What Percentage Of Income Is Unemployment In Ohio

The Ohio Department of Job and Family Services administers its own unemployment benefits program. During state fiscal year 2002 74 of all child support collections in Ohio came from income withholding.

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Living in same house 1 year ago percent of persons age 1 year 2015-2019.

What percentage of income is unemployment in ohio. Unemployment checks in Ohio normally amount to no more than half the lost weekly income topping out at 480 for a single person or 647 for someone with at least three dependents. 2011 2012 2013 Lowest Experience Rate. Payments are based on a percentage of household income and are consistent year-round.

Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows. State Taxes on Unemployment Benefits. National Unemployment Rate Ohio Unemployment Rate Ohio Unemployed.

60 February 2021. Ohio taxes unemployment compensation. With the Ohio Society of CPAs supported tax conformity legislation Senate Bill 18 being signed into law by Governor DeWine on March 31 the Ohio Department of Taxation has now issued guidance on Ohio tax filings related to the retroactive 10200 income tax exemption for unemployment.

You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing. Language other than English spoken at home percent of persons age 5. If the weekly benefit amount is 40000 and weekly earnings are 20000.

The Percentage of Income Payment Plan PIPP helps eligible Ohioans manage their energy bills year- round. State Income Tax Range. You must have worked and earned more than a specific amount in the base period.

Income withholding by employers is the single most effective method of child support collection. Payments are based on a percentage of household income and are consistent year-round. 4797 on more than 217400 of.

The states unemployment rate for those with a. Your weekly benefit is calculated as a percentage of your actual earnings during that period. Total earnings in week 20000.

As of December 27 2020 an additional 300 in unemployment benefits will be added to current state benefits. To calculate the earnings deduction. Ohio Unemployment Insurance BENEFITS CHART - 2021 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application.

Some taxpayers will file their 2020 federal and Ohio income tax returns after the enactment of. Ohio law allows that 20 of your weekly benefit amount be exempted from any earnings you may receive before a deduction is made. If your home is heated with gas you will have a monthly payment of 6 of your household income for your natural gas bill and 6 of your household.

Certain married taxpayers who both received unemployment benefits can each deduct up to 10200. December will see several changes to Ohios unemployment benefits. This deduction is factored into the calculation of a taxpayers federal AGI which is the starting point for Ohios income tax computation.

Unemployment and Educational Attainment Ohios unemployment rate for those who had not graduated from high school is 1727 percent in 2015. 285 on taxable income from 21751 to 43450. An example of how this is computed appears below.

34 on taxable income from 13400 to 22199 for taxpayers with net income less than 22200 59 on taxable income from 37200 to. Income withholding is just like any other automatic payroll deduction such as withholding for Social Security or state income taxes. This compared to a national rate of 1257 percent for the same group.

The money you receive through state-sponsored unemployment insurance is considered taxable income and must be reported to the federal government. The Percentage of Income Payment Plan PIPP helps eligible Ohioans manage their energy bills year- round. If your home is heated with gas you will have a monthly payment of 6 of your household income for your natural gas bill and 6 of your household.

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

This Map Shows Arc S Economic Classification Of The 420 Counties In The Appalachian Region For Fy 2019 October 1 2018 Th Appalachia West Virginia Appalachian

This Map Shows Arc S Economic Classification Of The 420 Counties In The Appalachian Region For Fy 2019 October 1 2018 Th Appalachia West Virginia Appalachian

Getting Back To Even Unemployment Unemployment Rate Capitalism

Getting Back To Even Unemployment Unemployment Rate Capitalism

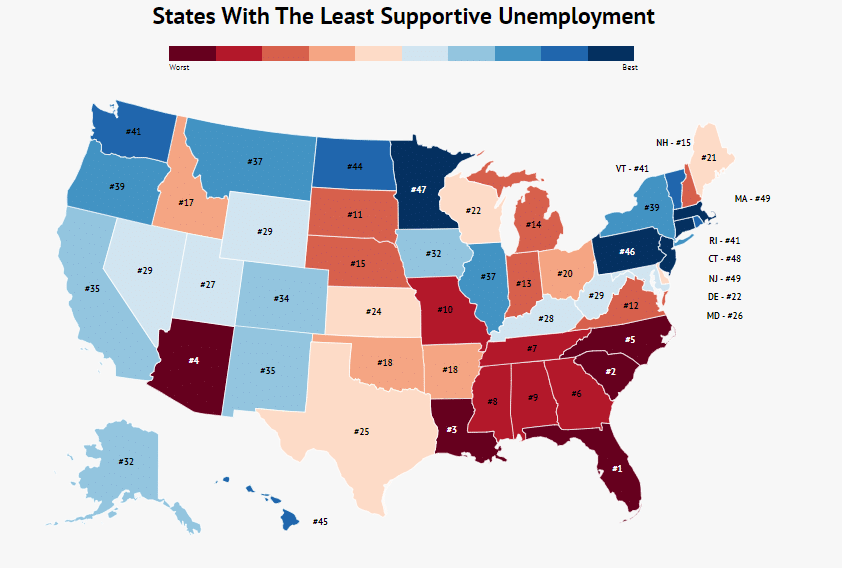

Here Are The States With The Least Supportive Unemployment Systems Zippia

Here Are The States With The Least Supportive Unemployment Systems Zippia

32 Free Child Support Agreement Templates Pdf Amp Amp Ms Word Child Support Agreement T Supportive Child Support Agreement

32 Free Child Support Agreement Templates Pdf Amp Amp Ms Word Child Support Agreement T Supportive Child Support Agreement

Are Liberal Arts Degrees Still Worth It Infographic Liberal Arts Degree Liberal Arts Liberal Arts Education

Are Liberal Arts Degrees Still Worth It Infographic Liberal Arts Degree Liberal Arts Liberal Arts Education

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Time To Reform Social Security Benefits Social Security Disability Benefits Social Security Disability Social Security Benefits

Time To Reform Social Security Benefits Social Security Disability Benefits Social Security Disability Social Security Benefits

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

Japanese Economy Struggles With Recessions In 2020 Economy Infographic Struggling

Japanese Economy Struggles With Recessions In 2020 Economy Infographic Struggling

Tour Links Ohio Sites Connected To Movie Abandoned Ohio Ohio State Reformatory Haunted Places

Tour Links Ohio Sites Connected To Movie Abandoned Ohio Ohio State Reformatory Haunted Places

Colin Gordon National Jobs In Recession And Recovery Chart Job Employment

Colin Gordon National Jobs In Recession And Recovery Chart Job Employment

Lakewood Ranked Most Stressed City In Ohio Fox8 Com Lakewood Ohio City

Lakewood Ranked Most Stressed City In Ohio Fox8 Com Lakewood Ohio City

Http Img651 Imageshack Us Img651 6822 Wineighborschartaug12 Gif Wisconsin Illinois Iowa

Http Img651 Imageshack Us Img651 6822 Wineighborschartaug12 Gif Wisconsin Illinois Iowa

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Greater Cleveland Food Bank Food Bank Cleveland Food Northeast Ohio

Greater Cleveland Food Bank Food Bank Cleveland Food Northeast Ohio

Chart Shows Non Employment Index Nei And The Unemployment Rate Employment Economic Research Index

Chart Shows Non Employment Index Nei And The Unemployment Rate Employment Economic Research Index

How To Calculate Amount Of Unemployment In Ohio 9 Steps

How To Calculate Amount Of Unemployment In Ohio 9 Steps

Post a Comment for "What Percentage Of Income Is Unemployment In Ohio"