Can Dependents File For Unemployment Ny

State e-file not available in NH. The tax break isnt available to those who earned 150000 or more.

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

It is best to apply for unemployment insurance online in the hours of 730AM - 730PM.

Can dependents file for unemployment ny. Dependents can usually receive unemployment insurance UI benefits provided they meet the caveats that state unemployment agencies require of anyone filing. State e-file available for 1995. However if you use TTYTDD call a relay operator first at 800 662-1220 and ask the operator to call the Telephone Claims Center at 888 783-1370.

Can I still claim his as a dependent even if he received unemployment. Personal state programs are 3995 each state e-file available for 1995. Claimants that file through PUA do not have to meet qualifying weeks and wages in the same way as they would for regular unemployment insurance program a spokesperson with.

E-file fees do not apply to NY state returns. E-file fees do not apply to NY state. Feel free to leave a comment or see the questions below for answers to some reader questions.

Call our Telephone Claim Center toll-free during business hours to file a claim. Call the New York unemployment phone number at 888 209-8124 MF 800 am. File your claim the first week that you lose your job.

From enhanced tax credits on unemployment to new tax credits for dependents the passing of the 2021 American Rescue Plan unlocked temporary relief measures for taxpayers on federal income taxes. During the coronavirus pandemic federal legislation has made UI requirements for dependents particularly college students a little less strict than they usually are. Consult your tax preparer for more details.

Release dates vary by state. A child of a taxpayer can still be a Qualifying Child QC dependent regardless of hisher income if. Telephone filing hours are as follows.

Monday through Friday 800 am to 730 pm. If your income or household status changed between 2019 and 2020 or if you have a new dependent in the household you may want to file promptly even if you also have UI income. If you file by phone we offer translation services.

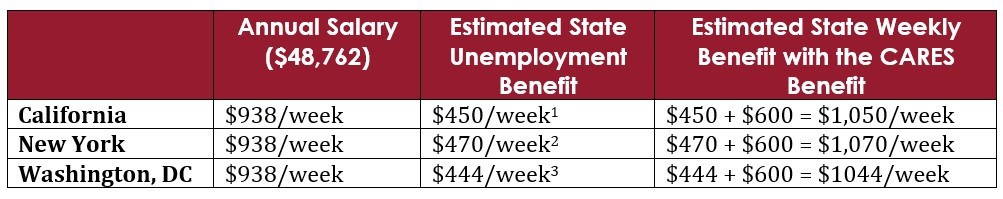

February 4 2021 423 AM. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person in 2020. States that allow for additional benefits for dependent children usually dont alter their benefit determination calculation but simply provide an additional lump-sum amount for.

But further guidance is expected soon. The federal government considers unemployment benefits to be taxable income although taxes are not automatically withheld from benefits payments the way an employer might take. Unemployment Insurance is temporary income for eligible workers who lose their jobs through no fault of their own.

Apply Online Now Apply By Telephone. In most years yes. The reason is the CARES Act which became law in.

From federal and state earned income tax credits to child and dependent care tax credits Lewis says low income earners in New York with outstanding tax bills and collecting unemployment. Dependent with unemployment. The unemployment tax exemption is separate from the 1400 stimulus payments for individuals making up to 75000 and couples making up to 150000 plus an.

He did not provide more than 12 his own support. In every state unemployment insurance agencies base benefits primarily on the applicants past earnings. He is under age 19 or under 24 if a full time student for at least 5 months of the year or is totally.

If you file Form 1040-NR for non-residents trusts and deceased individuals you cant exclude any unemployment compensation for your spouse. College students can now receive unemployment benefits provided they can prove they had paid work last year. Most personal state programs available in January.

While you are only eligible for unemployment insurance benefits if you are able and available to work under PUA you can receive benefits if you are the primary caregiver for a child whose school or care facility closed due to COVID-19. If you provided more than 50 of her support you can claim her but if you do she will more than likely have a tax liability for the unemployment she collected. If you are a hearing impaired individual who is being assisted by another person call the Telephone Claims Center at 888 783-1370.

