Does Unearned Income Count As Unemployment

Depending on the state you live in you may need to pay both federal and state income taxes. Unearned income in-kind supplied Excluded.

What Unearned Income Means On A Dependent S Income Tax Return Cpa Practice Advisor

What Unearned Income Means On A Dependent S Income Tax Return Cpa Practice Advisor

If the individual does not have a federal tax return available from the previous year.

Does unearned income count as unemployment. Specifically excluded from this definition is any unemployment compensation you receive from your state. While unemployment benefits are taxable they arent considered earned income. Here is some more information about unemployment benefits of which you may be unaware.

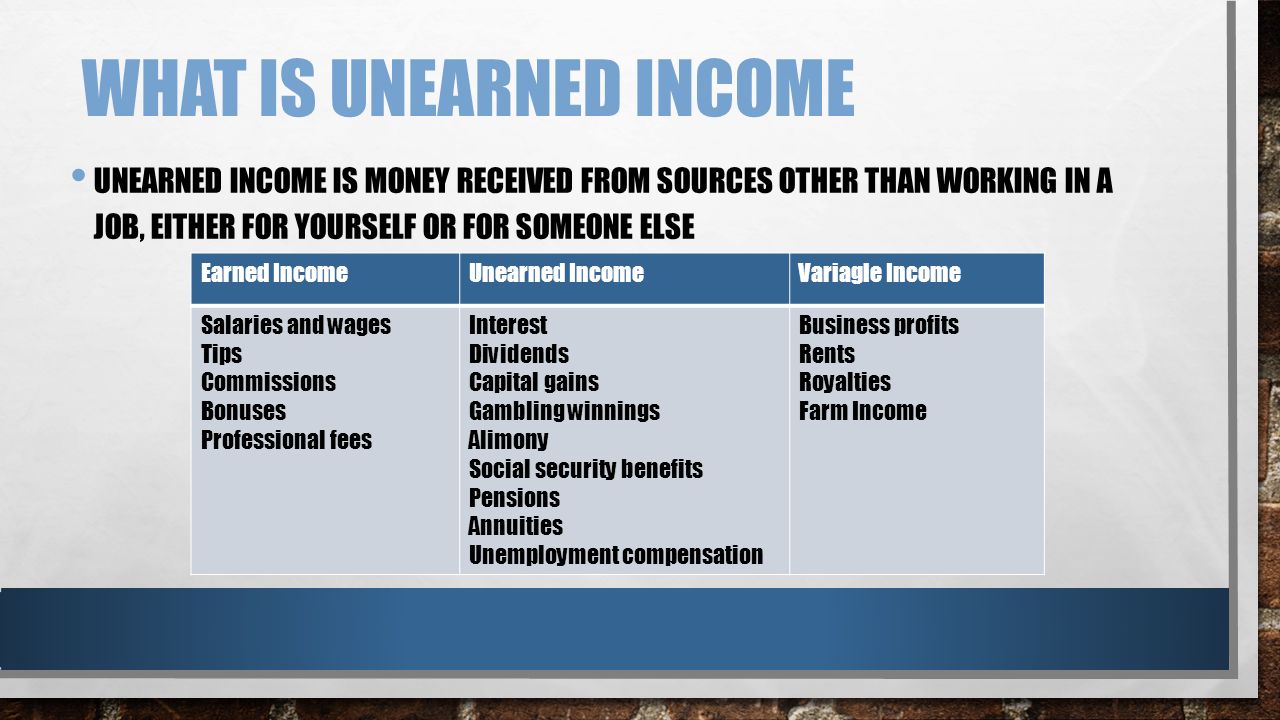

Unearned income includes taxable interest ordinary dividends capital gains including capital gain distributions rents royalties etc. Unearned Income is all income that is not earned such as Social Security benefits pensions State disability payments unemployment benefits interest income dividends and cash from friends and relatives. Yes unemployment benefits are a form of unearned income thats taxable and reportable on federal and state returns.

Income and Unemployment Benefits Eligibility for unemployment benefits is determined in part by your recent income from working. If this is the case consider the individual self-employed. For Form 8615 unearned income includes all taxable income other than earned income.

Count the result as self-employment income taking into account any changes for the prorated period. While it doesnt count towards your earned income total it does count towards your total amount of income received for the taxable year. Under normal circumstances receiving unemployment would result.

