Does Break In Claim Hurt Unemployment

If your payment shows as break in claim you need staff intervention. Breaks in claim can occur if you tried to reopen a claim but you earned more than your previous weekly benefit amount.

Guide To Additional Claims Ides

Guide To Additional Claims Ides

Week 3 said Break in Claim.

Does break in claim hurt unemployment. If your claim shows as allowed but your weeks are showing as denied you will need staff assistance. Q What does my claims status mean allowed pending or denied. I would call the unemployment commission and ask them for the specific reason why you are getting a break in your claim.

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. It includes a tax break on up to 10200 of unemployment benefits earned in 2020. Unemployment is meant to create a financial bridge from one job to the next so most.

2 The claimant works a job that is temporary in nature for the week and therefore cant claim benefits. I get that - I had a waiting week since I got laid off just before the new guidelines. If you both received 10200 for instance and qualify for the break you can subtract 20400 from your taxable income assuming your modified adjusted gross income is.

And to help confused taxpayers the IRS plans to automatically adjust. I applied for unemployment as I was supposed to and finally got paid for one week mid March. If your job injury is so serious that you cant work at any job even with reasonable accommodations for your disability its unlikely that your state will approve unemployment.

Understanding Key Unemployment Messages. I have filed every Sunday for the last three weeks on the dates it tells me Im required to do so. Unemployment insurance benefits are only reserved for those who are unemployed for reasons other than injury or disability.

Pandemic Emergency Unemployment Compensation PUEC which lengthens benefits for people who have exhausted the number of weeks for which they can claim unemployment will be extended through Sept. I answer all the questions correctly and when I initially filed I used the Covid number Dewine issued. Week 2 shows as paid.

If you are working part-time and received holiday pay or if you. 3 The claimant was ineligible for work for the week and therefore does not file. 10 That extra 600 is also taxable after the first 10200.

Please call 877 OHIO-JOB 1-877-644-6562 or TTY at 888 642-8203. Each time I check my claim status it says break in claim and I do not receive any unemployment benefits. However compensation is available from other sources both for those who were injured on the job and for those who incur temporary disabilities that.

The project is currently reviewed by the companys client. On average this tax break could reduce a tax filers liability or increase the refund received by up to 1020 or 2040 for couples. Yet another unemployment issue.

If your payment shows as pay held this could be for any of several reasons. But it is highly likely Congress will extend this tax break given elevated levels of pandemic induced unemployment. The company will contact me if there is any additional follow-ups or when the project is completed so the payment can be made.

Unless youve been notified otherwise yes. I reopened my claim for the week ending 072014 and got a break in form. Please call 877 OHIO-JOB 1-877-644-6562 orTTY at 888 642-8203.

Unemployment Insurance is temporary income for eligible workers who lose their jobs through no fault of their own. It provided an additional 600 per week in unemployment compensation per recipient through July 2020. File your claim the first week that you lose your job.

But as part of the new relief bill jobless workers are entitled to a federal tax break on their first 10200 of unemployment benefits. I tried to call Telephone Claim Center last week but theyre always busy. The issue I have is that my first week is listed as WW credited.

If your claim shows as pending. This rule applies to those with an income of less than.

How To Apply For Unemployment In La During Covid 19 Pandemic

How To Apply For Unemployment In La During Covid 19 Pandemic

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployed Hoosiers Say Dwd Is Turning Its Back On Fraud Victims Whas11 Com

Unemployed Hoosiers Say Dwd Is Turning Its Back On Fraud Victims Whas11 Com

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/CTBXTZX4BZHPJHIVPGMVEACHVA.jpg) Filing For Unemployment 6 Things Experts Say You Should Know

Filing For Unemployment 6 Things Experts Say You Should Know

Unemployed Hoosiers Say Dwd Is Turning Its Back On Fraud Victims Whas11 Com

Unemployed Hoosiers Say Dwd Is Turning Its Back On Fraud Victims Whas11 Com

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Coronavirus Denied Unemployment Benefits In Florida Here S What You Need To Do Wftv

Coronavirus Denied Unemployment Benefits In Florida Here S What You Need To Do Wftv

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Coronavirus Impact Louisiana Unemployment Claims Soar

Coronavirus Impact Louisiana Unemployment Claims Soar

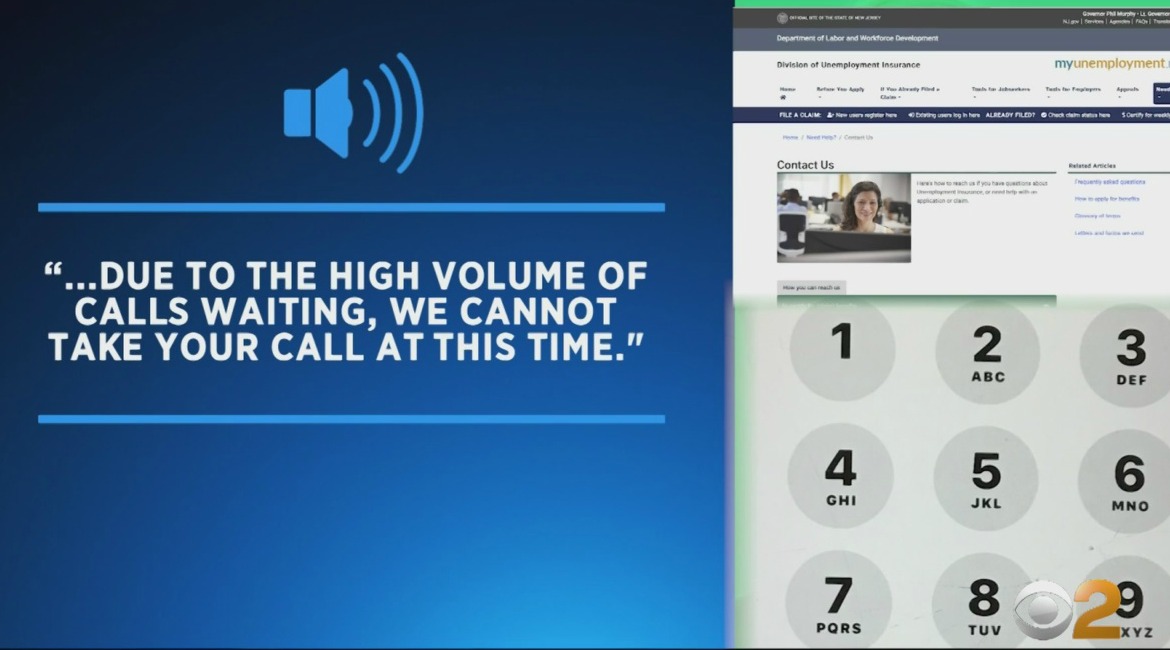

New York New Jersey Working To Eliminate Backlog Of Coronavirus Unemployment Claims Cbs New York

New York New Jersey Working To Eliminate Backlog Of Coronavirus Unemployment Claims Cbs New York

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

Discharged From A Job Unemployment Law Project

Discharged From A Job Unemployment Law Project

Here S What To Do If You Re Having Issues Getting Unemployment Benefits Wsoc Tv

Here S What To Do If You Re Having Issues Getting Unemployment Benefits Wsoc Tv

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

How To Apply For Unemployment In La During Covid 19 Pandemic

How To Apply For Unemployment In La During Covid 19 Pandemic

Post a Comment for "Does Break In Claim Hurt Unemployment"