Suta Tax Rate 2020 Michigan

Treasury and Tax Forms. Rates range from 006 to 103 of each employees income up to a wage base of 9500.

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Cheshire Twp 031030 ALLEGAN PUBLIC SCHOOL 331314 511314 271314 391314 331314 511314 BLOOMINGDALE PUBLIC S 324042 503538 264042 383538 324042 503538 Clyde Twp 031040 FENNVILLE PUBLIC SCHO 304224 484224 244224 364224 304224 484224 Dorr Twp 031050.

Suta tax rate 2020 michigan. Browse Forms by Type. But these cities charge an additional income tax ranging from 10 to 24 for Michigan residents. Best and Free Paystub Templates to use in 2020 View More.

If your business is new the unemployment tax rate is set at. Telephone conversation 2020 taxable wage base expected to stay 9000 but unconfirmed until February 2020. Your Michigan tax liability has the potential to increase over prior years when the taxable wage base was 9000 due to the current years increase.

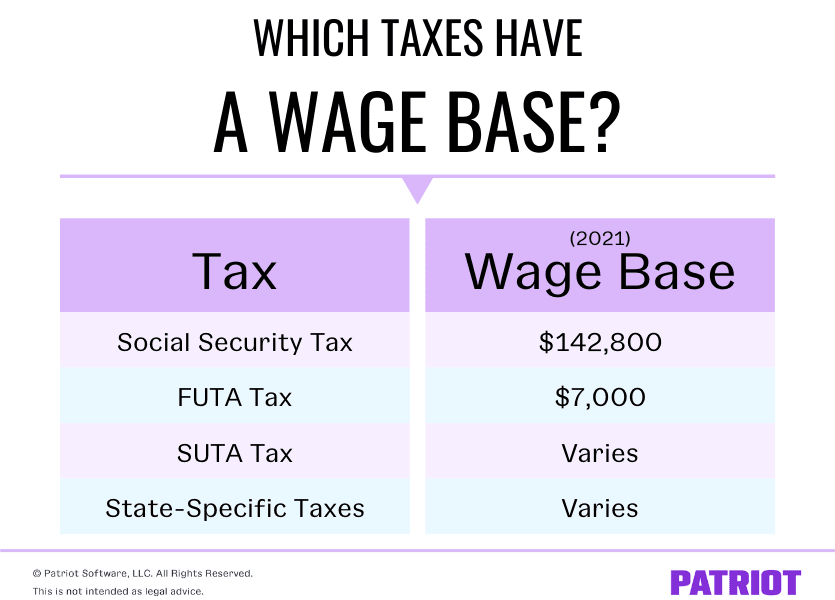

Updated June 29 2020 Save as PDF. This 7000 is known as the taxable wage base. Authorized Representative Declaration Power of Attorney.

Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well. The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year. 425 Personal Exemption.

Tax Rate - New Owner Acquires Existing Business or Businesses Merge. 20 rows 2020 STATE WAGE BASES 2019 STATE WAGE BASES 2018 STATE WAGE BASES. An extension of the 100 federal reimbursement of regular state extended unemployment benefits.

Plus you also need to factor in Michigans state unemployment insurance SUI. According to an UIA representative the basic 2020 SUI tax rates continue to range from 006 to 103. An income tax exclusion of 10200 for unemployment benefit income in the 2020 tax year for households with adjusted gross incomes under 150000.

2013 legislation HB 168 increased the SUI taxable wage base to a minimum of 10500 and a maximum of 18500 by tying the wage limit to the balance of the states unemployment trust fund the higher the trust fund balance the lower the taxable wage base. 425 Personal Exemption. 52 rows Each state has a standard SUTA tax rate for new employers and it will be different for employers who are in the business for long.

52 rows For example all new employers receive a SUTA rate of 125 in Nebraska. In 2020 the Trust Fund balance fell below 25B therefore. Each state sets a range of minimum and maximum tax rates for state unemployment taxes.

Calendar Year 2020 Information. Michigan 270 006 103 9500 Minnesota. Still have questions.

425 Personal Exemption. 4050 2019 Michigan Income Tax. 2020 Unemployment Insurance Tax Rate Schedules 2020 Taxable Wage Base is 37900 This amount is set annually and is 70 of a statewide average wage New Employer Rate Positive Balance Negative Balance Non-Construction 102 609 Construction 969 969 New Employers are Non-construction covered after June 30 2018.

An extension of federal funding for the first week of regular unemployment benefits. Generally in the first two years of a businesss liability the tax rate is set by law at 27 except for employers in the construction industry whose rate in the first two years is that of the average employer in the construction industry which is announced by UIA early each year. Calendar Year 2018 Information.

For 2020 the FUTA tax rate is projected to be 6 per the IRS. 2019 legislation HB 198 freezes the taxable wage base at 16500 for 2020 under the bill language from July 1 2019 to October 29. 4750 2020 Michigan Income Tax Withholding Tables Calendar Year 2019 Information.

Next youll need to know your states SUTA tax rate. Through the State Unemployment Tax Act. The tax rate assigned to a particular firm is within that specified range but will vary based on an individual companys assessment.

Your SUTA tax rate. August 28 2020 2020-2141 Michigan employers should expect to see an increase in the state unemployment insurance SUI taxable wage base from the 9000 that has been in effect for the past several years to the 9500 currently only required to be used by delinquent employers. When a business finds itself in a financial bind sometimes layoffs feel like the only option.

4400 2019 Michigan Income Tax Withholding Tables.

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

The True Cost To Hire An Employee In Texas Infographic

The True Cost To Hire An Employee In Texas Infographic

What Are Quarterly Wage Reports And Why Do They Matter Smallbizclub

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

What Are Employee And Employer Payroll Taxes Ask Gusto

What Are Employee And Employer Payroll Taxes Ask Gusto

Suta State Unemployment Taxable Wage Bases Aps Payroll

Suta State Unemployment Taxable Wage Bases Aps Payroll

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Suta Tax Rate Increase 2020 State By State Gusto

Suta Tax Rate Increase 2020 State By State Gusto

Suta Tax Your Questions Answered Bench Accounting

Suta Tax Your Questions Answered Bench Accounting

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

What Is The Futa Tax 2021 Tax Rates And Info Onpay

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes C100 Louisiana Louisiana S Business Roundtable

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes C100 Louisiana Louisiana S Business Roundtable

Covid 19 Will Your Suta Tax Rate Go Up Workest

Covid 19 Will Your Suta Tax Rate Go Up Workest

What Is A Wage Base Definition Taxes With Wage Bases More

What Is A Wage Base Definition Taxes With Wage Bases More

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

Post a Comment for "Suta Tax Rate 2020 Michigan"