Unemployment Mn Taxes 2020

Unemployment benefits are taxable under both federal and Minnesota law. The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020.

Https Rise Org Wp Content Uploads 2020 04 Application Step By Step Instructions Pdf

890 remains the maximum UI experience rate allowed under Minnesota law.

Unemployment mn taxes 2020. The federal government did include an additional amount. For more information read our announcement. 10 That extra 600 is also taxable after the first 10200.

The benefit only applies to those whose modified. Most states are following the federal governments lead and excluding PPP loans from taxable income according to the nonprofit Tax. Does the reason Im in Minnesota affect if I need to file a state Individual Income Tax for tax year 2020.

In the massive stimulus package enacted earlier this month lawmakers inserted a last-minute exemption for many taxpayers with up to 10200 of unemployment payments for 2020. 10200 in unemployment benefits wont be taxed leading to confusion amid tax-filing season. By Irina Ivanova March 19 2021 708 AM MoneyWatch.

However its all considered part of the unemployment package and it is all taxable. Welcome to the Minnesota Unemployment Insurance UI Program This is the official website of the Minnesota Unemployment Insurance Program administered by the Department of Employment and Economic Development DEED. The Legislature made this change to ensure that pandemic-related unemployment in 2020 did not affect 2021 tax rates.

View new employer rates for 2021. This would apply only to tax year 2020. You could get an additional 2000 or 5000 tax refund later this spring.

2 You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. What if Im in Minnesota due to COVID-19. As for those refunds aids and credits the biggest difference maker on the budgetary bottom line would be creating a tax subtraction for unemployment benefits up to 10200 for those with gross incomes under 150000.

Minnesota full-year and part-year residents are required to file a Minnesota income tax return if their. It provided an additional 600 per week in unemployment compensation per recipient through July 2020. Minnesota is taxing your un-employment benefits.

Under the latest stimulus package you will not be not taxed on the first 10000 of unemployment pay in 2020. The 19 trillion American Rescue Plan allows those who received unemployment benefits to deduct 10200 in payments from their 2020 income. Your 2021 UI experience rate or new employer rate will be calculated the same as it was in 2020.

With tax season in full swing Minnesota businesses and individual filers remain in limbo about whether they owe the state for pandemic relief. As tax bills come due some Minnesotans have been surprised to learn that extra unemployment payments through the CARES Act and later executive action didnt have taxes withheld. Taxpayers now have until May 17 2021 to file and pay their 2020 Minnesota Individual Income Tax without any penalty or interest.

The Minnesota Senate is moving quickly on state tax relief for some businesses and unemployed workers who received federal pandemic aid arguing lawmakers must act. Theyve always been taxable and 2020 is not an exception for that Reimer said. If you received an unemployment benefit payment at any point in 2020 we will provide you a tax document called the 1099-G.

Your 1099-G will give you the information you need to accurately report your unemployment benefits on your state and federal tax returns including. The 19 trillion Covid relief measure limits that break to. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from.

The relief bill includes a provision that waives federal taxes on the first 10200 in unemployment insurance income for individuals who have 2020 adjusted gross income of less than 1.

Minnesota Has Highest Covid 19 Death Rate And Highest Unemployment Rate Out Of Any Neighboring State

Minnesota Has Highest Covid 19 Death Rate And Highest Unemployment Rate Out Of Any Neighboring State

Minnesota Unemployment Relief For Covid 19

Minnesota Unemployment Relief For Covid 19

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Covid 19 Policy Updates Minnesota Chamber Of Commerce

Covid 19 Policy Updates Minnesota Chamber Of Commerce

As High Unemployment Persists Minnesota Borrows To Pay More Benefits Federal Reserve Bank Of Minneapolis

As High Unemployment Persists Minnesota Borrows To Pay More Benefits Federal Reserve Bank Of Minneapolis

Do I Pay Taxes On Unemployment What About My Stimulus Check

Do I Pay Taxes On Unemployment What About My Stimulus Check

Minnesota Unemployment Experience Unemployment

Minnesota Unemployment Experience Unemployment

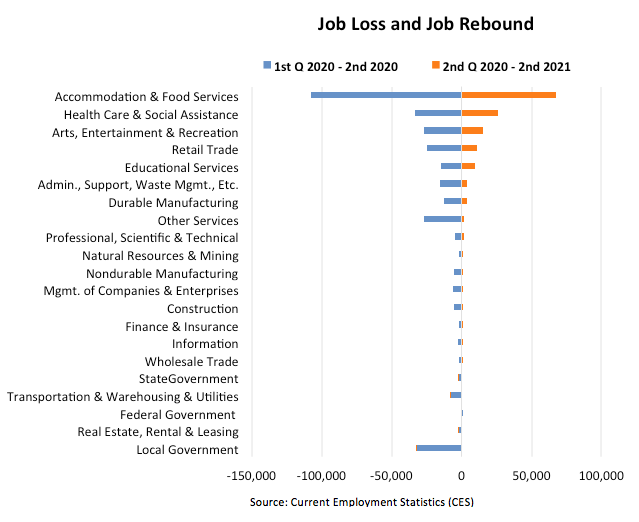

Minnesota Employment Forecast Second Quarter 2020 To 2021 Minnesota Department Of Employment And Economic Development