State e-file not available in NH. PUA is available for periods of unemployment between January 27 2020 and December 31 2020.

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

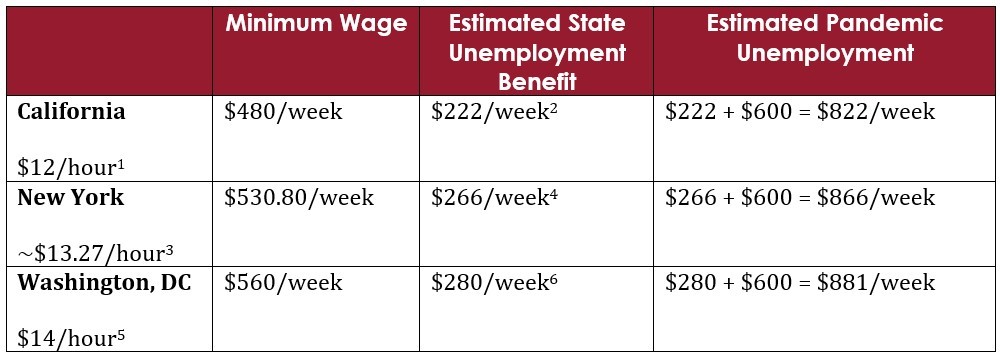

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

New York Coalition Letter On Covid 19 Unemployment Insurance Reform National Employment Law Project

New York Coalition Letter On Covid 19 Unemployment Insurance Reform National Employment Law Project

