What Is Ga Unemployment Tax Rate

In recent years in Georgia that amount known as the taxable wage base has been stable at 9500. Here is a list of the non-construction new employer tax.

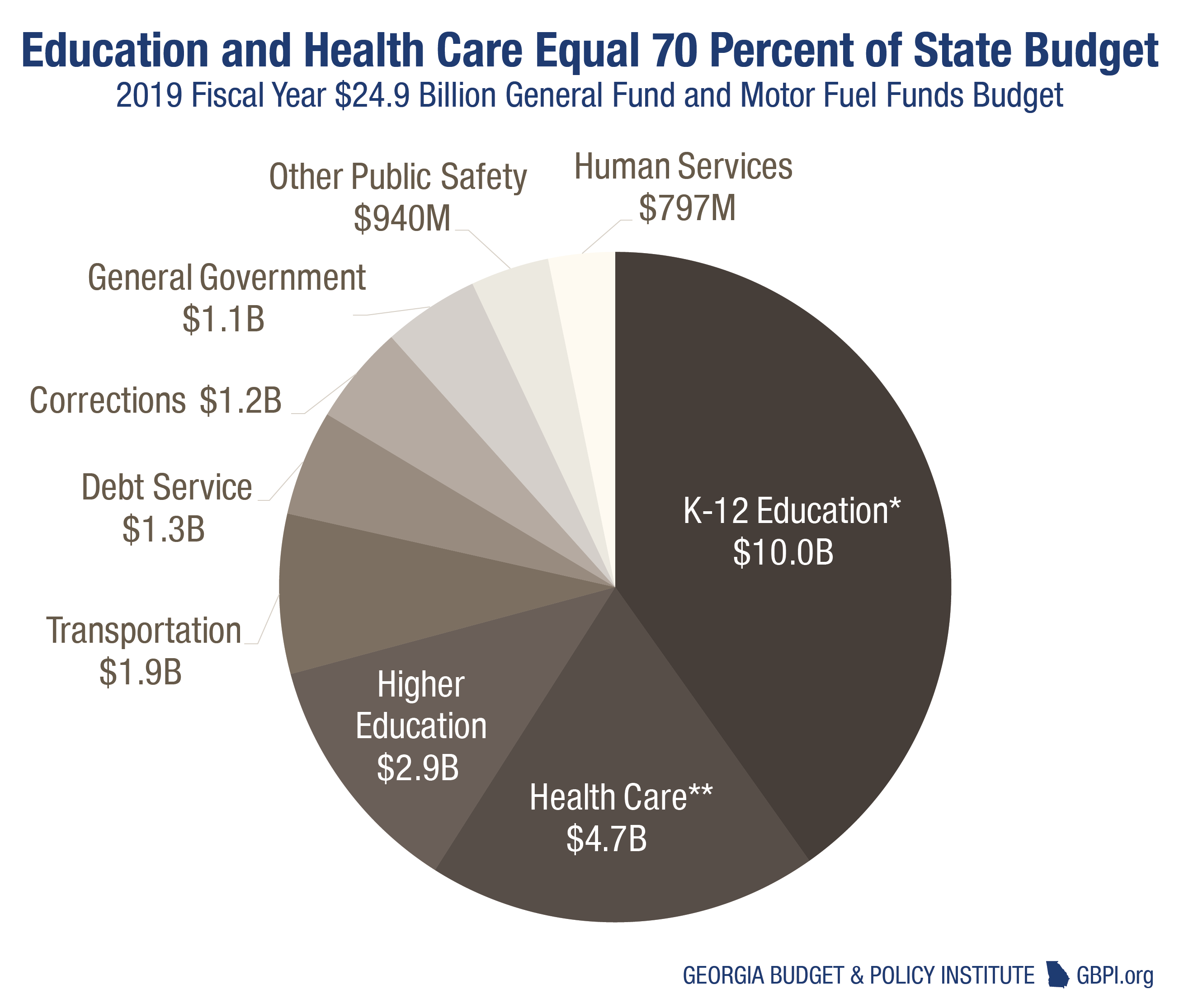

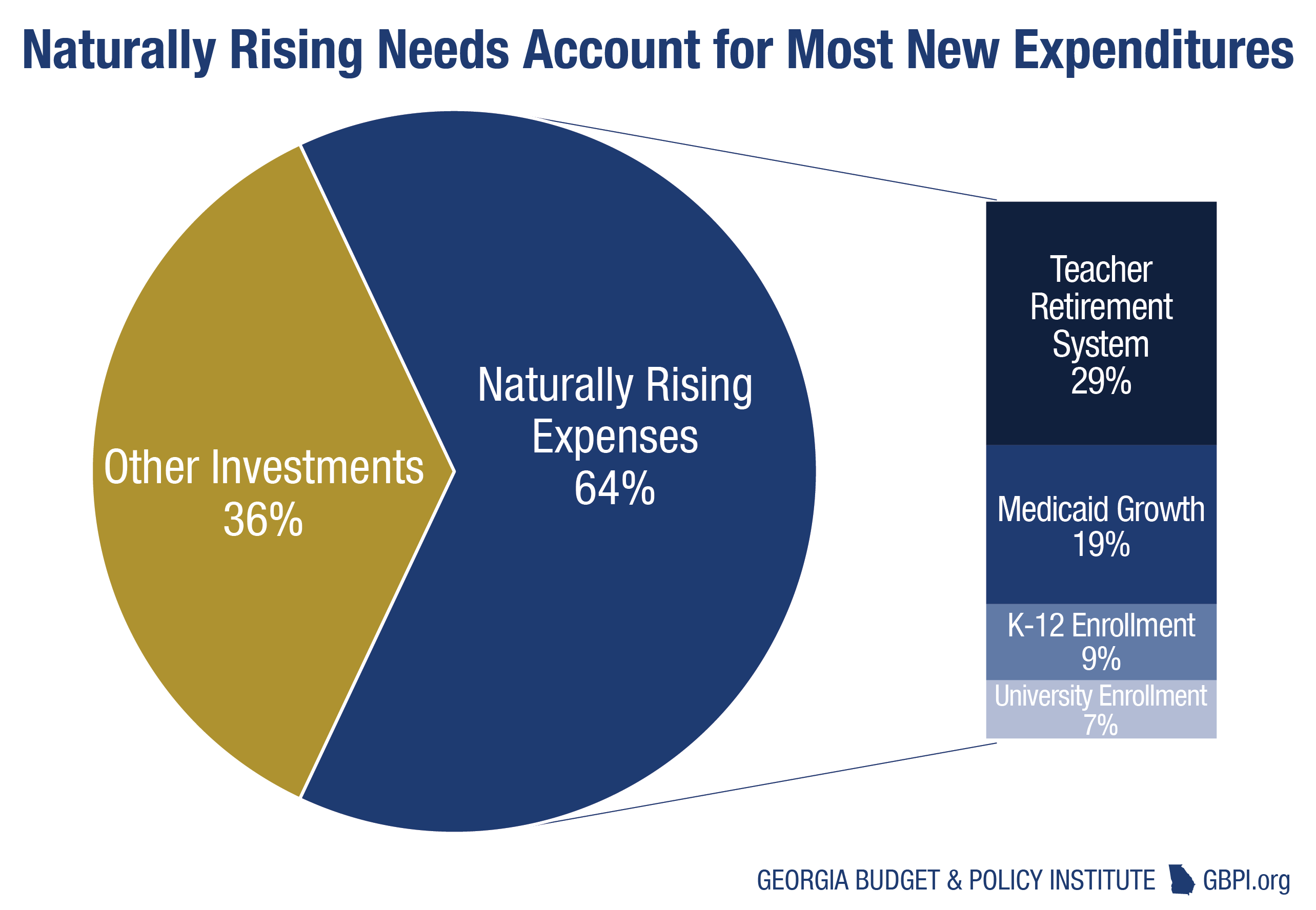

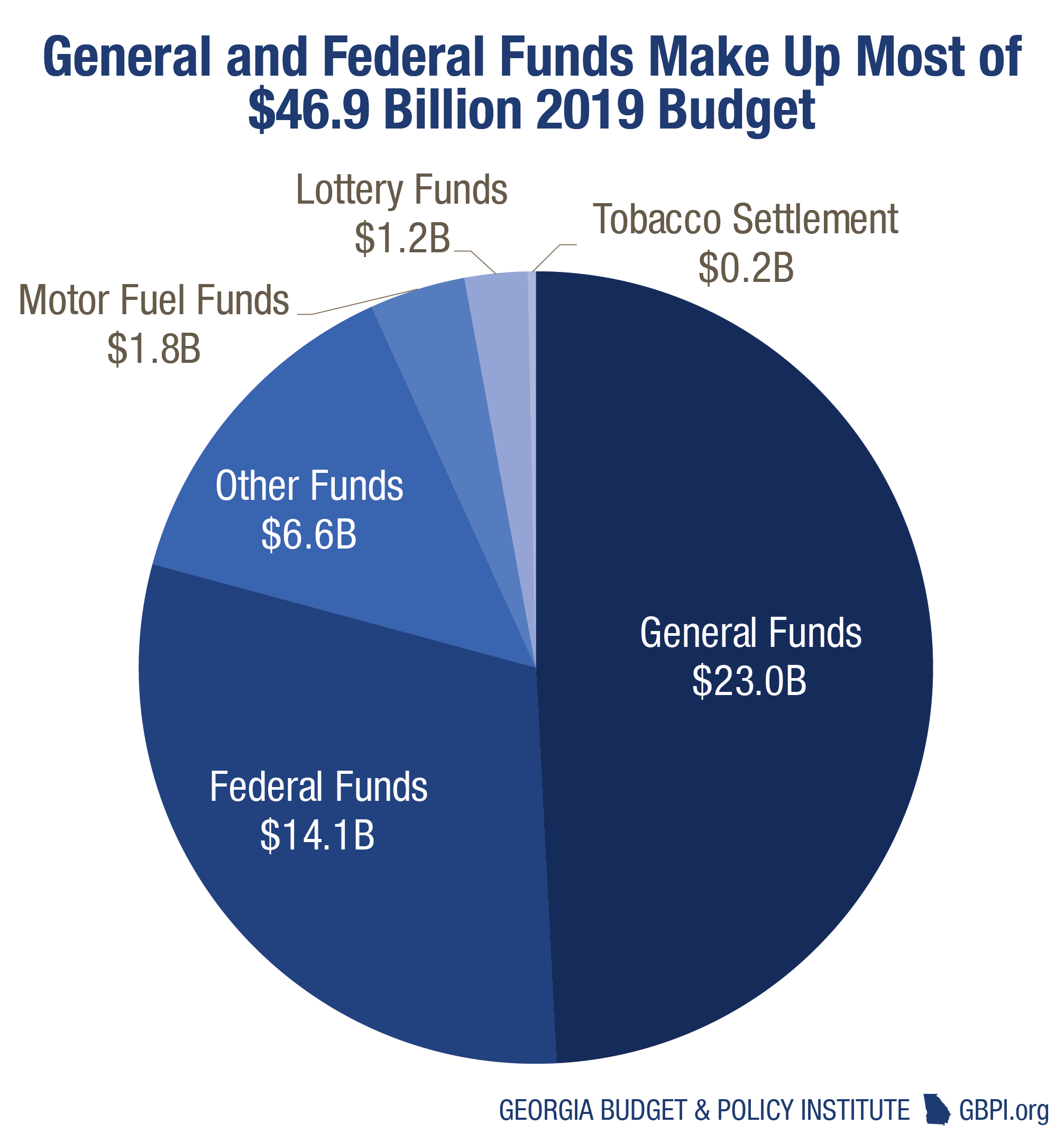

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

The Georgia Employer Status Report is necessary to establish an unemployment insurance tax account in Georgia.

What is ga unemployment tax rate. Quarterly tax wage report and payment information for employers. Annual Tax and Wage Report For Domestic Employment - DOL 4A 8748 KB Annual tax and wage report which domestic employers must file. You will be taxed at the regular rate for any federal unemployment benefits above 10200.

The 2021 Annual Tax Rate Notices DOL-626 and Voluntary Contribution DOL-626A and DOL626B are now available on the Employer PortalEmployers who are not registered to use the Employer Portal can do so by selecting the Employer Portal link found under Online Services. Im also upset because I tried several times in 2020 to have them start taking taxes out but it never happened I was an employer-claim for the majority of 2020. Starting in 2021 Proposition 208 approved by.

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income. Georgia law defines wages for SUI tax purposes as all compensation for personal services including salaries commissions and bonuses and the cash value of all compensation paid in any medium other than cash.

