New Stimulus Bill Non Taxable Unemployment

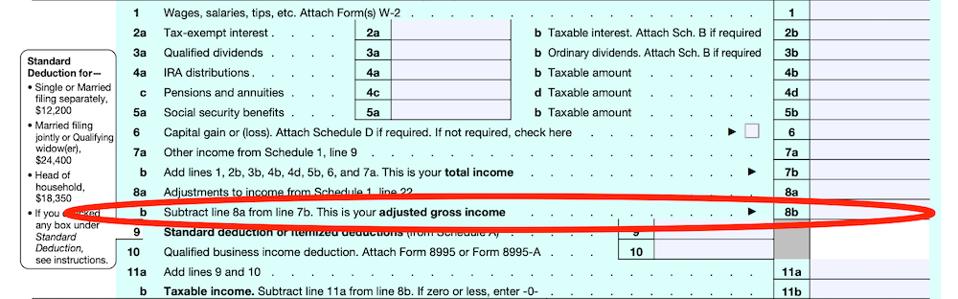

The IRS will send refunds for that tax break but you may need to wait for the money. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Direct Deposits Of 1 200 Stimulus Checks Will Start Arriving Wednesday Daily Mail Online Tax Refund Irs Checks

Direct Deposits Of 1 200 Stimulus Checks Will Start Arriving Wednesday Daily Mail Online Tax Refund Irs Checks

Dick Durbin D-Ill and Rep.

New stimulus bill non taxable unemployment. Unemployment compensation can affect your tax bill in other ways. Under the new stimulus bill that is due to come out they approved the exemption of taxable unemployment benefit income for 10200. For married couples this amount would be 20400.

The Upshot It is unclear if Durbin and Axnes bill will make its way into the 19 trillion stimulus package that President Joe Biden has proposed. A new tax break in the American Rescue Plan Act makes the first 10200 of unemployment benefits received in 2020 non-taxable for households with incomes under 150000. Because the new relief bill exempts the first 10200 from taxes youd only be taxed on 4800 if you received that same 15000 of unemployment benefits in 2020.

Although unemployment benefits are taxable the new. But as part of the new relief bill jobless workers are entitled to a federal tax break on their first 10200 of unemployment benefits. This only applies to taxpayers whose Adjusted Gross Income AGI for 2020 is.

2 days agoThe Internal Revenue Service is telling people not to file amended returns after the recent stimulus packages tax break on the first 10200 of unemployment benefits. I have my taxes completed but not filed because I have been waiting for this legislation. 2 days agoHowever the most recent stimulus bill signed into law by President Joe Biden makes up to 10200 of unemployment compensation received last year tax-deductible provided the individual who.

However with the new stimulus bill up to 10200 in last years unemployment payments can be exempt from taxes if your adjusted gross income AGI is less than 150000 according to new. Americans who lost their jobs last year and have already filed their tax returns will have one less headache to deal with. The amendment in the final stimulus bill will make the first 10200 in unemployment benefitscompensation received in 2020 non-taxable ie.

The latest stimulus bill allows tax exemptions for up to 10200 in unemployment benefits paid in 2020. Those receiving unemployment benefits will not need to pay federal income taxes on the first 10200 as long their 2020 adjusted gross income was less than 150000. The current package does not include a tax.

House Budget Committee Chairman Cody Smith R-Carthage is calling on lawmakers to waive the state income tax of unemployment payments. If you chose to withhold. This rule applies to those with an income of less than.

The bill is expected to be signed into law this week by President Joe Biden and says that the first 10200 in jobless benefits will be non-taxable for households with incomes under 1500000. Cindy Axne D-Iowa introduced a bill on Tuesday that would waive taxes on the first 10200 in unemployment benefits that individuals received last year. The recent stimulus bill includes a tax break on unemployment income.

President Joe Bidens American Rescue Plan passed on March 11 included another round of stimulus checks more money for the child tax credit and more weeks of bonus 300 unemployment. Unemployment benefits are considered taxable income but the new law provides a tax break. The weekly supplemental benefit which is provided on top of your regular benefit will remain 300 but run through Sept.

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Pin By Bea Vaquero On Concept In 2020 Student Loan Payment Children S Day Unemployment

Pin By Bea Vaquero On Concept In 2020 Student Loan Payment Children S Day Unemployment

Where To Add Your Stimulus Money On Your Tax Return Taxact Blog

Where To Add Your Stimulus Money On Your Tax Return Taxact Blog

Stimulus Check Update Why You May Want To File Taxes Asap To Get The Correct Amount

Stimulus Check Update Why You May Want To File Taxes Asap To Get The Correct Amount

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Youtube Student Loans Irs Irs Website

Youtube Student Loans Irs Irs Website

2021 Taxes A Comprehensive Guide To Filing Money

2021 Taxes A Comprehensive Guide To Filing Money

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be News Wfsb Com

Why Stimulus Checks May Appear To Impact Your 2021 Tax Refund Abc11 Raleigh Durham

Why Stimulus Checks May Appear To Impact Your 2021 Tax Refund Abc11 Raleigh Durham

Irs Claim Your 1 200 Stimulus Check By November 21 Irs Student Loans Irs Website

Irs Claim Your 1 200 Stimulus Check By November 21 Irs Student Loans Irs Website

If The Senate And House Can Agree To Send Another Economic Stimulus Payment To You And That S Not Guaranteed Th Incentives For Employees Cnet Tax Credits

If The Senate And House Can Agree To Send Another Economic Stimulus Payment To You And That S Not Guaranteed Th Incentives For Employees Cnet Tax Credits

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Post a Comment for "New Stimulus Bill Non Taxable Unemployment"