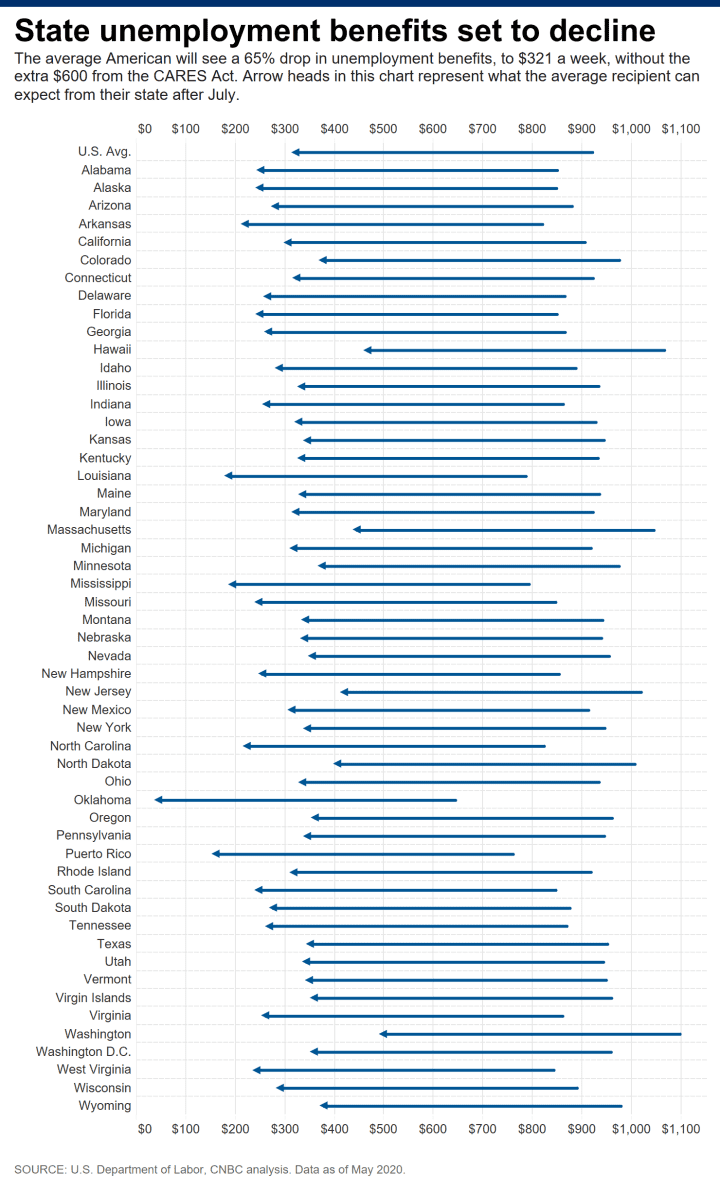

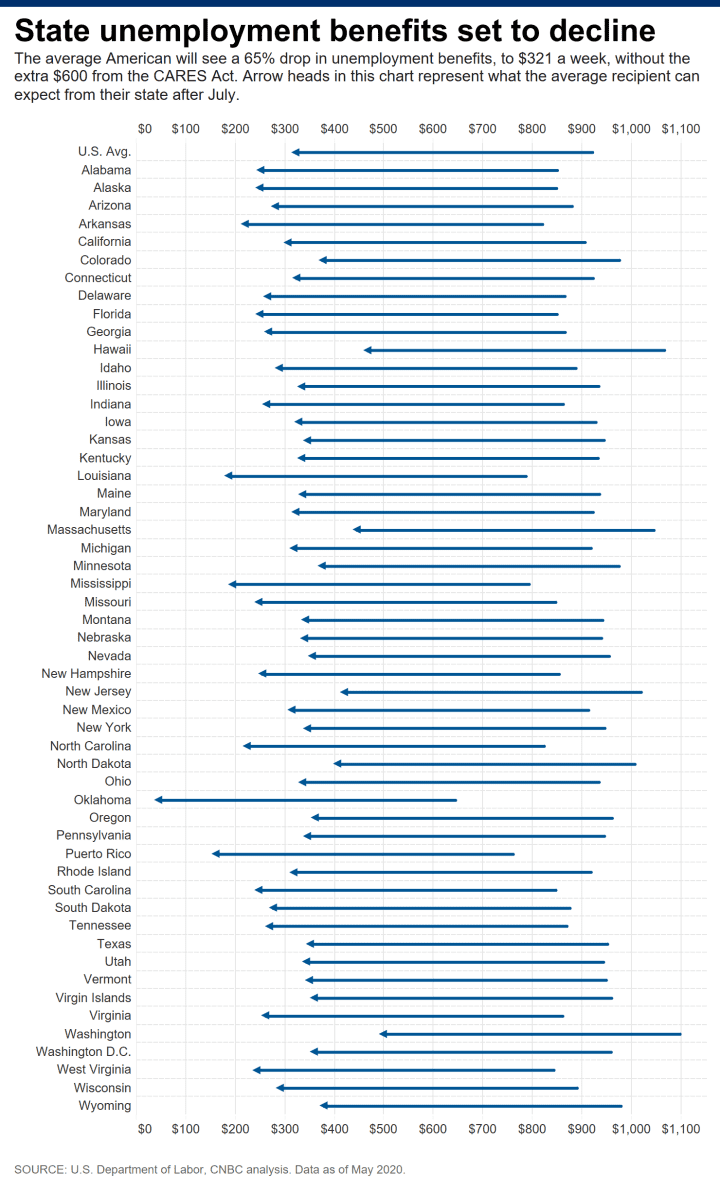

Just not from the 600. NJ workers currently claiming federal benefits will receive an additional 25 weeks. When it drops below 11 based on a three-month average it will start to phase out to 0 until the states unemployment rate drops below 6.

The AWRA proposal would continue to provide the full 600 extra weekly unemployment payment as long as the states unemployment rate is above 11. Thats down from the 400 federal. The last day to collect the benefit was July 25 so most eligible workers will see their final supplemental payment in the next week.

The option to withhold taxes was not available for the supplemental 600 and 300 Federal Pandemic Unemployment Compensation FPUC or 300 FEMA Lost Wages Assistance payments. On the other side Treasury Secretary Steven Mnuchin floated. Over the past three weeks more than 576000 New Jerseyans have filed for unemployment.

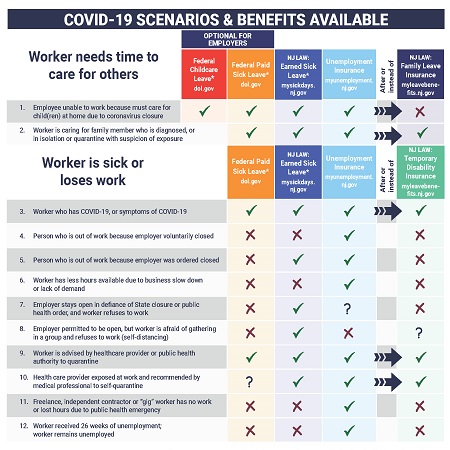

Provides an additional 300 per week to all PUA and regular Unemployment Insurance recipients from January 2 2021 through September 4 2021. You cannot receive pay or benefits from more than one programlaw at the same time. 6 for 300 more per week on top of what your state pays.

Oscar Gonzalez March 6 2021 814 am. You are responsible for paying any required federal taxes on any unemployment compensation payments you received in 2020 including these new COVID-19 related programs in 2020. Bidens 19 trillion COVID-19 relief package will extend enhanced unemployment benefits until Sept.

The 600 weekly unemployment supplement that had been available since April has put 75 billion into the pockets of out-of-work New Jerseyans. New Jersey does not tax unemployment benefits but the federal government does. Without the option to withhold.

The New Jersey Department of Labor website as of early Wednesday still said it intended to begin issuing the additional 600week compensation the end of the week of April 5 for payment of week. The 600 federal unemployment benefit has provided billions to Pennsylvania and New Jersey jobless workers. The federal American Rescue Plan Act was signed March 11 and extended unemployment benefits through Sept.

During the final week the extra 600 unemployment check was available more than 28000 New Jersey workers filed new unemployment claims the state Department of Labor said Thursday morning. It will be a separate payment from your regular unemployment benefit and will be available to those receiving benefits until July 25 2020. The extra federal unemployment insurance payments are set to expire soon but some recipients may need to pay taxes on the money.

