Does Puerto Rico Have Unemployment Benefits

Be prepared to provide basic information such as the address of your employer and the dates you worked there. These funds are processed through the Department of Labor of Puerto Rico.

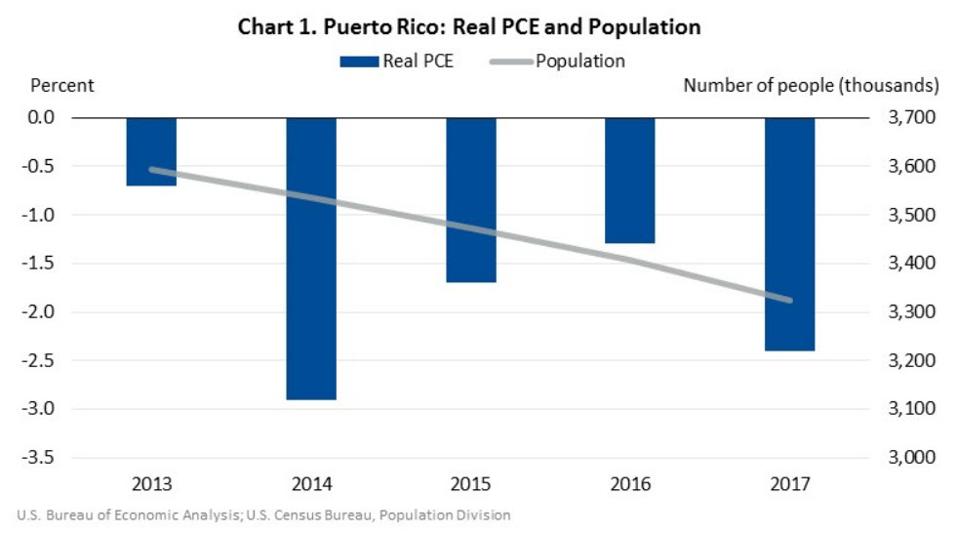

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Someone who was self-employed or who worked as a gig worker freelancer or contractor who doesnt typically receive unemployment benefits after being laid off could receive PUA instead.

Does puerto rico have unemployment benefits. The maximum duration of PUA benefits increases to 79 weeks up to 86 weeks in high-unemployment states and for PEUC up to 53 weeks. Federal Unemployment Tax and the Puerto Rico unemployment compensation tax. The notification must be in writing and made at the time of.

To see if you are eligible to receive these benefits and what additional information is needed when applying find out how to file your Puerto Rico unemployment claim. The 1400 stimulus checks from the Biden Administrations US. Currently PR unemployment benefits lag significantly behind those in US.

You must report any unemployment benefits you receive as part of your gross income on your taxes. In order to continue receiving Puerto Rico unemployment benefits you must be able to show the Department of Labor that you are actively seeking work and have not turned down offers for suitable employment. Employees cannot claim Temporary Non.

April 22 2020. Rescue Plan for residents of Puerto Rico a US. While unemployed workers in many places can receive 500 or more in one week even a highly-paid workers Puerto Rico unemployment benefits will.

However only employees are eligibleself-employed individuals are not. Mixed Earner Unemployment Compensation which gives some. Among the new unemployment-related benefits for Puerto Rico employees are.

Self-employed individuals were instead able to apply for a one-time 500 grant until May 1. Here is the contact information including websites and phone numbers for filing unemployment claims in. Every state is different but typically you have to apply for benefits through the labor department or unemployment agency in the state where you worked not where you live.

Puerto Rico Issues FAQs on Unemployment Benefits during COVID-19 Crisis April 17 2020 The Puerto Rico Department of Labor and Human Resources PR DOL has issued FAQs regarding unemployment benefits during the COVID-19 pandemic. Territory will not begin to arrive until at least May because the Internal Revenue Service IRS has not yet approved the distribution plan submitted by authorities on the island. A 600 supplement to state-paid unemployment compensation for those who already qualify for up to four months.

The Puerto Rico Department of Labor and Human Resources confirmed it has disbursed 785 million to some 12662 claimants who were waiting to receive the retroactive payment of both the unemployment insurance compensation and the Pandemic Unemployment Assistance aid. Puerto Ricos status as a territory means it has to follow federal law but not get all of the benefits. Benefits vary widely by state.

