What Is The New Jersey State Unemployment Tax Rate

Tax rate of 175 on taxable income between 20001 and 35000. For single taxpayers living and working in the state of New Jersey.

Aatrix Nj Wage And Tax Formats

Aatrix Nj Wage And Tax Formats

What Is the New Jersey SUISDI Tax.

What is the new jersey state unemployment tax rate. Therefore the composite return Form NJ-1080C uses the highest tax bracket of 1075. Tax rate of 14 on the first 20000 of taxable income. The state will actually mail that withheld amount to the IRS on your behalf.

Tax rate of 35 on taxable income between 35001 and 40000. Unlike federal or state income taxes there are annual limits on the amount of SUISDI tax an employee must pay. Employers the wage base increases to 35300 for unemployment insurance disability insurance and workforce development.

EY Payroll Newsflash Vol. If you are unsure of your Unemployment Experience Rate call the Department of Labor and Workforce Development Employer Accounts. The wage base is computed separately for employers and employees.

2018 Maximum Unemployment Insurance weekly benefits rate. The new employer rate continues to be 28 for fiscal year 2020. The 118 tax rate applies to individuals with taxable income over 5000000.

1075 on taxable income. New Jersey Unemployment Tax. Below are answers to frequently asked questions about benefit payments and taxes.

New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income. FREE Paycheck and Tax Calculators. With the taxable wage base of 134900 an employees maximum TDI contribution for 2020 will be 35074 up from 5848 from 2019.

New Jersey actually makes it very easy to ensure that youre not skipping your federal taxes by giving you an option to have 10 percent of your weekly unemployment benefit withheld for you. For important information on the 2020 tax year click here. 2018 Maximum Temporary Disability Insurance weekly benefit rate.

State Income Tax Range. The 118 tax rate applies to individuals with taxable income over 1000000. For Tax Year 2017 the highest tax rate was 897.

State Taxes on Unemployment Benefits. New Jersey does not tax unemployment compensation. 2018 Alternative earnings test amount for UI and TDI.

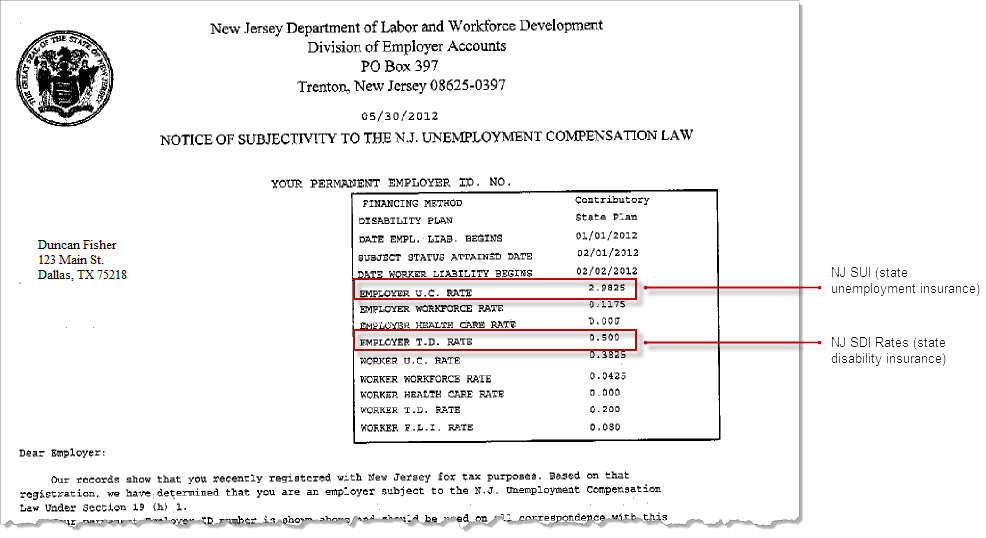

Employee and employer state Unemployment Insurance and Workforce DevelopmentSupplemental Workforce Funds tax rates will apply to the first 36200 of an employees earnings in 2021 up from 35300 in 2020. In general employers must pay 6 of gross wages up to a cap of 7000 per worker in order to fund federal unemployment taxes FUTA for each employee. The TDI rate will increase from 017 to 026 for 2020.

For 2018 these limits total 23759 with SUI accounting for 17356 and SDI at 6403. To help offset your future tax liability you may voluntarily choose to have 10 percent of your weekly Unemployment Insurance benefits withheld and. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes.

14 on up to 20000 of taxable income. Since July 1 1986 New Jerseys unemployment tax tables have included six columns of rates labeled columns A B C D E and E10. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes.

Here is a list of the non-construction new employer tax. 2018 Maximum Workers Compensation weekly benefit rate. 1 2020 the wage base will be computed separately for employers and employees.

Again an example might help. Column A rates the lowest rates are applicable when the fund is highest 350 of taxable wages or greater. New Jersey Unemployment Tax.

