What Is The Sui Tax Rate For 2020

Here is a list of the non-construction new employer tax. 100 West Midwest Casper WY 82601.

What Is The Federal Unemployment Tax Rate In 2020

What Is The Federal Unemployment Tax Rate In 2020

High rates of unemployment in the state can produce higher tax rates in subsequent years.

What is the sui tax rate for 2020. Conversely low unemployment can produce lower tax rates. The new employer SUI tax rate remains at 34 for 2020. The best negative-rate class was assigned a rate of 2232 percent which when multiplied by the 30200 wage base results in a tax of 67406 while those in the worst rate class pay at the rate of 5400 percent or 163080 when multiplied by 30200.

Lets get this question out of the way quickly for those needing only one answer. Factors Affecting Your Premium Rate. The new employer rates will remain at 36890 for non-construction employers and 102238 for construction employers.

The 2020 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. UI Tax Rate for Beginning Employers. 52 rows SUI tax rate by state.

Section 96-92b Minimum UI Tax Rate. Section 96-92c Maximum UI Tax Rate. 10 rows An employers tax rate determines how much the employer pays in state Unemployment Insurance.

If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office. 13 states are not offering the federal tax break on 2020 returns. If you live in a state that doesnt offer the unemployment tax break.

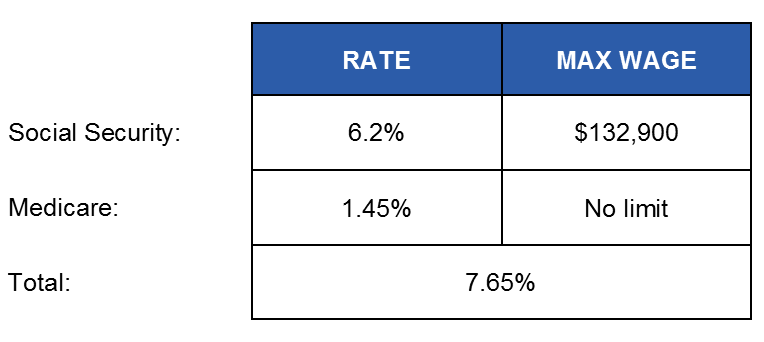

The federal unemployment tax rate is not the same as the state unemployment tax rate. Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well. This 7000 is known as the taxable wage base.

The worst positive-rate class was assigned a tax rate of 1240 percent resulting in a tax of 37448 when multiplied by the 30200 wage base. The Office of UC Tax Services plans to issue the Contribution Rate Notice for calendar year 2021 Form UC-657 no later than December 31 2020. Each state has its own tax rate for residents.

Section 96-92c Mail Date for Unemployment Tax Rate Assignments For 2021. 2020 SUI tax rates and taxable wage base The SUI taxable wage base for 2020 remains at 7000 per employee. For 2020 the FUTA tax rate is projected to be 6 per the IRS.

If the state has an outstanding loan for 2 years and is unable to pay back the loan in full by November 10th of the second year the 6 rate will be reduced by only 51 changing the percentage an employer will pay their federal UI tax to 9. If an employer pays state taxes timely the 6 rate will be reduced by 54 and the employer will pay their federal UI tax at a rate of 6. If you have questions about potential rates for a new employer please call the Unemployment Tax Helpline at 307-235-3217.

Idaho joins 12 other states in refusing unemployment tax break All income earned in 2020 through unemployment or otherwise will be taxed at regular rates. If an employer fails to complete their registration prior to submitting their report they will be assigned the highest base rate possible which is 85. The FUTA rate in 2020 is six percent.

Taxable wage base. 8 rows A table showing the breakdown of changes in employers UI tax rates from 2020 to 2021 for the. Tennessee is one of 31 states that use the reserve-ratio formula to determine employer premium rates.

Maximum Tax Rate for 2020 is 631 percent. Office Locations Contacts CASPER Main Office. The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year.

Your taxable wages are the sum of the wages you pay up to 9000 per employee per year. Depending on where you are located you may be responsible for paying both. Section 96-92e Final Date for Protest.

At the beginning of the year you will receive a Determination of Unemployment Tax Rate UC-603 UC-603 Sample 345 KB PDF advising you of your tax rate for the that calendar year. As a result the calendar year 2020 employer state unemployment insurance SUI experience tax rates will range from 12905 to 99333 down from 23905 to 110333 for 2019. Payroll less than 500000.

You pay unemployment tax on the first 9000 that each employee earns during the calendar year. December 21 2020 Final Date for Voluntary Contribution. The FUTA is determined based on employee wages and salaries.

The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years. Payroll greater than 500000.

Income Tax Rate In Italy The Ultimate Guide

County Surcharge On General Excise And Use Tax Department Of Taxation

County Surcharge On General Excise And Use Tax Department Of Taxation

.jpg?sfvrsn=8ccc851f_0&MaxWidth=800&MaxHeight=1500&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=2039FECEAD221051467E965AC5CF79DE) Employer Tax Rates Employers Kdol

Employer Tax Rates Employers Kdol

Governor Mike Dewine Signs 2020 2021 Ohio Budget With Several Significant Tax Changes What To Look For Cohen Company

How Is Sui Tax Rate Calculated Futufan Futufan Statetaxes Money Irs Finance Tax How Is Sui Tax Bookkeeping Services Bookkeeping Accounting Services

How Is Sui Tax Rate Calculated Futufan Futufan Statetaxes Money Irs Finance Tax How Is Sui Tax Bookkeeping Services Bookkeeping Accounting Services

Rate Of Minimum Income Tax Under Section 113 Income Tax Ordinance 2001 Turnover Tax Income Tax Tax Income

Rate Of Minimum Income Tax Under Section 113 Income Tax Ordinance 2001 Turnover Tax Income Tax Tax Income

2020 New Jersey Payroll Tax Rates Abacus Payroll

2020 New Jersey Payroll Tax Rates Abacus Payroll

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Https Des Az Gov Sites Default Files Media 2019 Rate Chart Compliant Pdf

Income Types Not Subject To Social Security Tax Earn More Efficiently

Income Types Not Subject To Social Security Tax Earn More Efficiently

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

New Income Tax Slabs Extra Burden On Middle Class Easy Method Of Tax Calculation In Excel Youtube In 2020 Income Tax Income Excel Formula

New Income Tax Slabs Extra Burden On Middle Class Easy Method Of Tax Calculation In Excel Youtube In 2020 Income Tax Income Excel Formula

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

What Is The Futa Tax 2021 Tax Rates And Info Onpay

Suta Tax Rate Increase 2020 State By State Gusto

Suta Tax Rate Increase 2020 State By State Gusto

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

Your 2013 Tax Rate Understanding Your Irs Marginal And Effective Tax Bracket Aving To Invest

Your 2013 Tax Rate Understanding Your Irs Marginal And Effective Tax Bracket Aving To Invest

Post a Comment for "What Is The Sui Tax Rate For 2020"