The FAQs were issued only in Spanish. Unemployment benefits are available to qualified employees who are able to work during the claimed weeks. As a reminder unemployment insurance benefits are taxable.

On the low end Puerto Ricos maximum weekly amount is 190 with Mississippi a close second at 235. New companies in Puerto Rico will begin paying unemployment compensation at a rate of 330 plus an additional 1 for a special unemployment benefits fund. If you were unemployed due to the recent Puerto Rico earthquakes you may be eligible to obtain up to 26 weeks of federal DUA Disaster Unemployment Assistance ranging from 66 to 190 in benefits per week.

All employers are required to pay a Disability Benefits Tax that finances benefits for illness and accidents whether or not they are related to employment. In the wake of the CoronavirusCOVID-19 the Secretary of the Puerto Rico Department of Labor Secretary announced today the availability of additional unemployment benefits in Puerto Rico for eligible employees as well as self-employed workers and independent contractors due to the enactment of the federal statute known as the Coronavirus Aid Relief and. Puerto Ricos Department of Labor and Human Resources has issued Circular Letter 2020-02 CC 2020-02 providing that effective immediately any private employer that lays off or reduces employees regular working hours is required to notify them of the benefits available under the Unemployment Insurance Program.

Employers must pay both the US. March 30 2020. Puerto Rican workers who are not receiving their wages in the pandemic may also receive unemployment benefits.