The annual total SUI tax rate is based on a range of rates. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. Employers that fail to receive a Tax Rate Notice or have questions about a tax rate should contact the Rate Unit at 4042323300.

10 That extra 600 is also taxable after the first 10200. Learn About Unemployment Taxes and Benefits. Georgia Unemployment Insurance UI program information.

You can take the tax break if you have an adjusted gross income of less than 150000. That provision only applies to tax-filers whose income is less than 150000. File Partial Unemployment Insurance Claims.

The 2020 Annual UI Tax Rate Notices are now available on the Georgia Department of Labor GDOL Employer PortalIf you are not registered on the Employer Portal please register immediately to avoid delays in receiving this important information. GDOL Rules Link to the rules of the Georgia Department of Labor which set forth operating procedures not covered in the Official Code of Georgia Annotated OCGA. 1 2019 unemployment tax rates for experienced employers are to range from 004 percent to 81 percent unchanged from 2018 the spokesman said in an email.

Tax rate calculations consider the history of both unemploy - ment insurance contributions and benefits paid to former workers growth of an employers payroll and the overall unemployment conditions for the state. Georgias range of unemployment tax rates for 2019 is to be unchanged from 2018 a spokesman for the state Labor Department told Bloomberg Tax on Dec. I know the tax break is good for federal unemployment but since GA wants us all to suffer Im stressed because Im not in a good position to pay a bunch of money back.

In recent years the rate has been 27. UI claims filed by employers for full-time employees who work less than full-time. However its always possible that amount could change.

The maximum tax rate is to fall to 756 from 81 The unemployment-taxable wage base is to be unchanged Georgias maximum unemployment tax rate for experienced employers is to decrease in 2020 the state Labor Department said Dec. 2013 legislation HB 168 increased the SUI taxable wage base to a minimum of 10500 and a maximum of 18500 by tying the wage limit to the balance of the states unemployment trust fund the higher the trust fund balance the lower the taxable wage base. 52 rows SUI tax rate by state.

It provided an additional 600 per week in unemployment compensation per recipient through July 2020. 2019 legislation HB 198 freezes the taxable wage base at 16500 for 2020 under the bill language from July 1 2019 to October 29 2020 so the Division of Unemployment Insurance and the Unemployment. File Tax and Wage Reports and Make Payments.

Access Title 34 of the Official Code of Georgia Annotated OCGA to view laws relevant to employment unemployment insurance and select safety issues. The state UI tax rate for new employers also can change from one year to the next.