Unemployment recipients started to get the 600 weekly payments on April 13. The additional 600week compensation will be issued beginning April 14 for the week of March 30. Some New Jersey unemploymentrecipients have started to receive their extra 600 weekly benefit from the coronavirus stimulus packageaccording to.

Unemployment Temporary Disability and Family Leave Insurance benefits require an application to the New Jersey Department of Labor. Anyone currently receiving unemployment in any amount will also receive the 300 weekly supplemental benefit. If you didnt elect to have federal taxes withheld you can go to.

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Kfor Com Oklahoma City

Extra 600 Unemployment Benefits Will Start Flowing As Early As This Week For A Lucky Few Kfor Com Oklahoma City

N J Unemployment Claims Rise Slightly As 600 Extra Federal Check Ends Nj Com

N J Unemployment Claims Rise Slightly As 600 Extra Federal Check Ends Nj Com

Nj Labor Department To Begin Making Pua Payments To Sole Proprietors And Independent Contractors Njbia New Jersey Business Industry Association

Nj Labor Department To Begin Making Pua Payments To Sole Proprietors And Independent Contractors Njbia New Jersey Business Industry Association

New N J Unemployment Claims Slow As Murphy Begins To Reopen State Nj Com

Njdol Jobless Residents Receive New Stimulus Payments

Njdol Jobless Residents Receive New Stimulus Payments

600 Checks Pushed Back A Week But Some Could See Retroactive Payments First State Update

How To Apply For The Free 600 Weekly Unemployment Benefit Youtube

How To Apply For The Free 600 Weekly Unemployment Benefit Youtube

Why Republicans Don T Want To Extend The 600 Unemployment Payments

Why Republicans Don T Want To Extend The 600 Unemployment Payments

More States Begin To Pay Additional 600 In Unemployment Aid Pbs Newshour

More States Begin To Pay Additional 600 In Unemployment Aid Pbs Newshour

Here S The Latest On When The Extra 300 Unemployment Checks Should Arrive In N J Nj Com

Here S The Latest On When The Extra 300 Unemployment Checks Should Arrive In N J Nj Com

Nj Unemployment Claims Fall As 600 Federal Weekly Supplement About To End Latest Headlines Pressofatlanticcity Com

Nj Unemployment Claims Fall As 600 Federal Weekly Supplement About To End Latest Headlines Pressofatlanticcity Com

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Trump Administration Opposes Extending Extra 600 Per Week For Unemployed Amid Coronavirus Crisis Abc7 New York

Trump Administration Opposes Extending Extra 600 Per Week For Unemployed Amid Coronavirus Crisis Abc7 New York

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Nj Applying For Extra 300 A Week In Federal Covid 19 Unemployment Benefits

Nj Applying For Extra 300 A Week In Federal Covid 19 Unemployment Benefits

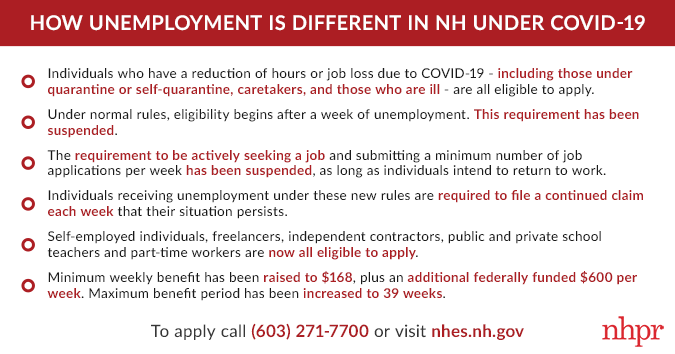

As Unemployment Surges In N H An Update On Changes To Benefits New Hampshire Public Radio

As Unemployment Surges In N H An Update On Changes To Benefits New Hampshire Public Radio

Coronavirus Update N J Unemployed Getting 600 Checks Whyy

Coronavirus Update N J Unemployed Getting 600 Checks Whyy

Post a Comment for "Unemployment Nj Extra 600"