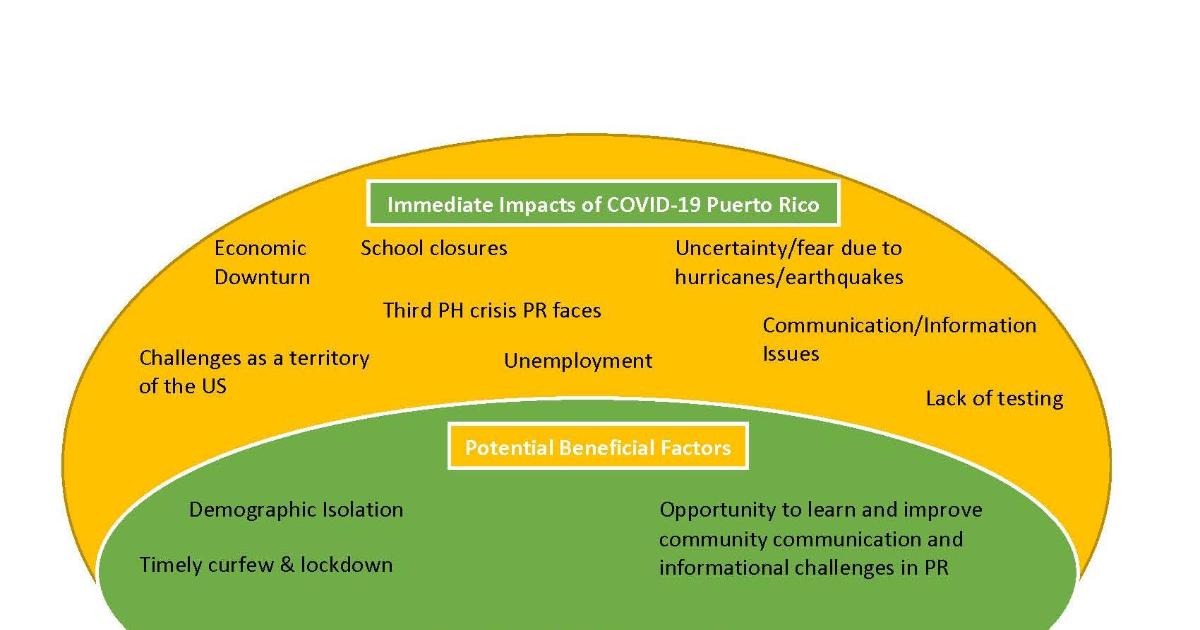

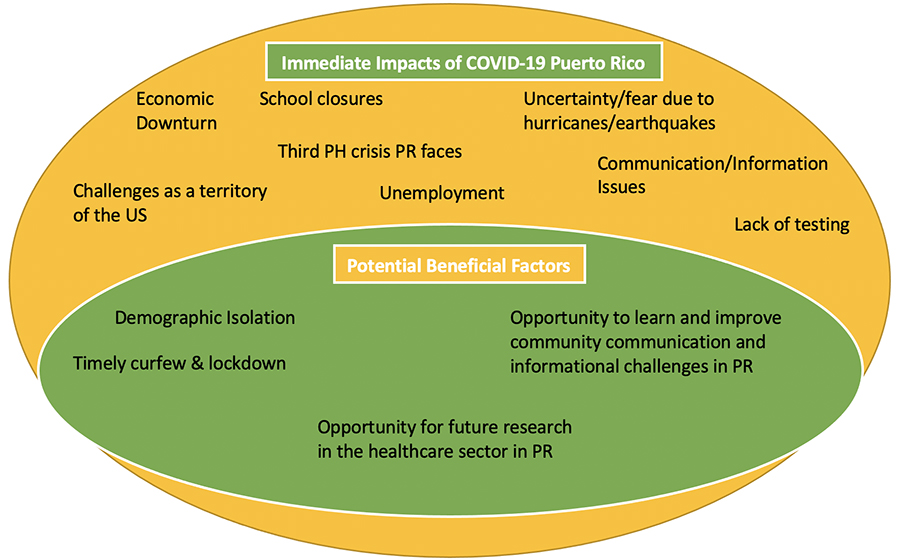

The Impact Of The Covid 19 Pandemic In Puerto Rico American University Washington D C

The Impact Of The Covid 19 Pandemic In Puerto Rico American University Washington D C

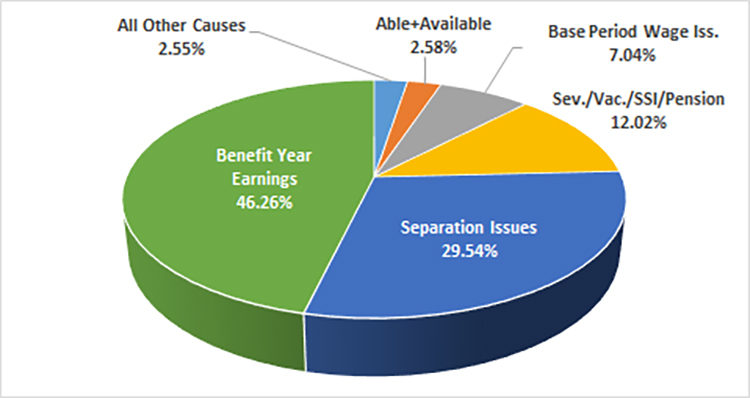

Cares Act Related Frauds In Puerto Rico Wikipedia

Cares Act Related Frauds In Puerto Rico Wikipedia

Puerto Rico Faqs On Unemployment During Covid 19

Puerto Rico Faqs On Unemployment During Covid 19

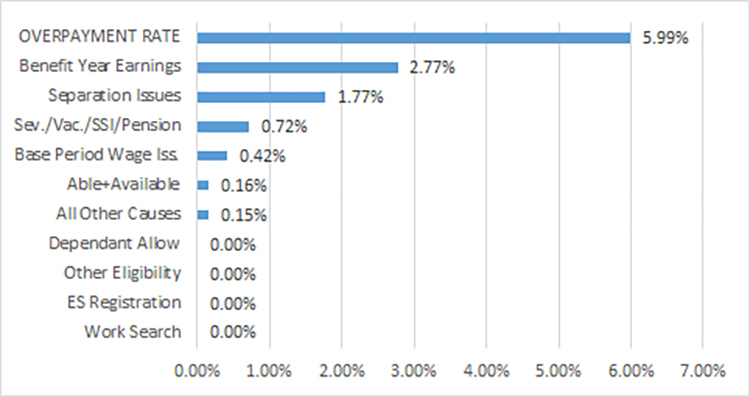

Puerto Rico U S Department Of Labor

Puerto Rico U S Department Of Labor

Puerto Rico S Predicaments Is Its Minimum Wage The Culprit Equitable Growth

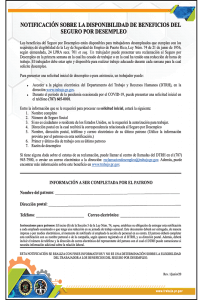

Puerto Rico Unemployment Insurance Notice Updated

Puerto Rico Unemployment Insurance Notice Updated

County Employment And Wages In Puerto Rico Third Quarter 2014 New York New Jersey Information Office U S Bureau Of Labor Statistics