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Gdol More Than 95 Payment Rate For Eligible Unemployment Insurance Claims Allongeorgia

Gdol More Than 95 Payment Rate For Eligible Unemployment Insurance Claims Allongeorgia

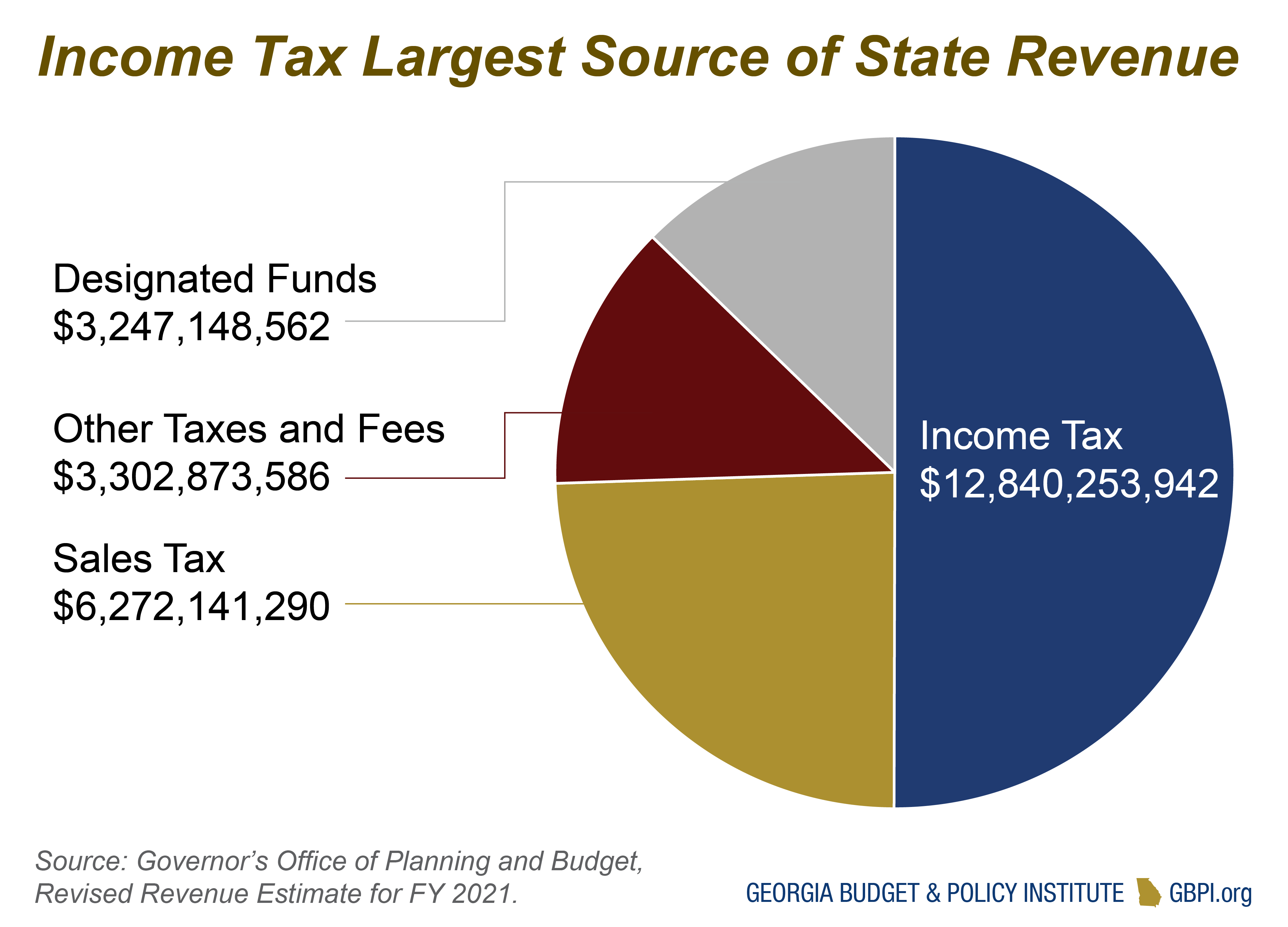

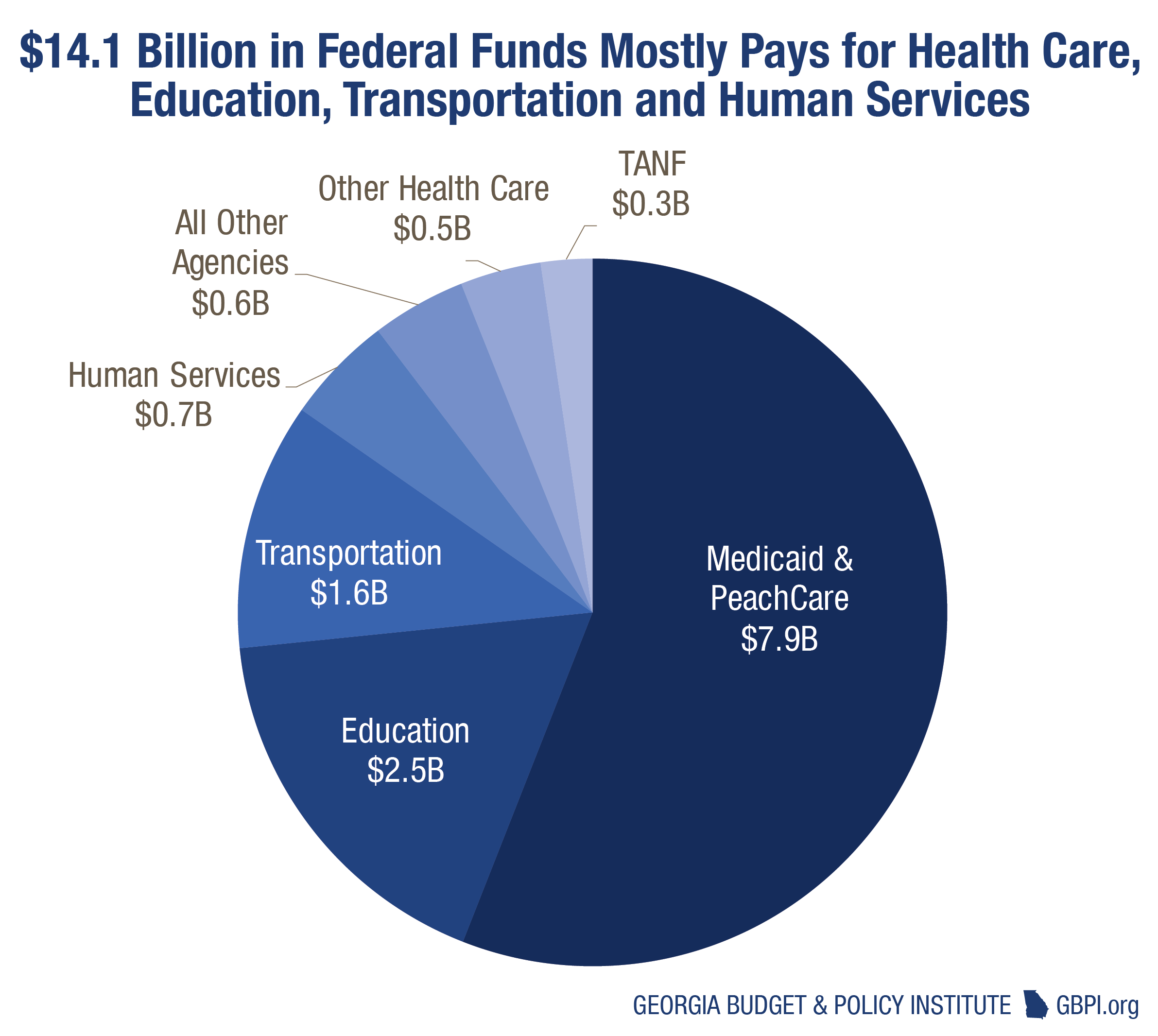

