Unemployment Insurance Ohio Employer

The SOURCE State of Ohio Unemployment Resource for Claimants and Employers. These factors are recorded on the employers account and are used to compute the annual tax rate after the employer becomes eligible for an experience rate.

Https Jfs Ohio Gov Ouio Employeroutreach Employeroutreachwebinar September2019 Stm

However you may remain anonymous.

Unemployment insurance ohio employer. Please complete one form for each assistance program where you suspect fraud may be occurring. Ohio employers can manage their unemployment compensation accounts online. Highlighted below are two important pieces of information to help you register your business and begin reporting.

Ohio will soon have a new unemployment insurance system. It is important to include as much information as possible. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees.

To pay that back would be a huge cost to Ohio businesses who are trying desperately to recover. The SOURCE will provide a user-friendly. Applying online is the quickest way to start receiving unemployment benefits.

To receive your Unemployment tax account number and contribution rate immediately please visit the Employer. To apply online employees should go to unemploymentohiogov. A New Opportunity to Evaluate Potential Employees The Ohio Learn to Earn OLE program is a new statewide initiative developed by the Ohio Department of Job and Family Services.

You have at least one employee in covered employment for some portion of a day in each of 20 different weeks within either the current or the preceding calendar year. Report it by calling toll-free. If you receive an unemployment insurance overpayment because of unreported or underreported wagesearnings you must repay that debt to ODJFS within 60 days.

How to Obtain an Employer Account Number. 1 day agoDue to the COVID pandemic Ohio is already over 14 billion in unemployment compensation debt. If employees dont have access to a computer they can apply by phone by calling 877-644-6562.

Cash assistance Ohio Works FirstOWF recipient. If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax. Employer Resource Information Center The Employer Resource Information Center ERIC is a self-service unemployment compensation tax.

In Ohio employers are required to submit their Quarterly Tax Return electronically. Employer Liability In most situations you are considered a liable employer under the Ohio unemployment law if you meet either of the following requirements. Eliminating Ohios outstanding federal unemployment loan balance and shoring up the states trust fund will prevent employers from facing an estimated tax increase in 2022 of over 100 million and could save employers as much as 658 million in tax increases over a three-year period said Ohio Chamber of Commerce President and CEO Andrew E.

The UI tax funds unemployment compensation programs for eligible employees. Click here for a step-by-step guide to applying online. Eliminating Ohios outstanding federal unemployment loan balance and shoring up the states trust fund will prevent employers from facing an estimated tax increase in 2022 of over 100 million and could save employers as much as 658 million in tax increases over a three-year period said Ohio Chamber of Commerce President and CEO Andrew.

For employers approved by the Office of Unemployment Insurance Operations to submit reports by paper please use the Ohio Unemployment Quarterly Tax Return JFS-20125. Employers with questions can call 614 466-2319. 1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a.

In Ohio state UI tax is just one of several taxes that employers must pay. Payments for the first quarter of 2020 will be due April 30. Unemployment insurance ERIC allows employers and third-party administrators to manage all their business related to unemployment contributions online.

Click below to access the desired unemployment compensation account. If you do not the overpayment will be reported to the Ohio Attorney General for collection and any federal income tax refund owed to you could be intercepted. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes.

Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. Unemployment benefits paid to eligible claimants are charged to the accounts of the claimants employers during the base period of the claim.

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

3 Ways To File An Ohio Unemployment Claim Wikihow

3 Ways To File An Ohio Unemployment Claim Wikihow

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

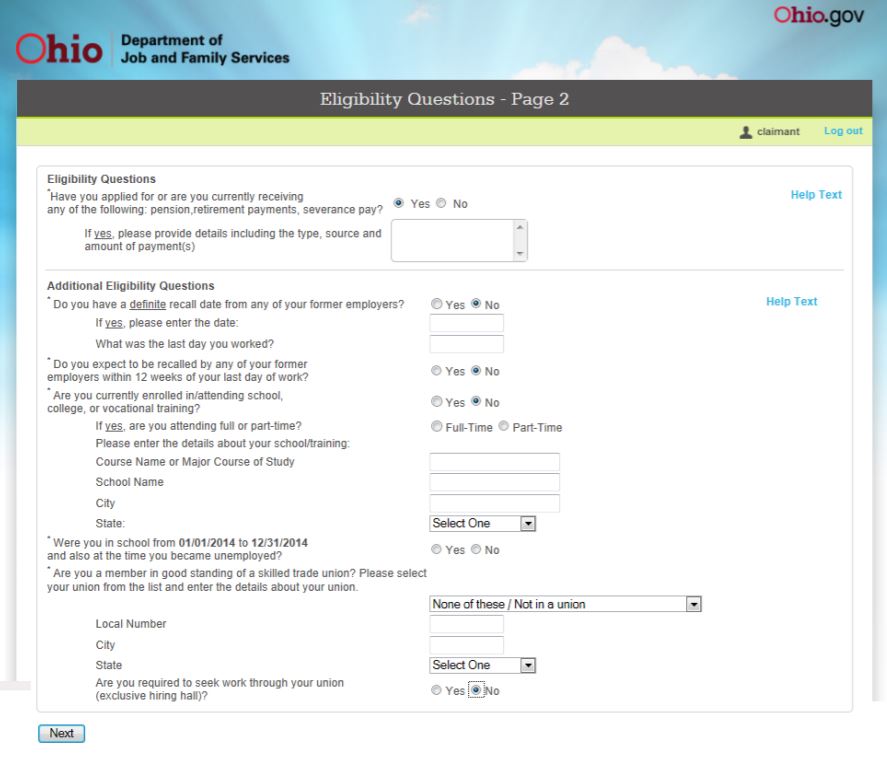

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

How To Get Unemployment Benefits In Ohio Applications In United States Application Gov

How To Get Unemployment Benefits In Ohio Applications In United States Application Gov

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Number Of Ohioans Who Filed For Unemployment Continues To Decline For 8th Straight Week

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Contact For Ohio Unemployment Benefits

Contact For Ohio Unemployment Benefits

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Post a Comment for "Unemployment Insurance Ohio Employer"