County Employment And Wages In Puerto Rico Third Quarter 2014 New York New Jersey Information Office U S Bureau Of Labor Statistics

The Impact Of The Covid 19 Pandemic In Puerto Rico American University Washington D C

The Impact Of The Covid 19 Pandemic In Puerto Rico American University Washington D C

Puerto Rico U S Department Of Labor

Puerto Rico U S Department Of Labor

Puerto Rico Unemployment Insurance Notice Updated

Puerto Rico Unemployment Insurance Notice Updated

Coronavirus Worsens Food Insecurity In Puerto Rico Amid A Looming Loss Of Federal Funds

Coronavirus Worsens Food Insecurity In Puerto Rico Amid A Looming Loss Of Federal Funds

Chart Puerto Rico Still Has Sky High Unemployment Statista

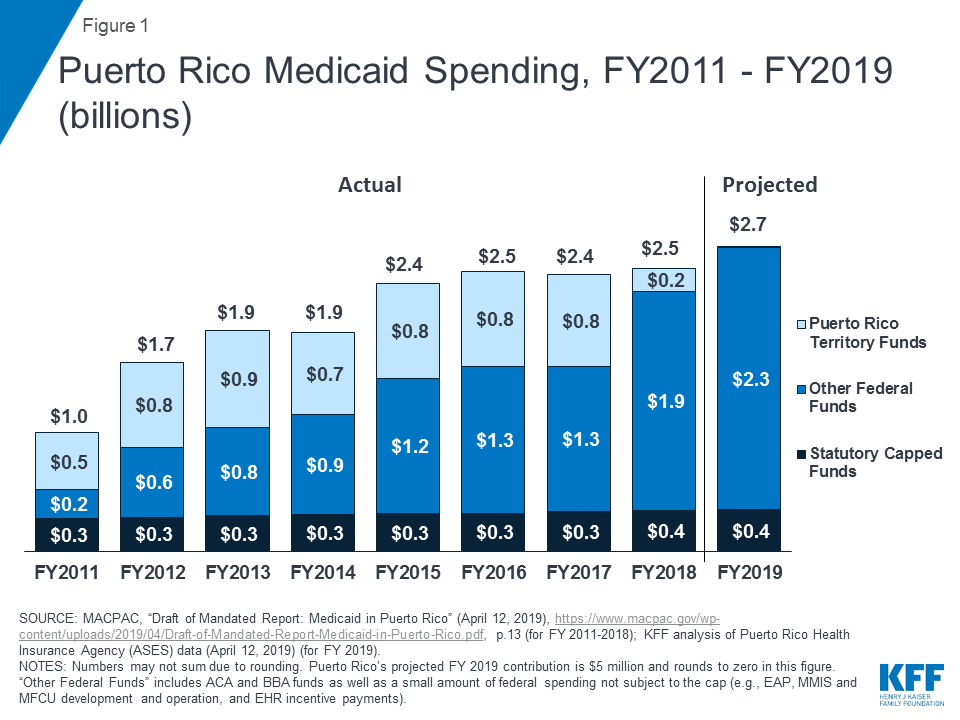

Medicaid Financing Cliff Implications For The Health Care Systems In Puerto Rico And Usvi Issue Brief 9311 Kff

Medicaid Financing Cliff Implications For The Health Care Systems In Puerto Rico And Usvi Issue Brief 9311 Kff