It also includes taxable social security benefits pension and annuity income taxable scholarship and fellowship grants not reported on Form W-2 unemployment. You CAN collect unemployment benefits if you have passive income. Unemployment compensation The IRS defines earned income as the compensation you receive from employment and self-employment.

For Medicaid the additional 600 per week of PUC is not countable and should be excluded in determining eligibility but other UI benefits are counted. As long as you didnt perform any work you can be eligible to get unemployment benefits. State unemployment insurance departments consider earnings to be reportable income for both figuring initial benefits and deducting part-time work and other earnings from weekly benefits.

If youre collecting unemployment benefits and youre smart the amount youre receiving is an after-tax amount. If youre receiving federal pandemic unemployment compensation include the additional 300 you get each week in your estimate. You can make 1000 a year or 100000 a year in unearned passive income and still collect unemployment insurance benefits.

Theres no limit either. Learn more from the US. Examples of unearned income include interest from savings accounts bond.

I understand unemployment is unearned income the 14000 and the 1500 she received from her job is earned income. Unemployment Compensation UC - before deductions. For figuring base pay earnings is straightforward -- the full amount of compensation that your former employer paid you.

But what does support mean. Does the unearned income count towards her own support. For those already receiving UI the full benefit amount counts as unearned income for SNAP at application.

Unemployment income is treated the same as unearned income from investments. The short answer is yes it does. So does unemployment count as income.

Revenue Act of 1978. Uniform Relocation Assistance Real Property Acquisition Policies Act of 1970 PL 94-646 section 218. Once youve applied for and been approved for benefits some types.

Unemployment insurance benefits including Pandemic Unemployment Assistance and Federal Pandemic Unemployment Compensation are considered unearned income and wont affect Social Security. Rental income should be considered unearned income if the individual is not self-employed. You might evaluate if they should file their own return.

Unearned income is income from investments and other sources unrelated to employment. There are a few places where they ask about earned vs unearned income. In-Kind Income is food shelter or both that you get for free or for less than its fair market value.

Include all unemployment compensation including unemployment compensation as a result of the coronavirus disease 2019 COVID-19 emergency. If it does then no I did not provided more the 50 oh her support. Working young adults are special Kiddies.

Overview Of How Income Is Calculated With Respect To Medicaid By Todd A Spodek Spodeklawgroup Medium

Overview Of How Income Is Calculated With Respect To Medicaid By Todd A Spodek Spodeklawgroup Medium

Https Www Sccgov Org Sites Ssa About Us Debs Policy Handbooks Policy Handbook Calworks Afchap28 Pdf

Onjuno What Is Unearned Income

Onjuno What Is Unearned Income

Determining Income Type Differences With Earned Unearned Income

Determining Income Type Differences With Earned Unearned Income

Chapter 2 Income Benefits And Taxes What Is

Chapter 2 Income Benefits And Taxes What Is

Tax Rates Separating Earned Unearned Income

Tax Rates Separating Earned Unearned Income

Unearned Income And Payments Ppt Download

Unearned Income And Payments Ppt Download

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Onjuno What Is Unearned Income

Onjuno What Is Unearned Income

2 2 Unearned Income And Payment Ppt Video Online Download

2 2 Unearned Income And Payment Ppt Video Online Download

Paycheck Basics Personal Finance Income Unearned Income An Individual S Income Derived From Sources Other Than Employment Such As Incomesourcesemployment Ppt Download

Paycheck Basics Personal Finance Income Unearned Income An Individual S Income Derived From Sources Other Than Employment Such As Incomesourcesemployment Ppt Download

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

8615 Filing Requirements And Ef Message 5292 Who Is Required To File Form 8615 How Do I Clear Ef Message 5292 According To Form 8615 Instructions Form 8615 Must Be Filed For Any Child Who Meets All Of The Following Conditions 1 The Child Had

8615 Filing Requirements And Ef Message 5292 Who Is Required To File Form 8615 How Do I Clear Ef Message 5292 According To Form 8615 Instructions Form 8615 Must Be Filed For Any Child Who Meets All Of The Following Conditions 1 The Child Had

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Inc Federal Income Tax Tax Preparation Social Security Benefits

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Inc Federal Income Tax Tax Preparation Social Security Benefits

Https Www Disabilityrightspa Org Wp Content Uploads 2020 04 Wipa 1 Pdf

Post a Comment for "Does Unearned Income Count As Unemployment"