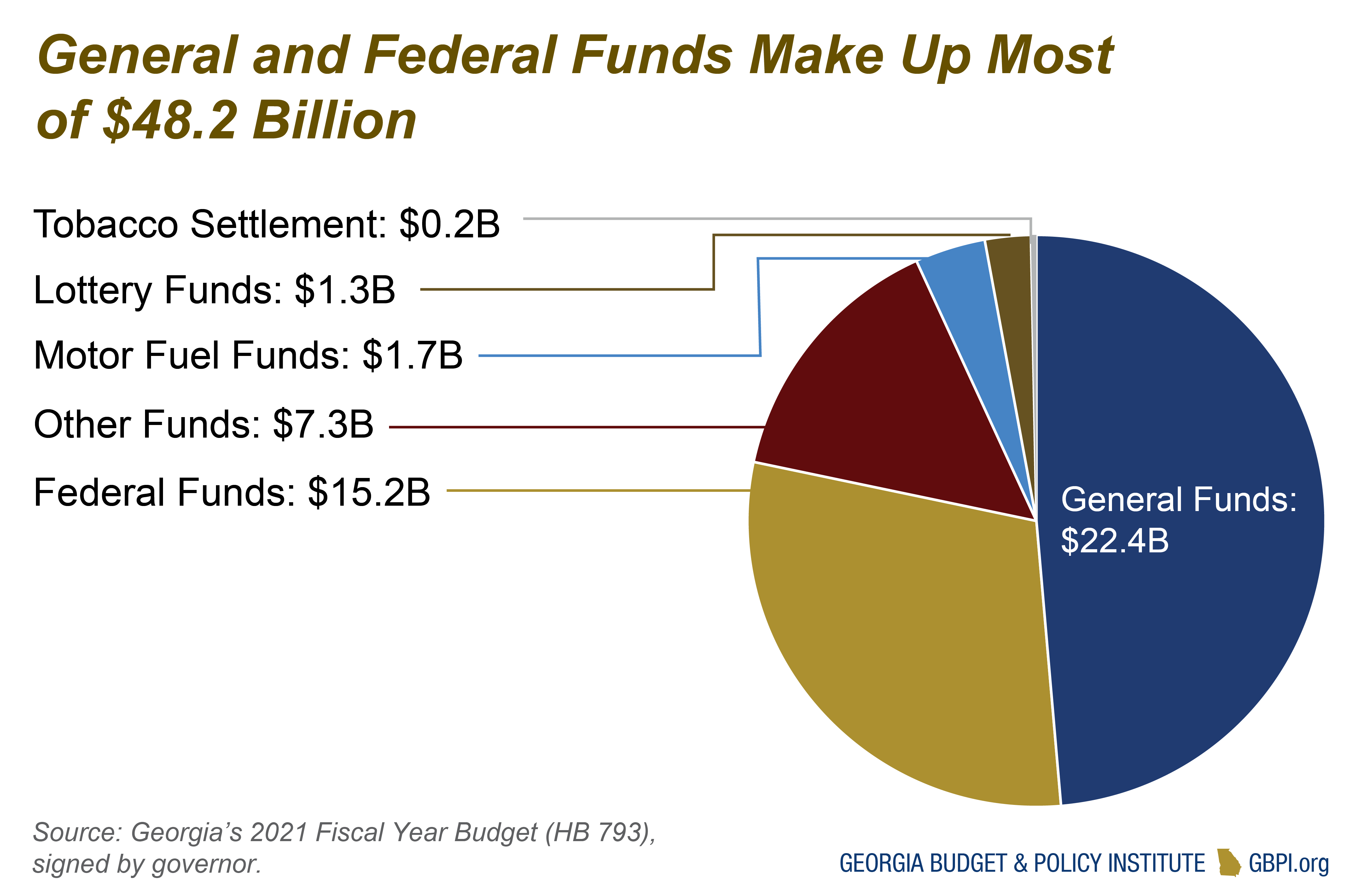

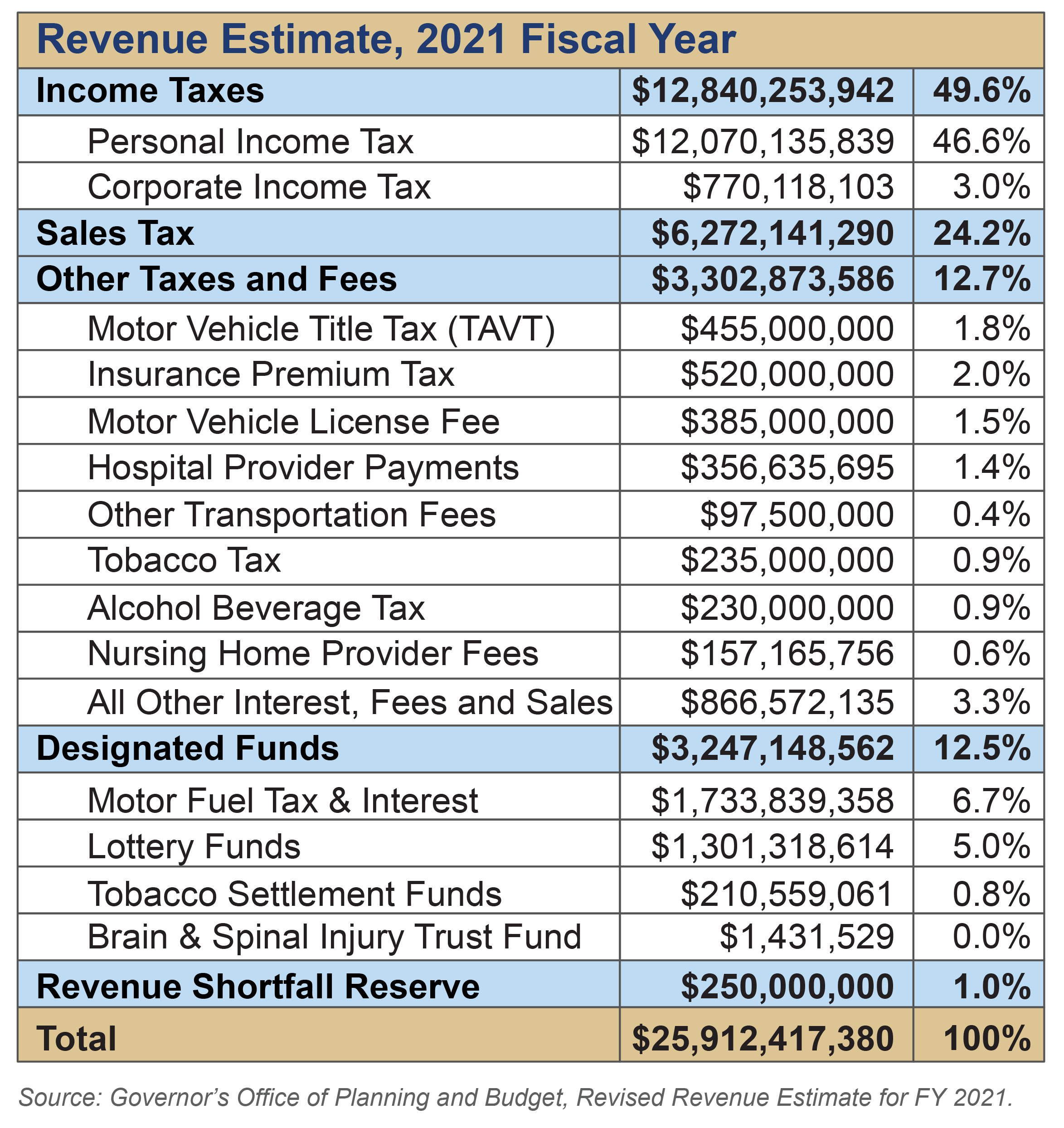

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Income Tax Retirement Planning