Https Www Cbpp Org Sites Default Files Atoms Files Policybasics Uiweeks Pdf

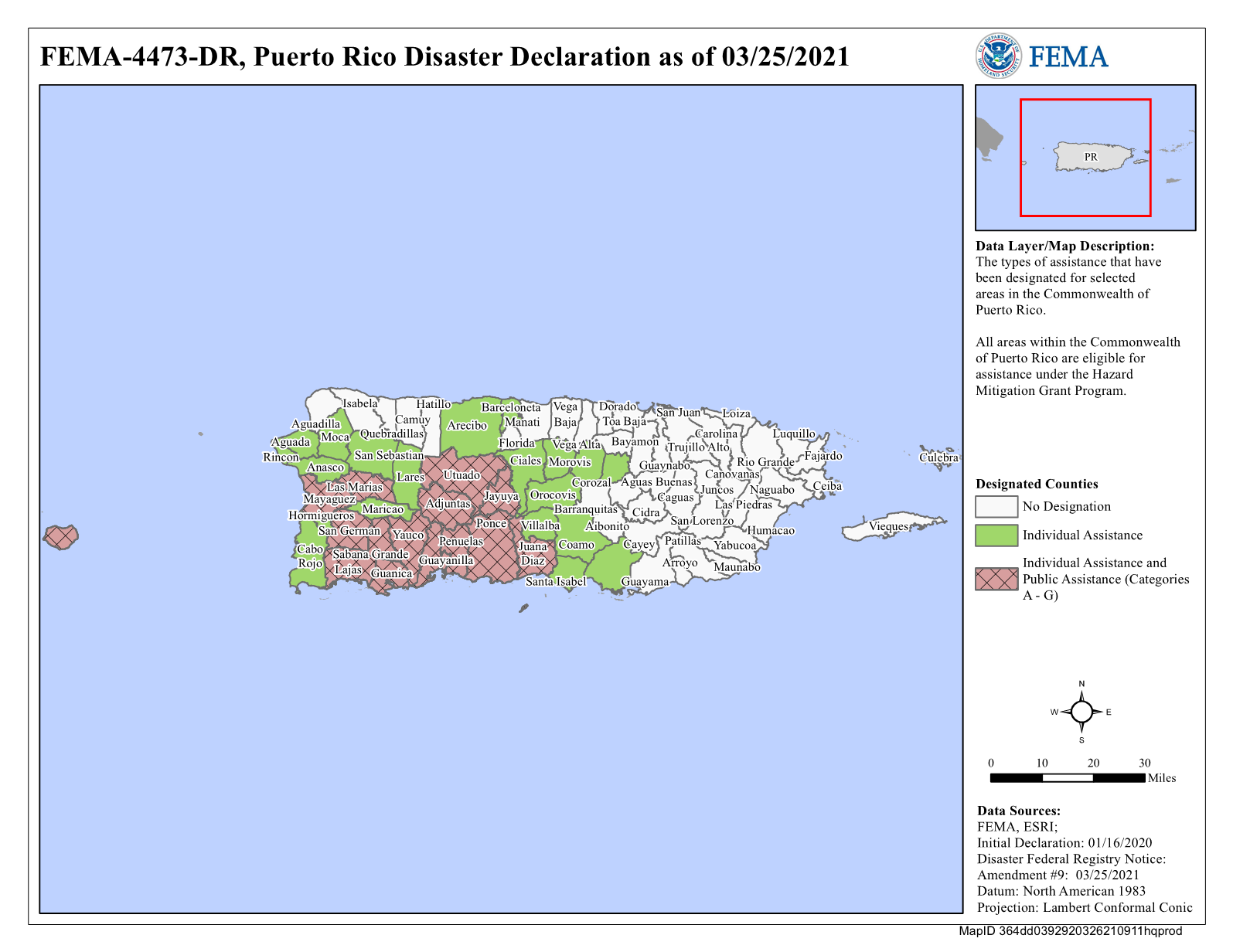

Puerto Rico Earthquakes Dr 4473 Pr Fema Gov

Puerto Rico Earthquakes Dr 4473 Pr Fema Gov

Puerto Rico Unemployment Rate 2020 Statista

Puerto Rico Unemployment Rate 2020 Statista

Puerto Rico S Economy Has Been Plummeting Like A Stone

Puerto Rico S Economy Has Been Plummeting Like A Stone

Post a Comment for "Does Puerto Rico Have Unemployment Benefits"