Minnesota Employment Forecast Second Quarter 2020 To 2021 Minnesota Department Of Employment And Economic Development

Minnesota Account Balance Is 0 What Does This Mean Unemployment

Minnesota Account Balance Is 0 What Does This Mean Unemployment

How Unemployment Benefits Stimulus Checks Could Impact Your 2020 Tax Returns

How Unemployment Benefits Stimulus Checks Could Impact Your 2020 Tax Returns

Extra Unemployment Benefits May Not Be Taxed After All Session Daily Minnesota House Of Representatives

Extra Unemployment Benefits May Not Be Taxed After All Session Daily Minnesota House Of Representatives

For Unemployment During The Covid 19 Pandemic Minnesota Is Below Average Minnpost

For Unemployment During The Covid 19 Pandemic Minnesota Is Below Average Minnpost

Covid 19 Coronavirus Resources International Institute Of Minnesota

Covid 19 Coronavirus Resources International Institute Of Minnesota

Extra Unemployment Benefits May Not Be Taxed After All Session Daily Minnesota House Of Representatives

Extra Unemployment Benefits May Not Be Taxed After All Session Daily Minnesota House Of Representatives

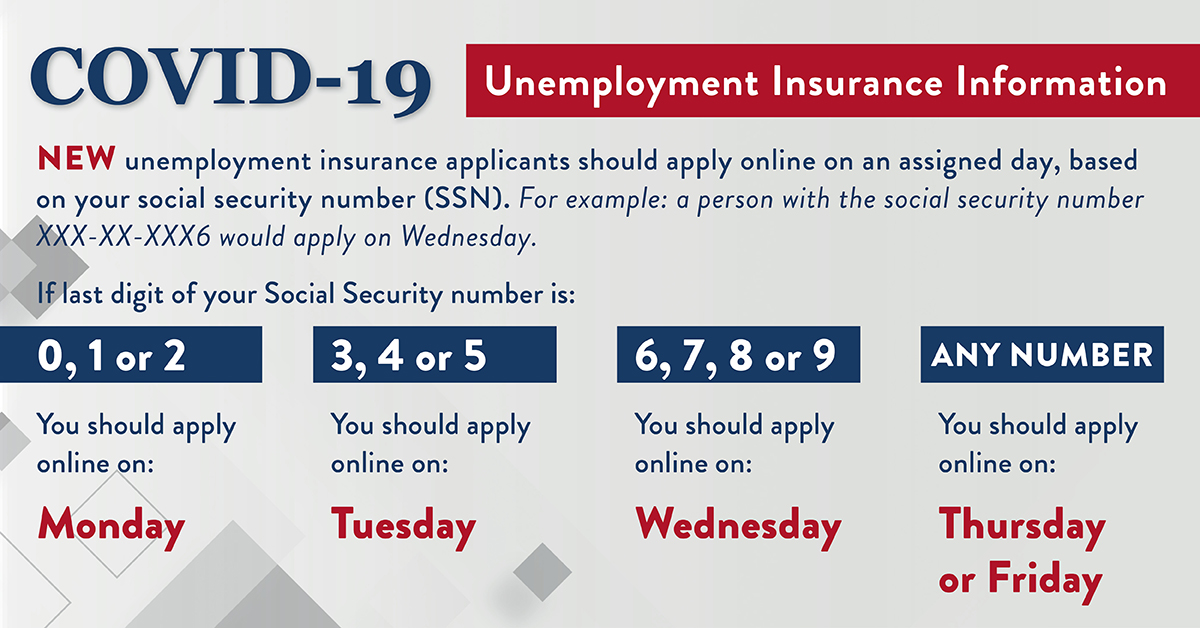

Minnesota Unemployment Faqs Winona Public Library

Minnesota Unemployment Faqs Winona Public Library

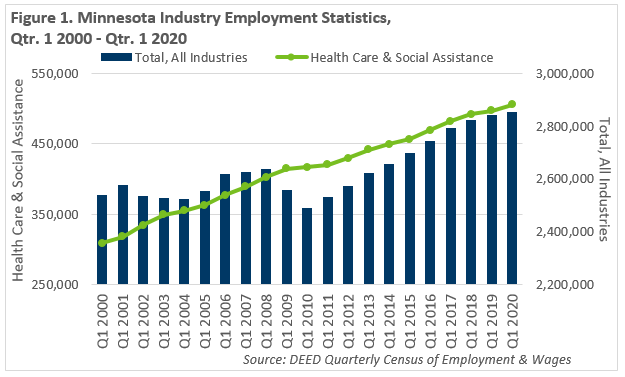

Minnesota S Health Care Employment Amid A Pandemic Minnesota Department Of Employment And Economic Development

Minnesota S Health Care Employment Amid A Pandemic Minnesota Department Of Employment And Economic Development

Minnesota Tax Forms 2020 Printable State Mn Form M1 And Mn Form M1 Instructions

Minnesota Tax Forms 2020 Printable State Mn Form M1 And Mn Form M1 Instructions

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Post a Comment for "Unemployment Mn Taxes 2020"