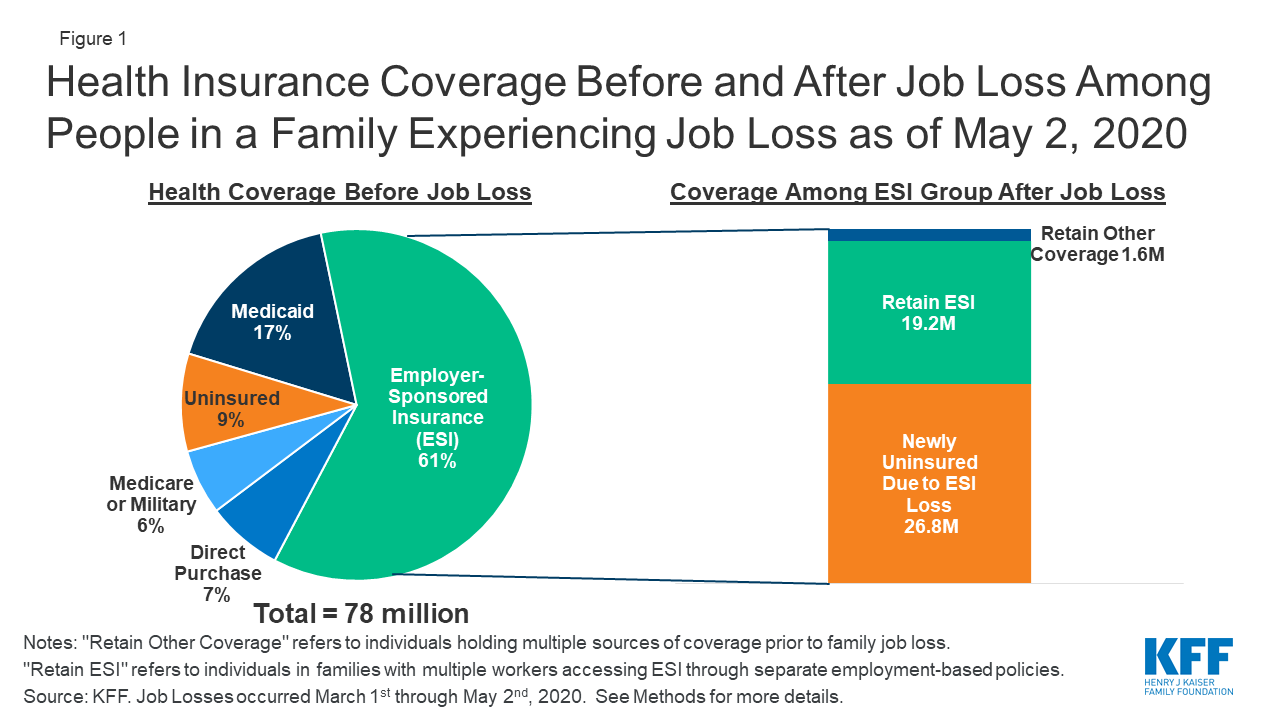

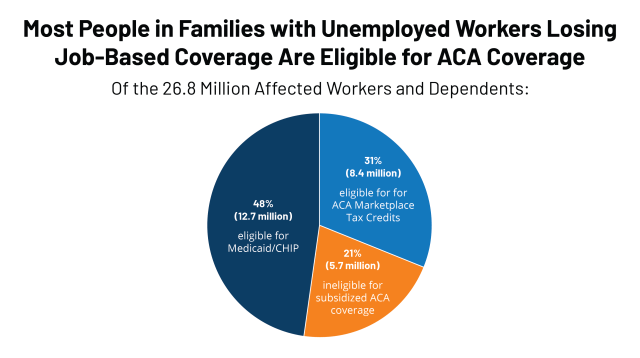

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

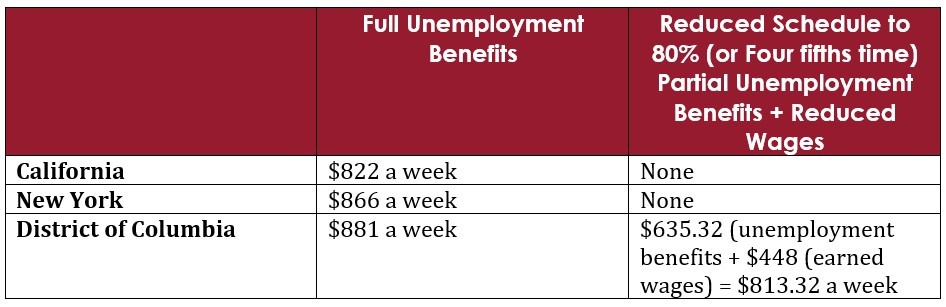

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

New York State Issues Guidance On Covid 19 Quarantine Leave Law Law And The Workplace

New York State Issues Guidance On Covid 19 Quarantine Leave Law Law And The Workplace

How Does Unemployment Work In New York Employment Lawyers

How Does Unemployment Work In New York Employment Lawyers

Covid 19 Resources Gender Equality Law

Covid 19 Resources Gender Equality Law

Can I Collect Nys Unemployment Benefits Workers Compensation Syracuse Ny Workers Compensation Lawyers Mcv Law

Can I Collect Nys Unemployment Benefits Workers Compensation Syracuse Ny Workers Compensation Lawyers Mcv Law

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Who Cares Unemployment Benefits For Reduced Hours And Furloughed Employees Steptoe Johnson Llp

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

New York Ny Dol Unemployment Insurance Compensation Enhanced Benefits Pua Peuc And 300 Fpuc Payment Eligibility And September 2021 Stimulus Funded Extension Aving To Invest

New York Ny Dol Unemployment Insurance Compensation Enhanced Benefits Pua Peuc And 300 Fpuc Payment Eligibility And September 2021 Stimulus Funded Extension Aving To Invest

Cares Act What You Need To Know Neighborhood Trust Financial Partners

Cares Act What You Need To Know Neighborhood Trust Financial Partners

Post a Comment for "Can Dependents File For Unemployment Ny"