For 2021 employees are subject to a 00425 000425 Workforce DevelopmentSupplemental Workforce Funds tax rate the same as 2020. New Jersey fiscal year 2020 SUI rates remained on the same table as FY 2019 As we previously reported employer SUI tax rates continue to range from 04 to 54 on Rate Schedule B for FY 2020 July 1 2019 through June 30 2020. 2018 Taxable Wage Base under UI TDI and FLI.

The FLI rate will increase from 008 to 016 in 2020. Alaska New Jersey and Pennsylvania collect. FREE Paycheck and Tax Calculators.

New Jersey Unemployment Experience Rate The default Unemployment Experience Rate for new employers is 28000. Since a composite return is a combination of various individuals various rates cannot be assessed. 52 rows SUI tax rate by state.

New Jersey payroll taxes include State Unemployment Insurance SUI and State Disability Insurance SDI. Tax rate of 5525 on taxable income between 40001 and 75000. Through the State Unemployment Tax Act SUTA states levy a payroll tax on employers to fund the majority of their unemployment benefit programs.

For employers for 2021 the wage base increases to 36200 for unemployment insurance disability insurance and workforce development. 2018 Base week amount. In all 50 states employers pay the same 6 rate for each and every worker but the federal government may change the rate in future years.

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

Historical New Jersey Tax Policy Information Ballotpedia

Historical New Jersey Tax Policy Information Ballotpedia

New Jersey Tax And Labor Law Summary Care Com Homepay

New Jersey Tax And Labor Law Summary Care Com Homepay

Keeping Up With New Jersey Employment Law Developments Ogletree Deakins

Keeping Up With New Jersey Employment Law Developments Ogletree Deakins

2020 New Jersey Payroll Tax Rates Abacus Payroll

2020 New Jersey Payroll Tax Rates Abacus Payroll

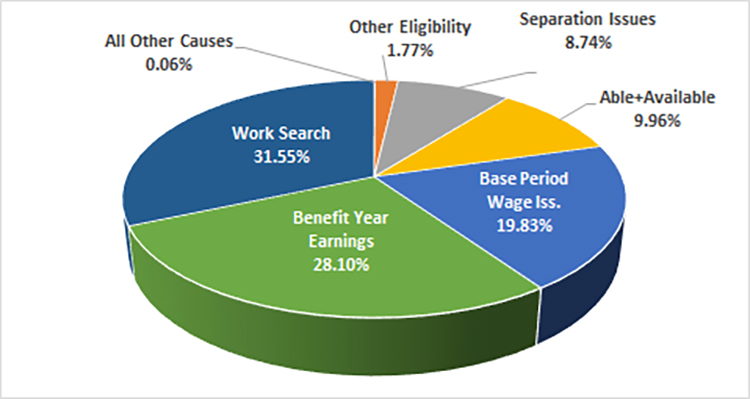

Lsnjlaw An Overview Of The Unemployment Appeals Process

Lsnjlaw An Overview Of The Unemployment Appeals Process

New Jersey U S Department Of Labor

New Jersey U S Department Of Labor

New Jersey Nj Tax Rate H R Block

New Jersey Nj Tax Rate H R Block

Aatrix Nj Wage And Tax Formats

Aatrix Nj Wage And Tax Formats

New Jersey Unemployment Benefits Eligibility Claims

New Jersey Unemployment Benefits Eligibility Claims

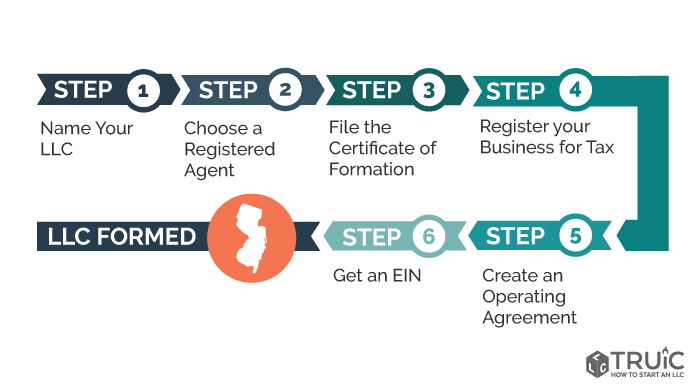

Nj Llc How To Form An Llc In New Jersey Truic Guides

Nj Llc How To Form An Llc In New Jersey Truic Guides

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Murphy And Sweeney Continue To Spar Over Cut In Sales Tax Nj Spotlight News

Murphy And Sweeney Continue To Spar Over Cut In Sales Tax Nj Spotlight News

Coronavirus New Jersey Updates From May 2020 Abc7 New York

Coronavirus New Jersey Updates From May 2020 Abc7 New York

New Jersey Announces New Tdi Rates And Benefits For 2021 Jgs Insurance

New Jersey Announces New Tdi Rates And Benefits For 2021 Jgs Insurance

New Jersey Payroll Tax Rates For 2016 Abacus Payroll

New Jersey Payroll Tax Rates For 2016 Abacus Payroll

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

New Jersey Unemployment Tips Hotel Trades Council En

New Jersey Unemployment Tips Hotel Trades Council En

Post a Comment for "What Is The New Jersey State Unemployment Tax Rate"