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

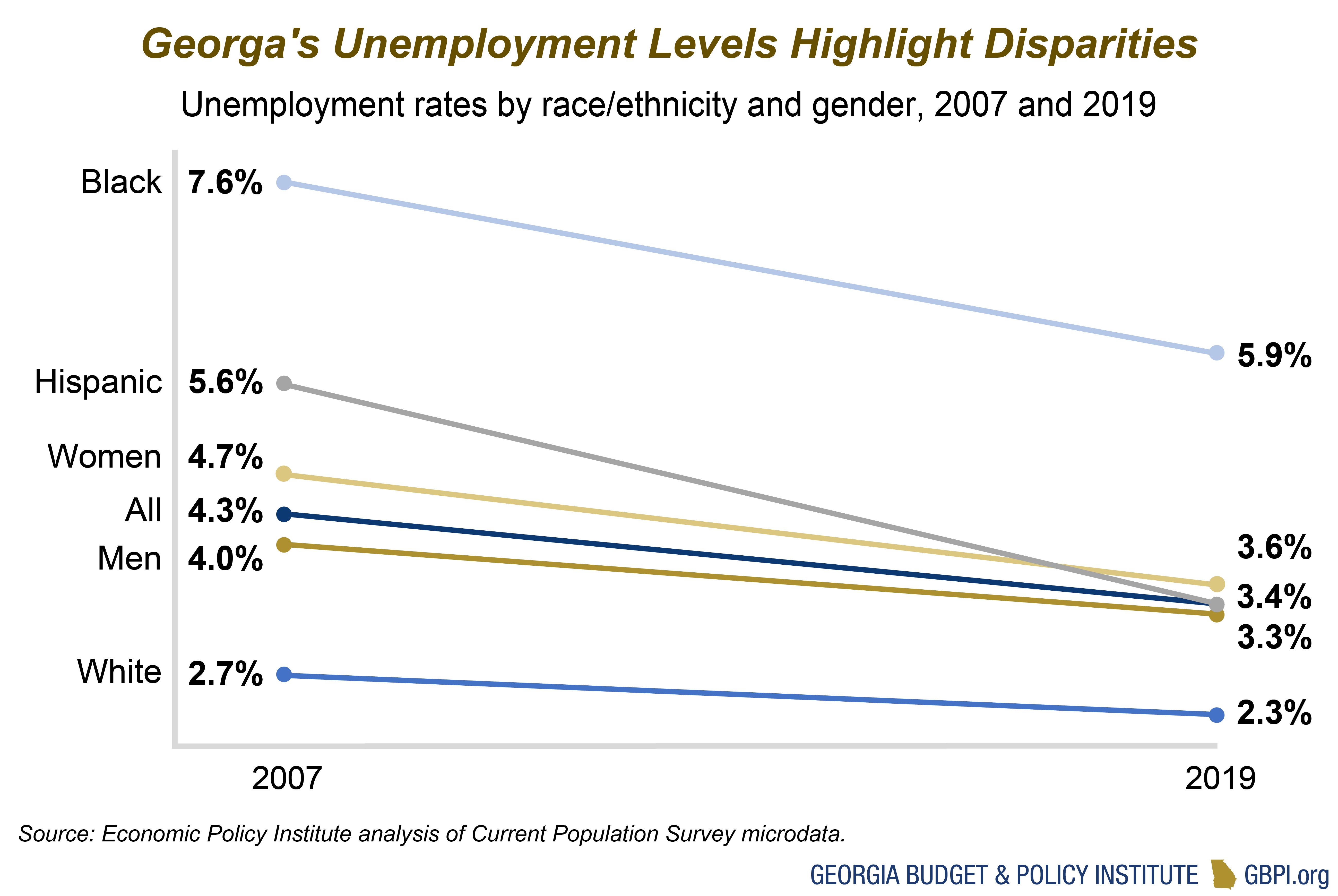

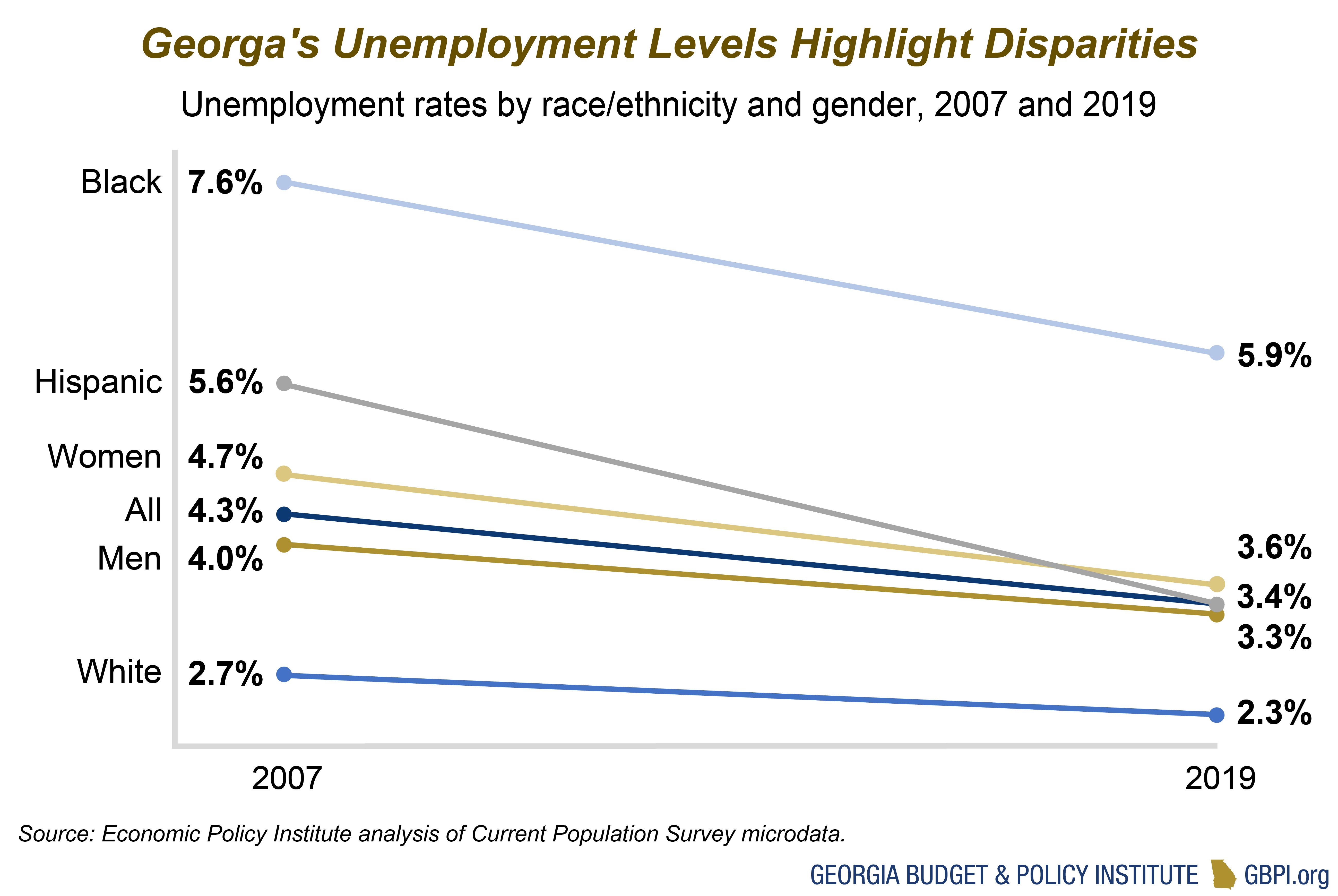

State Of Working Georgia Before And During Covid 19 Georgia Budget And Policy Institute

State Of Working Georgia Before And During Covid 19 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Where Your State Gets Its Money Fivethirtyeight Http J Mp 1hyejnz States State Tax How To Get

Where Your State Gets Its Money Fivethirtyeight Http J Mp 1hyejnz States State Tax How To Get

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

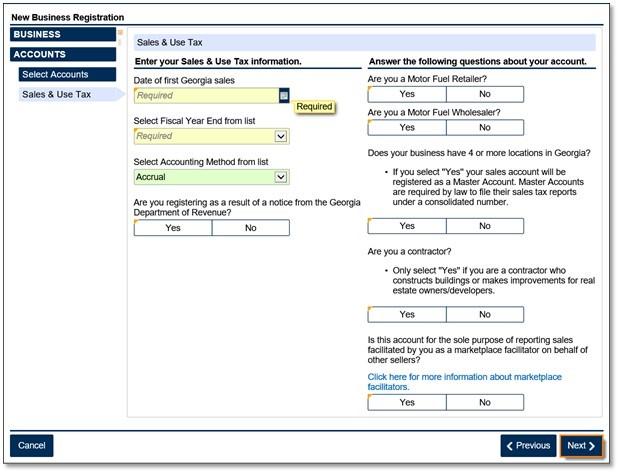

Marketplace Facilitators Georgia Department Of Revenue

Marketplace Facilitators Georgia Department Of Revenue

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Tax Refund Fraud Irs Crackdown Ensnares Legitimate Taxpayers Tax Return Tax Refund Extra Money

Tax Refund Fraud Irs Crackdown Ensnares Legitimate Taxpayers Tax Return Tax Refund Extra Money

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Ga How To E File Quarterly Tax And Wage Report Cwu

Individuals Faqs Unemployment Insurance Georgia Department Of Labor

Individuals Faqs Unemployment Insurance Georgia Department Of Labor

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Georgia State Budget Overview For Fiscal Year 2019 Georgia Budget And Policy Institute

Post a Comment for "What Is Ga Unemployment Tax Rate"